The Federal Open Markets Committee (FOMC) raised its goal rates of interest by 75 foundation factors on Wednesday, the most important price hike since 1994.

The increase got here consistent with market expectations that foresaw a extra hawkish committee in motion as newest inflation figures got here above expectations, marking a brand new 40-year excessive at 8.6%. FOMC Chair Jerome Powell, who additionally serves as chair of the Federal Reserve, had stated to start with of Could that the committee would enact a 50 foundation level increase in June had market knowledge reminiscent of the patron costs index (CPI) come as anticipated.

Powell defined the reasoning behind a change in course in a press convention held following the discharge of the FOMC financial coverage resolution on Wednesday by leaning on inflation – which he stated had “once more stunned to the upside.”

“Over the approaching months we’ll be in search of proof that inflation has been turning down,” Powell stated. “Hikes will proceed to depend upon incoming knowledge, however both a 50 foundation factors or 75 foundation factors improve appear extra seemingly for the subsequent assembly.”

Powell highlighted as soon as once more that the primary aim of the Fed and its FOMC is to deliver inflation all the way down to its 2% goal. Notably, the committee’s newest assertion eliminated a line from its previous assertion that learn, “With acceptable firming within the stance of financial coverage, the Committee expects inflation to return to its 2 % goal and the labor market to stay robust.” Nonetheless, the FOMC appended a line to that paragraph that said it’s “strongly dedicated” to curbing inflation to the goal price.

The committee additionally launched its new abstract of financial projections, a doc that places collectively the evaluation and forecasts of all FOMC members for gross home product (GDP) progress, unemployment price and inflation for this 12 months and the subsequent two.

Individuals now anticipate rates of interest to succeed in 3.4% by the tip of the 12 months and three.8% by the tip of 2023 earlier than lowering within the following years.

Powell reiterated that, consistent with member’s projections, the committee doesn’t anticipate a U.S. recession to ensue. Slightly, he stated the FOMC is watching intently a very powerful financial data to be nimble on the subject of financial coverage.

“We’re not making an attempt to induce a recession,” Powell stated.

The Fed chair navigated his speech between what he calls issues financial coverage can affect and issues it can’t. He defined that whereas a lot of the Fed’s work shifting ahead will probably be an try to re-balance provide and demand, policymakers can solely take care of the demand aspect and most accountable about inflation at present is on the availability aspect.

Powell talked about the rising commodity costs because of the warfare in Ukraine and broader provide chain disruptions as two key points at present affecting inflation and thus financial coverage.

“Our goal actually is to deliver inflation all the way down to 2% whereas the labor market stays robust,” Powell stated. “What’s turning into extra clear is that many components that we don’t management are going to position an enormous function in saying if that’ll be potential or not.”

“When demand goes down, you can see…inflation coming down,” Powell said, including that it wasn’t assured such a discount in demand, which is theoretically within the energy of the Fed, would achieve success.

On the subject of the labor market, Powell defined {that a} slight rise in unemployment wouldn’t invalidate an eventual capability to deliver inflation down.

“In case you have been to get inflation on its method all the way down to 2% and get unemployment at 4%, that’s nonetheless traditionally low ranges,” he stated. “I believe that may be a profitable end result. We don’t search to place individuals out of labor, after all, however you can not have the type of labor market we wish with out value stability.”

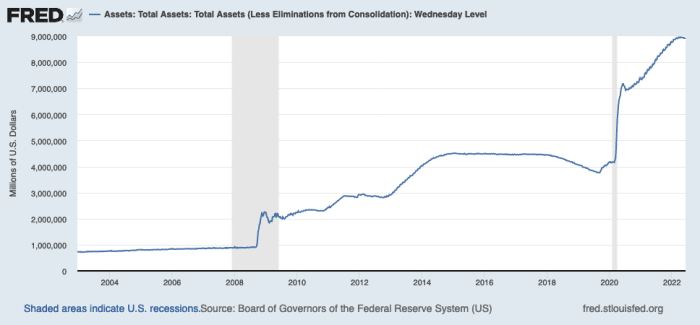

Notably, the Fed’s stability sheet seems to be already decreasing as quantitative tightening started on June 1 – as stated within the committee’s earlier assembly.

Newest knowledge exhibits the stability sheet of the Federal Reserve taking a breather after going parabolic on the outset of the COVID pandemic. Picture supply: FRED.

Bitcoin plunged forward of the discharge of the brand new financial coverage assertion however began recovering as quickly as Powell went dwell. The peer-to-peer digital foreign money rose 7.42% to $21,900 whereas the chair of the Fed spoke. Bitcoin is buying and selling at round $21,700 at press time.