Bitcoin prolonged losses to achieve ranges final seen in January 2021 on Wednesday amid a broader market sell-off.

The peer-to-peer digital forex struggled to carry the $30,000 stage all through the day as U.S. inflation ranges had been reported above market expectations and a macroeconomic risk-off motion retains gaining traction globally.

U.S. inflation reached 8.3% within the 12 months ending in April 2022, the U.S. Division of Labor Statistics reported Wednesday morning.

The market had pinned client costs index (CPI) expectations at 8.1% and the worse-than-expected outcomes ensued a overwhelmingly purple day for fairness markets within the nation.

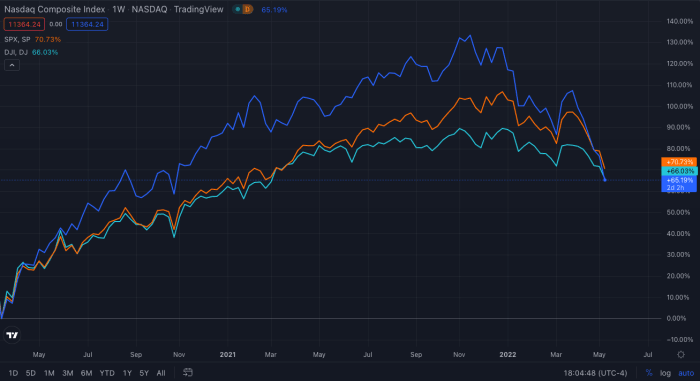

The Nasdaq dropped by greater than 3% on Wednesday to ranges not seen since November 2020. The Dow Jones and the S&P 500 additionally didn’t escape the carnage. The 2 indexes plunged to ranges each hadn’t revisited since March 2021. The Dow denoted a 1% loss whereas the S&P 500 slid by 1.65% in the present day.

Equities have turned south ever for the reason that Fed turned hawkish. Picture supply: TradingView.

Markets have largely turned south ever for the reason that U.S. Federal Reserve Board walked away from its overly accommodative insurance policies that started on the outset of the COVID-19 pandemic.

Turning on a extra hawkish tone, the Fed started diminishing its asset purchases a number of months in the past, however it wasn’t till March that the central financial institution’s Federal Open Markets Committee (FOMC) raised charges for the primary time in three years. The conservative 0.25% elevate would set a precedent for increased hikes to observe.

Earlier this month, the FOMC introduced that the Fed’s benchmark rate of interest would rise by 0.5% – double the rise of the earlier assembly. The committee’s hike in Might denoted the most important improve in rates of interest in over twenty years.

Moreover, the FOMC introduced it could start shrinking its stability sheet, that means it could now not be a holder of belongings like bonds and mortgages, driving bond yields and mortgage charges up and placing further stress on equities.

Bitcoin’s correlation with fairness markets will be partly defined by the better involvement {of professional} traders and establishments, that are delicate to the supply of capital and due to this fact rates of interest, Morgan Stanley reportedly mentioned.

Along with a hawkish U.S. central financial institution, international points just like the Russian battle in Ukraine and China’s ongoing lockdowns have careworn provide chains worldwide, additional pressuring markets all the way down to erase a part of the positive aspects made since late 2020 – Bitcoin included.