Scanning this week’s information there have been just a few tales that caught my eye.

The Central African Republic has adopted bitcoin as authorized tender, turning into the second nation on this planet to take action after El Salvador. To say that that is large information is an understatement.

Oddity, a D2C make-up firm, is providing a safety token tied to its upcoming IPO. Safety tokens might unlock a possibility for extra individuals to take a position pre-IPO, altering the best way personal corporations fundraise.

The European Parliament launched the ultimate spherical of discussions on the controversial “Unhosted Wallets” Regulation. The proposed regulation would require centralized crypto exchanges and custodial pockets suppliers to gather and confirm private details about self-custodial pockets holders. Attempting to make use of guidelines from conventional finance in crypto, simply exhibits how out of contact regulators are with crypto.

Ilias Louis Hatzis is the founder and CEO of Kryptonio pockets.

Africa is Embracing Bitcoin. Good Thought or Not?

The Central African Republic is thought for its invaluable assets, equivalent to diamonds and uranium, however regardless of all its pure assets, it’s also often called one of many poorest international locations on this planet. Now it’s often called the second nation to acknowledge bitcoin as a authorized tender. Quickly, individuals will be capable to pay both within the current forex (the CFA franc) or in BTC.

There are about 14 international locations within the space that use the African Franc, a French relic from colonial instances when European powers occupied the area. The CFA franc is pegged to the outdated French franc and subsequently to the Euro with a hard and fast trade charge of 100 CFA = 0.1525 euro. This makes these international locations successfully not sovereign and makes it tough to plan their financial insurance policies with a forex they don’t have any management over.

Just like the Central African nations utilizing the CFA, El Salvador in 2001 deserted its nationwide forex and adopted the US greenback as authorized tender.

However in September 2021 when El Salvador made bitcoin the nation’s official forex to compensate for the US greenback’s inflation, many had been skeptical and a few, together with the IMF, got here down laborious on its resolution.

Eight months later, change continues to be sluggish. Whereas you need to use bitcoin to pay for a Large Mac in McDonald’s, purchase a cup of espresso, or pay for groceries with a QR code, service provider penetration continues to be low and there have been some hiccups with El Salvador’s Chivo pockets.

A report from the Nationwide Bureau of Financial Analysis confirmed that the utilization of Bitcoin for on a regular basis transactions continues to be low and is concentrated among the many banked, educated, younger, and male inhabitants.

When Jimmy Tune visited El Salvador again in January he wrote:

“Bitcoin is incentivizing civilization-building conduct. This isn’t to say that the whole lot is ideal. There are nonetheless plenty of issues and lots of issues that want work. However what’s clear is that issues are getting higher.”

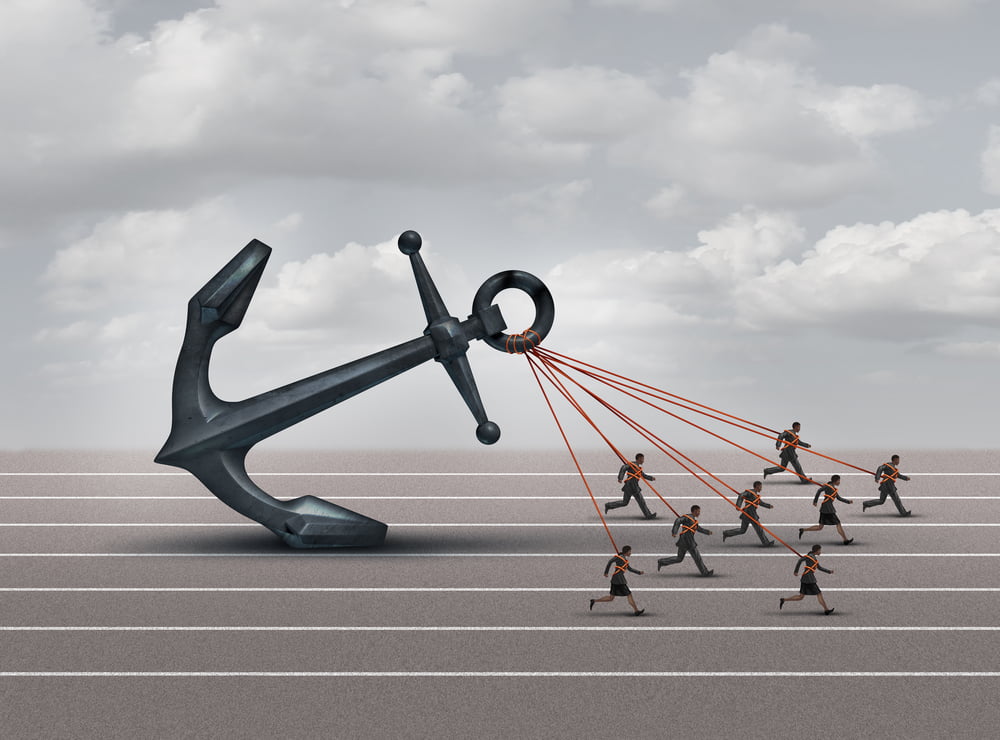

Any nation that doesn’t have its personal forex and suffers from excessive inflation might enhance its state of affairs by adopting bitcoin as authorized tender. The Central African Republic has made a daring transfer, attempting to regain management and enhance individuals’s lives.

Issues might take time, however El Salvador and the Central African Republic are exhibiting us what transitioning from fiat to sound cash appears like. Whereas a few small international locations in Latin America and Africa may not appear vital, we have to take a step again and think about the geopolitical and macroeconomic state of affairs on our planet.

IPO safety token conversion. A New Pattern in Fund Elevating?

Oddity is a magnificence firm with a robust give attention to expertise. They’ve launched a number of revolutionary initiatives designed to revolutionize the net magnificence trade.

Now, Oddity has turn out to be the primary non-crypto firm to tie a safety token on to its fairness possession. They’ve created a crypto token tied to a future IPO, to incentivize curiosity in a future public providing. The token will convert into common shares when Oddity goes public, at a 20% low cost from the IPO value.

Oddity’s tokens will go on sale on Might 11 and solely be out there to accredited traders ($200K+/yr or $1M internet value), by means of an SEC-registered blockchain platform known as Securitize.

Safety tokens are a singular sort of crypto asset designed to validate and guarantee possession rights and function value-transfer devices for a selected asset, or set of rights.

The idea behind safety tokens turned widespread with ICOs in 2017, which had been digital tokens bought by corporations and used to lift capital, very like a inventory providing. However with out being regulated or registered and with none possession stakes or dividend payouts, ultimately, they fizzled out.

Oddity may be onto one thing large. The flexibility to tokenize an unrealized asset in a regulated safety is revolutionary.

With a lot of the crypto market nonetheless unregulated, safety tokens are regulated belongings just like shares and bonds, regardless that they’re created and traded like cryptocurrencies.

Safety tokens might turn out to be an vital instrument for personal corporations, altering the best way they fundraise and unlocking a possibility for extra individuals to take a position pre-IPO.

The European Union vs. Self-Hosted Crypto Wallets

Just a few days in the past there was a giant dialogue within the European Parliament about new anti-money laundering (AML) guidelines. The brand new laws would require crypto suppliers to gather and confirm details about the helpful homeowners of all self-hosted pockets homeowners and report suspicious transactions to the authorities.

Self-hosted crypto wallets are software program that lets people retailer and use their cryptocurrency, with out counting on a third-party monetary establishment. However cryptocurrencies should not held in a single’s precise pockets. Quite the opposite, their worth by no means leaves the community. A person accesses and spends funds related to a given tackle by means of the corresponding personal key, an authentication code that verifies possession. Non-public keys are saved in crypto wallets. You’ll be able to consider wallets as keychains, relatively than conventional wallets.

Self-hosted wallets have a big impression on the efficacy of AML guidelines, as they permit peer-to-peer transactions. In transactions from one self-hosted pockets to a different self-hosted pockets, no third social gathering could be held accountable for AML oversight. To bypass this blind spot, regulators try to gather information concerning the possession of self-hosted wallets once they transact with custodial wallets.

They declare that these new guidelines will guarantee crypto-assets could be traced in the identical means as conventional cash transfers. However cryptocurrency transactions already are traceable on public blockchains. Learn “Contained in the Bitcoin Bust That Took Down the Net’s Greatest Baby Abuse Web site” and also you’ll perceive that bitcoin’s anonymity is only a fable.

Chris Brummer in his publish, describes it spot on:

“As a consequence, regulators not want banks, exchanges, and even crypto wallets to see the motion of digital belongings. Governments, like everybody else, can observe bitcoins and Ether on the blockchain as they transfer from tackle to deal with and watch as they’re used for illicit functions. And so they can make use of in-house capabilities or business forensics corporations to look at the place bitcoins from a number of addresses are spent in a single transaction, revealing multi-input schemes with one particular person having management over each spender addresses, permitting investigators to lump them right into a single identification. De-anonymization can contain steps so simple as following the cash till it lands at a pockets that may be tied to a identified pockets, or one with an trade the place a easy subpoena strips away the parable of anonymization.”

Cash laundering is between $800 billion and $2 trillion, and solely $8 billion was crypto-related. Regulators are proposing to maintain data of each crypto transaction. Do they observe $2 trillion value of transactions in cash that’s laundered yearly, as they’re now proposing to do with crypto?

The proposed laws solely exhibits that regulators are in the dead of night relating to this tech and the way it works.

To sum it up, restrictions to make use of self-hosted wallets:

- Signify a disproportionate response to the dangers posed by the unlawful use of digital belongings.

- Damage exchanges and drive individuals to decentralized platforms. It creates an even bigger problem of monitoring exercise, and even much less visibility and management for governments.

- Create a complete surveillance mechanism of peoples’ monetary lives.

- Remove the distinctive options of digital belongings that make them a catalyst for monetary inclusivity.

- Restrict purposes that stretch far past the transmission of cash.

Picture Supply

Subscribe by e mail to affix the opposite Fintech leaders who learn our analysis day by day to remain forward of the curve. Take a look at our advisory companies (how we pay for this free unique analysis.