Dang Quan Vuong is a dealer and market analyst at King Inventory Capital Administration.

Potential new traders who’ve these days joined the Bitcoin community have expressed social curiosity within the asset. Whether or not you’re promoting or shopping for bitcoin, your actions inherently have an effect on whale habits. On this article, we’ll deal with how social sentiment impacts whale habits and the way it connects to cost volatility.

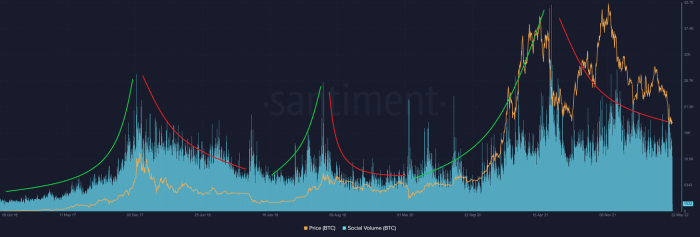

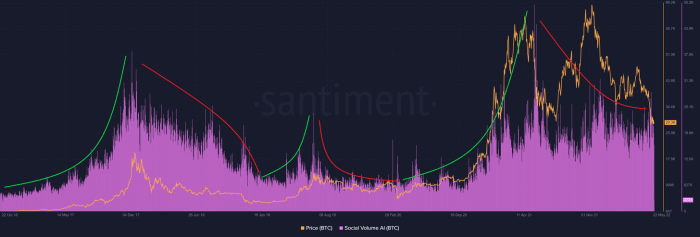

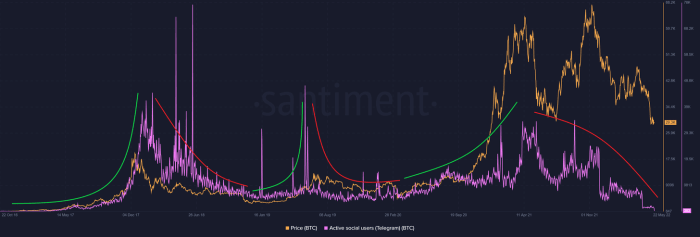

Taking a look at social quantity (the sum rely of content material that mentions Bitcoin-related phrases not less than as soon as, significantly on Reddit, Twitter and Telegram), we are able to see that social quantity and bitcoin worth has a optimistic correlation. So, what precisely is the justification for this phenomenon?

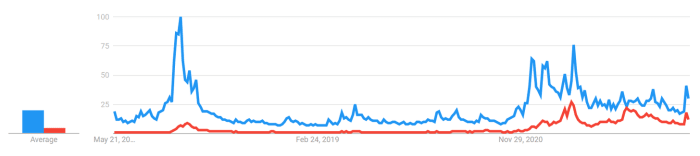

Accordingly, Google Development knowledge means that rising social quantity has piqued public curiosity and prompted them to conduct their very own searches for bitcoin. It exhibits that the quantity of bitcoin mentions and references on social media is related to public curiosity in bitcoin and should have influenced the general public’s funding selections.

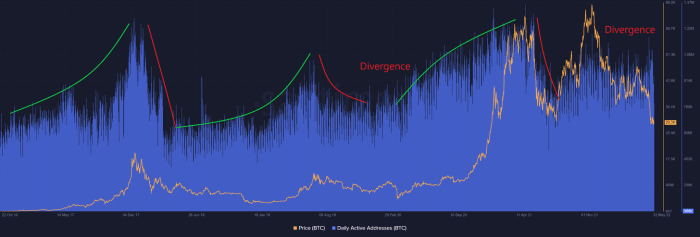

As evidenced by the variety of distinctive energetic addresses and transaction quantity, social sentiment has an impression on your complete community exercise. The day by day cumulative rely of distinctive addresses, together with senders and receivers, is proportional to social quantity, though there’s a important divergence when bitcoin is near a backside.

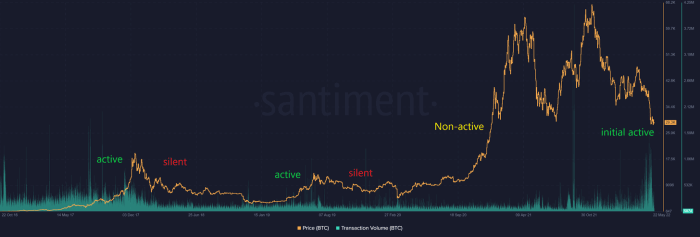

Equally, as market contributors develop into extra energetic throughout an uptrend from the underside, the full quantity of bitcoin despatched over the community in a given interval usually will increase, whereas it stays comparatively low throughout a downtrend.

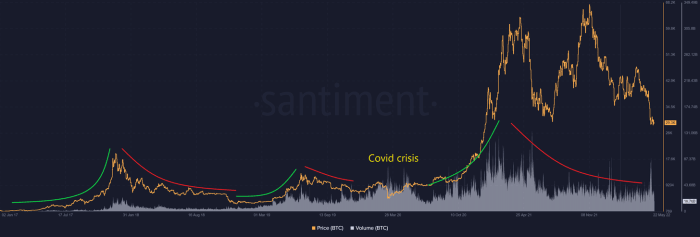

Buying and selling quantity straight displays bitcoin’s worth on account of heightened exercise, and traders behave extra aggressively throughout bull runs and fewer aggressively throughout bear markets.

In social psychology, the snowball impact is a course of that begins with a minor state and progressively grows in significance or measurement. The vivid portrayal is when a snowball rolls down a snow-covered mountainside, accumulating further snow, gaining extra weight and momentum till it lastly involves relaxation. The unfold of bitcoin on numerous social media platforms can have the same impact, as increasingly more consideration is given to it, inflicting bitcoin to realize elevated public consciousness and, in consequence, the snowball impact happens. The upper the bitcoin worth rises, the extra publicity it receives, which once more boosts shopping for momentum.

An upsurge in social media content material can be a believable cause for a gaggle of merchants and traders impacting the bitcoin worth. They go to purchase bitcoin and are confronted with stimulating content material from social media. This is able to draw better consideration to the optimistic features of Bitcoin and make extra folks conscious of it. The euphoria grows as extra people enter the market. Increasingly folks develop into concerned on account of the elevated consideration and the cycle continues time and again.

The market continues to rise till it reaches a vital level the place it stays in a situation of equilibrium and now not rises because of an absence of shopping for impetus. It’s as a result of diminished social curiosity marks the utmost of upwards momentum and the beginning of a downward development thereafter.

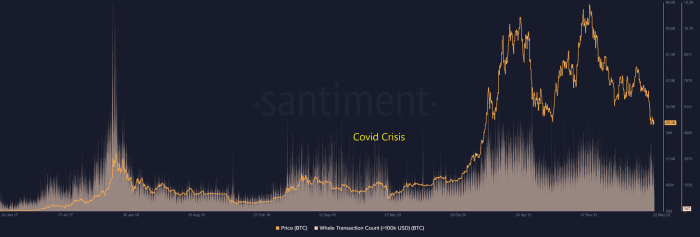

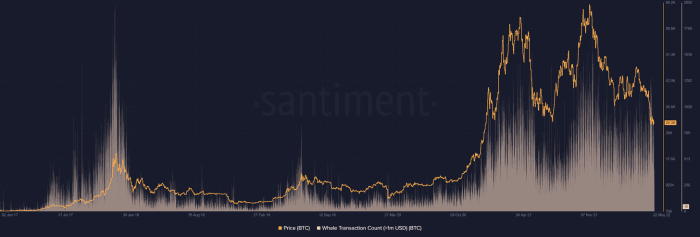

Whales, as many know, play a pivotal position in market motion as a result of they’ve the power to drive bitcoin’s worth, so it’s essential to find out once they enter the market. As proven within the following figures, the full variety of whale transactions over $100,000 and $1 million rises within the rally and falls within the decline. The charts reveal that whales are extra energetic throughout uptrends and fewer energetic in downtrends apart from the panic promote within the COVID-19 pandemic.

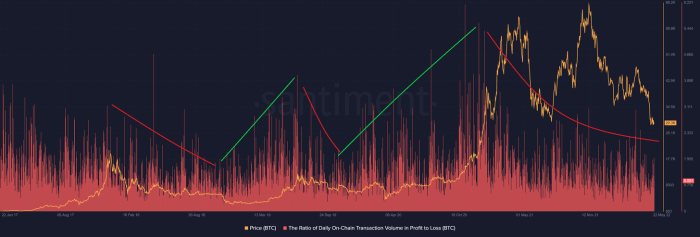

In a particular interval of time, the ratio of whole cash transferred in revenue to whole cash transferred in loss grows in uptrends and drops in downtrends. It signifies that revenue will increase throughout an upswing till it reaches its peak. Then it goes down till most traders are within the purple, at which level the development reverses.

P/L of day by day transactions is sort of highest close to the highest and lowest close to the underside. (supply)

In abstract, the premise of upswing momentum is the rising social sentiment as new traders eagerly enter the market. This self-fulfilling prophecy has traditionally been attributed to the acceleration of traded quantity. When the Bitcoin group thinks the market will transfer larger in an uptrend, extra buy orders are positioned, inflicting the market to development upward. In the meantime, whales are prone to distribute their holdings to newcomers earlier than forcing them to promote them at a loss after a time period. On account of the rising public curiosity, the community worth expands till there isn’t a extra shopping for momentum after which bitcoin ultimately will get dumped. This cycle is ready as much as repeat itself periodically.

This can be a visitor put up by Dang Quan Vuong. Opinions expressed are solely their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.