The ETH/USD buying and selling pair attracted extra merchants within the first quarter of 2022 and the turnover additionally surged by 93% as per the stories that now we have at this time in our newest Ethereum information.

The ETH/USD buying and selling pair pulled the most important variety of merchants from January to March 2022 and within the stories from Capital.com, the most important variety of merchants was held by DOGE in 2021 to the USD pair. Nonetheless, the ETH/USD pair took the spot for many merchants on the buying and selling platform for the primary time. The report famous that the crypto turnover went up by 93% within the quarter and regardless of the optimistic statistic, the report admitted that the rise in income doesn’t present the broader market traits as a result of the quantity was reached by just a few single-day spikes in quantity.

Capital.com outlined that the broader market is in a state of disinterest and the chief analyst David Jones famous that the BTC downtrend from November to January influenced the retail merchants’ curiosity in crypto however talked about that the merchants are “herd creatures” and are pushed solely by momentum. After the excessive investor participation in January, the subsequent few months confirmed a decline, and the asset merchants on the platform dropped by 16%. this quantity dropped by one other 10% in a month.

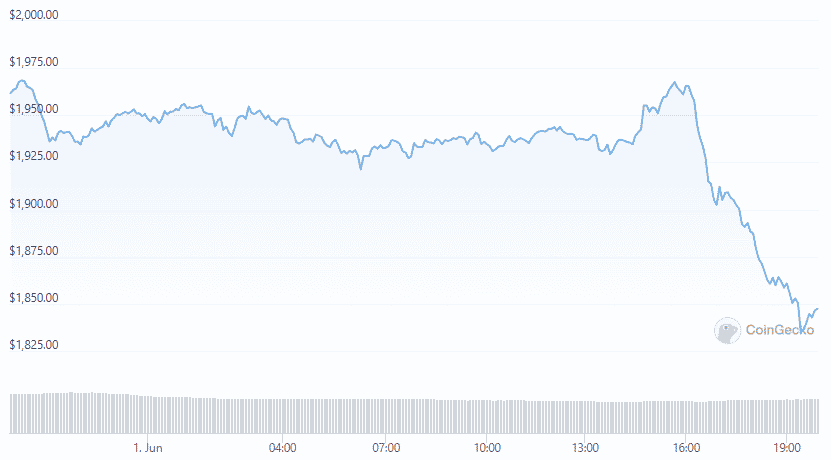

On Monday, the ETH value moved to the $2000 mark as BTC elevated above $30,900 however analysts famous that regardless of this bounce, the worth uptrend may find yourself weaker than the 2021 mid-year efficiency. Some analysts famous that there’s a chance to bounce to $2700 over the summer season. Within the meantime, the Ropsten testnet on Ethereum moved to the PoS consensus and Tim Beiko added that the testnet will merge with the brand new Beacon Chain which was launched on Monday. Two extra testnets referred to as Goerli and Spoila will transfer to PoS earlier than shifting to the ETH mainnet begins.

As not too long ago reported, Ethereum began a draw back correction from the $2000 resistance zone and the worth remains to be buying and selling close to the $1900 and the 100 hourly easy shifting common. There’s additionally a key bullish development line forming with the help close to $1905 on the charts of ETH/USD and the pair may even begin a recent enhance if it manages to remain above this degree.

DC Forecasts is a pacesetter in lots of crypto information classes, striving for the very best journalistic requirements and abiding by a strict set of editorial insurance policies. If you’re to supply your experience or contribute to our information web site, be happy to contact us at [email protected]