Bitcoin momentarily misplaced its 2021 bull market help by dropping to $26,000 on Might 12. Since then, it has climbed again to $30,000 and has been consolidating round that value stage.

Nevertheless, Bitcoin is much from being out of the woods since there is no such thing as a substantial help till the earlier all-time excessive value at $20,000 if the present $28,000-$30,000 vary is misplaced. A serious level of concern is that though the US greenback index is present process a correction proper now, there has virtually been no response within the value of Bitcoin, which hints on the weak point in Bitcoin’s pattern.

Outflows from altcoins are additionally persevering with following the UST/Terra debacle. Ethereum began to underperform Bitcoin for the primary time for the reason that 2018/19 bear market hinting at a brand new uptrend within the dominance of Bitcoin. Regardless of Tether’s just lately printed audit report which confirms its claimed $82 billion reserves, confidence in altcoin and stablecoin markets stays low.

On this challenge of the crypto ecosystem replace, we are going to focus on the alternate inflows of Bitcoin, in addition to the Bitcoin concern & greed index and a quick technical evaluation. We may even present an replace on Ethereum and the UST/Terra ecosystem, together with Tether’s current audit.

Bitcoin deposits to exchanges

Following the UST stablecoin’s de-pegging on Might 8, the Luna Basis Guard (LFG), a non-profit group that backs the Terra blockchain ecosystem, bought all of its Bitcoin reserves (80,394 BTC) to defend UST’s peg. This meant depositing bitcoins to cryptocurrency exchanges. As you possibly can observe within the chart beneath, alternate balances surged by as a lot as 86,000 bitcoins from their early Might backside ranges.

Supply: Glassnode

Will increase in alternate inflows can counsel that traders are concerned about promoting their Bitcoin holdings by depositing them to exchanges. This usually occurs shortly earlier than and after cycle tops, in addition to earlier than capitulation occasions.

Though the Bitcoin stability on crypto exchanges has been declining since January 2022, the sudden turnaround in Might triggered by the LFG sell-off might catalyze a brand new uptrend except market sentiment turns optimistic quickly. Since Might 2022 doesn’t correspond to a Bitcoin cycle high, this potential new uptrend within the BTC alternate stability might open the gates for a brand new Bitcoin downtrend.

Bitcoin Concern and Greed Index

Bitcoin’s concern and greed index measures market sentiment. Excessive greed often precedes cycle tops whereas excessive concern precedes market bottoms.

Supply: Various.me

The Concern and Greed Index is presently at ten which corresponds to a traditionally low stage and means excessive concern. As you possibly can see within the chart beneath, this index virtually at all times bottomed out at ten over the last 4 years. This implies that there’s a market construction at this stage and that the Bitcoin backside or capitulation may very well be very close to if it has not bottomed out already.

Supply: Various.me

Bitcoin value evaluation

Through the peak of the UST/Luna disaster, Bitcoin fell to as little as $26,000. Whether or not Bitcoin has one other leg down largely depends upon the already deteriorated market sentiment, in addition to the following motion of the S&P 500 inventory index.

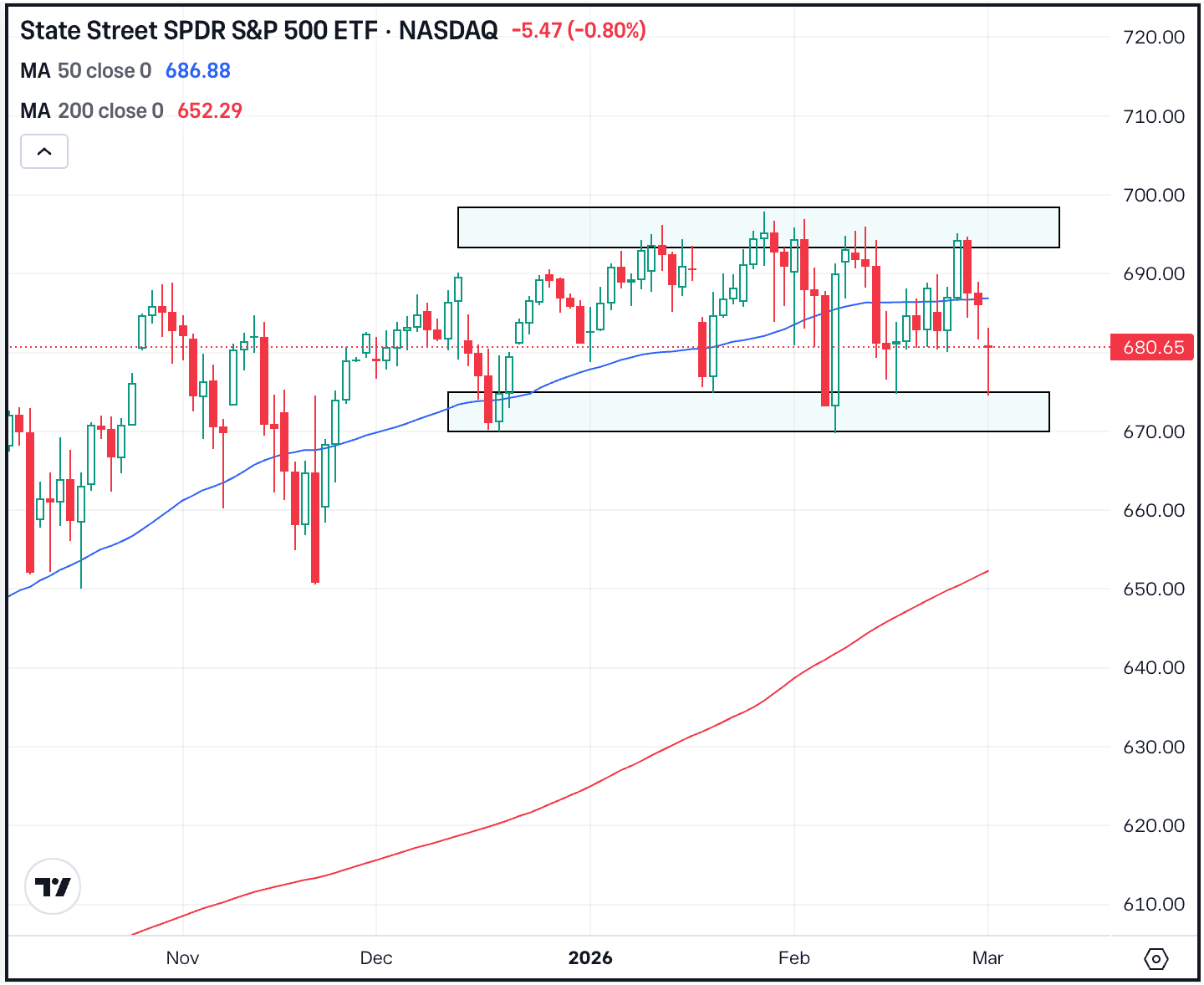

- S&P 500 inventory index

If the S&P 500 inventory index within the U.S. closes a buying and selling day beneath the essential 3,850 help, it may set off a sell-off to the following main help at 3,230 as you possibly can observe within the charts beneath.

This could imply an extra 17% drop from the present value, which may, traditionally talking, create as giant as an roughly 30% drop in Bitcoin’s value.

S&P 500 every day value chart. Supply: Tradingview

The index fell to as little as 3,810 on Friday, Might 20 however managed to shut the day above 3,900. The S&P’s strikes can be very essential this week which may additionally influence the cryptocurrency market.

- Bitcoin’s short-term construction

Within the meantime, Bitcoin wants to guard its short-term market construction at $28,700.

A four-hour closing beneath this stage, if accompanied by new destructive developments amongst cryptocurrencies and sell-offs within the S&P, may set off panic out there and trigger capitulation for Bitcoin.

Bitcoin/U.S. Greenback value chart on a 4-hour time-frame

- Overbought every day stochastic RSI

Throughout bear markets, momentum indicators can get rapidly overbought on larger time frames, just like the every day time-frame. Regardless of falling from $42,000 on April 21 to $26,000 by Might 12, Bitcoin’s stochastic RSI has already change into overbought on the every day chart with a mere 15% bounce from the $26,000 backside (see the chart beneath).

That is typical bear market habits in cryptocurrencies which may counsel that Bitcoin’s current bounce could also be nearing a high quickly and that the value might not have the ability to break above its present horizontal vary (the $32,000 resistance) because it runs out of additional momentum.

Bitcoin/U.S. Greenback every day value chart with the stochastic RSI indicator

- The US Greenback index

The US Greenback index, DXY, was rejected on the 105 resistance stage on Might 13 and the value has been dropping since then. Though the index fell to 102 very quickly on the week of Might 16, Bitcoin confirmed virtually no response within the meantime. Usually, such a steep drop within the DXY would set off a 20-25% rally within the Bitcoin value. As an alternative, Bitcoin may solely vary horizontally between $29,000 and $31,000 with its every day stochastic RSI already changing into overbought.

This implies that the Bitcoin pattern is weak and that it might have problem breaking out of its present horizontal vary to the upside.

Ethereum value evaluation

Ethereum carried out significantly better than Bitcoin throughout 2021, producing as a lot as 4 instances extra returns as of December 2021.

Thus far in 2022, Ethereum has failed to achieve the 0.1 historic resistance when it comes to the Ethereum/Bitcoin value parity. It additionally couldn’t get away of the rising channel that it has been following for over a 12 months (see the chart beneath).

Rising channels are sometimes confused with bull flags as a result of in addition they have a pole. Nevertheless, in bull flags, the flag is tilted downwards whereas rising channels face upwards, which usually tend to break downwards throughout a macro downtrend.

Throughout Bitcoin’s March 2022 rally, Ethereum failed to extend greater than Bitcoin and made a decrease excessive value on the Ethereum/Bitcoin chart (circled in orange within the chart beneath).

Ethereum/Bitcoin parity chart on a weekly timeframe

The Ethereum/Bitcoin parity is on the very backside of the channel help now. Shedding the channel help resulting from a Bitcoin crash or one other black swan occasion may trigger the parity to begin a brand new, stronger downtrend that would go as little as the following main help at 0.04.

Ethereum/Bitcoin parity chart on a every day timeframe

Ethereum recorded a extremely bearish rejection candle on Might 11 simply when it was making an attempt a breakout to the upside (see the chart above). The UST/Luna debacle introduced a sudden and powerful sell-off on the Ethereum/Bitcoin parity. Such robust rejections throughout the identical buying and selling day typically provoke a brand new, stronger pattern to the draw back.

Given the present outlook of the altcoin market as a consequence of the UST/Terra turmoil, tides could also be turning for Ethereum except the continued merge of the Ethereum blockchain creates a optimistic catalyst and new pleasure out there.

The proposed Terra fork

Luna printing stopped on Friday, Might 13 after 6.5 trillion tokens have been put into circulation and the token value bottomed out at round $0.00001. Since then, debates to avoid wasting the Terra ecosystem have been flooding the crypto area.

Voluntary coin burns by particular person traders, compensating small traders from the Luna Basis Guard, and issuing a brand new stablecoin backed with actual belongings are among the solutions which were made.

The latest dialogue to revive the challenge is to create a fork of the Terra blockchain.

Terra’s CEO and co-founder Do Kwon has just lately proposed forking the Terra community into a brand new chain.

In line with the proposal, the fork would create one billion new tokens to distribute amongst traders to incentivize them to remain within the Terra ecosystem whereas the outdated chain would change into often called “Terra Traditional” and the unique Luna tokens would change into “Luna Traditional”.

Terraform Labs is presently having a ballot to measure the investor sentiment in direction of a fork of the prevailing blockchain. In line with the ballot’s outcomes up to now, 65% of the voters voted in favor of the fork.

Alternatively, a current vote on Twitter exhibits a contradictory consequence to the Terra discussion board ballot. The vote asks the Luna neighborhood whether or not they need to fork Terra or burn Luna tokens and 93% of the respondents to this point have voted in favor of a Luna token burn.

Whether or not the Terra administration will heed the Terra neighborhood or the Twitter neighborhood, or provide you with one other resolution stays to be seen within the coming days.

Tether’s current audit report

Through the chaos of the UST’s de-pegging information, the market additionally grew to become frightened of Tether’s peg which precipitated the biggest stablecoin to quickly lose its peg. The scale of the Tether (USDT) market cap was 4 instances bigger than that of UST, so a meltdown within the worth of USDT poses a way more severe threat to the cryptocurrency market’s existence.

Not like UST although, the de-pegging of Tether was a short-lived one. Though the worth of USDT briefly dropped to a low of $0.96, it recovered inside 36 hours.

To guard the $1 peg, the Tether staff introduced on Might 12 that verified clients can redeem their US Greenback deposits from the Tether treasury in return for USDT tokens they maintain. Thus far, $8 billion price of USDT has been redeemed and faraway from circulation which dropped the entire USDT provide from $82 billion to $74 billion.

With the cooling down of the UST disaster, USDT redemptions additionally got here to a halt securing the Tether ecosystem for now. To regain the arrogance of its traders and the general cryptocurrency market, the Tether administration additionally launched an audit report that verifies its consolidated reserves.

The audit report might come as a aid to USDT holders as there was lots of uncertainty about how Tether backs itself. This was exacerbated by the SEC’s subpoenas prior to now and the excessive ratio of much less liquid industrial papers in Tether’s reserves as of the tip of 2021.

In line with the audit carried out by the unbiased accounting agency, MHA Cayman, the entire belongings of Tether Holdings are a minimum of $82,424,821,101, which is considerably larger than the worth of issued USDT digital tokens in circulation ($74 billion). This implies Tether’s reserves towards issued digital tokens exceed the quantity required to redeem them.