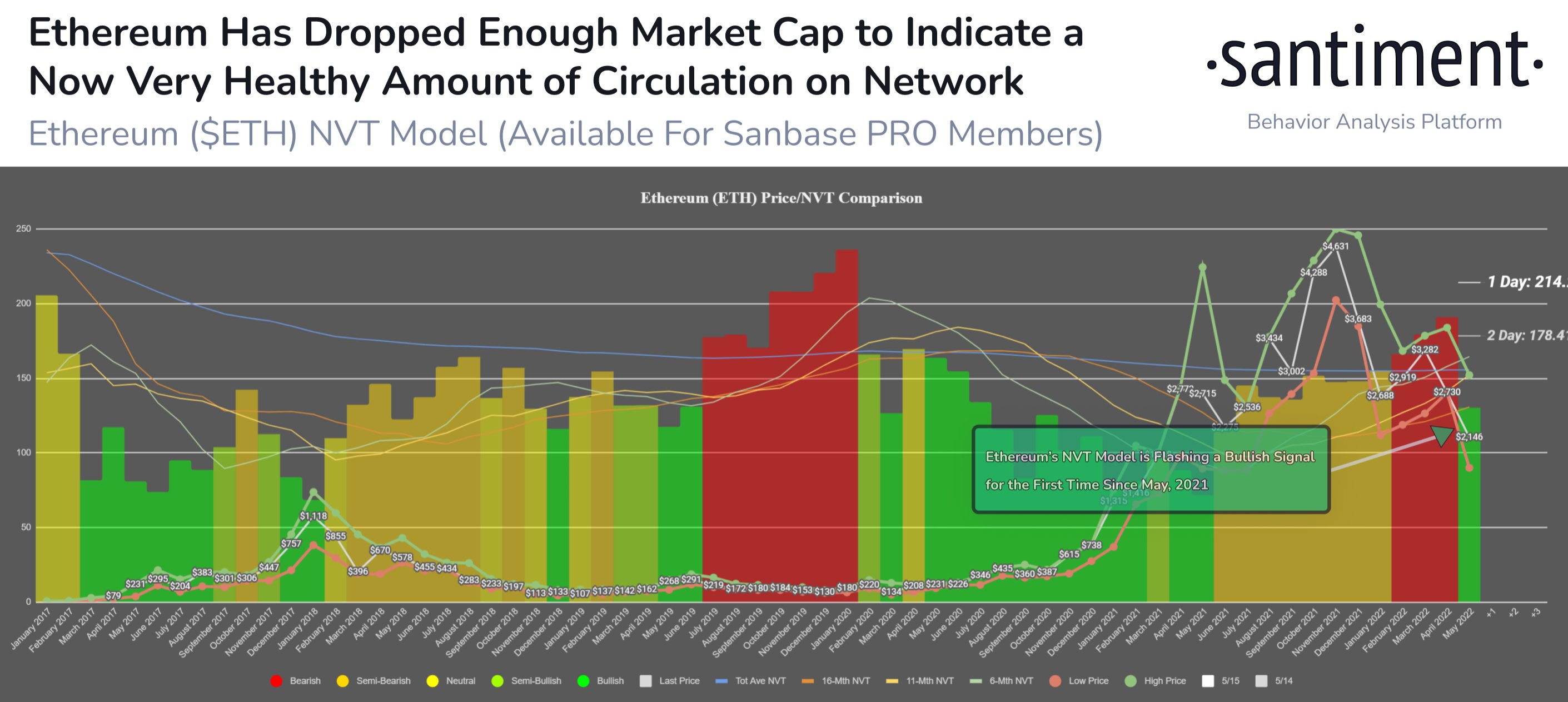

Blockchain analytics agency Santiment says Ethereum (ETH) is flashing a probably bullish sign regardless of experiencing a troublesome month within the markets.

In a brand new publish, Santiment explains how elevated token exercise coinciding with a drop in ETH’s value is an indication of bullish divergence.

Santiment takes under consideration Ethereum’s NVT (Community Worth to Transaction), which describes the connection between switch quantity and market capitalization.

“Ethereum’s value retrace has coincided with an increase within the asset’s token circulation.

After a 10-month stretch of ETH not receiving sufficient community circulation to justify excessive market cap ranges, our NVT mannequin reveals a bullish divergence resulting from such a dramatic dip occurring.”

Ethereum is at present down by over 7% and altering fingers for $1,927. Simply two weeks in the past ETH was buying and selling for practically $3,000.

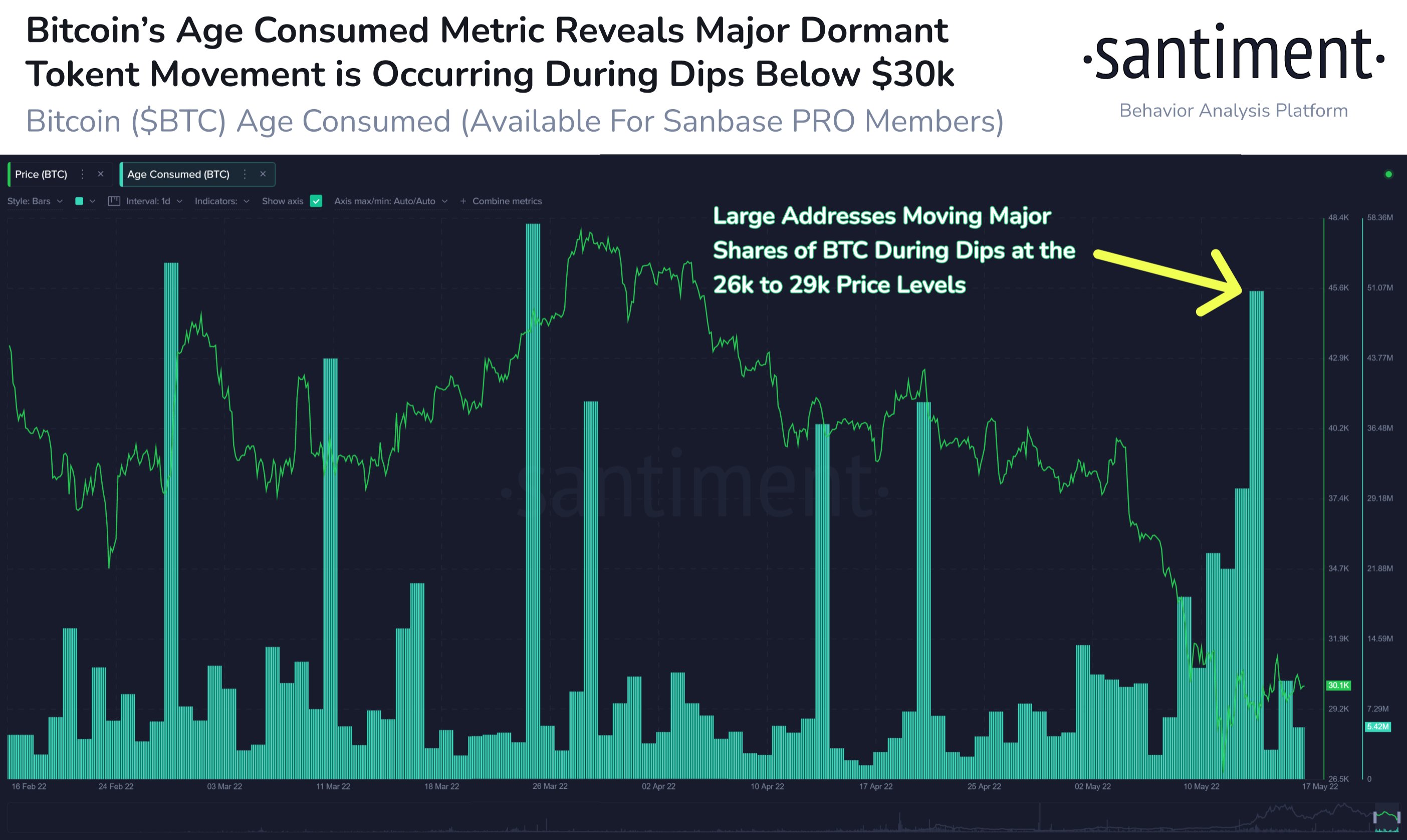

Shifting on to Bitcoin (BTC), the analytics agency appears to be like at a metric referred to as “age consumed,” which Santiment defines as displaying “the quantity of tokens altering addresses on a sure date, multiplied by the point since they final moved.”

The agency believes elevated exercise when BTC falls under the $30,000 degree signifies nervous merchants are promoting off their holdings.

“Bitcoin’s idle addresses have change into extra energetic this previous week, particularly throughout what was a serious capitulation dip final Thursday and Friday.

Usually, when age consumed spikes come up throughout value drops, it’s associated to weak fingers exiting positions.”

At time of writing, Bitcoin is down by 4.9% and buying and selling for $28,875.

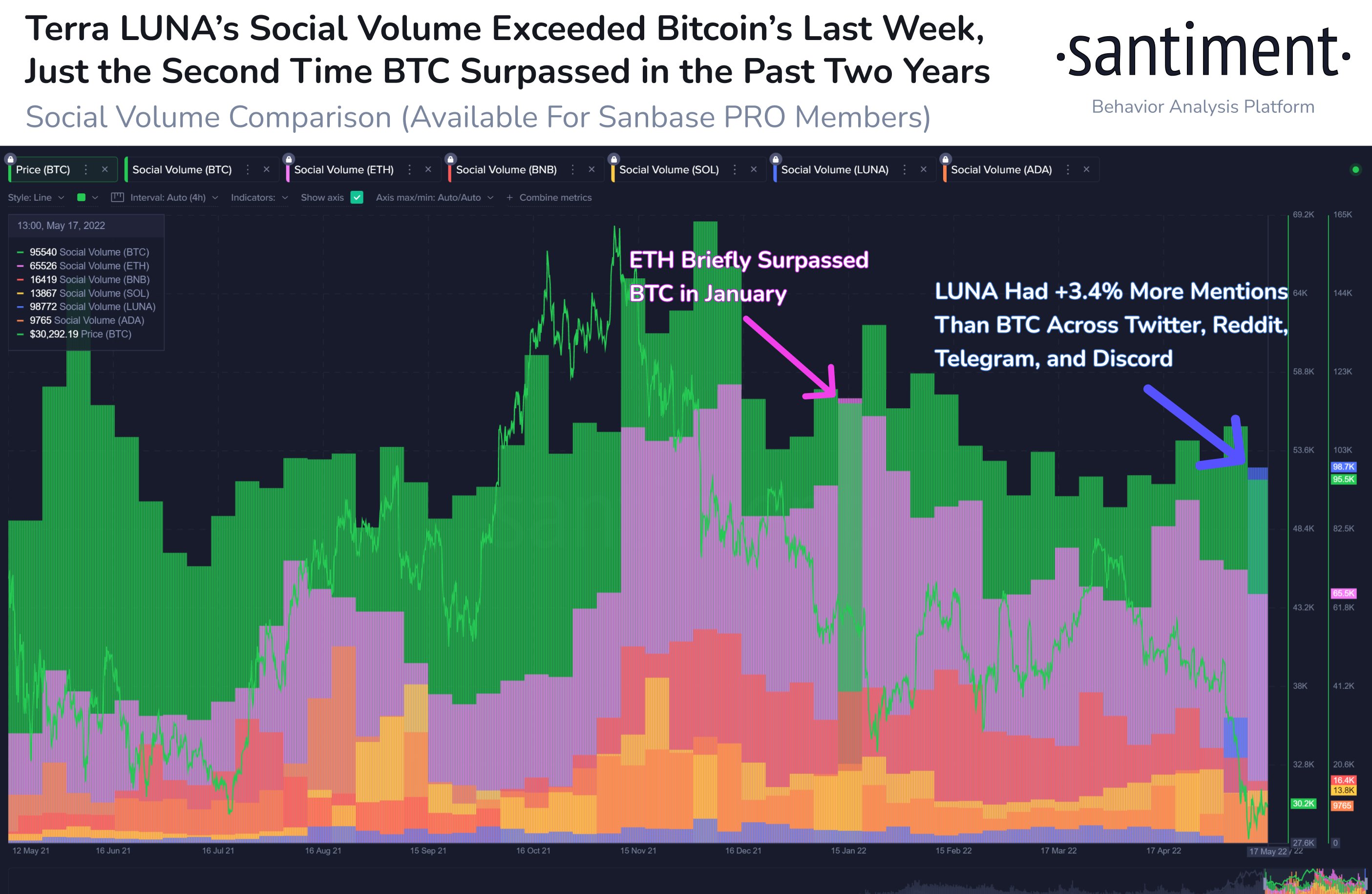

Santiment concludes its market evaluation by discussing how the crash of each TerraUSD (UST) and Terra (LUNA) was the most-talked-about crypto story of the week.

The agency notes that that is solely the second time in three years that Bitcoin hasn’t been on the high of the listing of crypto-related chatter.

“How massive of a narrative was LUNA’s downfall this previous week? For simply the second time since 2019, an asset aside from Bitcoin was the main asset by way of dialogue charges on crypto boards.

The earlier occasion was Ethereum’s brief burst in January.”

The algorithmic stablecoin TerraUSD stays down since its preliminary depegging from the US greenback on Might ninth, with UST at present valued at a mere $0.08.

Terra was buying and selling for over $80 till Might fifth when it fell off a cliff and ceded the $1.00 degree by Might twelfth.

Regardless of an enormous money infusion from the Luna Basis Guard (LFG), LUNA is down one other 19.32% and priced at $0.000151.

Verify Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you might incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in online marketing.

Featured Picture: Shutterstock/Media Fort