Watch This Episode On YouTube or Rumble

Pay attention To The Episode Right here:

On this episode of the “Fed Watch” podcast, Christian and I sit down with Dylan LeClair, head of market analysis at Bitcoin Journal Professional. Every week, he and Sam Rule write near-daily updates for subscribers, and as soon as a month they launch a big Bitcoin market report. Bitcoin Journal Professional’s “Could 2022 Report” is what we’re masking for essentially the most half in right this moment’s episode.

You’ll find the slide deck we use for this episode right here, or you may see all of the charts on the finish of this put up.

“Fed Watch” is the macro podcast for Bitcoiners. Every episode, we focus on present macro occasions from throughout the globe, with an emphasis on central banks and foreign money issues.

Market Cycle

Earlier than we get into the superior charts that LeClair introduced, I wish to get an thought of the place he sees bitcoin in its market cycle timing. I ask, considerably facetiously, if we’re in a bear market, as a result of we’re positively not in a typical 80-90% drawdown.

LeClair responds by saying we’re in a traditional bear market, not essentially a traditional bitcoin bear market. He factors out that the upswing of this cycle didn’t have the everyday parabolic blow-off prime we’ve seen beforehand in bitcoin, in addition to there being extra technical and elementary help within the mid-$20,000s as much as $30,000 — so drawdown strain will even seemingly be restricted. LeClair additionally provides that the common person value foundation was hit by the wick to the latest lows. All in all, there’s important help underneath the present value and it stays to be seen if there’s sufficient bear momentum to interrupt to new lows.

Lastly, on the market-cycle timing questions, LeClair factors out a really underappreciated market growth: the collateral kind on exchanges has principally switched from bitcoin in earlier cycles to now being stablecoins like Tether (USDT) and USDC. In different phrases, the dominant buying and selling pairs and money deposits on exchanges have modified from bitcoin to stablecoins. Prior to now, an important buying and selling pair for any altcoin was versus BTC, which has modified to being versus a stablecoin like USDT. This can be a monumental shift in market dynamics and can seemingly result in far more secure costs for bitcoin, as a result of much less bitcoin can be compelled to liquidate within the hyper-speculative shitcoin bubbles.

Bitcoin Journal Professional Charts

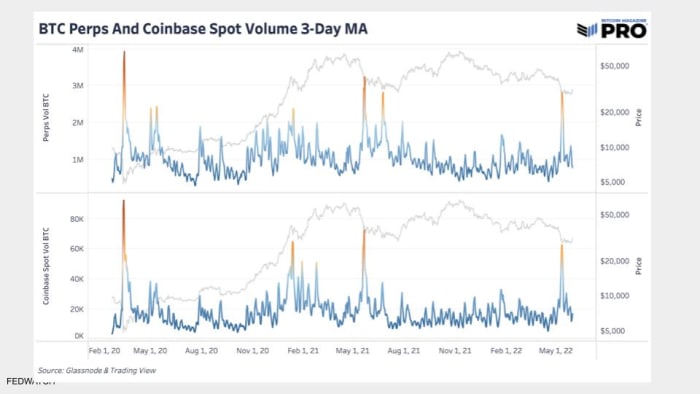

“That is Coinbase spot quantity, being the dominant American alternate, and the Perp [perpetual futures] quantity aggregated over a bunch of various derivatives exchanges. What we will see is numerous quantity spikes. Traditionally, when bitcoin is buying and selling palms in that dimension, it alerts some type of market prime or backside, some important change in market construction.” – Dylan LeClair

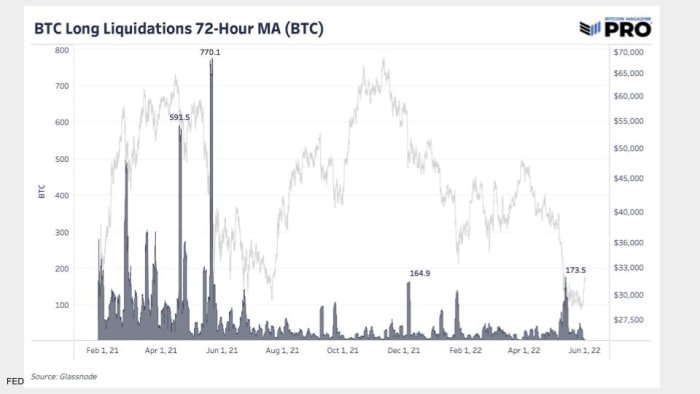

The following chart reveals the distinction in market construction resulting from stablecoins. LeClair says that 70% of the by-product market was nonetheless collateralized by bitcoin across the 2021 summer time sell-off. At the moment, it’s a lot a lot smaller than that. Subsequently, we should always anticipate there to be fewer liquidations in bitcoin when shitcoin bubbles pop, and that’s precisely what we see.

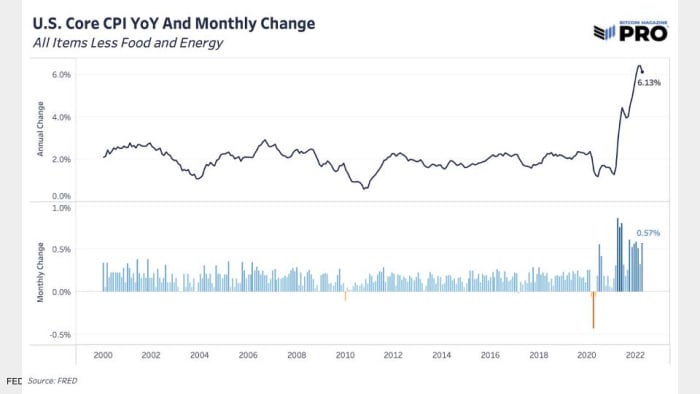

What’s nice concerning the Bitcoin Journal Professional newsletters is that they not solely have a look at the bitcoin market but in addition how macro could possibly be affecting bitcoin. The following two charts are about CPI and rates of interest. LeClair does an excellent job breaking these down through the podcast.

I ask LeClair about his pondering on the Federal Reserve financial coverage, and he focuses his evaluation round actual rates of interest. He says actual charges should keep damaging with a purpose to erode the large world debt burden. Subsequently, if the Fed hikes even to three.5%, for actual charges to remain damaging the CPI should keep above that.

Subsequent up is CK’s favourite indicator, the Mayer A number of, or the 200-day transferring common value divided by present value. When the value is beneath the 200-day transferring common, this ratio is beneath 1, and has traditionally been a great way to time the market.

Probably the most dense informational charts on Bitcoin Journal Professional is up subsequent, and that’s Reserve Threat.

“The Reserve Threat chart mainly weighs Hodler conviction, whether or not sturdy or weak, with value.”

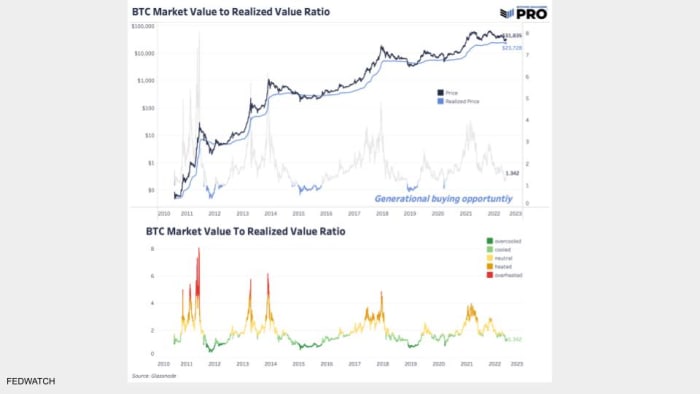

Our final chart for the day is Realized Worth, and that is LeClair’s favourite. It’s a good way to strip out a lot of the noise and volatility of the bitcoin value and focus on the pattern.

“One of many cool issues concerning the transparency of this community is, we will see when each single bitcoin has ever moved, or was ever mined. We are able to additionally [assign each UTXO a price of when it last moved] to return with what we name Realized Worth. […] We are able to see when everyone seems to be underwater on common.” – LeClair

Bitcoin Regulation from Senator Lummis

On the finish of the present we wrap up with a dialogue on the just lately proposed draft laws, by Senator Lummis, that outlines a brand new framework for bitcoin and what the invoice calls “digital property.” In reality, they don’t use the phrases bitcoin, Ethereum, blockchain and even cryptocurrency within the draft in any respect.

Suffice it to say, we tease out some opinions from LeClair and trip with the livestream crew, however you’ll must take heed to get that complete insightful dialogue! We dive into the consequences on the bitcoin market, exchanges and a future bitcoin spot ETF!

That does it for this week. Due to the readers and listeners. If you happen to take pleasure in this content material please subscribe, evaluation and share!

This can be a visitor put up by Ansel Lindner. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.