A preferred crypto strategist is highlighting one key metric to find out whether or not or not Bitcoin (BTC) will outshine altcoins within the coming months.

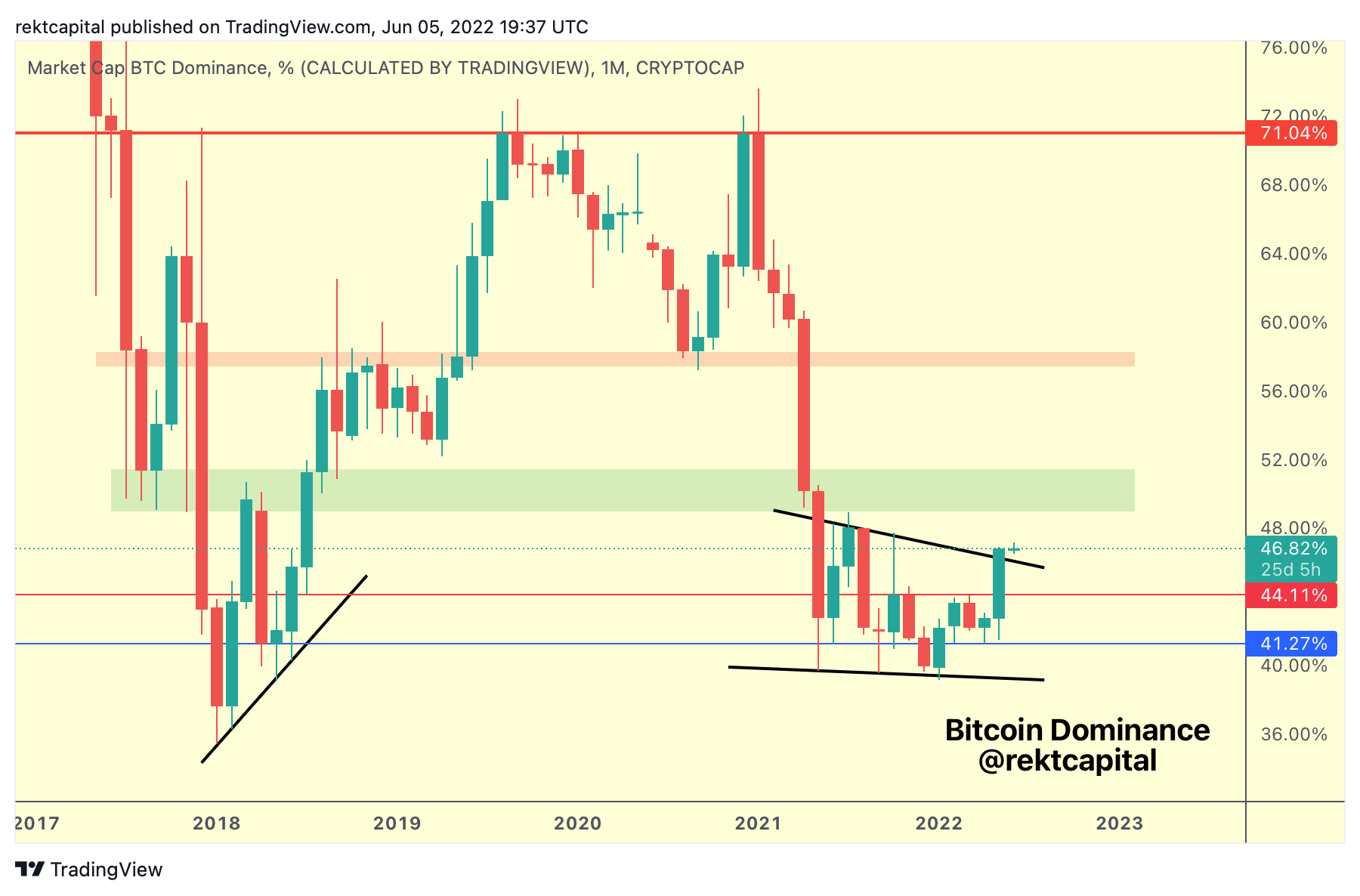

The pseudonymous dealer Rekt Capital tells his 312,300 Twitter followers the Bitcoin Dominance chart (BTC.D) appears poised to rise and full a wedge sample courting again to early 2021.

“BTC Dominance is on the cusp of confirming a breakout from a year-long wedging construction (black).

A breakout from this sample would doubtless result in extra draw back on altcoins.”

The BTC Dominance chart tracks how a lot of the whole crypto market capitalization belongs to Bitcoin. A bullish BTC Dominance suggests Bitcoin is rising quicker than different crypto belongings or altcoins are shedding worth whereas the main crypto by market cap surges.

The analyst subsequent zooms in on the chart to say that if BTC.D can maintain its breakout, it’s going to doubtless land within the 49% to 51% zone, a top final reached in April and Could of 2021 when Bitcoin was buying and selling above $60,000.

“BTC Dominance has reached the highest of the black wedging construction. In reality, seems like BTC Dominance is breaking out from the wedge.

If BTCDOM dips into the black wedge prime and the retest is profitable… BTCDOM might then soar to as excessive because the inexperienced space above.”

Rekt Capital concludes his evaluation by mentioning Bitcoin’s 200-day shifting common (MA) as a possible indicator of what would mark a worth backside for BTC within the present bear market.

“Traditionally, BTC tends to backside at, round, or simply under the 200-week MA (orange).

BTC would want to drop a further -25% from present costs to backside on the 200 MA.”

At time of writing, Bitcoin is altering palms for $29,393, down over 4% within the final 24 hours.

Examine Worth Motion

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses you could incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/Musjaka/Chuenmanuse/Andy Chipus