Annually, Bitcoin continues to develop in stature. Bitcoin goes mainstream by each metric — monetary worth, adoption charges, transaction quantity, you title it.

However not everybody’s glad Bitcoin adoption is rising. Specifically, the banking business feels threatened by bitcoin’s rise and continues to wage warfare on the cryptocurrency.

That banks don’t like Bitcoin shouldn’t be a shock. Satoshi Nakamoto’s invention is the best disruption to the age-old financial system in many years. As a peer-to-peer community for creating and exchanging worth, Bitcoin might render banks ineffective.

To guard their place, banking establishments have resorted to the basic device of warfare: propaganda. By spreading misinformation, banks hope to discredit Bitcoin — lowering public adoption and inspiring stricter regulation.

A (Transient) Historical past Of Massive Finance’s Propaganda Conflict On Bitcoin

From the onset, Massive Finance will need to have realized Bitcoin may doubtlessly disrupt the banking system. However they selected to consider its use would stay restricted to drug sellers, pc geeks, cypherpunks, libertarians and different fringe components.

However as cryptocurrency adoption grew, particularly amongst institutional traders, panic unfold within the banking system. For the primary time, the chance that this “magic web cash” might displace banks was actual.

Thus, banks launched a coordinated effort to discredit cryptocurrencies. Bitcoin was and is a favourite goal, given its standing because the world’s first and hottest cryptocurrency.

In 2014, Jamie Dimon, billionaire President and CEO of JPMorgan Chase, America’s largest financial institution, declared Bitcoin “a horrible retailer of worth” on the World Financial Discussion board in Davos, Switzerland. Nevertheless, that didn’t cease the state of New York from issuing licenses to Bitcoin exchanges the next yr.

Dimon adopted up along with his criticism of bitcoin in 2015, saying the cryptocurrency would by no means obtain approval from governments. In his phrases, “No authorities will ever help a digital foreign money that goes round borders and doesn’t have the identical controls.”

Not happy, the JPMorgan Chase supremo launched his greatest assault on Bitcoin but on the 2015 Barclays World Monetary Companies Convention. Not solely did he name Bitcoin a fraud much like Tulipmania, however he additionally threatened to fireside anybody who traded Bitcoin through his firm.

Dimon isn’t the one Massive Finance stalwart who has tried to undermine Bitcoin. President of the European Central Financial institution Christine Lagarde has additionally been vital of Bitcoin previously.

At a Reuters Subsequent Convention, Lagarde branded bitcoin “a extremely speculative asset,” including that it has been used to conduct “some humorous enterprise and a few fascinating and completely reprehensible cash laundering exercise.” That is even because the European Central Financial institution was contemplating launching its digital foreign money known as the digital euro on the time.

The ECB, too, has typically lent itself to the anti-Bitcoin propaganda marketing campaign. In its 2021 Monetary Stability Evaluation, the apex banker in contrast surges in bitcoin’s worth to the notorious South Sea Bubble. “[Bitcoin’s] exorbitant carbon footprint and potential use for illicit functions are grounds for concern,” it added within the report.

Even the world’s largest monetary establishments have additionally joined in on the anti-Bitcoin social gathering. For instance, the World Financial institution refused to help El Salvador’s plan to undertake bitcoin as authorized tender, adducing “environmental and transparency shortcomings” of the cryptocurrency. The Worldwide Financial Fund (IMF) additionally urged the Latin American nation to drop Bitcoin early this yr.

After all, there are various, many extra situations of old-money establishments sowing doubt and spreading misinformation about Bitcoin. Nonetheless, these statements all level to the identical conclusion: banks hate Bitcoin and can cease at nothing to discredit it.

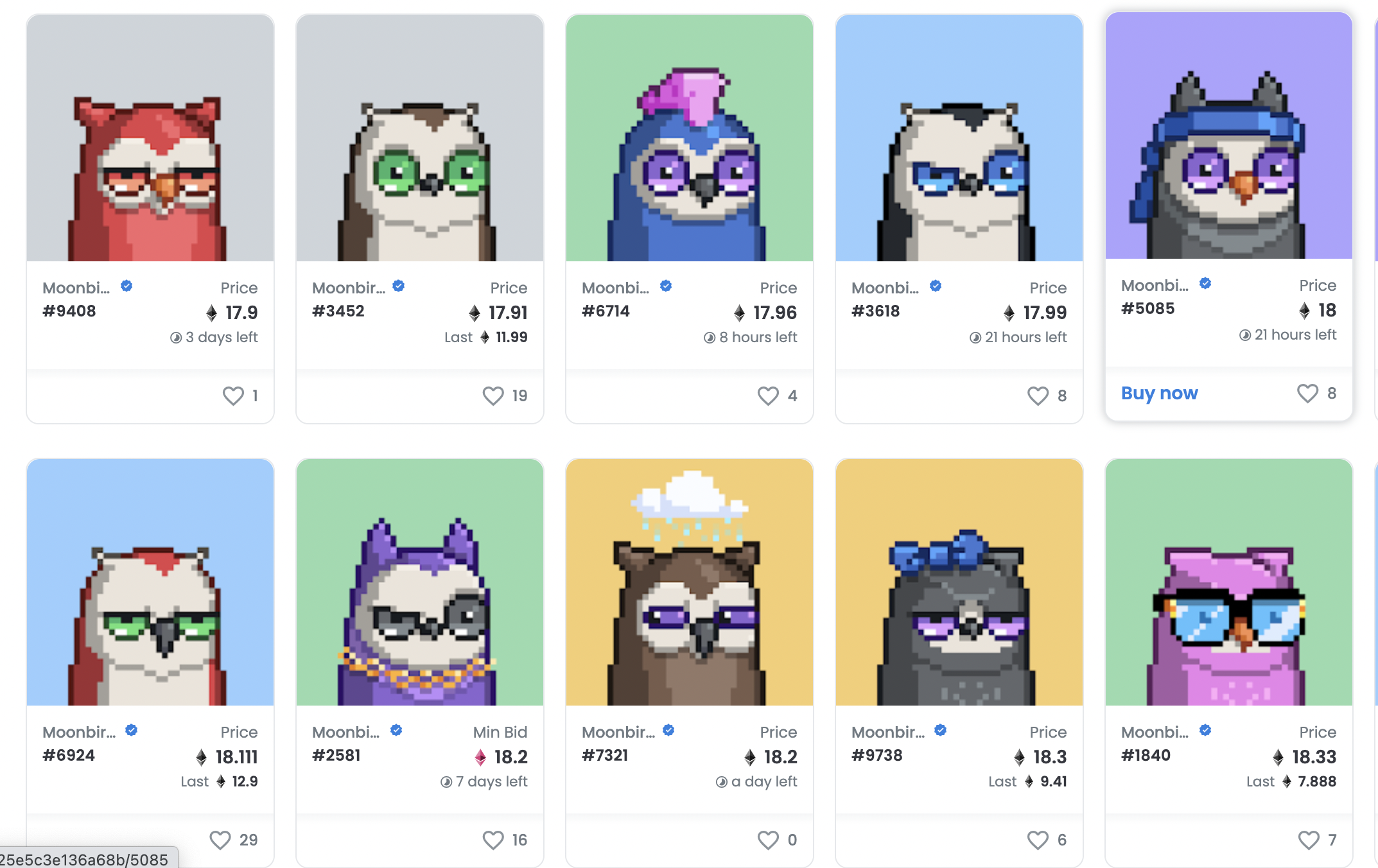

“Bitcoin Is Dangerous, Blockchain Is Good”

Some monetary gamers have taken one other tack of their disinformation marketing campaign. This entails criticizing Bitcoin however praising the underlying blockchain know-how that powers the system.

Banks see the potential of blockchain know-how to revolutionize funds and need to co-opt the know-how for his or her profit. For instance, JPMorgan Chase, the avowed Bitcoin critic, has created a cryptocurrency known as “JPMCoin” operating on its Quorum blockchain.

Central banks have additionally touted blockchain’s functionality to energy central financial institution digital currencies (CBDCs) — cryptocurrencies issued and backed by governments. Such belongings are pegged to a fiat foreign money, just like the greenback or euro, very similar to a stablecoin.

The Financial institution for Worldwide Settlement (BIS) ripped into cryptos in a June 2021 report, describing them as speculative belongings used to facilitate cash laundering, ransomware assaults and different monetary crimes. “Bitcoin, specifically, has few redeeming public curiosity attributes when additionally contemplating its wasteful power footprint,” the report declared.

Sarcastically, the BIS advocated for CBDCs in the identical report. Right here’s an excerpt:

“Central financial institution digital currencies signify a singular alternative to design a technologically superior illustration of central financial institution cash, one that provides the distinctive options of finality, liquidity, and integrity.

Such currencies may kind the spine of a extremely environment friendly new digital fee system by enabling broad entry and offering sturdy information governance and privateness requirements based mostly on digital ID.”

The “Bitcoin dangerous, blockchain good!” line has change into the favourite chorus of banks and fintech operators in response to Bitcoin’s reputation. As all the time, this argument misses the purpose.

With out Bitcoin’s decentralized structure, blockchain-based fee financial techniques are ineffective. Permissioned blockchains like Quorum endure from centralization and single factors of failure — issues Nakamoto sought to right by creating Bitcoin.

The identical points plague CBDCs. As I defined in a latest article, centralized management of a digital greenback or pound causes the identical issues witnessed with fiat currencies. With central banks controlling each influx and outflow of cash, it’d be all-too-easy to conduct monetary surveillance, implement unpopular financial insurance policies and conduct monetary discrimination.

A much bigger downside with this line of argument is that it fails to contemplate Bitcoin’s greatest power: cryptoeconomics. Satoshi’s best contribution was a novel mixture of financial incentives, sport idea and utilized cryptography needed for protecting the system safe and helpful within the absence of a centralized entity. Centralized blockchains with poor incentives are open to assault identical to another legacy system.

Why Are Banks Scared Of Bitcoin?

Conventional banks have lengthy made cash by charging customers to retailer and use their cash. The common account holder pays account upkeep charges, debit charges, overdraft charges and a plethora of fees designed to revenue the financial institution. All of the whereas, the financial institution loans out the cash sitting within the account, whereas giving customers solely a fraction of the earned curiosity.

Bitcoin, nevertheless, poses a menace to the banking business’s income mannequin. With cryptocurrencies, there are not any establishments serving to customers to retailer, handle or use their cash. The proprietor stays utterly answerable for their bitcoins.

However, wait, there’s extra.

Higher And Cheaper Transactions

Bitcoin makes it doable to switch cash to anybody, immediately, no matter the quantity concerned or the recipient’s location. And customers can try this with out counting on an middleman like their native financial institution.

On common, Bitcoin-powered transactions are sooner and cheaper than transactions by means of banks. Take into account how a lot time it takes to course of a world switch and the hefty charges that banks cost.

Aside from miner charges, persons are not paying anybody else to course of transactions on the Bitcoin blockchain. And quantities of any measurement, giant or small, will be moved with out the standard pink tape. In lower than 10 minutes, Bitcoin processes an irreversible cash switch. Banks merely can not match that.

Retailer Of Worth

Banks assist clients prepare long-term investments in gold, bonds and different belongings, to safe the worth of their cash. And so they cost a charge for custodianship, funding consulting and portfolio administration.

However what occurs when individuals work out they don’t must depend on banks to retailer worth?

As a consequence of its intrinsic properties, Bitcoin is quickly rising as a most well-liked retailer of worth. Bitcoin is scarce (solely 21 million models will ever be produced), but in addition fungible and transportable. This makes it even higher than conventional shops of values like gold.

As a result of anybody can simply purchase bitcoin and HODL, banks can now not make cash off shilling asset administration plans. Banks, like JPMorgan, have tailored by promoting bitcoin-based investments corresponding to futures — however that gained’t save them.

Resistance To Manipulation

Banks have lengthy survived by manipulating the monetary system for personal positive aspects. The 2008 monetary disaster resulted from underhanded dealings by among the world’s greatest banks, together with Lehman Brothers, which later declared chapter.

For example, banks all the time lend out extra money than they personal in what’s known as leveraging. Ought to everybody resolve to withdraw their cash from banks, all the business would inevitably crash.

Bitcoin permits individuals to be their very own banks. Cash in a Bitcoin pockets can’t be manipulated or utilized by anyone other than the holder. For the primary time, individuals now have the ability to manage their cash.

Banks Can’t Kill Bitcoin

The depth of the banking business’s data warfare reveals simply how a lot they concern Bitcoin — as they need to. It’s solely a matter of time earlier than bitcoin permeates each monetary sector — offshore settlements, escrow, funds, asset investments and extra.

When that occurs, banks will change into the newest victims of technological disruption. Simply as Netflix changed video leases and Amazon changed bookstores, Bitcoin will change banks. And no quantity of doubt-sowing and misinformation will reverse that.

It is a visitor publish by Emmanuel Awosika. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.