Whereas the overall worth locked (TVL) in decentralized finance (defi) hovers simply above the $214 billion mark, a defi protocol known as Lido has been transferring nearer towards taking Curve’s high spot when it comes to TVL in a defi protocol. Presently, the liquid staking resolution Lido has $19.2 billion in staking belongings derived from 5 totally different blockchain networks together with Ethereum, Solana, Terra, Polygon, and Kusama.

Lido’s Staked Belongings Symbolize Near 9% of the $214 Billion Locked in Defi

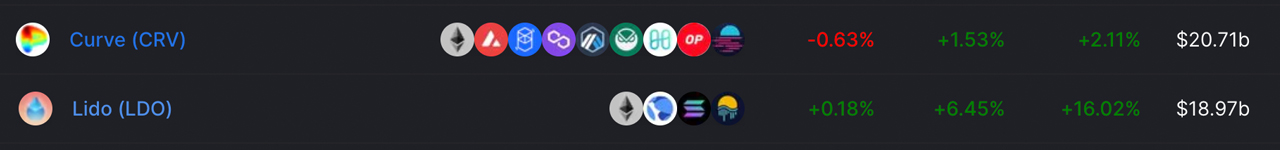

In response to defillama.com, there’s $214 billion whole worth locked in decentralized finance on the time of writing. Presently, the biggest defi protocol when it comes to TVL dimension is Curve Finance, the decentralized change (dex) platform. Immediately, Curve dominates the pack with $20.71 billion and a dominance score of round 9.67%, in accordance with defillama.com statistics on April 20, 2022.

So far as TVL in defi protocols is anxious, Curve has led the pack for weeks on finish, however the liquid staking resolution Lido might take the reins quickly. Lido’s TVL, no less than in accordance with in the present day’s defillama.com metrics, is $18.97 billion, up 16.02% during the last 30 days. Lido has seen vital utilization as a result of the defi protocol permits Ethereum, Solana, Terra, Polygon, and Kusama customers to make use of their staked belongings to achieve yield on high of yield.

So if a consumer determined to bond Terra’s LUNA into the token known as BLUNA, they’d change LUNA for BLUNA to start out getting staking rewards. In the meantime, along with the bond stake, BLUNA tokens can be utilized in swimming pools, to earn much more rewards from the bonded tokens. The identical will be stated about different networks like Ethereum, as Lido’s staked ether (STETH) instructions the 18th largest market capitalization out of 13,671 cryptocurrencies. Lido staked solana (STSOL) is the 193rd largest market cap, and BLUNA is the twenty second largest on Wednesday.

Whereas defillama.com notes that Lido’s TVL is $18.97 billion, it solely accounts for 4 of the blockchains that Lido makes use of for staking. Polygon is lacking from defillama.com’s metrics, and in accordance with Lido’s stats on April 20, 2022, there’s $19,220,700,179 staked amongst 99,606 stakers. Lido stats present $10.6 billion from Ethereum, $8.21 billion from Terra, $363 million from Solana, $3.3 million from Kusama, and $13.8 million stemming from the Polygon community.

3.9%, 23.9% APY Relying on Chain Rewards and Skipping Validator Lock-Ups

In response to present staking estimates, Lido’s Ethereum staking resolution is the bottom with a 3.9% annual proportion yield (APY), whereas Kusama’s is the best at 23.9% APY. Whereas Lido is touted for its potential to double stake belongings, there are some defi liquidity pool suppliers that take the reward from Lido staking providers, and Lido warns customers this may be the case.

One specific advantage of Lido is individuals can skip utilizing a validator lock-up interval (though there may be an unbonding interval) as a result of they’ll promote their bonded tokens on the open market. Selecting this route, nonetheless, the consumer will lose the payment related to the dex swap and roughly 1-2% in worth relying on the bonded token.

Lido Finance is taken into account a “staking firm,” and there are a variety of staking corporations within the trade. Immediately, there are staking corporations corresponding to Kyber Community, Celer Community, Blockdaemon, and extra. Lido, nonetheless, has an unlimited quantity of worth locked in the present day throughout 5 totally different blockchains and in latest occasions the overall amount of staked belongings has swelled exponentially.

What do you consider the liquid staking resolution Lido? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss precipitated or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.