Disclaimer

This report is meant for CoinSutra VIP customers. This analysis report relies on the present market circumstances and shouldn’t be handled as direct monetary recommendation. Investing in crypto-assets has threat attributable to excessive volatility, so make investments solely that quantity which you’re alright to lose. We aren’t a monetary advisor, and this isn’t a monetary recommendation. #DYOR

The blockchain trade has come a good distance within the final decade. With so many networks and functions at our disposal, this expertise would disrupt a number of current industries.

However as of now, there’s a bottleneck. All of the networks and functions in themselves are remoted from one another. Let’s take Uniswap as an Instance.

Uniswap is a Decentralised Trade (DEX) constructed on the Ethereum blockchain community. You should utilize this alternate to swap crypto tokens. However there’s a downside that it’s constructed on the Ethereum community, and you’ll solely swap Ethereum-based tokens. Non-Ethereum tokens have to be listed in a Artificial or Spinoff type, often known as Wrapped Tokens. So, platforms like Uniswap lack cross-chain performance.

Now let’s take Binance for example which gives customers with an entire cross-chain expertise. On Binance, you’ll be able to very simply swap ETH with BTC. Each of those tokens pertain to completely different networks. However the greatest downside with Binance is that it’s centralized and custodial. That is in opposition to the core values of the blockchain trade.

The vast majority of crypto transactions are nonetheless being processed by means of centralized exchanges similar to Binance, Coinbase, FTX, and many others. It’s not a secret that these exchanges have full custody of your funds, and in case there’s a hack on the alternate, chances are you’ll lose all of your funds. Additional, with these exchanges dealing with such an unlimited quantity of buying and selling quantity, they’d turn out to be the long run banks of the trade with a lot centralized energy.

Due to this fact, there was a necessity for an answer. The perfect blockchain ecosystem is solely decentralized and cross-chain. Which means that no single platform or community would dominate the trade. Additional, all of the functions and property are interoperable with one another.

Thorchain is a venture that tries to try this. So let’s discover out what this venture is all about.

What’s Thorchain?

For a layman, Thorchain may be described as a Cross-Chain Uniswap. However there may be much more to it.

Thorchain is a Layer 1 blockchain community constructed with Cosmos SDK (Software program Improvement Package). Due to this, Thorchain is a community that’s interoperable with different blockchain networks. Thorchain has a cross-chain liquidity mannequin constructed on this community that means that you can:

- Swap crypto property even when two property pertain to completely different blockchain networks. For instance, swapping ETH (Ethereum Community) with BTC (Bitcoin Community). Additional, this swap is completed in a decentralized and non-custodial method.

- Earn passive earnings in your crypto property by depositing them into Thorchain Liquidity Protocol.

Presently Helps the next property as of April 2022:

Who’re the Founders of Thorchain?

Thorchain was and is being constructed by an nameless staff of builders. Due to this fact, we don’t have the background particulars of any lead member.

Thorchain is extra like a neighborhood venture with no management or command construction. You may learn extra about this right here.

Now let’s perceive the potential use circumstances of the Thorchain Protocol.

What are the Use Circumstances of Thorchain?

The use circumstances of the Thorchain community are as follows:

1. Thorswap

Thorswap is a multi-chain DEX (Decentralised Trade) constructed on the Thorchain community. It makes use of Thorchain’s Liquidity Protocol, the place you’ll be able to both swap tokens or present liquidity.

For extra info on this, you’ll be able to learn our Newbie’s Information for Liquidity Swimming pools.

2. Thorchain Identify Service

Thorchain identify service is a Area Identify Service much like Ethereum Identify Service. You may register a multichain area identify with Thorchain, which you’ll additional use for sending and receiving funds. If a receiver has a Thorchain area identify, the sender would merely add the area identify within the transaction interface as a substitute of a sophisticated pockets handle.

This simplifies the method of sending and receiving crypto funds.

You may discover Thornames right here.

3. Thorchain Synthetics

Thorchain Synthetics are a spinoff model of Layer 1 crypto property. For instance, ETH is a cryptocurrency native to the Ethereum Community. sETH is an artificial crypto-token issued on the Thorchain community which might mimic the worth of ETH. The advantage of an artificial asset is that you may commerce sETH on Thorchain with out paying a excessive gasoline charge of the Ethereum Community. Additional, the transaction time would even be considerably much less.

Within the case of synthetics issued by Thorchain, property are backed up by 50% of the asset whose artificial model is created and 50% of RUNE tokens.

Tasks like Synthetix and Mirror Protocol already present related artificial tokens. You may learn extra about Mirror Protocol right here.

Additional, you’ll be able to learn extra about Thorchain Artificial Belongings right here.

4. Digital Collectibles

Like every other Layer 1 blockchain community, Non-Fungible Tokens may be created on Thorchain. Presently, there are a number of collections generated on the community, similar to Thorchain Collectibles, THORGuards, PixelTHOR, ThorchainPunks, ROON, and many others.

If you’re new to the idea of NFTs, then you’ll be able to seek advice from our Newbie’s Information to NFTs.

How does a Swap transaction work in Thorchain?

Let’s assume that you just need to swap 1 BTC with ETH. In different phrases, you’re promoting BTC and shopping for ETH. There can be three completely different transactions.

- BTC is shipped out of your pockets to Thorchain Vault,

- ETH is shipped from the Thorchain vault to your pockets, and

- RUNE within the ETH+RUNE liquidity pool is transferred to the BTC+RUNE liquidity pool.

You may learn extra about Thorchain Swap transaction right here.

Now on this transaction, the next price will probably be incurred by the protocol:

- Inbound transaction gasoline charge

Fuel charge for switch of BTC out of your pockets to Thorchain Vault. Fuel charge can be paid in BTC. Let’s assume the gasoline charge to be $100.

- Outbound transaction gasoline charge

Fuel charge for switch of ETH from Thorchain Vault to ETH – Fuel charge paid in ETH. Let’s assume the gasoline charge to be $100.

- Slippage price

Slippage is the price of change in asset liquidity. You may learn extra about slippage right here. Let’s assume the slippage charge to be $100.

The charge collected from you for this swap can be as follows:

| Particulars | Quantity (Estimate) |

| Inbound Fuel Payment | $100 |

| 3 Instances Outbound Fuel Payment | $300 |

| Slippage Payment | $100 |

| Whole Payment | $500 |

You may learn extra concerning the charge charged by Thorchain right here.

Word: The above transaction price is simply an instance to clarify the mechanism. Relying on the community visitors, the precise gasoline price could also be excessive or low.

What are the Elements of Thorchain?

The primary elements of Thorchain are as follows:

1. Events Concerned

The three forms of folks concerned within the Thorchain ecosystem are:

- Merchants

- Liquidity Suppliers

- Node Operators

A Dealer is an individual who would use the platform for swapping crypto property. For utilizing the Thorchain swapping service, the dealer would pay a Buying and selling Payment which is the first income supply of the platform.

These customers deposit their property within the Liquidity Swimming pools and earn yield. This yield is paid by the protocol from the charge collected from the merchants. 33% of the protocol’s income is distributed to Liquidity suppliers.

These are individuals who run nodes on the Thorchain often called Thornodes. Additional, these operators additionally run a node on every supported chain similar to Ethereum, Bitcoin, Terra Community, and many others. 67% of the protocol’s income is distributed to Liquidity suppliers. Personal Keys of property assist in the Liquidity Swimming pools is saved with node operators in a decentralized method. To efficiently course of a transaction, 2/third of nodes want to substantiate it.

2. Thorchain Community Nodes

As already acknowledged, Thorchain is a community constructed on pc nodes. These nodes are often known as Thornodes. The present variety of energetic nodes is round 100, which is predicted to be prolonged to 250 in the long term.

These node operators are chargeable for an environment friendly transaction throughput of the community. All of the Thornodes are nameless and don’t help public delegation.

Additional, all of the personal keys are saved with these nodes in a decentralized method. Any transaction would want the approval of atleast 2/third of the Nodes.

Thorchain community nodes should lock RUNE tokens into the protocol as collateral. The quantity of RUNE tokens to be locked can be equal to the Whole Worth of property locked on Thorchain.

Additional, if any node operator misbehaves, then his share of collateral might be slashed. Thus, retaining the nodes in test.

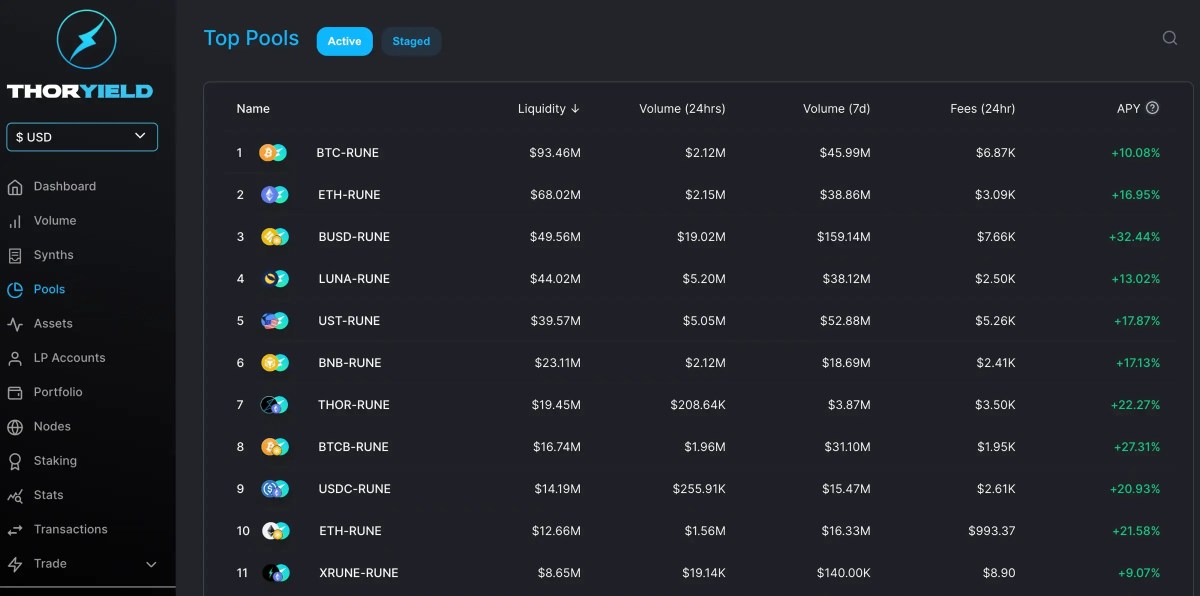

3. Thorchain Liquidity Swimming pools

Liquidity Swimming pools are an important element of the Thorchain ecosystem as the entire ecosystem is constructed round these swimming pools.

These are twin asset swimming pools during which one asset would all the time be RUNE which is the in-house token of the platform. In different phrases, if there may be an ETH pool, then the pool would encompass ETH and RUNE in a 1:1 ratio of worth. Equally, if there’s a BTC pool, then the pool would encompass BTC and RUNE in a 1:1 ratio of worth.

As already talked about, 33% of the platform’s income can be distributed to the Liquidity Suppliers of those swimming pools.

Whereas depositing funds right into a liquidity pool, liquidity suppliers would solely pay the traditional gasoline charge (a.ok.a. Inbound charge). Nevertheless, the outbound charge is thrice the common gasoline charge whereas withdrawing these property.

Additional, Thorchain additionally gives Impermanent Loss Safety to its Liquidity Suppliers. In case there may be an Impermanent loss to a Liquidity Supplier, then this loss is compensated by the protocol within the type of RUNE tokens. Nevertheless, Impermanent loss safety is partial for the primary 99 Days of offering liquidity. After that you just saved full safety.

You may be taught extra about Impermanent Loss with our Newbie’s Information.

4. Thorchain Vaults

The overall property of the protocol, i.e., pool property, nodes bonded property, and different property, are saved in two several types of vaults.

- Inbound Vaults, a.ok.a. Asgard TSS Vaults

These vaults maintain many of the property of the protocol. Any transaction by means of these vaults wants atleast to be authorized by atleast 2/third of the nodes. Due to this fact, the transaction is tremendous safe, but it surely’s additionally gradual.

The second sort of vault is known as outbound vaults.

- Outbound Vaults, a.ok.a. Yggdrasil Vaults

These are the vaults dealt with by particular person node operators. Any transaction from this vault solely wants that respective node operator’s signature. Due to this fact, the transaction is quicker, however it’s much less secure. From the safety viewpoint, the worth of property in an Outbound Vault would by no means be greater than 25% of the collateral supplied by the node operator. This fashion node operator wouldn’t have any motivation to steal the funds.

You may learn extra about Thorchain Vaults right here.

5. RUNE Token

RUNE is the in-house token of the Thorchain ecosystem, which additionally acts as its spine.

Token Economic system of RUNE

| Particulars | Quantity |

| Most Provide (Supply) | 500 Million |

| Whole Provide | 335 Million |

| Circulating Provide | 330.7 Million(66% of the Most Provide) |

| Token Value (as of 13 Might 2022) ($) | $ 3.58 |

| Market Cap ($) | $ 1.18 Billion |

| 24 Hour Buying and selling Quantity ($) | $ 218 Million |

| Whole Worth Locked ($) | $ 225 Million |

Initially, RUNE had a most provide of 1 Billion. Nevertheless, in October 2019, this provide was diminished to 50%, i.e., to 500 Million. The preliminary provide of 1 Billion was minted, and afterward, the a part of tokens mendacity unused in Reserves was burnt to scale back the utmost provide. You may learn extra about RUNE token burn right here,

The overall provide is 335 Million, and the circulating provide is 330.7 Million which is 66% of the utmost provide.

As of 13 Might 2022, the token value is $3.58, which makes the market cap round $1.18 Billion. Additional, the platform has a Whole Worth Locked (TVL) of $225 Million.

Token Distribution

| Particulars | %age | No. of Tokens |

| Seed | 5% | 25 Million |

| Preliminary DEX Providing (IDO) | 16% | 80 Million |

| Builders | 10% | 50 Million |

| Operational Reserve (Firm) | 13% | 65 Million |

| Neighborhood Reserve | 12% | 60 Million |

| Nodes and LP Rewards (10+ Years) | 44% | 220 Million |

| Whole | 500 Million |

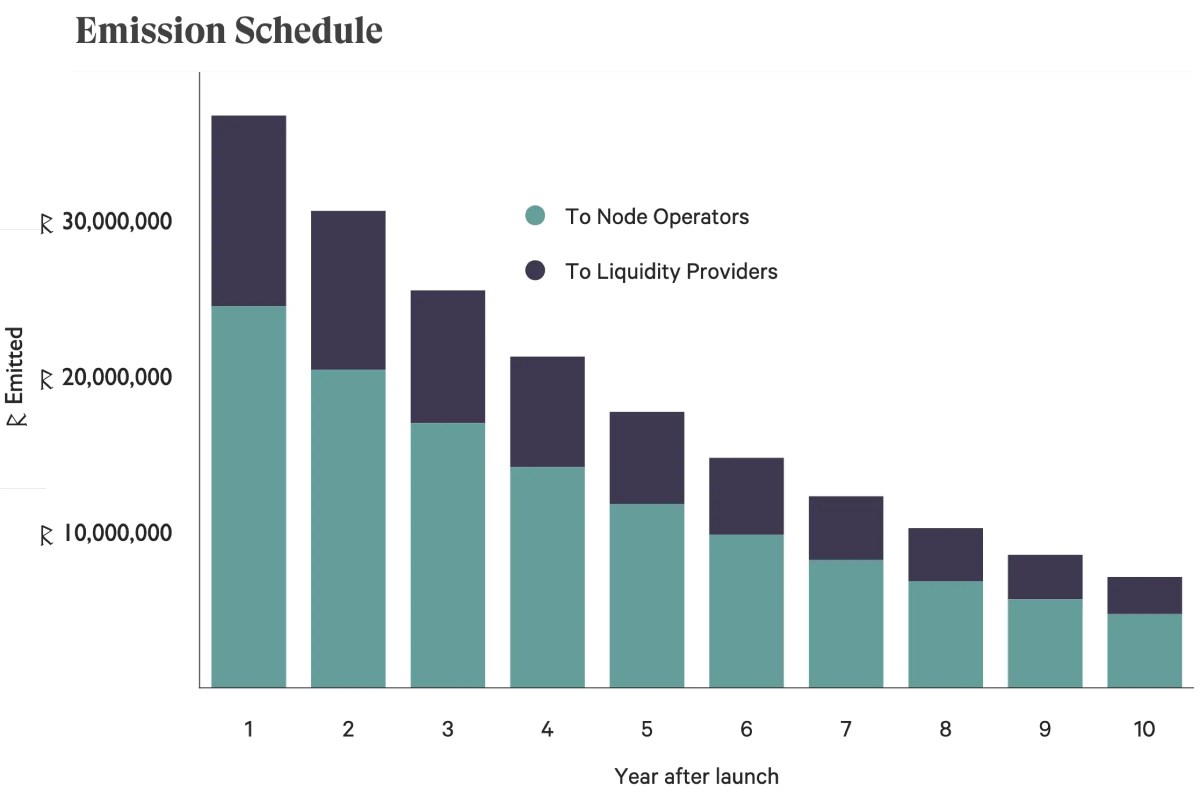

Token Emission

The remaining RUNE tokens are anticipated to be emit until 2028 within the following method.

Additional, RUNE incentives can be distributed to Node Operators and Liquidity Suppliers one thing like this.

Use Circumstances of RUNE token

The use circumstances of RUNE tokens are as follows:

- Charges charged by the merchants are collected in RUNE.

- The RUNE holders govern Thorchain.

- ThorNodes have to bond RUNE tokens to validate a transaction.

- Every liquidity pool has a 50% share of RUNE tokens. Which means that if you wish to deposit ETH within the Thorchain liquidity pool, you might want to deposit an equal quantity of RUNE tokens.

In different phrases, RUNE gives a four-dimensional utility to the protocol:

| Liquidity All of the liquidity swimming pools within the protocols have 50% RUNE in them. |

Safety All of the node operators have to bond RUNE Tokens as collateral. This collateral may be slashed upon any misbehavior from the node operator. |

| Governance RUNE holders can take part within the governance of the protocol. |

Incentives Incentives to Liquidity suppliers, node operators, and merchants are paid in RUNE. |

The place can you purchase RUNE Token?

You should buy RUNE tokens on the next crypto exchanges:

| Centralized Exchanges | Remarks |

| Binance | Accessible for all components of the world besides the US and sanctioned nations. US Residents ought to use Binance.US |

| ByBit | Not accessible within the US and Singapore. |

| FTX | Not accessible within the US |

| MEXC World | Not accessible within the US |

| Decentralized Exchanges | Remarks |

| Binance DEX | Fuel charge will probably be charged along with the buying and selling charge. |

| Thorswap | Fuel charge will probably be charged along with the buying and selling charge. |

The place can you purchase RUNE Token?

Wallets, the place you’ll be able to maintain your RUNE tokens safely are as follows:

For extra info on Crypto wallets, you’ll be able to refer our Crypto Pockets Guides as follows:

Thorchain Community Statistics

Whole Worth Locked as of 30 April 2022

What’s the Income Mannequin of Thorchain?

Thorchain has the next sources of earnings and corresponding bills:

| Earnings | Bills |

| Token Swap Payment | Block Rewards (67% Nodes, 33% LPs) |

| Thorname Registration Payment | Impermanent Loss Safety |

| Synth Minting Payment | Synth Staking Yields |

| Node Slashing Penalties | Some other rewards |

| Community charge for on-chain transactions |

Roadmap of Thorchain

Within the coming future, Thorchain will probably be engaged on options similar to:

- Market orders

- Restrict Orders

- Leverage Buying and selling

- P2P (Peer to Peer) Lending

- Staking

- Extra community integrations (together with privateness and layer 2 chains)

- Extra DEX (Decentralised Exchanges) integrations

- Lending and Financial savings

Thus, aiming to construct an entire decentralized various ecosystem to centralized exchanges. You may learn extra about Thorchain Roadmap right here.

Now, let’s consolidate the professionals and cons of the venture.

Advantages and Limitations of Thorchain

What are the Advantages of Thorchain?

The varied advantages of the Thorchain protocol are as follows:

- Cross-chain ecosystem

Thorchain has considerably simplified the cross-chain operations. You may very simply swap one asset with one other no matter whether or not the 2 property pertain to a single blockchain community or not.

This is able to additionally improve the cross-chain DeFi ecosystem.

- Decentralized and Nameless

The entire means of swapping funds on Thorchain is decentralized and non-custodial. Additional, consumer identification stays utterly nameless as there isn’t any want for KYC. Due to this fact, any Decentralised Trade (DEX) that desires to supply cross-chain companies can merely supply liquidity from Thorchain.

- Bug Bounties

Thorchain has a Bug Bounty program the place anybody who would assist establish the potential vulnerability within the protocol can be rewarded. The utmost bounty is $500,000.

You may learn extra about Thorchain bug bounty right here.

- Safety Audits

Within the current few months, Thorchain has been by means of a number of safety audits. Nevertheless, this was accomplished after $8 Million have been hacked and stolen from the protocol in July 2021. You may learn extra concerning the Thorchain Hack and Safety Audit right here.

Now, let’s see what the potential downsides of this venture are.

What are the restrictions of the Thorchain?

The varied limitations of the Thorchain protocol are as follows:

- Excessive transaction charge

As described within the instance above, Thorchain expenses a excessive transaction charge.

Nevertheless, presently, there’s a proposal to vary the construction of outbound charges, which may scale back the burden on Merchants and Liquidity Suppliers. You’ll find the mentioned proposal right here.

- Low Whole Worth Locked

Contemplating the cross-chain ecosystem supplied by Thorchain, the present TVL of the platform is admittedly low. The venture would want so as to add extra options and decrease the transaction charge for higher adoption of the platform.

- Centralization

With 100 energetic node operators, the community is a bit centralized for the time being. This is kind of a problem with each venture constructed with Cosmos SDK. Virtually, growing the variety of nodes would enhance the time taken per transaction, making the community inefficient. So, this won’t change sooner or later as effectively.

Conclusion – Thorchain Elementary Evaluation

Thorchain is without doubt one of the most vital cross-chain liquidity tasks out there. Conceptually the protocol has a mote out there, and never many tasks present full interoperability throughout varied blockchain networks.

Additional, folks’s perception within the centralized crypto ecosystem is shaking as a result of it dangers a person’s funding. Due to this fact, sooner or later, DeFi will probably be a major crypto market and thus, the necessity for these tasks will probably be on the rise.

Therefore, RUNE is a wonderful token to carry for the long run. Additional, RUNE value motion is range-bound for just a few months. Due to this fact, operating a Grid Buying and selling Bot might be a worthwhile avenue.

Resources

Kalki is a seasoned content material author with over two years of expertise writing about blockchain and Cryptocurrencies. His ardour for Bitcoin and cryptocurrencies bloomed in late 2019. Crypto’s technological and financial implications are what curiosity him most.

He’s a Chartered Accountant and Lawyer with over 10 years of expertise within the FinTech trade. He likes to learn, journey and go for lengthy rides on his bullet bike.