Ethereum’s topside bias stays weak after the 7% drop over the previous day whereas it did acquire some bearish momentum after breaking the $1920 help line so it could now lengthen losses if it breaks the $1760 help so let’s learn extra in the present day in our newest Ethereum information.

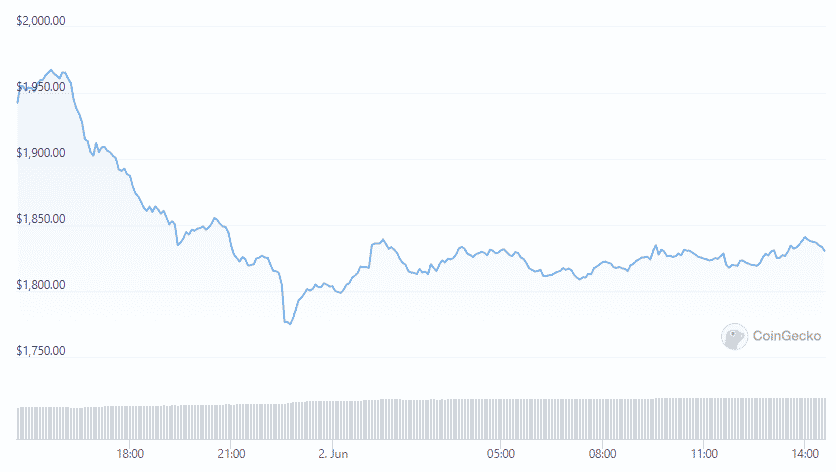

Ethereum began a contemporary decline after breaking the $1920 help and now the worth is buying and selling under $1900 and there was a break under the key contracting triangle with help near $1900 on the hourly chart for the ETH/USD pair. The pair examined the $1760 help and remained at a danger of extra losses as ETH didn’t clear the $2000 resistance with a pointy bearish response under the $1950 and the $1920 help ranges.

The bears managed to push the worth under the 61.8% fib retracement degree from the upwards transfer of $1705 swing low to the $2015 excessive. Ether’s value dropped under the $1840 help and dropped under however then examined the $1760 help. The pair is now correcting positive factors and buying and selling above the $1800 degree. The value is buying and selling close to the 23.6% fib retracement degree from the decline of $2015 swing excessive to $1762 low. The preliminary resistance is near the $1835 degree with the subsequent main resistance nearing the $1888 degree and the 100 hourly easy shifting common and close to the 50% fib retracement degree from the drop of $2015 excessive to the $1762 low.

A transfer above the $1888 degree may push the worth to the primary resistance at $1920 and extra positive factors may ship it in the direction of the $2000 resistance zone. If ETH fails to get better above the $1888 resistance, it could lengthen the drop and the preliminary help is close to the $1758 zone. Ethereum’s topside bias stays weak with the key help nearing the $1760 degree and the draw back break under this degree may ship the worth to $1720. Extra losses may provoke a transfer to $1650 the place the bulls would possibly emerge. The MACD for the pair is dropping momentum within the bearish zone and the ETH/USD is under the 40 ranges.

As not too long ago reported, The ETH/USD buying and selling pair pulled the largest variety of merchants from January to March 2022 and within the experiences from Capital.com, the largest variety of merchants was held by DOGE in 2021 to the USD pair. Nonetheless, the ETH/USD pair took the spot for many merchants on the buying and selling platform for the primary time. The report famous that the crypto turnover went up by 93% within the quarter and regardless of the constructive statistic, the report admitted that the rise in income doesn’t present the broader market developments as a result of the quantity was reached by a number of single-day spikes in quantity.

DC Forecasts is a frontrunner in lots of crypto information classes, striving for the best journalistic requirements and abiding by a strict set of editorial insurance policies. In case you are to supply your experience or contribute to our information web site, be at liberty to contact us at [email protected]

![Purchase Cell Telephones with Bitcoin & Crypto [2022] Purchase Cell Telephones with Bitcoin & Crypto [2022]](https://bitpay.com/blog/content/images/2022/05/buy-cell-phones-with-crypto.png)