The ETH whales present sustained accumulation based on the on-chain knowledge and this sample represents a departure from the whale sell-off development which impacted the community for months so let’s learn extra right now in our newest Ethereum information.

The information from Santiment exhibits that the ETH Whales present sustained accumulation over the previous two weeks and so they broke out a sustained possession downtrend after the beginning of the 12 months and are again to proudly owning over 12% of the availability. The ETH whales are outlined as addresses that maintain between 1000 and 10,000 ETH which is between $3 million and $30 million price of cash at right now’s costs. As of Thursday, whale possession sat at 12.07% of ETH and up from 11.92% about 10 days earlier.

Whales have infrequently proven sustained accumulation in months however the focus among the many holders surged in December after which dropped since. The buildup is related to the upper costs because it means given crypto has grow to be scarce for the market. Bitcoin’s value broke larger after what gave the impression to be a $1.6 billion whale purchase and the ETH value is but to react positively however it’s in a week-long decline.

As earlier reported, Ethereum’s consensus layer deposit contract comprises over 12 million ETh and over 10% of Ethereum’s provide. Over 360,000 validators locked 32 ETH within the contract that may permit the funds to be moved from the mainnet to the Beacon Chain which is a working PoS model of Ethereum with which the mainnet is ready to merge sooner or later. The deposit contract for the ETH consenSys layer referred to as eTH 2.0 exceeded 12 million ETH which is price about $34 billion at present costs. Which means that about 10% of the whole ETH provide is locked within the consensus layer deposit contract.

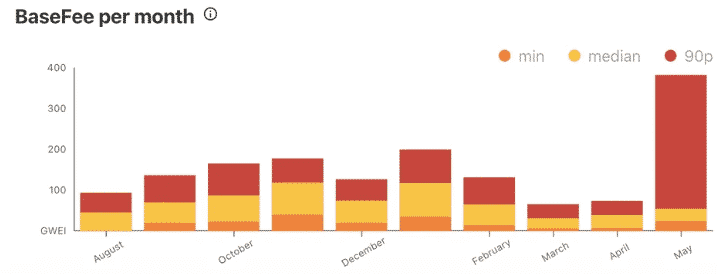

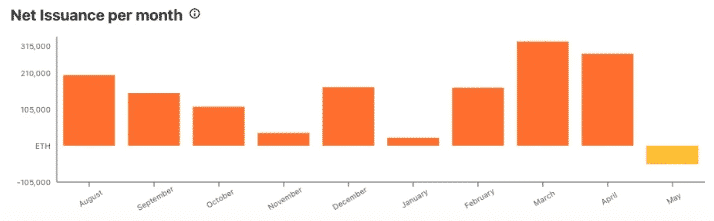

Ethereum Basis Trent Van Epps emphasised that not solely the Merge will make the chain safer, however it should additionally scale back the ETH community’s power use by 99.95% and the Merge can scale back the annual issuance of ETH to a internet 0% down from the present 3-5%. along with greater than 12 million, ETH locked within the deposit contract for the Beacon Chain at 2.18 million cash have been destroyed since Enchancment Proposal 1559 was launched in August. The improve sought to stabilize the community transaction charges and intruded a base payment ETH Burn.

DC Forecasts is a pacesetter in lots of crypto information classes, striving for the very best journalistic requirements and abiding by a strict set of editorial insurance policies. In case you are to supply your experience or contribute to our information web site, be happy to contact us at [email protected]