The U.S. Federal Reserve is predicted to lift the federal funds charge throughout its subsequent assembly on Wednesday and JPMorgan economist Michael Feroli believes that rising inflation will push the Fed to extend the speed by 75 foundation factors (bps). Final week, CME Group information indicated the market priced in a 95% probability that the U.S. will see a 50 bps charge hike this month. Though, whereas some count on a hawkish Fed, some imagine the U.S. central financial institution could act dovishly if markets worsen.

International Markets Shudder With Focus Directed on the Fed’s Subsequent Price Hike — JPMorgan Economist Expects a 75 bps Improve

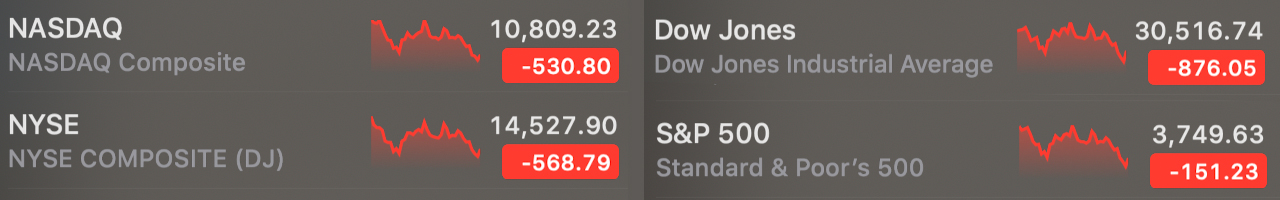

Main U.S. inventory indexes and cryptocurrency markets dropped considerably on Monday, because the day was thought of one of many bloodiest begins to the week in a very long time. CNBC’s Scott Schnipper mentioned on Monday that the “S&P 500 is now in an official bear market, in keeping with S&P Dow Jones Indices.”

Treasured metals like gold and silver dropped in worth as effectively, as gold’s worth per ounce slipped 2.67% and silver dropped 3.58%. Your entire crypto economic system misplaced 18% throughout the course of the day on Monday and BTC dropped beneath $21K. At present, all eyes are on the upcoming Federal Open Market Committee (FOMC) assembly the place members of the Federal Reserve System are anticipated to lift the federal funds charge.

Average will increase will be between 25 to 50 bps. The Fed can go as excessive as 75 to 100 bps throughout the subsequent assembly and some are predicting 75 foundation factors is within the playing cards. Final week, CME Group information had proven the market priced in a 95% probability that the Fed would elevate the benchmark charge by 50 bps. Nonetheless, JPMorgan economist Michael Feroli thinks a 75 bps enhance is coming and 100 bps can also be attainable.

Feroli instructed shoppers in a notice on Monday {that a} “startling rise in longer-term inflation expectations” could push the Fed to extend the speed by 75 foundation factors on Wednesday. “One may wonder if the true shock would really be climbing 100bp, one thing we expect is a non-trivial danger,” Feroli added.

Goldman Sachs Economists Predict a 75 bps Hike — JPMorgan Strategist Marko Kolanovic Thinks a Dovish Shock Might Occur

Goldman Sachs economists agree with Feroli as they imagine a 75 bps hike will seemingly be introduced on the FOMC assembly. “Our Fed forecast is being revised to incorporate 75 bps hikes in June and July,” Goldman economists defined on Monday.

The Goldman Sachs analysts’ notice to traders provides:

We anticipate two extra charge will increase in 2023 to three.75-4%, adopted by one reduce in 2024 to three.5-3.75%. We anticipate a 50bp enhance in September, adopted by 25bp will increase in November and December, for an unchanged terminal charge of three.25-3.5%. We count on the median dot to indicate 3.25-3.5% at end-2022.

In the meantime, regardless of Feroli’s 75 bps prediction, JPMorgan’s Marko Kolanovic instructed the press that the U.S. will seemingly keep away from a recession. The strategist at JPMorgan Chase & Co. defined that Fed could act dovish going ahead because of the craziness in bond markets and inventory markets as effectively.

“Friday’s robust CPI print that led to a surge in yields, together with the sell-off in crypto over the weekend, are weighing on investor sentiment and driving the market decrease,” Kolanovic’s notice to shoppers detailed on Monday. “Nonetheless, we imagine charges market repricing went too far and the Fed will shock dovishly relative to what’s now priced into the curve,” the JPMorgan strategist added.

What do you consider the upcoming FOMC assembly and the following charge hike? Do you assume will probably be reasonable or aggressive? Or do you assume a dovish shock is within the playing cards? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss triggered or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

![[LIVE] July 31 Crypto Updates – Bitcoin Holds $118K as Powell Freezes Rates Despite Trump’s Pressure: Best Crypto to Buy Now? [LIVE] July 31 Crypto Updates – Bitcoin Holds $118K as Powell Freezes Rates Despite Trump’s Pressure: Best Crypto to Buy Now?](https://sbcryptogurunews.com/wp-content/themes/jnews/assets/img/jeg-empty.png)