In a earlier article, we launched three tokenomic fashions for single-token blockchain video games and their respective professionals and cons.

On this article, we’ll go over dual-token tasks, an innovation that got here after single-token video games, which is the preferred mannequin right now.

The twin-token mannequin emerged within the first half of 2020 when Axie Infinity launched SLP (Clean Love Potion) to scale back promoting stress on AXS, the unique recreation token of Axie Infinity.

Since then, nearly all main titles have had a dual-token economic system.

To know how dual-token video games work and why this mannequin exists, we should always take a look at how Axie rolled out SLP.

Earlier than introducing SLP, Axie was a single-token GameFi, the place gamers enter USD and obtain the sport token, AXS. With great consumer progress and cash from many PE funds supporting the market, Axie efficiently ran on only one token for over a yr.

Nevertheless, it was not troublesome for Axie to appreciate how important new customers had been for the tasks. As soon as new cash stopped coming in, a dying spiral would start.

To alleviate promoting stress on AXS, Axie launched SLP in 2020. Whereas AXS was used for governance and staking rewards, gamers would use in-game utility token SLP for breeding new Axies and incomes extra SLP. The event group elevated the ratio of $AXS- $SLP required for breeding and elevated the quantity of $SLP wanted for copy.

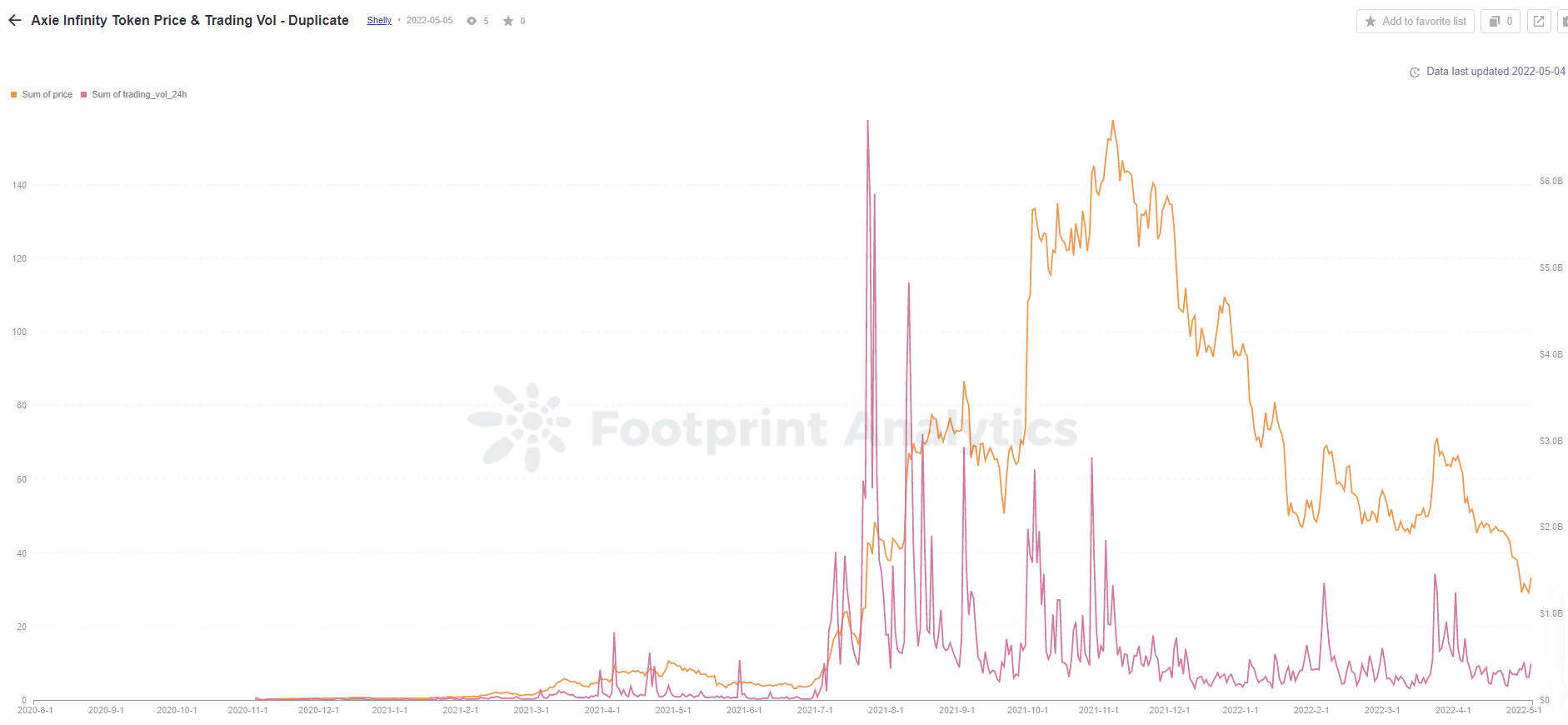

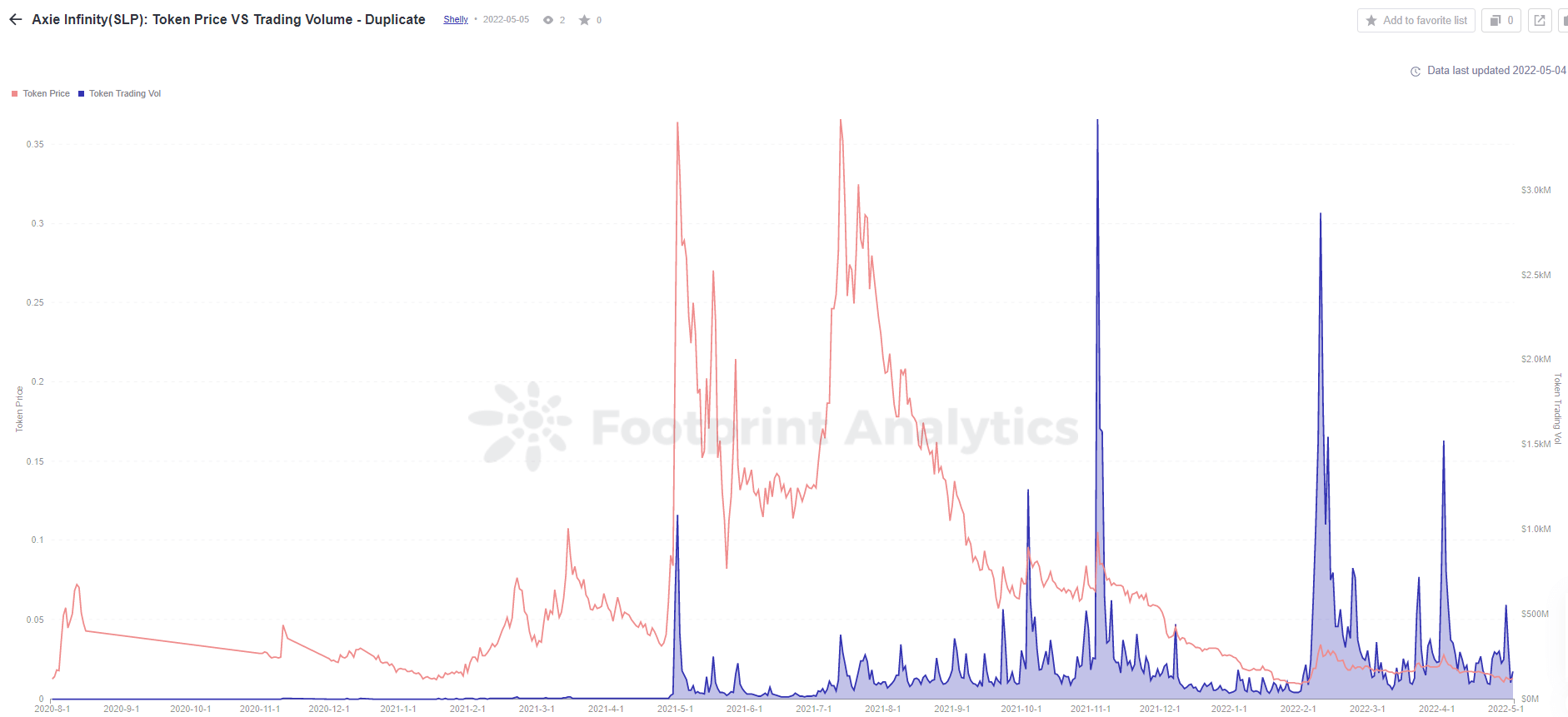

At first, the brand new mannequin labored as deliberate. In accordance with Footprint Analytics, AXS’s worth roared proper after SLP was dropped at the sport, whereas SLP’s token worth stood beneath $0.1 for a number of months. SLP had seen an uptrend drawn by newcomers for the reason that GameFi summer time.

Nevertheless, this development didn’t final lengthy, and SLP quickly fell right into a dying spiral. The Axie group responded by altering the group governance construction to change into extra decentralized. In addition they eliminated SLP as the sport’s PVE (Participant vs. Surroundings) yielded earnings on Feb. 9 to scale back SLPs mint and provide. With these modifications, SLP’s worth elevated.

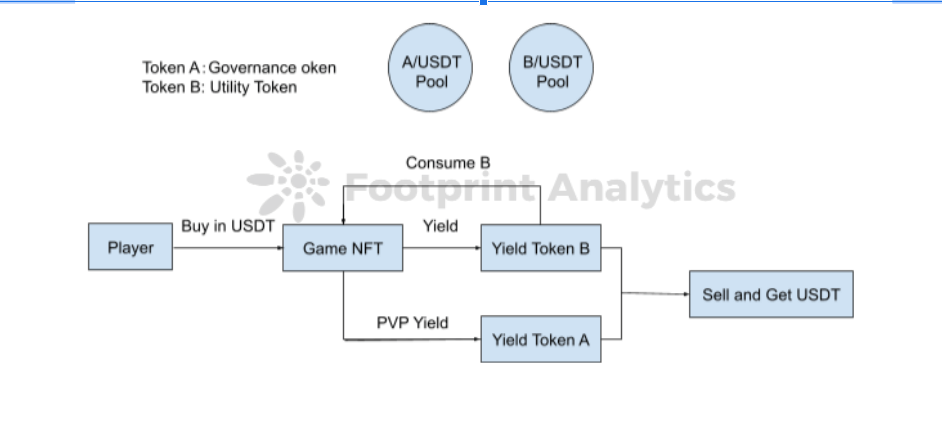

The twin-token mannequin has solidified whereby one token is especially used for governance—proudly owning extra of this permits the holder to have extra voting energy in group votes in regards to the venture—and one other is used for in-game capabilities, i.e., the utility token. In most video games right now, gamers earn a lot of the yield within the normally lesser valued utility coin and a bit within the governance coin as a premium, e.g., in the event that they personal precious NFTs.

Moreover Axie, a number of different well-liked GameFi tasks, similar to BinaryX and Starsharks, additionally use the dual-token mannequin.

Two totally different classes of twin tokens GameFi

A lot of the newly launched dual-token GameFi tasks undertake the mannequin of the “enter recreation token and output recreation token” mannequin.

For instance, BinaryX gamers use governance tokens to begin the sport and yield utility tokens as returns, whereas Starsharks gamers begin and yield utility tokens within the recreation.

We all know from the earlier article that the associated fee and returns are extremely correlated to this mannequin’s token worth. It’s a lot simpler to regulate the tokenomic fashions with out centralized adjustment with the twin tokens than the USD value-based mannequin. The USD-based mannequin requires an oracle to specify the variety of corresponding tokens, which complicates the dual-token mannequin.

On this article, we offer an analytical strategy to dividing totally different classes of twin tokens GameFi: After the sale of Genesis NFT, what strategy does the venture proprietor use to extend the variety of NFTs available in the market to satisfy the demand for NFTs from new gamers?

At first, a lot of the GameFi tasks will promote Genesis NFT on the official platform or companion platforms similar to Binance NFT or Opensea to build up preliminary gamers. They then have a number of mechanisms to mint additional NFTs whereas fuelling token consumption. These embody:

- Breeding Mannequin: On this mannequin, the second technology NFTs and subsequent NFTs come from the breeding of Genesis NFTs, with no extra blind containers bought. This mechanism requires burning/spending tokens to mint the brand new NFTs, which permits the sport to affect the promoting stress on the tokens relying on the worth of minting.

- Blind Field Mannequin: In contrast with the breeding mannequin, the blind field is straightforward. The group units the variety of NFTs within the recreation, and when the market is sweet, or consumption goes up, gamers promote extra. This buoys the worth of the tokens as a result of they want them to purchase the NFTs.

Nevertheless, all formidable, long-view tasks will declare that a lot of the cash from blind field gross sales, whether or not in USDT or utility tokens, goes straight to the group treasury or burnt. Starsharks is so well-liked as a result of it introduced to burn 90% of the utility tokens from blind field gross sales.

Abstract of dual-tokens GameFi tokenomics

Tokenomics are a vital a part of a GameFi venture, together with metrics just like the variety of new gamers, the variety of lively gamers, and the distinction between output and consumption.

As GameFi evolves, every cycle sees new financial fashions and improvements, every with its personal professionals and cons. Severe buyers may study to identify tendencies inside particular tokenomic fashions to time bottoms, predict FOMO inflation, generate yield throughout backside stabilization, and different methods.

An article initially by Watermelon Recreation Guild, edited by Footprint Analytics group.

The Footprint Group is a spot the place information and crypto lovers worldwide assist one another perceive and achieve insights about Web3, the metaverse, DeFi, GameFi, or another space of the world of blockchain. Right here you’ll discover lively, numerous voices supporting one another and driving the group ahead.

What’s Footprint Analytics?

Footprint Analytics is an all-in-one evaluation platform to visualise blockchain information and uncover insights. It cleans and integrates on-chain information so customers of any expertise degree can rapidly begin researching tokens, tasks, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anybody can construct their personalized charts in minutes. Uncover blockchain information and make investments smarter with Footprint.