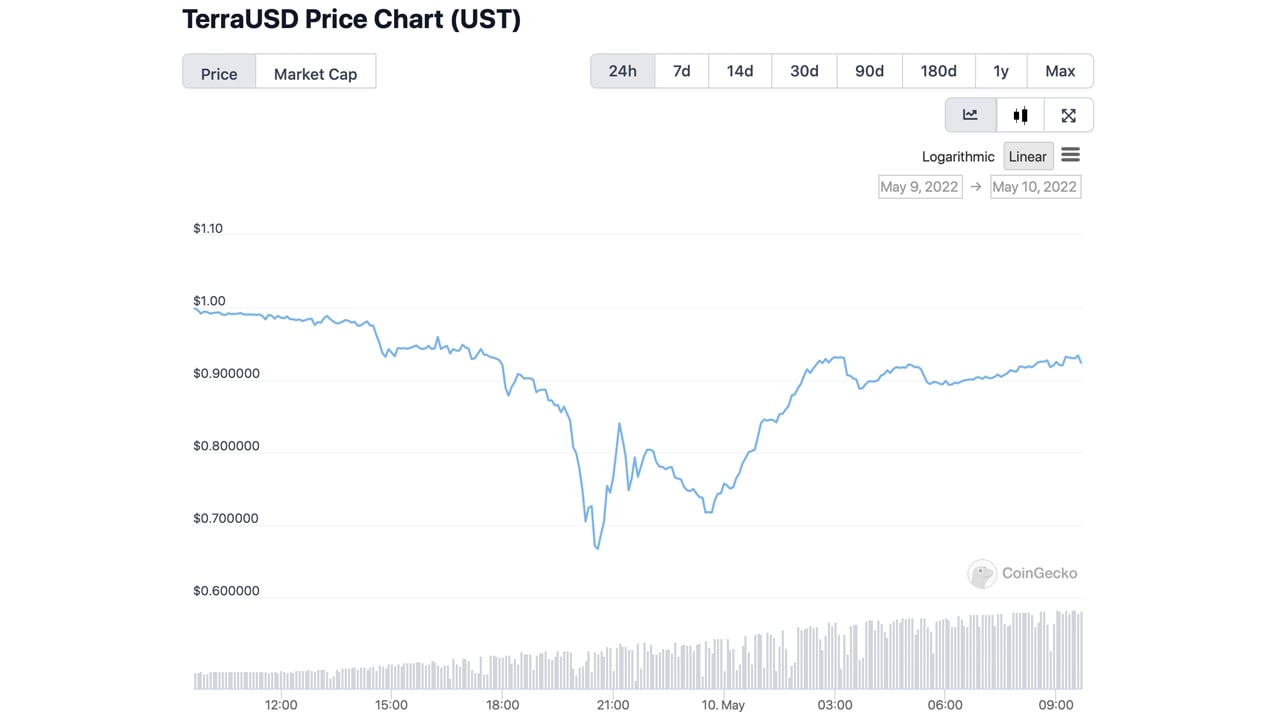

On Monday, Could 9, 2022, the stablecoin terrausd (UST) misplaced its parity with the U.S. greenback and dropped to an all-time low of $0.66 per unit. The stablecoin has been some of the topical discussions in crypto throughout the previous 24 hours, as many have been betting on whether or not it’ll fail or get better. Nonetheless, by 9:15 a.m. (ET) on Tuesday morning, the stablecoin has managed to climb again to $0.934 per unit.

UST Stablecoin Plunged to $0.66 per Unit, Rumors Unfold Like Wildfire

The Terra blockchain mission has been struggling in current occasions, because the community’s native asset LUNA has shed 43.6% towards the U.S. greenback throughout the previous 24 hours. Furthermore, the stablecoin terrausd (UST) has additionally been coping with intense strain because the token’s worth plummeted from $0.99 to a low of $0.66 per unit. On a couple of exchanges, UST dropped as little as $0.62 per unit during times of maximum promoting. Simply earlier than UST dipped $0.09 decrease than the $1 peg, Terra’s co-founder Do Kwon told the public that the staff was “deploying extra capital.”

A-Staff is assembling.

— Terra (UST) ? Powered by LUNA ? (@terra_money) May 9, 2022

In the course of the course of Monday night, the Luna Basis Guard (LFG) emptied the LFG bitcoin pockets that after held roughly 70,736.37 BTC. At the moment, there’s zero bitcoin within the pockets because it has been drained dry. The identical may be mentioned for the LFG Gnosis protected handle, because the ethereum handle held $143 million on Could 3. As we speak, the pockets holds $135.58 in ether, and some different ERC20 tokens with small values. Whereas LFG and Do Kwon advised the general public on Monday that $1.5 billion in bitcoin and UST could be lent to market makers, the present strikes have been much less clear.

Whereas UST plunged to $0.66 per unit, numerous theories swirled across the crypto business. There have been claims that the multinational hedge fund and monetary companies firm Citadel was involved. Reviews further claim that Binance order books had paused throughout the UST sell-off. For a small time period, Binance paused LUNA and UST withdrawals. Moreover, there’s been discuss of well-known crypto funds bailing out Terra as properly, by funneling billions again into the stablecoin’s ecosystem.

“There’s a rumor spreading about Leap, Alameda, and many others. offering one other $2B to ‘bail out’ UST,” theblockcrypto head of analysis Larry Cermak tweeted on Monday night. “Whether or not this rumor is true or not, it makes good sense for them to unfold. The largest query right here is, even when they will get it to $1 by some miracle, the belief is irreversibly gone.”

After UST Rebounds to $0.93, Individuals Query Trusting the Stablecoin Undertaking, Anchor TVL Slips by 43% in a Single Day

Discussions about individuals dropping belief in LUNA, UST, and Terra, typically, have been littered throughout social media. “Irrespective of how this ends, I don’t need individuals to name UST decentralized once more,” the bitcoin advocate Hasu tweeted on Monday. “Even the little collateral backing it has is intransparent and managed by a single social gathering. Used to carry out discretionary open market operations. That is like 10x worse than the Fed,” Hasu added.

? $UST stablecoin peg breaking…

Similar story as with all central financial institution making an attempt to defend a foreign money peg: as soon as the market casts a no confidence vote, your prop-up fund not often has sufficient belongings to forestall the dam from breaking. pic.twitter.com/x3llQtABmv— Tuur Demeester (@TuurDemeester) May 9, 2022

Investor Lyn Alden additionally made an announcement concerning the Terra catastrophe after she predicted it could happen final month. “Terra’s multi-billion-dollar algorithmic stablecoin UST blew up in the present day,” Alden said. “Other than destroying the worth of LUNA, they used their bitcoin reserves to attempt to defend the peg, sort of like a flailing rising market utilizing its gold reserves to defend its FX.”

In the course of the in a single day buying and selling classes and into the buying and selling classes on Tuesday morning, UST has been recovering from the losses. To date, terrausd (UST) has managed to climb again to $0.934 per unit, or down 6% from the $1 parity. Terra’s co-founder Do Kwon has not tweeted since saying the ‘A-team’ was deploying capital, though the co-founder may be very well-known for defending his mission. On the identical time, LFG has additionally not up to date the general public since its last tweet, which mentioned it might present extra updates.

Mark my phrases. The UST failure shall be used as proof by coverage makers to manage stablecoins to loss of life and champion CBDCs.

This isn’t good.

— Dennis Porter (@Dennis_Porter_) May 10, 2022

Along with the issues with LUNA’s and UST’s value, the decentralized finance (defi) lending protocol Anchor has shed 43.7% of its whole worth locked (TVL) throughout the previous 24 hours. On the time of writing, Anchor has a TVL of round $7.22 billion and $95.08 million is Avalanche-based collateral. Anchor was as soon as the third-largest defi protocol, and it has dropped right down to the sixth place on Tuesday.

Individuals in tradfi making enjoyable of UST… not realizing their stablecoin additionally depegged by 8% this 12 months.

— Erik Voorhees (@ErikVoorhees) May 10, 2022

Many surprise what’s going to occur if UST regains its $1 parity with belief within the stablecoin so shaken. Many UST house owners may very well be ready for the $0.99 space or near that vary, to allow them to money out of the stablecoin and transfer into one thing else. At $0.934141, UST is nearer to the $1 parity, however an funding of 5,000 UST would solely equate to $4,670.70 at present costs.

What do you consider the Terra mission’s points and the current UST de-pegging? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.