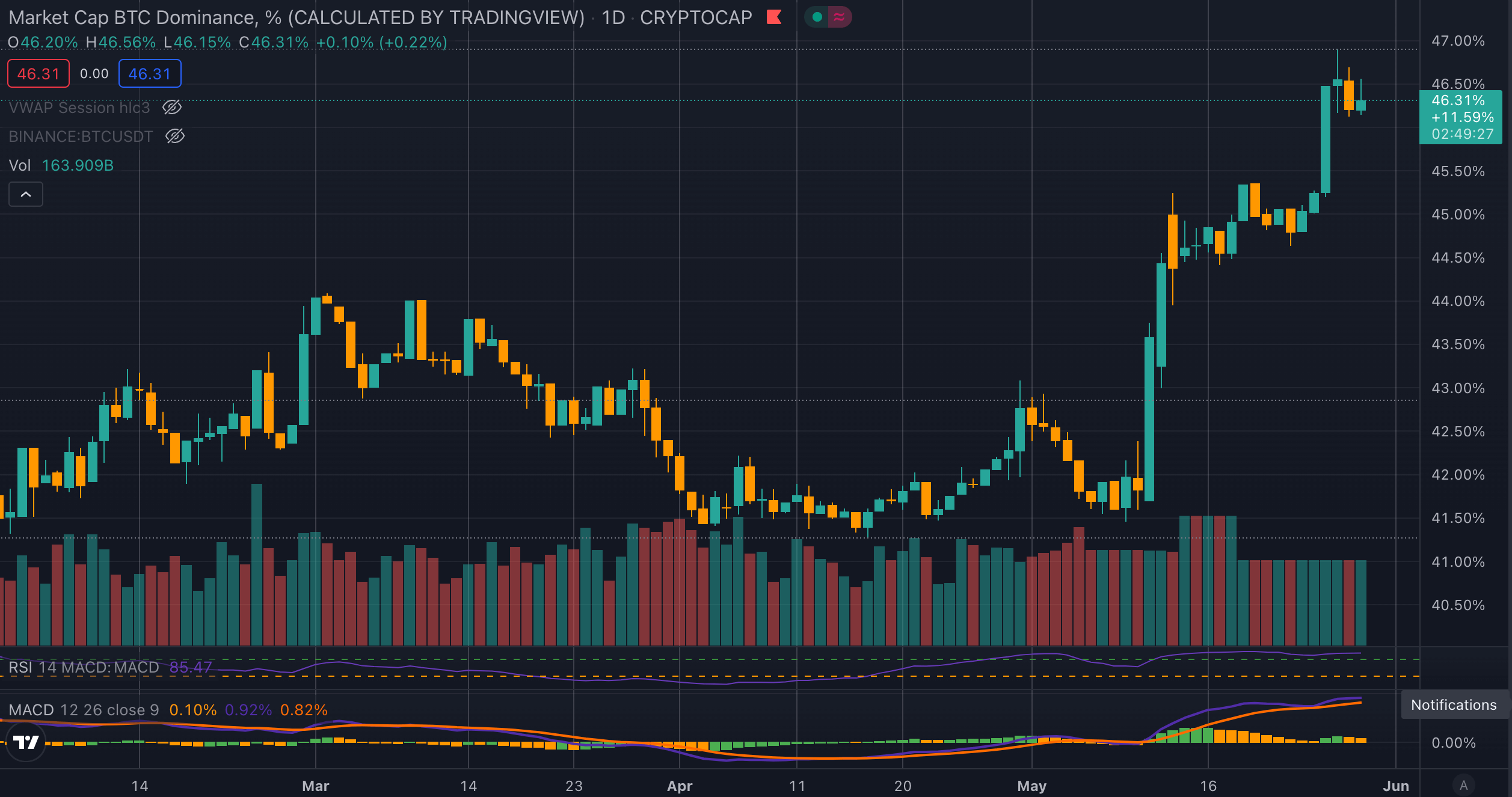

Bitcoin (BTC) dominance continues to interrupt by means of native highs, reaching 46.5%, whereas Bitcoin closed its ninth weekly crimson candle in a row.

Dominance is a measure of Bitcoin’s share of the worldwide crypto market cap.

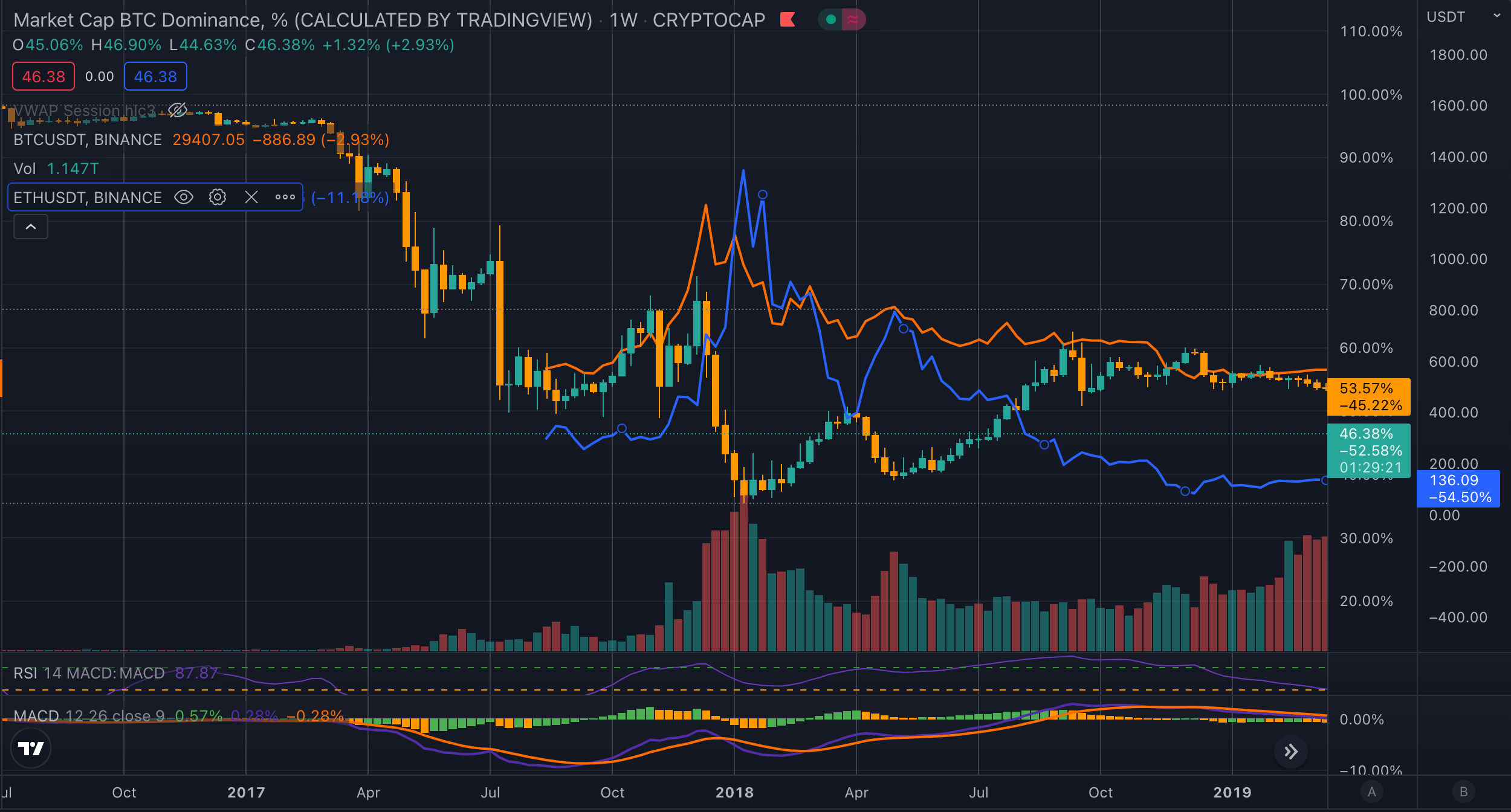

Till March 2017 Bitcoin dominance held above 95% as there have been few competing digital currencies till the ICO growth. Through the 2017 bull run, Bitcoin’s dominance fell from 95% to a low of 35% by January 2018.

The timing got here inside 30 days of the highest for the cycle for Bitcoin and correlated on to the blow-off prime for Ethereum’s peak. After reaching the underside Bitcoin’s dominance rose again to 73% by September 2019 whereas the value of Ethereum dropped 87% to $171.

The worth of Bitcoin from January 2018 to September 2019 had fallen simply 20% by comparability. Ought to Bitcoin’s dominance proceed to rise in 2022 because it has in earlier halving cycles what might this imply for the remainder of the crypto market?

The worth of Ethereum versus Bitcoin has lately reached a yearly low after considerations round points on the Ethereum Beacon Chain resulted in downward value strain on Ethereum. Additional, the same development will be seen when combining a few of the different prime altcoins to Bitcoin.

The beneath chart is a mixed comparability for Cardano, Binance Coin, and Ethereum to Bitcoin. Ought to the decline proceed alongside an increase in Bitcoin dominance it reveals a 74% draw back potential for altcoins when valued in opposition to Bitcoin.

The worldwide market cap of the cryptocurrency trade is at the moment round $1.3 trillion with Bitcoin making up $580 million. Hypothetically, ought to Bitcoin’s value and world market cap stay fixed over the subsequent few months however its dominance will increase again to 2019 ranges that would go away simply $350 million for the remainder of the trade and over 19,000 crypto tasks. Crypto Winter traditionally weeds out the weaker tasks and the present cycle might be no completely different.

Bitcoin dominance is a key indicator to observe to present a broader perception into the energy of the crypto markets at giant. When the value of Bitcoin goes up whereas its dominance decreases or stays the identical it means the broader trade can also be seeing development. Nevertheless, when dominance will increase it’s normally an indication of weakening within the crypto trade and a constructive for Bitcoin maximalists alone.