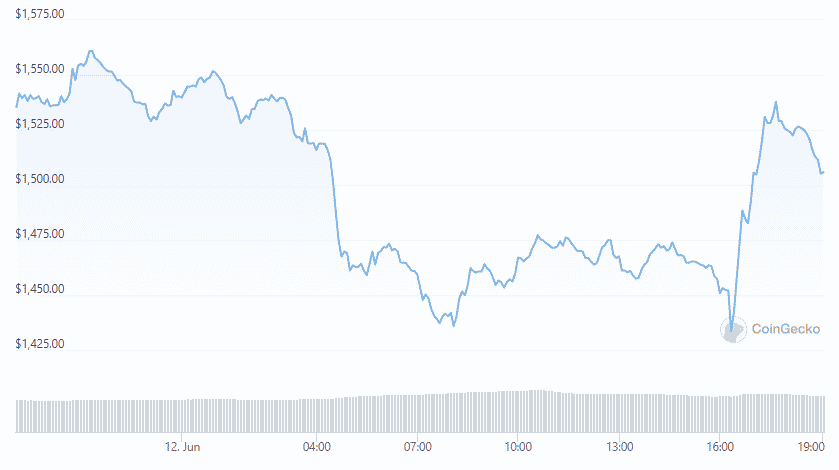

ETH costs stay down for 4th season and it’s buying and selling beneath $1800 with costs repeatedly so let’s learn extra at present in our newest Ethereum information.

Despite the losses, the bearish momentum prevented ETH From breaking via the $1800 stage up to now week. After a sluggish tempo in April, the inflation surged once more in Might which could have a adverse affect on the crypto markets already affected by the FED’s strict financial insurance policies. On the time of writing, the ETH costs stay right down to an intraday low of $1,761 lower than a day after reaching a excessive of $1,812. As per the info from CoinMarketCap, the costs of ETH declined by 7% up to now day.

The Ethereum worth continued to crash below the dynamic resistnace of the descending trendline since final month. The selloff for the pair seen in Might surpassed the January low of $2170. Within the face of the rising instability out there, the promoting stress dropped, leading to a gradual decline. Despite the intraday lows, the assessment of the previous week reveals 0.33 % worth development. This allowed ETH to stay above the $1750 stage regardless of the various bear makes an attempt to decrease the worth and different cryptocurrencies additionally took a beating like Solana, Avalanche, and Cardano that every one retreated by 10% up to now day.

For the reason that first half of final month, the worth of ETH dropped in response to the descending trendline and reached a brand new low of $1718 with many retest of the resistance indicating the most important influence in the marketplace gamers. Ethereum stays the second-biggest digital asset by market cap and in Might, ETH has a market cap of $235 billion. The drop in ETH market cap will be traced to a broader selloff of digital belongings up to now weeks. Within the meantime, inflation is boosting the households to be prudent with their spending administration, particularly those who have decrease incomes that spend an even bigger portion of the price range on fundamentals like payments and meals.

As just lately reported, Ethereum’s merge because the blockchain’s most awaited transition from the present proof of labor to a proof of stake will likely be a step nearer if the deliberate trial upgrades on the general public testnet go as deliberate. First rolled out in 2016, Ropsten is the ETH oldest testnet which permits for blockchain improvement testing earlier than deploying on the mainnet. Just like different testnets, it’s just like the mainnet with a key distinction that no actual funds are in danger if technical points happen.

DC Forecasts is a pacesetter in lots of crypto information classes, striving for the best journalistic requirements and abiding by a strict set of editorial insurance policies. If you’re to supply your experience or contribute to our information web site, be happy to contact us at [email protected]

![Switched from first-gen hardware wallets to fully airgapped QR signing… and wow. [Keystone 3 Pro review] Switched from first-gen hardware wallets to fully airgapped QR signing… and wow. [Keystone 3 Pro review]](https://external-preview.redd.it/PyR8wfye9674tKNBXx-gCs0nkqOf2vEm7T8-Wwg7nSs.jpeg?width=320&crop=smart&auto=webp&s=68c4f1dd66dbbea4d21ac33fd3d546ebc7692984)