Transcript

Angie Lau: Memecoins, NFTs, DeFi, play-to-earn and Net 3.0 — simply among the jargon from the digital world that’s more and more changing into part of our every day lives. And this digital world and economic system may very well be price — get this — trillions of {dollars} in only a few quick years from now.

Welcome to Phrase on the Block, the sequence that takes a deeper dive into blockchain and the rising applied sciences that form our world on the intersection of enterprise, politics and economic system. It’s what we cowl proper right here on Forkast. I’m Editor-in-Chief Angie Lau.

Effectively, in the present day we’re in dialog with Ronit Ghose, who’s the worldwide head of banking, fintech and digital belongings for Citi World Insights. And he’s monitoring the rise of the metaverse very carefully for one of many world’s largest banks. It’s nice to have you ever on the present with me, Ronit. Welcome.

Ronit Ghose: Thanks for having me.

Lau: All proper. So when did Citi begin engaged on its crypto and metaverse positioning? When did it begin for the financial institution and when did it begin for you?

Ghose: I work for our thought management workforce, which I run, known as Citi World Insights. So our mandate is to horizon-scan. So, we’re form of mandated or tasked to have a look at what’s coming over the horizon. A variety of what we do runs forward of what the financial institution is doing operationally — and I’ll come again to that in a second. I’ve been taking a look at crypto on and off from in all probability about 2016, 2017 — not tremendous early, however nonetheless, it’s been just a few years, partly as a result of I used to be interacting so much with our Asia-based purchasers, and in 2016 it was evident in Hong Kong, in (South) Korea, in different components of East Asia, that this was actually taking off and we have been getting 1000’s of individuals dialing into occasions we have been internet hosting on the subject. And now we’ve seen one other resurgence within the final 18 to 24 months, each with establishments, so household places of work, hedge funds, and now with corporations.

Lau: What are they asking you?

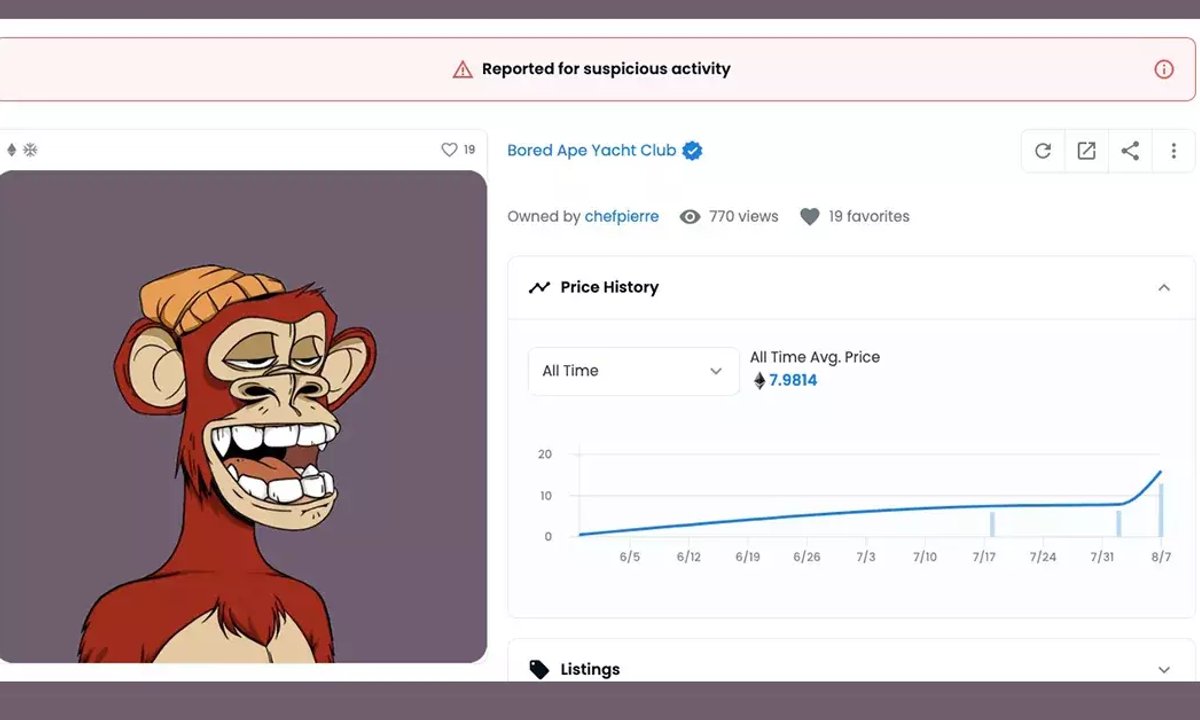

Ghose: How can we do that? What can we do? What’s it? So some individuals are like, ‘We’ve already obtained an NFT as a part of our advertising and marketing technique or our branding technique. Inform me what else I ought to be doing.’ Others are, ‘We’re eager about it, however we’re not within the house. How do I get entangled?’ And there are others who’re, ‘I need to make investments on this house. I need a greater solution to make cash, so assist me navigate that house.’ Everybody’s on this house, as a result of if you consider it, the metaverse is the subsequent era of the web, and blockchain being a subset of that. So it’s overlapping however not the identical. It’s not synonymous, but it surely’s overlapping.

So, in that context, if we outline it as the subsequent era of the web, in fact you’re going to have an interest, as a result of the Web has reshaped our lives over the past 15, 20 years.

Lau: And the query now’s, the potential is so huge. And also you only recently launched your metaverse and cash report — Citi Insights, as you’ve mentioned — doubtlessly representing an US$8 trillion to US$13 trillion alternative by 2030. The positioning — that metaverse is the subsequent web, the subsequent era of the web … What’s the potential right here? What’s the considering behind the estimation of an as much as $13 trillion alternative?

Ghose: So it’s the Nineteen Nineties. I’m in school. To make use of the Web, I needed to go to the pc lab and combat with physics Ph.D.s, who would win. They knew computer systems higher than me. At the moment, my youngest boy, who’s eight, is accessing the Web for eight, 12 hours a day, in all probability, on the weekends — hopefully not on faculty days. And he’s doing it by a smartphone. Now we’re speaking a couple of subsequent era which is device-agnostic — may very well be smartphone-based, may very well be VR (digital actuality) headset-based, may very well be AR (augmented actuality)-based, gaming system … It’s multi-device, device-agnostic. And it’s visible. It’s immersive. And that’s completely different, and it’s doubtlessly far more thrilling. And it’s far more highly effective for all types of use circumstances, together with issues like training, well being — and we’ll come again to that — however in the meanwhile it’s 2D visible or it’s learn and write.

However think about a 3D visible world, an immersive world. However wait, that’s the world we reside in, the bodily world. So, for the primary time in about 20 or 30 years, we’ve managed to recreate the bodily world — or we’re about to begin recreating at scale the bodily world in a digital world. So, for me, the metaverse is highly effective as a result of I’m meshing one of the best bits of the bodily world and one of the best bits of the digital world. And we will unleash so many use circumstances for good — and in addition for dangerous. Every thing that’s dangerous concerning the web, the Net 2.0 world, may get magnified to the Nth diploma in a metaverse or Net 3.0 world.

So there’s enormous potential, enormous upside, a number of thrilling use circumstances, and considering as an investor or a banker, a number of — trillions of {dollars} of — time, but in addition important coverage questions on, ‘Is that this factor simply going to go uncontrolled? How are we going to watch it? How are we going to control it? How are we going to make sure that our rights, our freedoms … civility is maintained in that house?’

Lau: These are enormous inquiries to ask. And the expertise is advancing so rapidly that it’s actually laborious to maintain up optimistically as properly, although. We’re seeing the emergence of how individuals are utilizing the expertise to be human in our house — DAOs (decentralized autonomous organizations), for instance — how we need to do peer-to-peer in DeFi. And it does include good and dangerous. And people are actually crucial inquiries to ask. The hot button is, I believe, how can we economize this and make it a good play?

Ghose: Let’s put some numbers round this. To begin with, let’s assume it’s a VR-based entry or a VR-based portal. What does it price? A pair hundred {dollars}. It’s costly, but it surely’s not US$1,000-plus that we spend on smartphones or the shiny newest Apple units. So it’s a few hundred {dollars}. That’s the essential sort of VR headset. Clearly extra superior VR, these may very well be US$1,000-plus. And with all expertise, over time, prices come down. So, hopefully the patron interface, the headset — both VR or AR — or what’s prone to occur — and we are saying this situation in our report — is that most individuals will entry the ‘metaverse-lite’ expertise by their telephones. They’ll have some sort of 3D expertise with that cellphone. That’s going to be fairly inclusive, truly. That’s the excellent news.

The dangerous information is, for the metaverse to work — and I’m doing this from a lodge room, and we have been discussing simply earlier than we went reside, do I’ve sufficient, no matter, bandwidth — the problem with the metaverse is latency. I want the pictures, the info to commute for me to have that sort of 3D visible world that I’m interacting in. And to have latency within the single-digit milliseconds. The latency goes to be a difficulty primarily based on the telco infrastructure in the present day. Additionally, bandwidth could also be much less of a difficulty, provided that 5G is being rolled out the world over.

Let’s simply take a sensible instance. If I’m doing a Zoom name with, say, a few of my buddies, fintech or banking or coverage in varied African markets that are presently booming for fintech, their Zoom name drops frequently in a manner. If I’m doing the decision in Dubai with somebody in Abu Dhabi, it doesn’t drop. I’m primarily based in Dubai. Or if I’m doing the decision from Dubai to somebody in London, the place I grew up, it doesn’t drop. However I’m doing it to Lagos — it’ll drop frequently, and that’s going to be a difficulty. If I have been a authorities or a policymaker or a philanthropist or perhaps a profit-motivated billionaire, I might take a leaf out of the India story. I’ve had a lot of fintech entrepreneurs and buddies of mine inform me my enterprise wouldn’t exist in India in the present day if we didn’t have low-cost information. And low-cost information shouldn’t be fairly, however virtually as essential as having consuming water and good healthcare. It’s not fairly there, but it surely’s virtually as highly effective.

The web is flattening the whole lot globally, identical to geopolitics is pulling us aside. Know-how is pulling us again collectively as a world neighborhood. The metaverse can try this, however simply on the Nth diploma. So I’m hopeful that individuals will step up … simply out of sheer self-interest, and we as a monetary establishment and others need to be a part of that course of.

Lau: That’s an ideal level. We have been speaking concerning the historic significance of the position of banks. First, within the Industrial Revolution, with the trendy banks of in the present day actually having their roots again then to fund the business, and now we’re on the cusp of one thing actually fascinating — the subsequent era of the web. And also you say, Ronit, the banks have a crucial position to play right here. How?

Ghose: A number of, a number of ranges. To construct the infrastructure of the metaverse goes to be lots of of billions of {dollars} when it comes to capital expenditure for semiconductors, for chips, for bandwidth. After which on prime of that, the functions that we’ve constructed. And also you’re doubtlessly speaking about billions, if not low trillions, of {dollars} of spend entering into and a TAM that’s a lot greater than that — the entire addressable market.

So, that’s going to wish funding. That’s what banks do. Both by our steadiness sheets or as intermediaries, more and more in latest a long time, we offer entry to funding. In order that’s rule No.1. Rule No.2 is strategic dialog — serving to huge company purchasers and governments navigate this house. In order that’s the sort of technique.

Rule No.3 is on the investor facet — buyers, household places of work, establishments, pension funds. We’re taking a look at how greatest to speculate, and that’s the place we may also help, as properly by evaluation. And I say ‘we’ because the monetary business generically reasonably than my firm. We may also help when it comes to monetary evaluation, when it comes to funding recommendation. So, there are such a lot of dimensions. At a really primary stage as properly, the whole lot we do will change, identical to the pandemic. Video conferencing has already modified.

Lau: On this Covid world and on this globally related world, if we will’t bodily journey to see one another, are we then disconnected? As you’ve mentioned, you’re seeing the chance as a monetary business. In February, we heard from JPMorgan, the primary main financial institution to determine a metaverse presence, opening a digital lounge in (metaverse platform) Decentraland. I’m curious what the interior response was at Citi, and in addition, what do you suppose the response was amongst your friends within the institutional house?

Ghose: Certain. So, clearly an ideal financial institution that you simply referred to there, however the first within the metaverse have been in all probability the Koreans. Perhaps they’re not world, however South Korea, as most of your viewers is aware of, is to date forward of many different international locations relating to expertise. And lots of the South Korean monetary establishments, banks, brokerage companies already established a metaverse presence final yr.

Now, there’s a sort of greater query to throw on the market — and I’m not choosing on any specific establishment, be it Korean, American, British, Hong Kong, Chinese language … however how a lot of this can be a sort of flag-waving train? It’s like ‘Hey, we’re renting or proudly owning a bit of digital land.’ That’s cute, but it surely’s simply cute. However what else are you doing? Are you actively serving to your purchasers present companies … whether or not fiat or crypto? Are you able to, in a regulatory compliant manner, get entangled in DeFi and blockchain, which is the open metaverse? So these are the broader inquiries to ask as an observer or a consumer of a financial institution or an analyst.

Lau: That’s an ideal level. And I need to ask you about open metaverse and DeFi. How do banks coexist in a extremely unregulated house like DeFi?

Ghose: It’s a extremely fascinating query. DeFi is decentralized finance. It’s blockchain-based monetary companies, and the position of a centralized establishment, be it the inventory trade, the custodian, the financial institution is changed by a wise contract or good contracts. And the company construction, the organizational construction is a DAO reasonably than a company or a PLC. In order that’s the definition.

In a pure DeFi world. When you’re a DeFi maximalist, you’re like, ‘Burn the banks down. We don’t want them, eliminate them. We are able to function in a trustless manner primarily based on code and good contracts.’ And that’s good. I imply, I don’t imply to be flippant, however the sort of maximized view of it is rather like, that’s good. It sort of works in a really small area of interest or a tutorial paper. You may play this in 10 years and make enjoyable of me once I’ve been confirmed flawed. However proper now, I simply suppose it appears to be like good now.

Now. But it surely’s additionally super-relevant. We are able to’t say I’m going to disregard it as a result of it appears to be like just a little bit … as a result of what we predict will occur is that there are advantages of DeFi, notably the place there’s market failure, the place the prevailing system doesn’t work.

So, I sit in Dubai, our household’s from the U.Ok. Simply this morning, with out oversharing, my 19-year-old son mentioned, ‘School charges obtained to be paid, dad.’ And I transferred some cash. And the cash obtained from Dubai to the U.Ok. very, in a short time. I imply, I obtained on my laptop computer in my lodge room in (Washington) D.C. and the cash went from one huge American financial institution department in Dubai to at least one very huge British financial institution department in London. It was completed. Now, final yr — it was two years in the past — I attempted to ship cash from Dubai to Cairo. Took three weeks. Okay, that was Eid holidays within the Center East. It took three weeks. I didn’t know the place the cash was. The gum has not gone. What DeFi does — what crypto, digital belongings do — is it strikes cash quicker than the prevailing conventional fiat rails, in lots of however not all circumstances.

It additionally offers a possibility for individuals who really feel both due to era, as a result of they’re youthful, or as a result of they’re excluded of their neighborhood — all of the international locations excluded from the worldwide system — it provides them an alternative choice. So, I like to think about it as a extremely neat ‘Choice B’ for many individuals.

And lastly, we speak so much concerning the metaverse, however this may very well be a extremely good use case. In a manner, for me, blockchain was like an answer in search of an issue. And I’ve obtained the issue now, which is in a metaverse or a digitally native web world — computerized settlement, transferring cash digitally, makes extra sense in lots of circumstances than going by the prevailing card-based fiat system. So, in a manner, the metaverse may very well be a extremely good use case, notably the open metaverse.

In order that’s why I believe you possibly can’t ignore DeFi, regardless of my earlier feedback about (how) it’s going to be a distinct segment. Now, for many of us, I believe for at the very least the subsequent 5-7 years, entry to DeFi remains to be going to be CeFi or TradFi, and it’s the identical thought as the rationale we use our iPhones on a regular basis: it’s easy, it’s intuitive. I can unpack the field, whether or not it’s the laptop computer or the pc. I don’t have to be an engineer to make it work. Growth, it really works. The interface is very easy. Most of Net 3.0 and DeFi isn’t for 98% of the inhabitants, so there’s nonetheless going to be some sort of interface.

And the position for the banks is, you could be the interface. Would you need to have a giant tech firm or a next-generation like Coinbase be the interface? And the hazard for the banks is that by the point they get round to, or they’re allowed to, it’s too late to be the interface. However we nonetheless want an interface, for not all, however for many people.

Lau: Effectively, it doubtlessly additionally solutions the enormous elephant — ape, gorilla, no matter you need to name it — within the room, and that’s regulatory challenges. I’d wish to shift the dialogue to some of the essential components of the metaverse — and it’s digital belongings. It’s Bitcoin, and it’s additionally concerning the regulatory house. However let’s speak about Bitcoin right here first, Ronit. The unique cryptocurrency is changing into more and more correlated with conventional monetary markets. Its correlation to the S&P 500 hit a 17-month excessive on the finish of March. So, as soon as upon a time it was for CyberPunks — now it’s very a lot correlated to Wall Road. What do you see because the evolution of Bitcoin, the primary driver behind this elevated correlation? What does this imply for crypto innovation?

Ghose: It’s no shock that correlations have picked up, and so they’ve been rising for some time. I imply, earlier than, there was a reasonably first rate correlation between Chinese language credit score creation and Bitcoin costs, when China had a disproportionate position in each mining and buying and selling of Bitcoin just a few years again. Just lately, there was a giant improve within the correlation of U.S. cash provide, or the change in U.S. cash provide within the final couple of years, and crypto and Bitcoin particularly. And so possibly it’s not a lot that the inventory market was correlated with Bitcoin — it’s that each Bitcoin and the inventory market have been correlated with U.S. cash provide or with world credit score creation.

It’s a threat asset, and a part of it goes again to your expertise query. It’s concerning the future. How is crypto just like, say, a excessive hyper-growth firm with no EBITDA (earnings earlier than curiosity, taxes, depreciation, and amortization) or low EBITDA? Since you’re saying this can be a imaginative and prescient of the long run, as a result of I imagine in crypto decentralization, the values of that and the advantages of that. If you consider it in a purely conventional monetary manner, you’re discounting again that worth in the present day.

So, loads of worth is out sooner or later as a result of the person numbers in the present day in crypto are nonetheless low. However sooner or later, there’s going to be possibly billions of individuals utilizing blockchain. At the moment there aren’t. It’s a really small quantity. So, since you’re discounting it again, it’s going to be a risky, high-risk asset, and whenever you had stimulus — Covid stimulus, the huge ramping up of cash provide within the U.S. and elsewhere within the Western world — no shock correlation of threat belongings went up. That’s not so dangerous.

Lau: And what’s the position of regulators and policymakers on this house, particularly as we see extra institutional cash coming into the system. Compliance points, all of that’s truly beginning to actually form how and the place crypto is rising.

Ghose: Yeah. It’s a extremely essential query, as a result of like all new applied sciences, all new issues, all new enterprise fashions, all new applied sciences considerably begin within the grey or illicit areas. It’s not crypto-specific. It occurs. As a result of oftentimes — consider the sharing economic system, whether or not it’s Uber or Airbnb — guidelines don’t exist, or they arrive alongside and so they break present guidelines. And oftentimes the illicit sectors are typically extra entrepreneurial initially.

So, due to that sort of heritage that Bitcoin and crypto had — and there’s nonetheless an enormous quantity of scams and rug-pulls in DeFi — regulators begin from a place of warning as a result of they’ve seen, form of, the dangerous actors. And likewise regulators begin from a place of, ‘Hey, this isn’t one thing we’re used to regulating, so we have to find out about it.’ So that they transfer at a slower velocity, naturally and understandably. Then the innovators constructing within the house — what we’re seeing the world over — there are completely different paces — is a a lot better understanding of the subject. So, inside regulators around the globe, within the U.S., in different components, there’s enormous understanding in comparison with 5 years in the past, and also you’re additionally getting some form of competitors between states.

So, as I mentioned, I’m primarily based within the UAE. The UAE has taken the view that, ‘We are able to attempt to regulate this, after which use that to create a hub.’ Identical to finance is regulated. Identical to London grew within the Nineteen Sixties because the monetary middle, we emerged. We’re going to begin seeing some jurisdictions working forward. There’ll be different jurisdictions that say, ‘Nah, I don’t see the upside as a result of I need to management. And inherently why do I want this?’ So there’ll be different jurisdictions which are extra primarily based on form of democratic give-and-take. It’ll must undergo the method like electoral cycles, and it’ll must be a response to the market, should you like. Polls, elections. Younger individuals saying, ‘No, that is truly good reasonably than dangerous. When you ban it utterly, I’m not going to vote for you.’ So, that’ll in all probability play out in some states as properly.

Lau: And we’re seeing it play out in some international locations — South Korea, to be very particular. I need to rapidly speak about Dubai right here. You’re primarily based within the Emirates. We’ve seen a lot curiosity within the metropolis from crypto contributors. Why is everybody transferring there?

Ghose: Be a part of me. Come on over. I believe it’s regulatory certainty. Even two years in the past, there wasn’t that a lot regulatory certainty. You would come to Dubai, you may go on a sandbox, after which the banks wouldn’t open a checking account for you should you have been a crypto firm. And this occurs everywhere in the world. It was occurring within the UAE as properly. However you had very clear messages prime down from the rulers of the nation that we’re going to attempt to regulate this. ADGM (Abu Dhabi World Market) in Abu Dhabi, in Dubai — there’s a digital asset regulator that’s been introduced just lately.

They’re setting up frameworks to permit regulation. There’s a pro-future or a pro-technology agenda, and these are small locations. Perhaps somebody like a startup or a speedboat, they will transfer quicker. They’ll pivot. Whereas bigger economies, bigger methods, possibly they’re like oil tankers. They’re highly effective, however possibly they don’t transfer or pivot so quick. So, I believe that’s what’s occurring. Additionally for eight months of the yr, seven months a yr, it’s an ideal place to reside.

Lau: However let’s speak about infra, in addition to the regulatory and monetary companies help. Is the federal government giving some concessions? Is licensing and the regulatory course of streamlined, making it simple to arrange store? What would the expertise be if a startup have been to land in Dubai and say, ‘Okay, I’m prepared’? How simple is it to arrange a enterprise?

Ghose: Generically, Dubai is simple — or comparatively simple — to arrange a enterprise in comparison with many international locations. You may simply take a look at the stats for the variety of days, the variety of hours spent. So, the method of incorporating a enterprise is comparatively simple. I’m not a lawyer, I’m not a compliance advisor, so in case your viewers does have questions on this, there are individuals we will advocate. Or you possibly can take a look at web sites and podcasts which have taken place on this matter. So it is best to get correct skilled recommendation, not from an analyst like me.

But it surely’s comparatively simple to arrange a enterprise. Something that’s going to the touch wherever within the crypto world goes to take time. The distinction is that now in Dubai, within the federal capital of the UAE, Abu Dhabi, in each areas, there are guidelines. And it’s a lot simpler for a financial institution or any supplier — knowledgeable companies agency — to take care of you, if there’s a regulatory framework. The place there’s no guidelines, it’s a lot tougher for a regulated entity like a financial institution to say, ‘I’m going to take care of you.’ There are guidelines in place. It’s not excellent but, but it surely’s an ideal form of first few steps.

Lau: Wonderful dialog. Ronit. We actually recognize you becoming a member of us on Phrase on the Block. And also you’re welcome again anytime.

Ghose: Thanks.

Lau: And thanks, everybody, for becoming a member of us on this newest episode of Phrase on the Block. I’m Angie Lau, Editor-in-Chief of Forkast. Till the subsequent time.