Do Kwon, a co-founder of Terraform Labs, was behind Proposal 1623, which referred to as for the creation of a brand new Terra blockchain and the abandonment of the failed UST stablecoin and Luna Basic (LUNC) tokens. After debuting on Could 28, Luna 2.0 is already operational, however there are nonetheless many unresolved questions and issues relating to every thing that occurred between the second UST crashed and the launch of a brand new token.

The tokens had been issued at $17.8, in accordance with Coinmarketcap knowledge, and eventually soared to $19.53 on Could 28. On Monday, nonetheless, it went down virtually 70% to $5.45 in lower than 48 hours.

Each holders of the challenge’s depreciating UST stablecoins and holders of the older, existent Luna tokens obtained recent Luna tokens in Terra’s proposal to resuscitate the challenge. Previously valued at greater than $40 billion, the older cash renamed as Luna Basic (LUNC) have a market valuation of lower than $1 billion.

The Airdrop of LUNA – Was it Truthful?

On Could 16, this Terra Ecosystem Revival Scheme was launched and it contained a plan to “reimburse” LUNA and UST buyers who had been harmed by the crash. The brand new Terra tokens had been to be given out as an airdrop to those buyers.

The intention was to airdrop tokens to pre-attack holders at Terra Basic block 7544910 and post-attack holders at Terra Basic block 7799000, respectively. The airdrop has already taken place on most exchanges; nonetheless, it has been met with widespread criticism from the group.

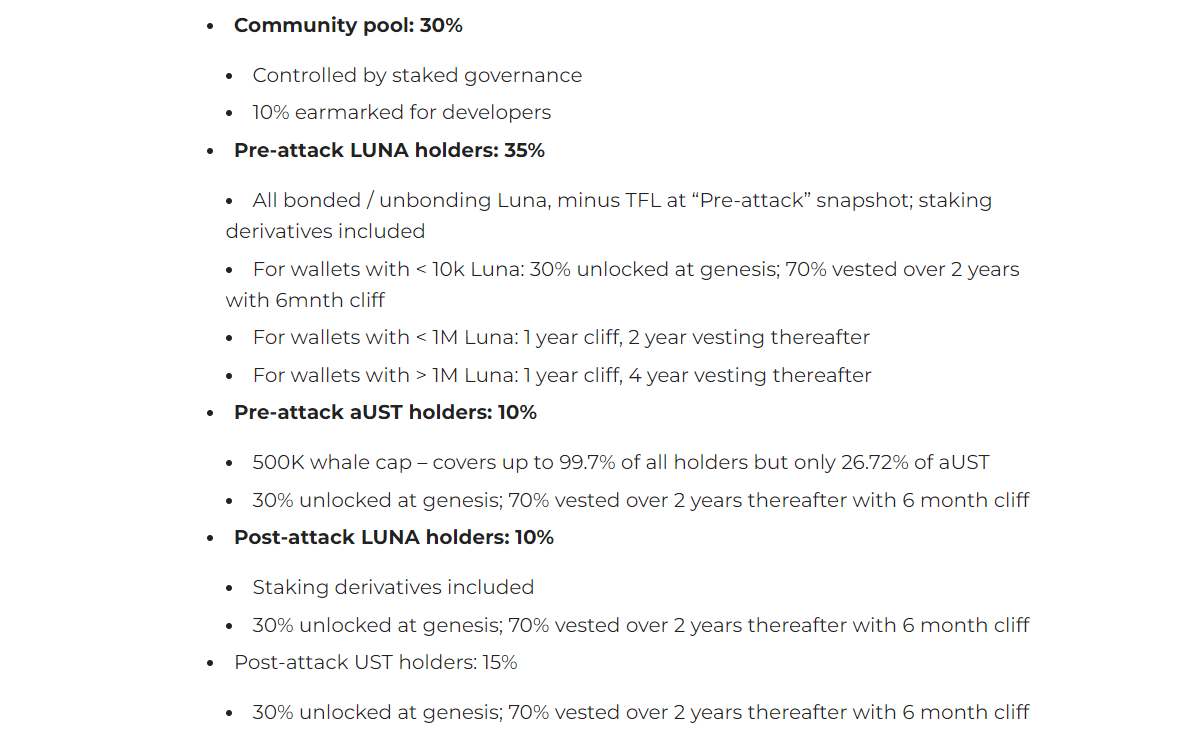

The preparations determined for distributing LUNA Airdrop

One of many criticisms levelled at how this airdrop was carried out is that it ignored the buyers who rushed in to purchase the outdated Luna, now referred to as LUNC, as a way to get monetary savings.

Regardless of Terraform Labs persevering with to challenge extra tokens in useless to save lots of the UST peg, many buyers acquired Terra at low costs. These buyers have been omitted of the airdrop as a result of they may obtain the least share of the airdrop, in accordance with the airdrop directions.

Purchase LUNA through eToro Now

Your capital is in danger.

Crew Terra’s Response to the LUNA Airdrop Complaints

Some customers additionally complained that they didn’t obtain the exact variety of tokens that the challenge promised. The Terra workforce acknowledged the issues and said that they had been engaged on an answer, however didn’t present a particular timeframe for when the difficulty could be resolved.

The Crew Terra’s Twitter deal with posted a tweet shortly after stating, “Consideration LUNA airdrop recipients. We’re conscious that some have obtained much less LUNA from the airdrop than anticipated & are actively engaged on an answer. Extra data will likely be offered when we’ve got gathered all the knowledge, so keep tuned.”

What Buyers Take into consideration LUNA After the Crash

There at the moment are apprehensions that the group will lose religion in Terra because of the airdrop incident, at the same time as Do Kwon and Terraform Labs work to revive their religion in Terra LUNA. The destiny of the group’s religion in Terra will likely be decided by how the airdrop scenario is dealt with.

In line with market gamers, it isn’t obvious how, and reserve property required to take care of the coin are usually not clear. They declare that issues are unlikely to change very quickly.

Crypto.com resumed Buying and selling of LUNA2/USDC Pair

The VP of Analysis and Technique at EarthID, Mr Sharat Chandra stated that “Onerous forking the chain with out addressing the underlying algorithm that didn’t hold the peg was wishful considering for the founder and group members who voted for Terra2.0.”

The Terra ecosystem has misplaced the belief of buyers, he famous, and a easy change of chain nomenclature with out addressing the core reason behind the disaster is not going to assist Terra’s resurrection.

Purchase LUNA 2.0 Now

Your capital is in danger.

Mr. Vikram Subburaj, CEO of Giottus Crypto Platform, said that the brand new Luna 2.0 coin is at present being airdropped to present LUNA and UST holders. He additionally famous that as a result of the airdrop and vesting schedule necessitates that LUNA’s commerce liquidity is restricted, sure exchanges have commenced buying and selling. As a consequence, he predicts that buying and selling costs will likely be fairly risky for the primary two months or so.

Luna faces an unclear future, and investor disappointment may make algorithmic stablecoins out of date. It’s sure that the founder and the corporate must make excessive efforts to regain the belief whereas making the basics of the crypto sturdy.

Learn Extra:

Fortunate Block – Our Really helpful Crypto of 2022

- New Crypto Video games Platform

- Featured in Forbes, Nasdaq.com, Yahoo Finance

- LBLOCK Token Up 1000%+ From Presale

- Listed on Pancakeswap, LBank

- Free Tickets to Jackpot Prize Attracts for Holders

- Passive Revenue Rewards – Play to Earn Utility

- 10,000 NFTs Minted in 2022 – Now on NFTLaunchpad.com

- $1 Million NFT Jackpot in Could 2022

- Worldwide Decentralized Competitions

Cryptoassets are a extremely risky unregulated funding product. No UK or EU investor safety.