In early 2009, Bitcoin buying and selling was peer-to-peer, initially by way of PayPal. Nevertheless, it solely took a couple of months earlier than the primary ramp was launched. Mt Gox and earlier variants had been, as anticipated, rudimentary and centralized. Quick-forward lower than a decade later, and crypto buying and selling is a vibrant business with billions moved day by day.

Exchanges are crucial channels for shifting billions of property between customers and chains. Because the business expands and crypto finds adoption, their function will solely be magnified. This rise is very when decentralized finance (DeFi) is on the fore, dangling irresistible provides.

DeFi and the Position of Liquidity Aggregators

In lower than three years, DeFi instructions billions in Whole Worth Locked (TVL), with demand stemming from the sub-sphere’s worth proposition.

DeFi is, because the identify suggests, decentralizing finance utilizing good contracts, permitting customers from throughout the globe to entry funds. Thrilling as it could be, there should be dependable ramps with acceptable ranges of liquidity for easy trustless swapping of tokens.

Decentralized exchanges (DEXes) are launched from main good contracting platforms like Ethereum and the BNB Chain and have comparatively excessive ranges of liquidity. Nevertheless, since there are greater than a dozen blockchains with energetic crypto initiatives whose tokens command a whole lot of hundreds of thousands in market cap, most merchants have been manually hopping between exchanges or utilizing liquidity DEX aggregators.

Aggregating DEXes, for instance, 1Inch, allows easy swapping of various tokens listed in varied DEXes from one person interface. By doing this, liquidity aggregating DEXes saves time and assets, encouraging extra customers to channel funds into DeFi.

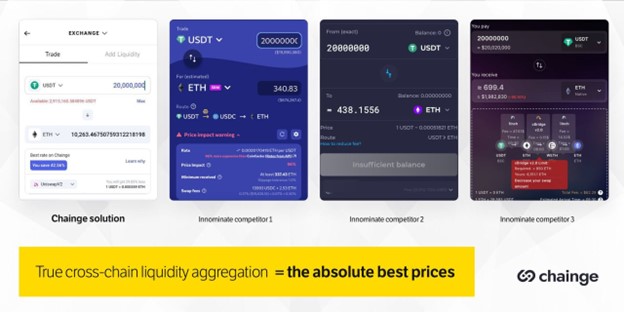

Nonetheless, whereas liquidity aggregating DEXes play a large function in DeFi, most are single-chain and some multi-chain, permitting its customers to bridge their property, however none have cross-chain aggregation capabilities. Consequently, merchants obtain fewer tokens than they’d if they may entry liquidity on a number of chains on the identical time… Oh, wait. Now they will.

Chainge Finance: Greatest Pricing, Cross-Chain, and Swift Settlement

There’s an enormous downside that Chainge Finance is at the moment tackling. The cross-chain liquidity DEX aggregator’s builders have launched a blockchain-based buying and selling venue laser-focused on guaranteeing merchants swap property in probably the most liquid surroundings guaranteeing the most effective charges.

Swapping tokens by way of Chainge Finance is non-custodial and supplied by means of a simple-to-use cellular interface. The platform additionally options helpful asset administration instruments utilized by over 400k customers for a mixed TVL of greater than $160 million and a complete aggregated liquidity of over $40 Billion. Distinguished instruments out there in Chainge Finance embody a spot, futures, and choices DEX, common digital property with cross-chain roaming capabilities, a time-framing module, and extra.

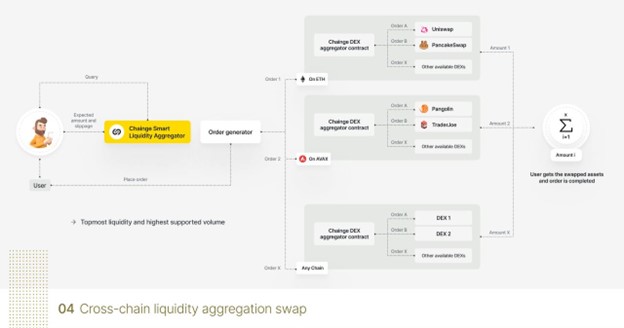

Each order initiated from Chainge Finance can be queried in all 20 supported DEXes and “crawled” for the most effective costs. As soon as the chords are struck, the order is break up throughout a number of liquid chains for the dealer to obtain the most effective costs. The half taken could be conveniently considered within the app’s order particulars part.

Chainge Finance does this by means of its proprietary smart-router that leverages DCRM know-how and a swap pathfinder algorithm. The Good Router instrument searches built-in DEXes throughout a number of chains for the most effective charges for decrease slippage whereas additionally establishing a route for a swift settlement.

Sensible instance

When a person desires to swap token A for token B, the good router will question the DEXs and decide real-time liquidity for the A/B pair in all DEXs on every chain.

Taking gasoline value into consideration, the good router will return the most effective path to execute the order.

As an example, the mounted quantity of A tokens to swap on the Ethereum in Uniswap DEX + the mounted quantity of A tokens to swap on the Ethereum chain in Sushiswap DEX + the mounted quantity of A tokens to swap on the BSC chain in Pancake DEX, and extra till the overall swap quantity is reached.

After the person locations the order, the next steps can be executed:

- Token A is wrapped into the fusion chain (it doesn’t matter what chain token A is on)

- The transaction to burn all token A common property on fusion is signed

- The burn receipt is used to name completely different proxy swap good contracts on every chain to make use of token A on these particular chains to execute the swap.

- Inside the slippage margin, the swap order can be executed.

NB: If the slippage margin is exceeded, the swap deal can be solely partially accomplished and the person will instantly get the remaining portion of A tokens again.

This use case ought to render apparent the large benefits of utilizing the Chainge Finance cross-chain liquidity aggregator aka probably the most liquid DEX in the marketplace.

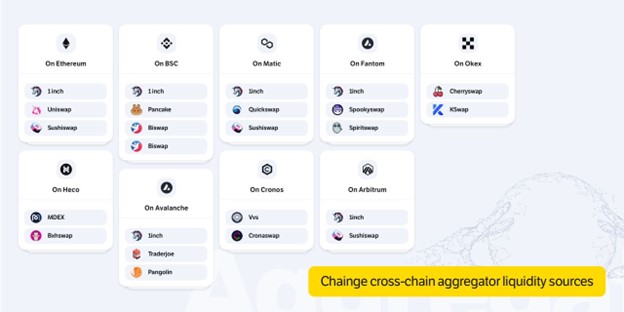

Chainge Finance has Included over 20 DEXes and 1 aggregator throughout 9 chains

Notably, Change Finance’s DCRM Expertise is patented and developed by Fusion Basis in partnership with among the world’s main safety and cryptography specialists, together with Louis Goubin, Professor of Pc Science on the College of Versailles, and Pascal Paillier, Ph.D.

Chainge Finance has already built-in with greater than 20 DEXes and 1 aggregator throughout 9 widespread blockchains, (with tons extra to be steadily added). For instance, on Ethereum, Chainge Finance integrates 1inch, Uniswap and SushiSwap. In the meantime, within the Cronos blockchain, they’ve chosen VVS and Cronaswap.

This DeFi protocol is well-thought-out and is a minimize above the remaining. It’s purposefully designed to resolve current ache factors of inconveniently low liquidity leading to unfavorable swapping charges in addition to eliminating the necessity to use cross-chain bridges.

Finally, Chainge Finance has designed a platform the place merchants can confidently swap cross-chain property at the most effective swapping charges in extremely liquid environments and handle their crypto property backed up by top-grade safety protocols.