Fast info about The Merge…

-

Ethereum 2.0 is the transition from the proof of labor (PoW) consensus mechanism to the proof of stake (PoS) mannequin.

-

PoW is utilized by a handful of blockchains, essentially the most notable of which is the daddy of cryptocurrencies—Bitcoin (BTC). Ethereum additionally began out utilizing the PoW methodology, however as its recognition grew, PoW was discovered to be too labour intensive for Internet 3.0, too sluggish, and too environmentally unfriendly.

-

PoS alternatively completes transactions extra effectively, makes use of much less energy, and advantages from a lot decrease transaction charges.

-

Community stakeholders validate transactions and are rewarded for his or her efforts with the native forex of the platform—on this case, ETH.

Why do folks name The Merge Ethereum 2.0?

Ethereum 2.0, Eth2 or The Merge are all the identical factor beneath totally different names. Whereas Ethereum tried to distance itself from the primary label it gave its new venture—Ethereum 2.0—for most individuals with greater than a passing curiosity within the venture, the identify has caught.

To resolve the issue of confusion brought on by shifting semantics from the world’s main good contract blockchain, the phrases Ethereum 2.0, Eth2, and The Merge shall be used interchangeably all through this deep dive into the subject.

What’s Ethereum 2.0?

The ETH Merge is the transition from Eth 1 to Eth2. The Merge entails the fusion of the Beacon chain, layer 1 PoS testnet with Ethereum’s PoW mainnet. For a time the 2 have been operating in parallel to keep away from a platform meltdown within the occasion of a sudden change. When the PoS consensus mechanism replaces the present PoW consensus mechanism, The Merge shall be full and PoW will not exist on the Ethereum blockchain.

The Merge goals to resolve a variety of issues which have lengthy hampered Ethereum and its use circumstances. These are:

-

Congestion

-

Excessive gasoline charges

-

Safety challenges

-

Pace of transactions

-

Scalability

This text goals to reply every query you might need about how the crew at Ethereum plan to sort out these points and assess the corporate’s roadmap.

What’s the distinction between ETH 1.0 and ETH 2.0?

Ethereum 1.0, or Eth1, is the place the place Ethereum’s good contracts are signed and sealed. These are at present dealt with by a Proof of Work (PoW) consensus just like Bitcoin, which the Ethereum crew desires to maneuver away from.

Eth2 goals to flip PoW to Proof of Stake (PoS). This PoS layer didn’t exist earlier than which meant that Ethereum’s layer 1 needed to do the entire laborious knowledge processing. This was sluggish and brought on bottlenecks and different inefficiencies.

With the PoS consensus layer in place, Ethereum 2.0 will have the ability to course of and execute good contracts extra rapidly. The Merge refers back to the fusion of those current and new layers—what is named a tough fork—that eliminates the outdated PoW consensus mechanism and ushers in Proof of Stake.

What’s a consensus mechanism and the way does it work?

Consensus mechanisms are merely a manner for computer systems working collectively to verify that an occasion occurred. If there are sufficient validator nodes on the community, these cross-check data with each other to agree on the ‘reality’ of an occasion. If greater than 51% of validator nodes agree with one another then ‘consensus’ has been reached.

It is a very important course of in distributed databases and good contracts which make selections algorithmically. The computer systems are successfully witnesses that agree or disagree {that a} consensus is reached. This additionally prevents unhealthy actors from taking up the community in a biased manner.

Proof of labor (PoS) vs proof of stake (PoW)

In its most straightforward type, Proof of Work (PoW) is the place computer systems do ‘the work’ fixing advanced cryptography issues to realize a reward. It’s a bit like sending a robotic down right into a pit to mine gold. Solely the most effective, best and hard-working robots will carry again the gold deposits. Bitcoin is the primary instance of a PoW consensus mechanism the place highly effective computer systems work ever tougher to mine the following coin.

Proof of Stake (PoS) is reliant on cooperation between individuals who use their computer systems to validate transactions. To be allowed to do that—in different phrases, to be accepted as a validator—members should stake the blockchain’s native cryptocurrency (within the case of Ethereum 2.0 that is ETH), to earn the rewards. Of relevance now, PoW is maligned by environmentalists due to the large quantity of computational energy, and subsequently vitality, required for the crypto puzzles to be solved. PoS, alternatively, makes use of far much less vitality to attain an analogous aim.

What are the 4 phases of The Merge?

There are 4 phases to the total rollout of Ethereum 2.0. Beneath is a fast run-through of what occurs in every part:

Part 0: In December 2020, Part 0 marked the launch of the PoS consensus mechanism named Beacon. Working in parallel to Ethereum’s PoW mainnet, Beacon is made up of PoS validators with staked ETH to make sure that the entire shards that allow Eth2 to scale are synchronously working.

Part 1: That is the place the shard chains begin actively working. If part 0 is akin to beginning the engine of a automotive, Part 2 is placing the foot on the gasoline and highway testing the tech. Every shard is a PoS blockchain working each independently and along side the opposite shards to course of all transactions.

Part 1.5: That is the place the PoW Ethereum chain, or mainnet, is ‘merged’ with the brand new PoS Ethereum chain. That is the principle transition from the legacy system of processing transactions to the brand new system.

Part 2: At this level, all shards are energetic. At this level, The Merge shall be full with all shards speaking with each other, effectively operating good contracts and hunting down unhealthy actors.

Why is The Merge taking place now?

Though the Merge is going on now, that is one thing that has been on the forefront of Ethereum founder, Vitalik Buterin’s, thoughts for a very long time. Conscious of the excessive vitality utilization required for PoW consensus mechanisms and the associated congestion points, Buterin’s want to enhance the infrastructure and make Ethereum extra scalable, sustainable, safe and far quicker has existed for nearly so long as Ethereum itself.

The shortage of progress and fixed delays, nevertheless, led to a few of Buterin’s colleagues and co-founders leaping ship and organising new layer one protocols, particularly Cardano (Charles Hoskinson), and Polkadot (Dr Gavin Wooden).

When will Ethereum 2.0 occur?

The Merge is prone to occur someday in 2022, although many consultants consider this might occur later.

Why is the transfer to Eth2 taking so lengthy?

To organize for the transfer to PoS, a consensus layer needed to be constructed to run in tandem with the mainnet the place dApps and good contracts dwell. In essence, this was like creating Ethereum yet again differently. Shifting hundreds of dApps from one system to a different can also be no simple feat.

The crew determined to construct a parallel chain quite than merely change from PoW to PoS to scale back the danger of breaking the community and taking hundreds of dApps constructed on the community down on the similar time.

Will Ethereum be a distinct coin after The Merge?

No, the one factor that shall be totally different is mainly what’s beneath the hood. The token shall be precisely the identical. Nevertheless, the tokenomics of Eth2 will differ in that the ecosystem will develop into deflationary. Which means that fewer ETH shall be accessible, which is constructive for the value of ETH and excellent news for holders of the coin.

What are the enhancements of The Merge?

The enhancements of The Merge are taking place particularly on the consensus layer. That is the place validations happen. At the moment, miners validate blocks via PoS. This requires huge quantities of pc energy and makes use of up quite a lot of vitality. This isn’t a great factor when the world is attempting to scale back its carbon footprint.

Ethereum transferring to proof of stake will lower vitality consumption by 99.9%. To place this in perspective, that is roughly the identical quantity of electrical energy that will get utilized by your entire inhabitants of Mexico annually—round 300 terawatt-hours!

As beforehand talked about, after The Merge, Ethereum can even present a greater person expertise by operating extra effectively.

How is the brand new Ethereum PoS chain secured?

The brand new chain forming the spine of Ethereum 2.0 is secured by validators. These are swimming pools of people who stake their Ethereum to earn rewards in ETH. Their stake and, subsequently, their presence helps safe the community. Consider staked ETH a bit such as you would gasoline in a automotive.

At the moment, there are round 10million ETH deposited with an estimated worth of just about $30billion. Packaged into blocks of 32 ETH. It’s these deposits that present validation nodes on the Ethereum Beacon Chain.

How can I stake Ethereum and develop into a validator to earn rewards?

The {hardware} prices, setup and preliminary quantity required to develop into a validator are onerous for anybody with out expertise—or sufficient capital.

For instance, simply to develop into a validator you want to have the ability to stake a minimal of 32 ETH which is the most effective a part of $100k on the time of writing. The excellent news is that you would be able to leapfrog this problem by heading to an alternate that helps staking Ethereum. Beneath are among the greatest exchanges the place you should purchase Ethereum and stake it.

Min. Deposit

$200

Promotion

Entry the world’s hottest Crypto property together with Bitcoin, ETH, LTC, XRP

Mechanically copy top-performing Crypto merchants

Deposit utilizing PayPal + 9 different deposit choices accessible (not accessible to US customers)

Description:

eToro is a multi-asset funding platform with greater than 2000 property, together with shares, ETF’s, indices, commodities and Cryptoassets. eToro gives over 60+ Cryptoassets to take a position or put money into their CryptoPortfolio the place traders can profit from the gathered progress of Bitcoin, Ethereum, XRP, Litecoin and different main cryptocurrencies. eToro customers can join with, study from, and duplicate or get copied by different customers.

Fee Strategies

1Pay, 2C2P, 3d Safe Credit score Card, ACH, ANELIK, Abaqoos, AdvCash, AlertPay, Alfa-Click on

Algocharge, AliPay, American Specific, Apple Pay, AstroPay, BPAY, Financial institution Hyperlink, Financial institution Switch, Financial institution Wire, Baofoo, BitGold, BitPay, Bitcoin, Boleto, Borneo Exchanger, Bradesco, CSS System, CUPS, CartaSi, Carte Bleu, Carte Bleue, Money, CashU, Cashier Order, Examine, Examine (UK solely), China UinonPay, China UnionPay, ClickandBuy, Contact, Contact Z, Credit score Card, Cryptocurrencies, DCPay, DIXIPAY, Dankort, Debit Card, Dengi On-line, DineroMail, DirectPay, Dotpay, E-dinar, ELV, ENets, EPS, EXCARD, Easy2Pay, EcoPayz, Ecommpay, Ecurrencyzone, EgoPay, Emerchant Pay, Eprotections, EstroPay, Ethereum, Euro Financial institution Account, Euteller, Specific Dotpay, Specific Polish Submit Workplace 24/7, Specific Zabka Market, Ezeebill, Ezybonds, FasaPay, Fastapay, Fastbank, Sooner Funds, FilsPay, GTBank, Gate2Shop, Giropay, GlobalCollect, GlobalPAY, GlobePay, Gluepay, Halcash, I-Account, IPS, Best, Indonesia Exchanger, InstaBill, Instadebit, IntellectMoney, Interswitch, Itukar, KNET, Klarna, LaoForexBoard, LavaPay, Lion Fee, LiqPay, Litecoin, Lobanet, MOTO, Mailing Money, Masari, Mastercard, MegaTransfer, Mister Money, Moneta, Cash Order, MoneyBookers, MoneyGram, MoneyPolo, Multibanco, NETBANX, Nab, Namecoin, Neosurf, NetPay, OKPAY, OMT, OmahPoin, OnPay.ru, On-line Naira, OrangePay, PAYSEC, POLi, POLi & BPay, PYEER, PagoEfectivo, Paxum, Pay Nova, PayCo, PayPal, PayRetailers, PayWeb, Payeer, Payoneer, Payonline, Payvision, Payza, Excellent Cash, PocketMoni, Postbank, Powercash 21, Pay as you go MasterCard, Pay as you go MasterCard (I-Account), Pay as you go MasterCard (Intercash), Pay as you go MasterCard (Payoneer), Privat 24, Przelewy24, QIWI, RBK Cash, Speedy Switch, RegularPay, SEPA, Safecharge, SafetyPay, SahibExchange, Shilling, SmartPay, Sofort, SolidTrust Pay, SorexPay, Sporopay, Inventory Certificates, Swish, Teleingreso, Thailand Exchanger, Ticketsurf, Todito Money, Transact Europe Fee, Trazus, TrustPay, Trustly, UAE Alternate, UPayCard, Ukash, Unet, UnionPay, Unistream, Uphold, Verve, Vietnam Exchanger, Visa, VixiPay, VoguePay, Vouchers, Pockets One, WeChat, WebMoney, WebPay, Western Union, Wire Switch, Wirecard, Yandex, Yandex Cash, Yemadai, YuuPay, Z-Fee, Zenith, dinpay, eCard, eCheck, eKonto, ePay bg, ePayments Switch, eTranzact, iPay, mPay, neteller, paysafecard, postepay, skrill, unichange.me

Full laws checklist:

ASIC, CySEC, FCA

Cryptoasset investing is unregulated in most EU international locations and the UK. No client safety. Your capital is in danger. CFD crypto buying and selling is unavailable for purchasers residing within the UK and US.

Min. Deposit

$1

Promotion

The world’s largest cryptocurrency alternate with over 2bn every day customers

Progressive buying and selling platform providing huge vary of crypto cash

Helps over 60 strategies of fee together with PayPal

Description:

Binance has grown exponentially because it was based in 2017 and is now one among, if not the most important cryptocurrency exchanges in the marketplace.

Fee Strategies

1Pay, 2C2P, 3d Safe Credit score Card, ACH, ANELIK, Abaqoos, AdvCash, AlertPay, Alfa-Click on

Algocharge, AliPay, American Specific, Apple Pay, AstroPay, BPAY, Financial institution Hyperlink, Financial institution Switch, Financial institution Wire, Baofoo, BitGold, BitPay, Bitcoin, Boleto, Bonds, Borneo Exchanger, Bradesco, CEX.io Cell App, CFDs, CSS System, CUPS, CartaSi, Carte Bleu, Carte Bleue, Money, CashU, Cashier Order, Examine, Examine (UK solely), China UinonPay, China Union Pay, China UnionPay, ClickandBuy, Commodities, Contact, Contact Z, Credit score Card, Cryptocurrencies, Currencies, DCPay, DIXIPAY, Dankort, Debit Card, Dengi On-line, DineroMail, DirectPay, Dotpay, E-dinar, ELV, ENets, EPS, ETFs, EXCARD, Easy2Pay, EcoPayz, Ecommpay, Ecurrencyzone, EgoPay, Emerchant Pay, Eprotections, EstroPay, Ethereum, Euro Financial institution Account, Euteller, Specific Dotpay, Specific Polish Submit Workplace 24/7, Specific Zabka Market, Ezeebill, Ezybonds, FasaPay, Fastapay, Fastbank, Sooner Funds, FilsPay, Foreign exchange, GTBank, Gate2Shop, Giropay, GlobalCollect, GlobalPAY, GlobePay, Gluepay, Halcash, I-Account, IPS, Best, Indices, Particular person US State License(s), Indonesia Exchanger, InstaBill, Instadebit, IntellectMoney, Interswitch, Investmate, Investmate, Itukar, KNET, Klarna, LaoForexBoard, LavaPay, Lion Fee, LiqPay, Litecoin, Lobanet, MOTO, MT4, MT5, Mailing Money, Market Maker, Masari, Mastercard, MegaTransfer, Mister Money, Cell Buying and selling App, Cell Buying and selling Platform, Moneta, Cash Bookers, Cash Order, MoneyBookers, MoneyGram, MoneyPolo, Multibanco, NETBANX, Nab, Namecoin, Neosurf, NetPay, OKPAY, OMT, OmahPoin, OnPay.ru, On-line Naira, OrangePay, PAYSEC, POLi, POLi & BPay, PYEER, PagoEfectivo, Paxum, Pay Nova, PayCo, PayPal, PayRetailers, PayWeb, Payeer, Payoneer, Payonline, Payvision, Payza, Excellent Cash, PocketMoni, Postbank, Powercash 21, Pay as you go MasterCard, Pay as you go MasterCard (I-Account), Pay as you go MasterCard (Intercash), Pay as you go MasterCard (Payoneer), Privat 24, Przelewy24, QIWI, RBK Cash, Speedy Switch, RegularPay, SEPA, Safecharge, SafetyPay, SahibExchange, Shilling, SmartPay, Sofort, SolidTrust Pay, SorexPay, Sporopay, Inventory Certificates, Shares, Swish, Teleingreso, Thailand Exchanger, Ticketsurf, Todito Money, Commerce Interceptor, Transact Europe Fee, Trazus, TrustPay, Trustly, UAE Alternate, UPayCard, USD, Ukash, Unet, UnionPay, Unistream, Uphold, Verve, Vietnam Exchanger, Visa, VixiPay, VoguePay, Vouchers, Pockets One, WeChat, Internet Primarily based Buying and selling Platform, WebMoney, WebPay, Webtrader, Western Union, Wire Switch, Wirecard, Yandex, Yandex Cash, Yemadai, YuuPay, Z-Fee, Zenith, cTrader, dinpay, eCard, eCheck, eKonto, ePay bg, ePayments Switch, eToro Cell Buying and selling Platform, eToro Buying and selling Platform, eTranzact, iPay, mPay, neteller, paysafecard, postepay, skrill, unichange.me

Min. Deposit

$0

Promotion

Description:

World’s longest-standing crypto alternate. Since 2011 Bitstamp has been offering a safe and dependable buying and selling venue to over 4 million people and a variety of institutional companions.

Will the price of transactions on Ethereum go down with The Merge?

No. It is a frequent false impression that must be debunked. There are 5 layers in blockchain structure. These are:

-

{Hardware} layer

-

Knowledge layer

-

Community layer

-

Consensus Layer

-

Software and presentation layer, also referred to as the execution layer

All the modifications are being made to the consensus layer the place validations happen. Though it will ease congestion and velocity issues up, transactions are finalised within the execution layer which stays unchanged.

The excellent news is the discount in congestion ought to scale back value volatility, which shall be welcome information for individuals who transact repeatedly on Ethereum. However for individuals who wish to transfer small quantities of crypto round on Ethereum’s platform after The Merge, it is going to nonetheless stay a comparatively costly possibility in comparison with different layer one blockchains equivalent to Solana.

How will Ethereum 2.0 have an effect on the value?

The long run value of any cryptocurrency is notoriously tough to foretell, and Ethereum isn’t any exception. It’s because there are such a lot of variables at play, from authorities laws to wider fundamentals equivalent to inflation and geopolitical uncertainty.

That mentioned, it’s extensively believed amongst consultants, based mostly on institutional behaviour and the excessive quantity of whole worth locked (TVL) by stakeholders within the community—mixed with extra beneficial tokenomics—that value appreciation is probably going.

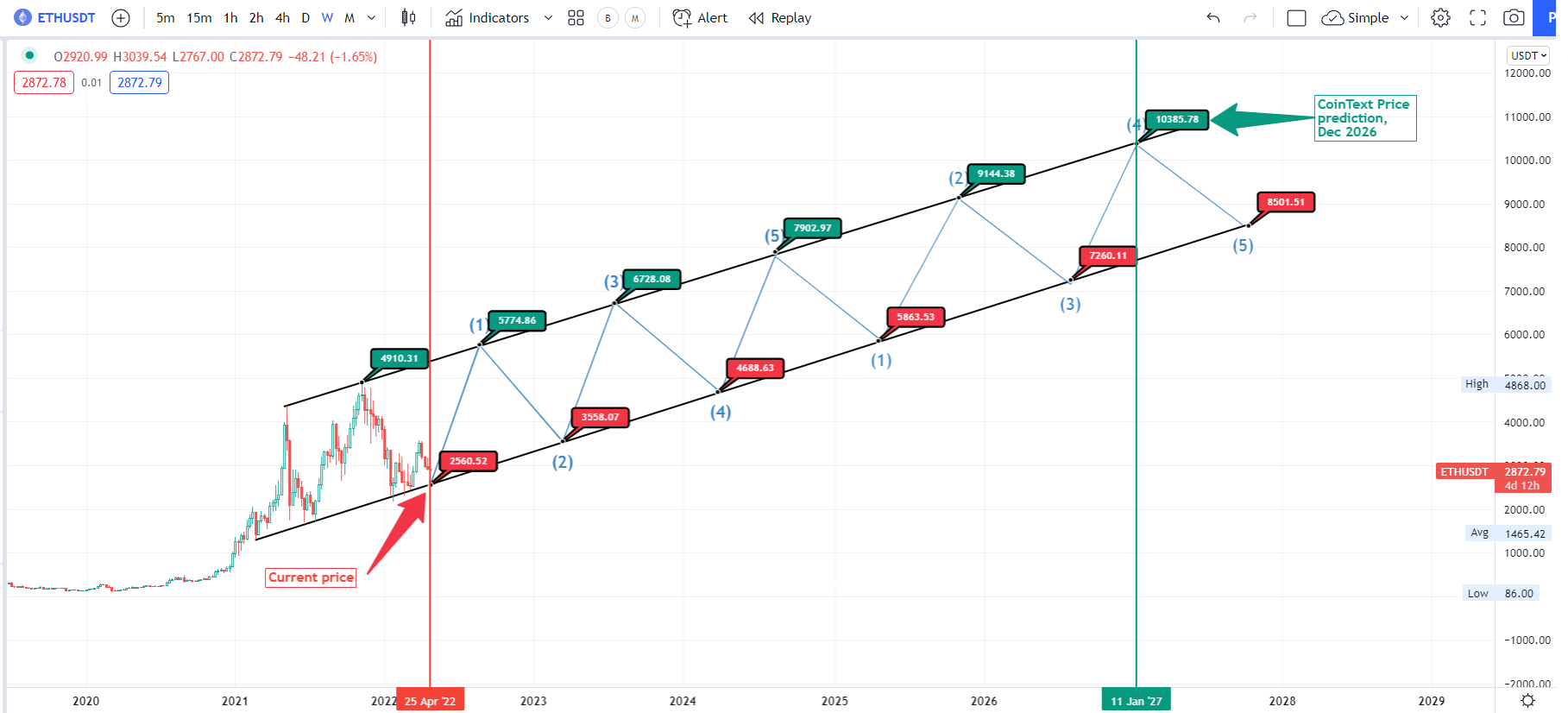

Many anticipate Ethereum’s transition to PoS shall be constructive for the value of the coin with consultants suggesting that the value of Ethereum after The Merge may breach the $10,000 mark—greater than 3X its present value. For a extra detailed breakdown of potential value outcomes over the approaching years see under.

5-year value prediction for Ethereum (ETH) after The Merge?

Regardless of a large number of spikes and dips typical of the unstable cryptocurrency markets, in case you zoom out on Ethereum, you would argue that it has been on a momentous bull run because it was created.

In 2015, you would purchase one ETH for simply $0.31. By the tip of 2021, the identical coin would have value greater than $4500. In proportion phrases, that’s over a 1.4million p.c enhance in simply 7 years!

Consultants now predict that Ethereum may attain $10,000 or extra in 2022 and past. At CoinText, we wish to take a extra conservative view, and whereas we do see ETH hitting $10,000, we don’t assume that can occur earlier than 2026.

Beneath are some estimates of value predictions for Ethereum within the subsequent 5 years, based mostly on our technical evaluation.

Ethereum value 2022 (excessive/low): $2171 / $ 5774

Ethereum value 2023 (excessive/low): $3558 / $6728

Ethereum value 2024 (excessive/low): $4688 / $7902

Ethereum value 2025 (excessive/low): $5863 / $9144

Ethereum value 2026 (excessive/low): $7260 / $10,385

What’s going to the long run be for Ethereum 2.0?

As soon as Ethereum 2.0 is in place, the elevated velocity of the community shall be a lift to Web3 builders eager to construct dApps on Ethereum’s infrastructure.

What are the dangers with The Merge?

The primary dangers related to The Merge are linked to its competitors. Whereas Ethereum has a first-mover benefit within the layer one blockchain house, it has needed to study from its personal errors. These embrace obtrusive safety issues leading to hacks and plenty of delays in upgrades and forks that brought on frustration among the many group.

Maybe the most important drawback the blockchain has had previously is seeing a few of its co-founders and main builders bounce ship to start out (or try to start out) brighter and shinier variations of Ethereum. Different so-called ‘Ethereum Killers’ have appeared, equivalent to Solana and Avalanche, wielding their digital axes prepared to chop Ethereum right down to dimension.

So, the actual danger for Ethereum is velocity. For Ethereum 2.0, affected by delays, the query is: can it obtain The Merge and efficiently transition to PoS earlier than new layer 1 platforms both steal or lure new builders away by promising, and delivering, higher Web3 options.

What occurs to ETH after the merge?

After the Ethereum Merge, shard chains shall be carried out.

What’s sharding and what are shard chains?

Sharding is expertise carried out on blockchains to ease congestion and eliminate bottlenecks. Shards allow better knowledge throughput and scalability. Ethereum 2.0 may have 64 shards accessible to course of knowledge.

A great way to think about that is as taking a single observe highway and turning it right into a 64 lane freeway. This eases congestion and makes the switch of knowledge a lot quicker.

Will Ethereum 2.0 change Ethereum?

Sure, Ethereum 2.0, which is Proof of Stake, will change Ethereum 1.0 which is Proof of Work. However solely the consensus mechanism is being changed. Which means that, as a substitute of miners extracting new cash from the Ethereum community and receiving mining rewards, stakers shall be rewarded for holding and staking ETH.

The tokenomics of Ethereum can even change with extra cash being burned. That is good for the value of ETH. Vitally, the blockchain’s native cryptocurrency, ETH, stays unchanged in The Merge.

Will Ethereum 2.0 have a distinct crypto coin?

No. Ethereum’s native coin, ETH, is not going to change. There shall be no extra tokens added to the ecosystem both. The one cryptocurrency on Ethereum will nonetheless be ETH.

How do I put together for the Ethereum improve?

Except you wish to develop into a validator and stake ETH to earn rewards, there may be nothing you’ll want to do to arrange for the improve as Ethereum goals to make the transition as seamless as potential.