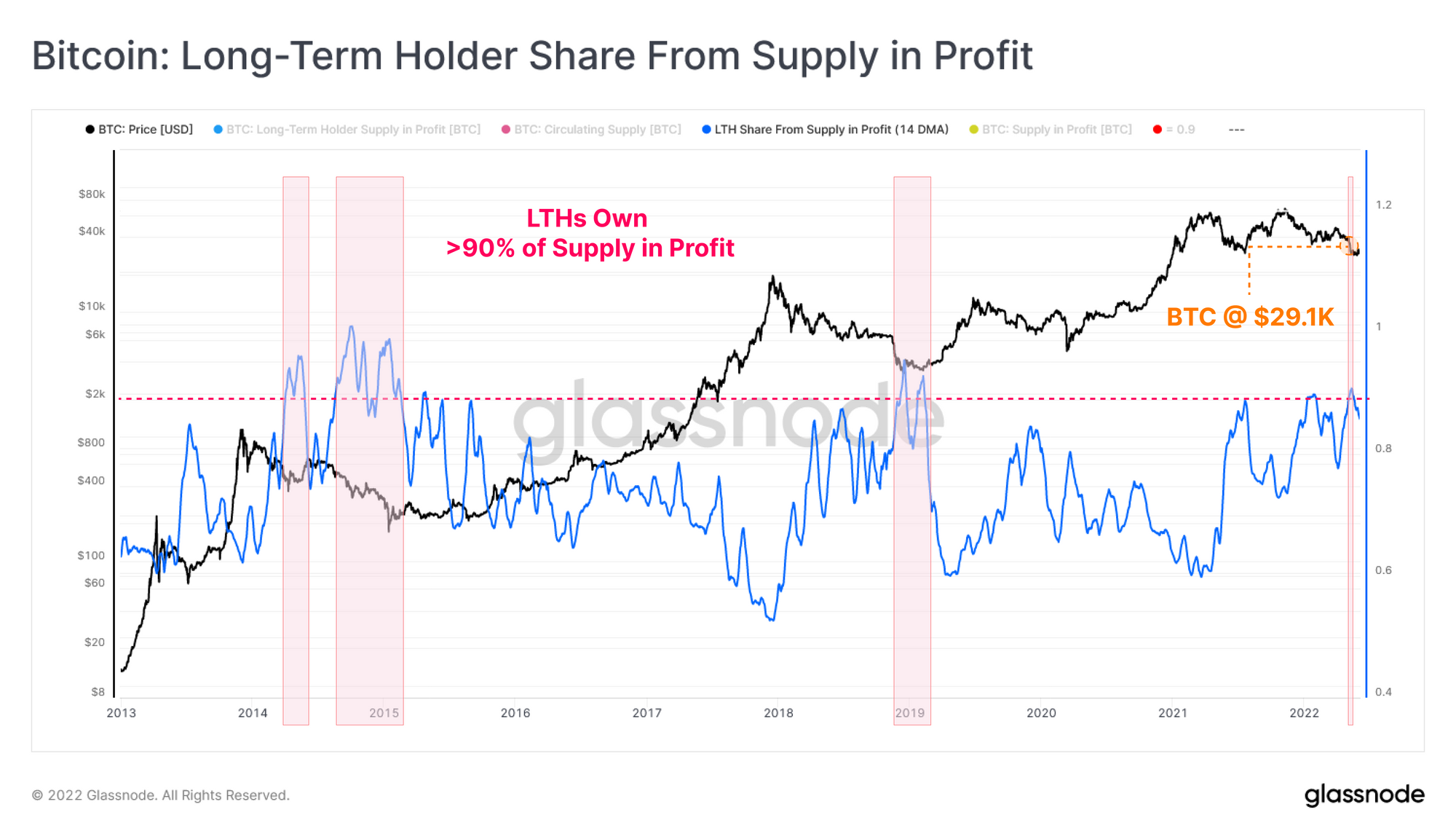

Newest information from Glassnode reveals Bitcoin long-term holders at present personal round 90% of the entire provide in revenue.

Bitcoin Provide In Revenue Share Of Quick-Time period Holders Declines

In keeping with the newest weekly report from Glassnode, dominance of long-term holders has noticed rise just lately.

The related indicator right here is the “provide in revenue,” which measures the entire variety of cash which might be at present holding a revenue within the Bitcoin market.

The metric works by checking the on-chain historical past of every coin to see what value it was final bought at. If this earlier value was lower than the present one, then the coin has now gathered some revenue.

Associated Studying | Bitcoin Bullish Sign: 1k-10k BTC Holders Have Been Shopping for Lately

Then again, the final promoting value being greater than the newest worth of the crypto would recommend the coin is holding a loss in the mean time.

The provision in revenue indicator naturally solely measures the previous kind of cash. Now, here’s a chart that reveals what share of this provide in revenue is owned by the long-term holders (LTHs):

Seems like the worth of the indicator has noticed some rise just lately: Supply: Glassnode's The Week Onchain - Week 23, 2022

LTHs solely embrace these traders who’ve held their Bitcoin since a minimum of 155 days with out promoting or shifting them. The cohort that has been holding since days lower than this threshold are referred to as the “short-term holders” (STHs).

As you possibly can see within the above graph, it looks as if in the previous couple of weeks the proportion of the availability in revenue owned by LTHs crossed the 90% mark. Because of this the share of STHs shrunk under 10%.

Associated Studying | Bullish: Bitcoin Marks First Inexperienced Weekly Shut After Two Months In The Purple

Such values of the indicator have additionally been seen just a few instances earlier than within the historical past of the crypto. Often, these earlier situations have taken place throughout late-stage bear market intervals.

The report notes that at these values the short-term holders are almost at a peak ache stage as they maintain nearly no unrealized income.

If this previous pattern is something to go by, then the present LTH provide in revenue of round 90% could also be an indication that the crypto has began to enter right into a late bear market.

BTC Value

On the time of writing, Bitcoin’s value floats round $29.5k, down 6% within the final seven days. Over the previous month, the crypto has misplaced 18% in worth.

The under chart reveals the pattern within the value of the coin during the last 5 days.

The value of the crypto appears to have noticed a pointy plunge down over the previous day | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, Glassnode.com