The following bull market in Bitcoin is now constructing a backside. Consequently, bears proceed to rule the market, sending the value of bitcoin under $29,000 within the final 24 hours. Merchants anticipating the bear market to conclude could have to attend longer on account of unfavorable circumstances.

Will Bitcoin Retrace?

Bitcoin isn’t any stranger to retracements of upper than 20%. Extra substantial corrections have occurred in Bitcoin’s historical past than this present one.

Those that have been round lengthy sufficient to recall earlier meltdowns of greater than 50% in lower than a month can attest that that is simply one other hiccup. Since Bitcoin’s inception, there have been round seven value corrections, with the value dropping by half. Bitcoin has all the time bounced again after every of those corrections.

Bitcoin fell by 83% in a brief time period in April 2013. When China first outlawed Bitcoin in December of that 12 months, it dropped one other 50%.

BTC/USD slides under $30k. Supply: TradingView

2018 was a troublesome 12 months. Though it reached an all-time excessive of about $20,000 in December 2017, it was solely price about $3,000 in December 2018.

Newer buyers will recall the March 2020 meltdown, when Bitcoin dropped 50% in a couple of of days. In Could of 2021, the identical occasion occurred.

Associated studying | New Knowledge Reveals China Nonetheless Controls 21% Of The International Bitcoin Mining Hashrate

Regardless of this, markets are in chaos in the present day, with Bitcoin down greater than 20% within the earlier week and greater than 50% from its all-time excessive in November 2021.

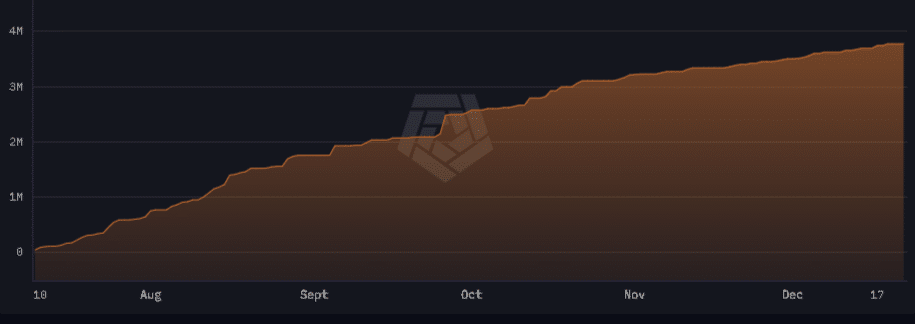

The 200 week shifting common(WMA) might be probably the most reliable and simple chart to offer some info on Bitcoin’s current place . It normally rebounds again quickly from the 200 WMA. Solely twice in historical past has Bitcoin fallen under the 200 WMA, and each instances it was just for a short while. For greater than a month, it has by no means been under the 200 WMA.

Bitcoin’s 200 WMA is now about $22,000. With a present value of roughly $29,000, it could in all probability go decrease and even commerce sideways for some time, however the worst is probably going behind it.

Bloomberg Analyst Believes BTC Will Plummet

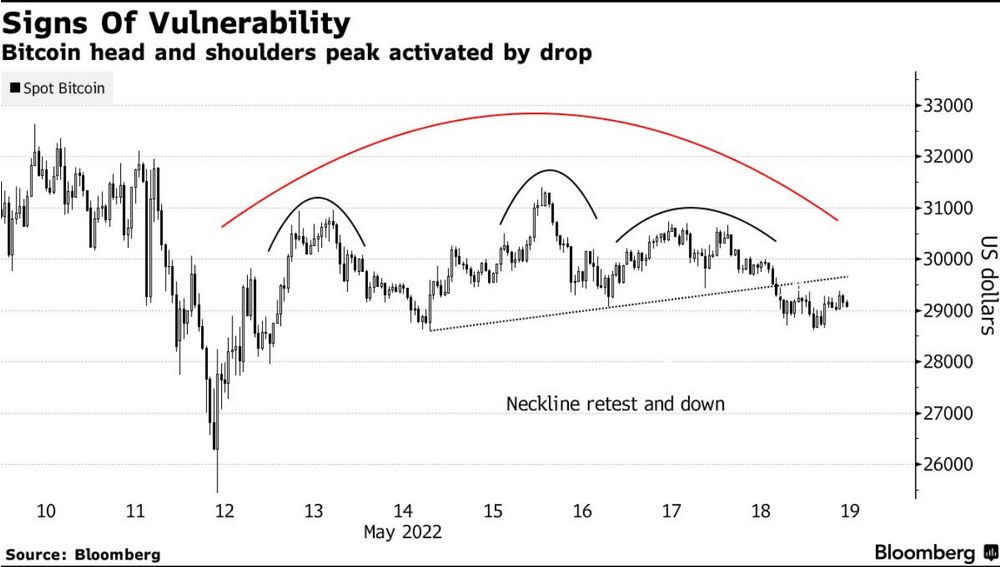

Regardless of a latest 15% rally from the lows reached final week, Bloomberg analysts consider the flagship cryptocurrency will proceed to fall. BTC now seems to be extra fragile than beforehand.

In keeping with the article, Bitcoin’s latest rally has resulted within the formation of a “saucer-top” sample on an hourly BTC chart. A Head and Shoulders sample has emerged inside it, indicating a development change from bullish to bearish.

Supply: Bloomberg

After BTC dipped beneath the formation’s neckline, the sample was activated.

In an effort to keep away from an extra drop, the Bitcoin value should now surge over $30,800.

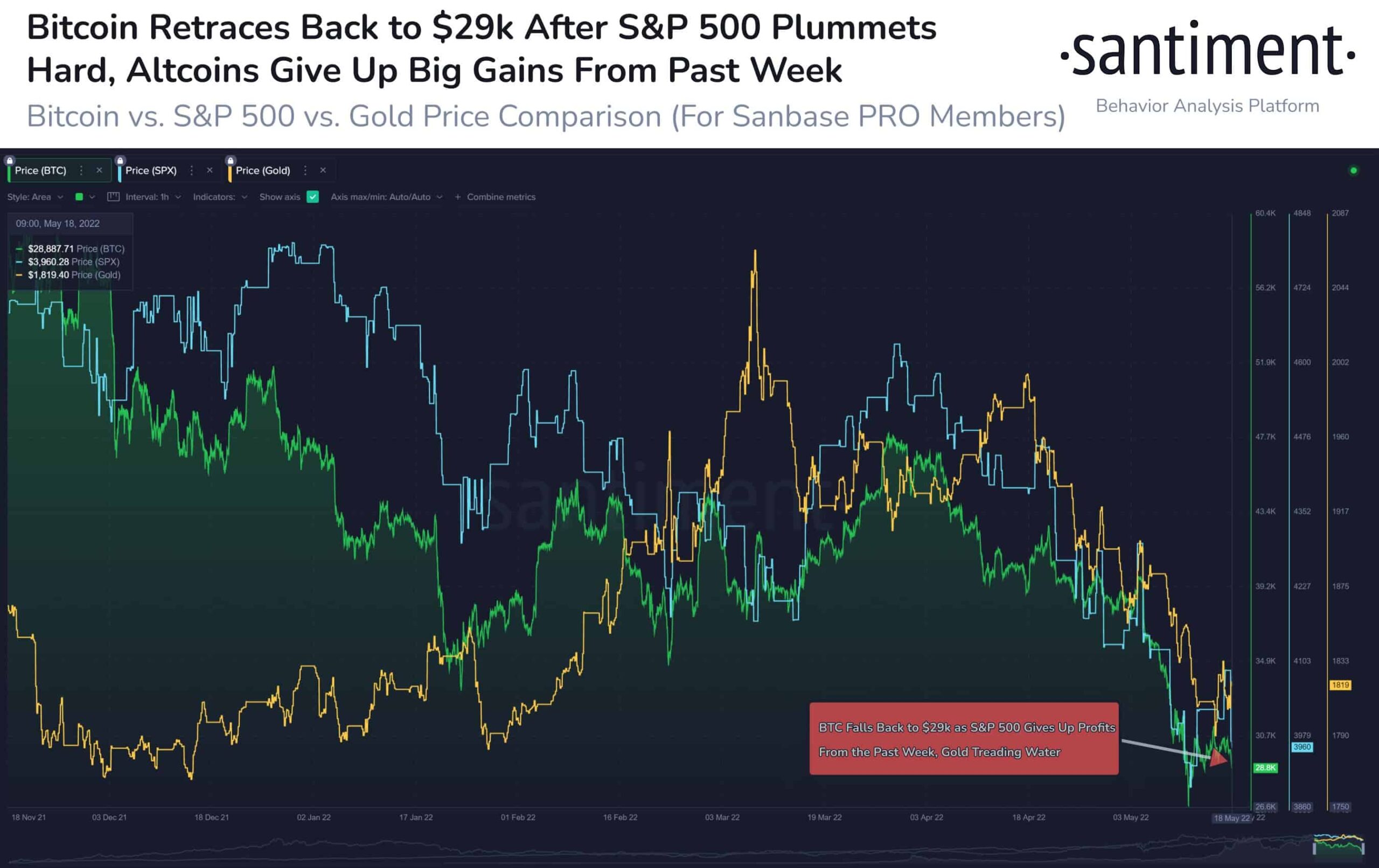

Santiment’s Bitcoin statistics reveals a lackluster market sentiment as merchants stay detached. On Could 18, the S&P 500 fell greater than 3%, dragging Bitcoin down with it. Certainly, for the reason that starting of 2022, the correlation between Nasdaq-100 and Bitcoin has remained tight, making it indication for anticipating Bitcoin value motion.

Bitcoin-U.S. Fairness Market Correlation. Supply: Santiment

Nasdaq-100 futures and different U.S. index futures are down about 1.5 % on the time of writing. It means that the Bitcoin value could proceed to fall. In reality, Asian and European inventory markets are down greater than 2% in the present day.

Whales, then again, look like anticipating a backside as a way to proceed accumulating. In keeping with Rekt Capital, Bitcoin’s RSI has now reached the extent the place long-term buyers have traditionally gained probably the most.

Associated studying | Funding Charges Fall To Yearly Lows Following Bitcoin’s Fall Under $29,000

Featured Picture by Pixabay | Charts by TradingView