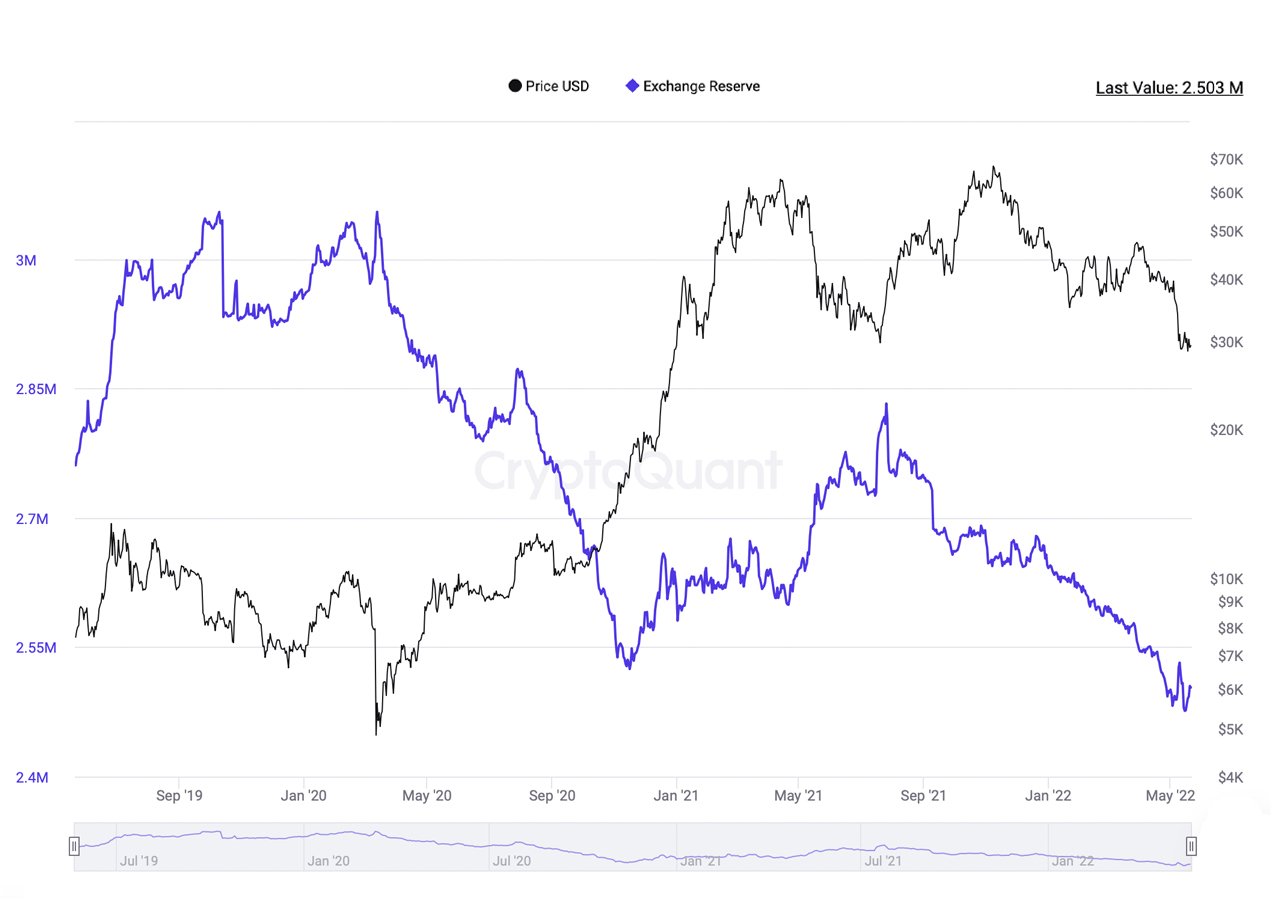

Amid the market carnage tied to Terra’s current fallout, bitcoin despatched to exchanges noticed a quick spike on Could 7, leaping greater than 2% greater from 2.481 million to 2.532 million bitcoin. Regardless of the current improve of bitcoin despatched to buying and selling platforms, the variety of bitcoins on exchanges at present stays decrease than ever earlier than.

Bitcoin Continues to be Taken Off Exchanges

Bitcoin (BTC) continues to be faraway from centralized cryptocurrency exchanges because the quantity is far decrease than the lows that had been recorded on November 15, 2020. 248 days earlier, on March 12, 2020, the day after the notorious ‘Black Thursday,’ there have been simply over 3 million bitcoin held on centralized digital forex buying and selling platforms.

In the course of the course of that time-frame, the variety of BTC held on exchanges dropped 15.86% on March 12 from 3 million BTC to 2.524 BTC on November 15, 2020. In newer instances, the variety of BTC held on exchanges has been decrease and in Could the metric hit two vital lows.

First on Could 2, 2022, cryptoquant.com knowledge exhibits there was 2.481 million BTC held on exchanges. The two.481 million bitcoin was 1.70% decrease than the variety of BTC held on November 15, 2020. Nevertheless, amid the Terra blockchain fallout and the terrausd (UST) de-pegging occasion, there was a quick spike of BTC deposits despatched to exchanges.

After the low on Could 2, there was a 2% improve in BTC deposits despatched to centralized crypto exchanges. However that metric modified actual fast as the two.532 million bitcoin excessive on Could 7, dropped over the course of the next week down 2.21% decrease to 2.476 million BTC.

Out of $73 Billion in Bitcoin Held on Buying and selling Platforms, 5 Exchanges Maintain Over $50 Billion

On the time of writing, there’s 2.503 million bitcoin price $73.7 billion held on digital forex buying and selling platforms. Knowledge supplied by Bituniverse’s Change Clear Steadiness Rank (ETBR) signifies Coinbase holds roughly 34% of the bitcoin held on exchanges. The ETBR listing exhibits that Coinbase holds 853,530 bitcoin on the buying and selling platform which is valued at roughly $25.14 billion utilizing present BTC trade charges.

13.58% of the two.503 million bitcoin saved on exchanges is held by Binance. Binance is the second-largest trade, when it comes to BTC holdings, because it at present controls a stash of 340,410 BTC price roughly $10 billion.

Okex instructions the third-largest place, when it comes to BTC holdings, as the corporate at present holds 266,530 BTC, or 10.62% of the combination complete. Huobi International instructions the fourth largest place at present, with 160,950 bitcoin held on the platform. Huobi’s BTC stash equates to six.39% of your complete 2.503 million bitcoin held by exchanges.

The crypto trade Kraken is the fifth largest BTC holder with 102,900 bitcoin held or 4.07%. Between the highest 5 exchanges, so far as BTC reserves held is worried, the group of buying and selling platforms holds 68.66% of the two.503 million bitcoin.

The 5 exchanges command 1.724 million BTC price $50.7 billion out of the combination of two.503 million price $73.7 billion. Whereas there’s quite a bit much less BTC held on exchanges, the variety of bitcoin held by these buying and selling platforms is basically focused on Coinbase, Binance, Okex, Huobi, and Kraken.

What do you concentrate on the quantity of BTC saved on centralized exchanges? What do you concentrate on the 68% held on 5 crypto buying and selling platforms? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, cryptoquant.com knowledge,

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss triggered or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.