After the collapse of Terra’s once-stable coin terrausd (UST), a lot of folks puzzled the place the Luna Basis Guard’s (LFG) bitcoin went, because the funds have been supposed for use to defend the UST’s $1 parity. On Friday, the blockchain intelligence and analytics agency, Elliptic, printed a weblog put up that summarizes the place the bitcoin was despatched, in accordance with the agency’s community surveillance instruments.

LFG Bitcoin Stash Deposited Into 2 Digital Forex Exchanges In line with Elliptic’s Blockchain Analytics Software program

Whereas reflecting on the current crypto market chaos and the Terra stablecoin implosion, a large number of folks on boards and social media asked the query: “The place is LFG’s Bitcoin reserve?” As an example, this weekend on Twitter one particular person wrote:

Luna Basis Guard (LFG) had a bitcoin reserve that was price over $3B earlier than the UST and Luna disaster started. However the LFG reserve pockets is now empty nevertheless it was reported that Bitcoins weren’t used to calm the disaster. Then the place did the Bitcoins go to? Folks want solutions.

Moreover, on Could 13, Terra’s founder Do Kwon advised the general public that the workforce was planning to replace the crypto neighborhood with reference to the bitcoin (BTC) reserves.

“We’re at the moment engaged on documenting the usage of the LFG BTC reserves throughout the de-pegging occasion,” Kwon said. “Please be affected person with us as our groups are juggling a number of duties on the similar time.” Following Kwon’s Twitter thread, the blockchain analytics firm Elliptic printed a weblog put up that explains the LFG’s BTC strikes in additional element.

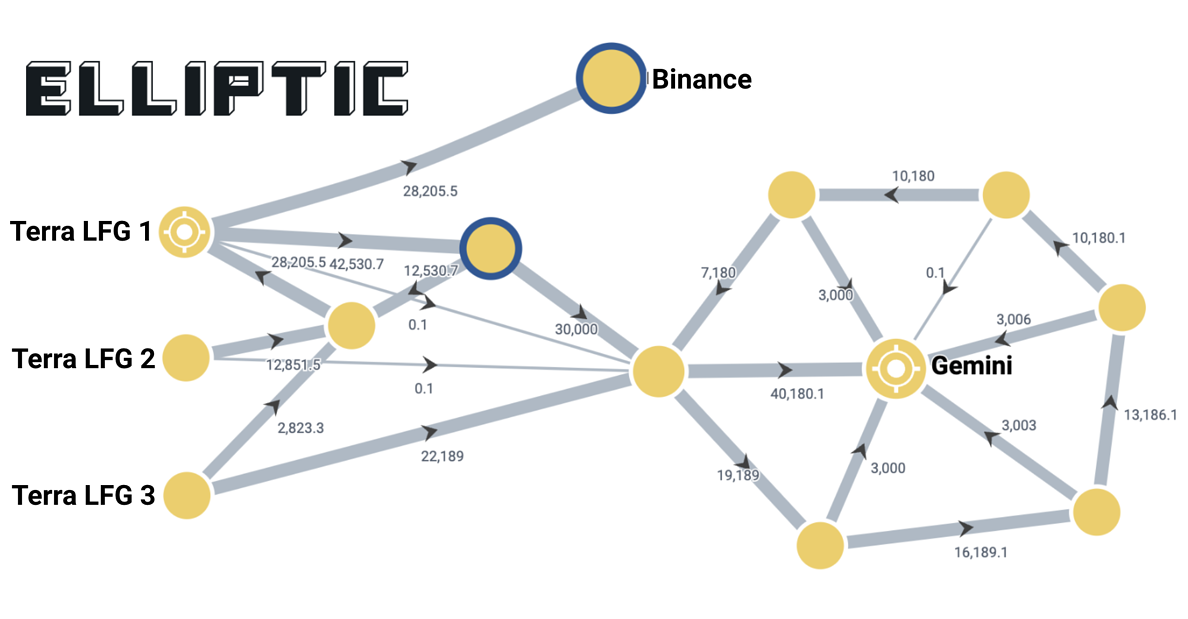

When the nonprofit group LFG determined to maneuver the bitcoin on Could 9, Elliptic’s blockchain analytics software program monitored the state of affairs. After LFG revealed it might mortgage $750 million in BTC to market makers, Elliptic’s weblog put up particulars that Kwon clarified LFG would use the BTC “to trade.” Then Elliptic’s software program caught two transactions price 52,189 BTC despatched to a brand new handle tied to the LFG stash.

80,394 Bitcoin Moved From LFG’s Stash

Along with the 52,189 BTC, LFG held one other pockets with 28,205 BTC, and LFG’s complete bitcoin reserve added as much as roughly 80,394 bitcoin (BTC) whole. In line with Elliptic, all of the funds have been despatched to Binance and Gemini amid the market chaos.

“The whole thing of this 52,189 BTC was subsequently moved to a single account at Gemini, the US-based cryptocurrency change – throughout a number of bitcoin transactions,” Elliptic mentioned on Friday. “It isn’t potential to hint the property additional or establish whether or not they have been offered to assist the UST value.” The weblog put up provides:

This left 28,205 BTC in Terra’s reserves. At 1 a.m. UTC on Could tenth, this was moved in its entirety, in a single transaction, to an account on the cryptocurrency change Binance. Once more it’s not potential to establish whether or not these property have been offered or subsequently moved to different wallets.

Bitcoin.com Information additionally appeared into the onchain actions and confirmed that Elliptic’s abstract was correct. As an example, the LFG bitcoin pockets interacted with this bitcoin handle, and the pockets is flagged as a Binance sizzling pockets. Oxt.me knowledge has an annotation written by Ergobtc that claims it’s the buying and selling platform’s “central sizzling pockets.” The pockets was created on October 8, 2021, and 9.5 million BTC has handed via the pockets.

LFG’s bitcoin pockets additionally interacted with this handle which additionally has an oxt.me annotation that claims it’s a Gemini change handle. The handle created on June 13, 2017, has seen a complete of 1,284,918 BTC go via the bitcoin pockets. Whereas the Binance sizzling pockets nonetheless incorporates BTC for warm pockets providers, the Gemini change handle has a zero stability on Could 14, 2022.

What do you consider Elliptic’s abstract of the LFG bitcoin stash and actions? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Elliptic

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss precipitated or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.