Within the wake of Constancy Investments saying their plan to permit buyers to place crypto in 401(okay) retirement accounts, US Treasury Secretary Janet Yellen termed it a “very dangerous” selection.

“It’s not one thing that I might suggest to most people who find themselves saving for his or her retirement,” famous Yellen in Washington at an occasion organized by the New York Instances. “To me, it’s a really dangerous funding,” she continued.

Stern Response to Constancy’s Announcement

Constancy Investments is the primary supplier to be itemizing such an providing, which will probably be obtainable midyear for the 23,000 corporations that use Constancy for his or her retirement accounts. Yellen was responding to a query about this very announcement, to which the Labor Division has additionally expressed opposition.

Senators Elizabeth Warren, Tommy Tuberville, and Cynthia Lummis had been additionally current on the dialogue round digital currencies in 401(okay), together with representatives from the Division of Labor.

The latter has already responded with a compliance report back to the transfer, threatening authorized motion. In the meantime few senators have requested solutions on how Constancy plans to handle dangers related to such an introduction.

There’s one other group of lawmakers, nevertheless, who’re on crypto’s aspect. Alabama Senator Tommy Tuberville has just lately talked a few “Monetary Freedom Act” permitting buyers so as to add cryptocurrencies to their 401(okay) retirement financial savings plans.

Wyoming Senator Cynthia Lummis is selling crypto legalization in her much-awaited invoice proposal.

Different Facet of the Desk: Crypto for Retirement Financial savings

Many monetary planners consider that cryptocurrencies could be a priceless addition to a well-balanced funding portfolio and that their clients have already begun to take action exterior of employer-sponsored retirement plans.

Constancy’s announcement is being considered as a watershed second for cryptocurrency adoption within the US, and by affect, all the world. Constancy being the main pensions supplier within the nation, with a person base of greater than 20 million individuals, the transfer clearly outlines a rising demand amongst Constancy plan sponsors.

Sure demographics could also be scared off by the prospect of holding crypto, a brand new asset class with a repute for volatility, as a possible choice for retirement financial savings. Small allocations and variety of cryptocurrencies, nevertheless, can show helpful for retirement investments in the long term, in line with specialists.

It is because cryptocurrencies have a tendency to maneuver independently of different property, and the perfect prescription for robust diversification is a weak correlation. Inserting small percentages of retirement plans in crypto is extensively thought of a sensible transfer.

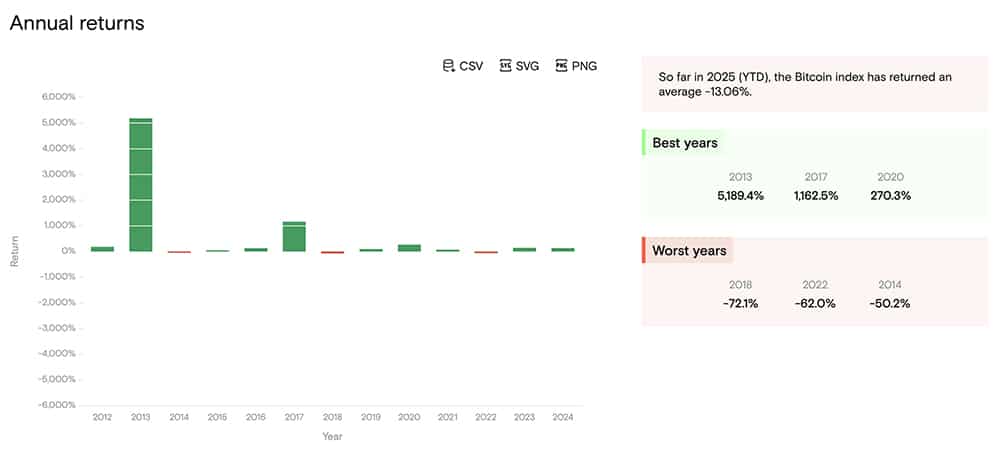

Subsequent, comes the query of volatility. Whereas investing in crypto retirement, as in different extra risky funding classes reminiscent of shares, the sluggish descent approach will probably be helpful; if you’re youthful, you could have an extended funding time horizon, and longer time horizons have traditionally been linked with decreased volatility.

As you get nearer to retirement, you may progressively switch your retirement financial savings to much less risky property.

Constancy’s Deep-Rooted Perception in Crypto

This isn’t Constancy Funding’s first stance in pushing cryptocurrency adoption. It was one of many first main monetary corporations worldwide to start out Bitcoin mining approach again in 2014.

The agency additionally began its distinct cryptocurrency unit in October 2018. It additionally has its toes dipped into the crypto custody enterprise, which is already a “massive success”, in line with CEO Abigail Johnson. Constancy’s Canadian subsidiary achieved the standing of the primary regulated Bitcoin custodian in Canada solely final yr.

The crypto evaluation platform, Sherlock, was additionally launched on Constancy in 2021.

The Congress response to Constancy’s newest pro-crypto announcement is awaited. Secretary Yellen believes it’s cheap for Congress to handle it as a hazard and regulate which property will be included in tax-favored retirement autos, reminiscent of 401(okay) plans.

“I’m not saying I like to recommend it, however that to my thoughts could be an inexpensive factor,” Yellen commented when requested about Congressional motion.

For buyers, this will grow to be a complicated time. There are many assets obtainable on InsideBitcoins that can assist you perceive the present and future prospects of main cryptocurrencies, the authorized and social setting round cryptos, and the best-performing property at the moment.

It’s endorsed that you simply plan round cryptocurrency investments as rigorously as different monetary autos, particularly in relation to retirement financial savings. Be sure you have long-term monetary targets in thoughts and you’ve got clear causes for purchasing crypto – as a retailer of worth, as a possible funding, for portfolio diversification, and so forth.

Learn extra:

Fortunate Block – Our Really useful Crypto of 2022

- New Crypto Video games Platform

- Featured in Forbes, Nasdaq.com, Yahoo Finance

- LBLOCK Token Up 1000%+ From Presale

- Listed on Pancakeswap, LBank

- Free Tickets to Jackpot Prize Attracts for Holders

- Passive Revenue Rewards – Play to Earn Utility

- 10,000 NFTs Minted in 2022 – Now on NFTLaunchpad.com

- $1 Million NFT Jackpot in Might 2022

- Worldwide Decentralized Competitions

Cryptoassets are a extremely risky unregulated funding product. No UK or EU investor safety.