The 2 largest cryptos, Ethereum and Bitcoin are down by over 50% from their all-time excessive and the trade flows present totally different photos regardless of the bearish worth motion available on the market so let’s have a more in-depth look right this moment at our newest crypto information.

Having spent the previous 5 weeks in decline, the trade’s two largest cryptos by market cap Bitcoin and Ethereum are down by 50% from their ATH that was posted in 2021 through the bull run. Bitcoin dominates 41.8% of the market with a capitalization of $628 billion and it’s buying and selling at $32,947 which is a stage not seen since 2021 as per the information aggregator CoinMarketcap. The determine recorded a 51.9% drop in worth since BTC set to an ATH of $68,789 in 2021 and it’s a comparable story with Ethereum as properly.

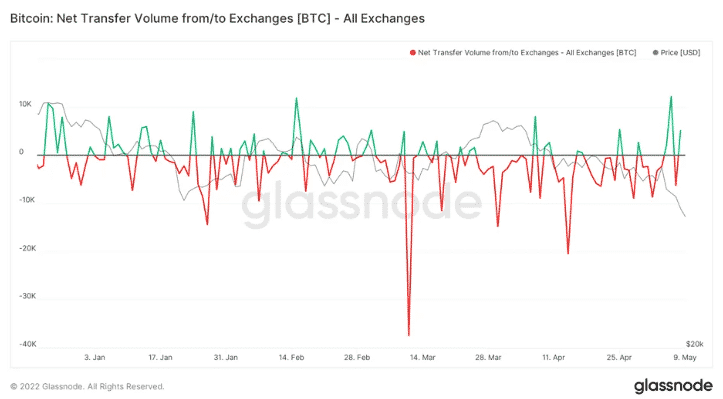

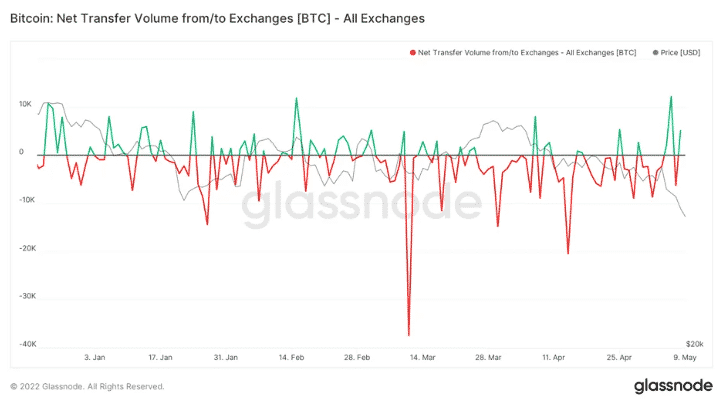

Ethereum has a marekt dominance of 19.2% with a present marekt cap of $289 billion however it’s buying and selling at $2,395 or about 50.9% of the previous excessive of $4,891 that was posted in November 2021. Aside from the BTC current worth motion could be understood in gentle of the inflows and outflows on exchanges and the larger inflows typically sign an imminent bear market as buyers moved their holdings on exchanges to promote for fiat or fiat-pegged stablecoins.

The larger outflows could be a bullish sign as buyers might be shifting their holdings to chilly storage wallets for holding in the long term. As per the information from Glassnode, Bitcoin’s 15% dip over the previous week additionally correlated with web switch volumes to varied exchanges and on Might 6, there was a web influx of 12,246 BTC or $402 million at right this moment’s costs. Ethereum’s web switch volumes for the month indicated that almost all buyers had been shifting their holdings off of exchanges and the contradiction between the current bearish worth motion accompanied by bigger outflows from exchanges solely means that there might be different forces at play for the second-biggest cryptocurrency.

Ethereum holders might be pulling their idle cash from exchanges for staking functions which leads as much as the community’s merge that’s anticipated in Q3. Traders can dump their holdings on totally different decentralized exchanges on the earth of DEFI however when evaluating transaction quantity for ETH on coinbase and DEFI largest decentralized trade Uniswap, the latter reported a buying and selling quantity of $1.63 billion previously 24 hours whereas former studies simply over $500 million.

If not within the DEFI sector, the ETH leaving from exchanges might be getting deployed in lending or borrowing protocols which might be used to mint stablecoins or host different DEFI actions which don’t lead to promoting the asset.

DC Forecasts is a pacesetter in lots of crypto information classes, striving for the best journalistic requirements and abiding by a strict set of editorial insurance policies. In case you are to supply your experience or contribute to our information web site, be happy to contact us at [email protected]