As soon as the third largest stablecoin, TerraUSD (UST) has shaken your complete stablecoin market after it collapsed on Could 9. As an alternative of lastly determining an answer to algorithmic stables like hundreds of individuals thought, it went to zero practically in a single day.

UST failed as a result of a sudden and big sell-off because it depegged, inflicting an extreme quantity of Terra (LUNA) to be minted. Regardless of its quickly increasing provide, LUNA didn’t re-anchor UST to $1 as its worth plummeted.

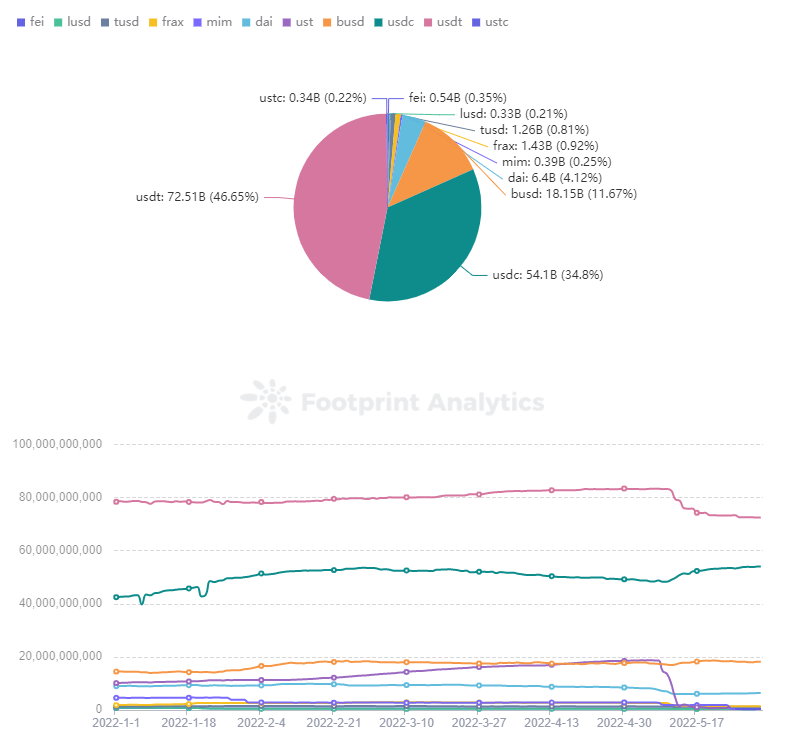

UST’s market cap surpassed Binance USD (BUSD) in April, which means it trailed solely behind Tether (USDT) and USD Coin (USDC). However, the collapse got here so shortly that it was too late for a lot of traders to even money out at a loss.

The occasion has created the most important disaster of belief in DeFi. Stablecoins are not secure.

However crises deliver their very own alternative. How has the stablecoin market modified after UST?

Persons are nervous about Tether and warming to USD Coin

USDT and USDC account for nearly 80% of the whole stablecoin market.

For every USDT issued, Tether’s checking account is deposited with USD funding on a 1:1 foundation. USDC is much like USDT and is issued by Circle.

USDT is by far the extra controversial challenge out of the 2. In Oct. 2021, it garnered important press protection for its alleged lack of transparency and repeated penalties from US regulators for mendacity to the general public.

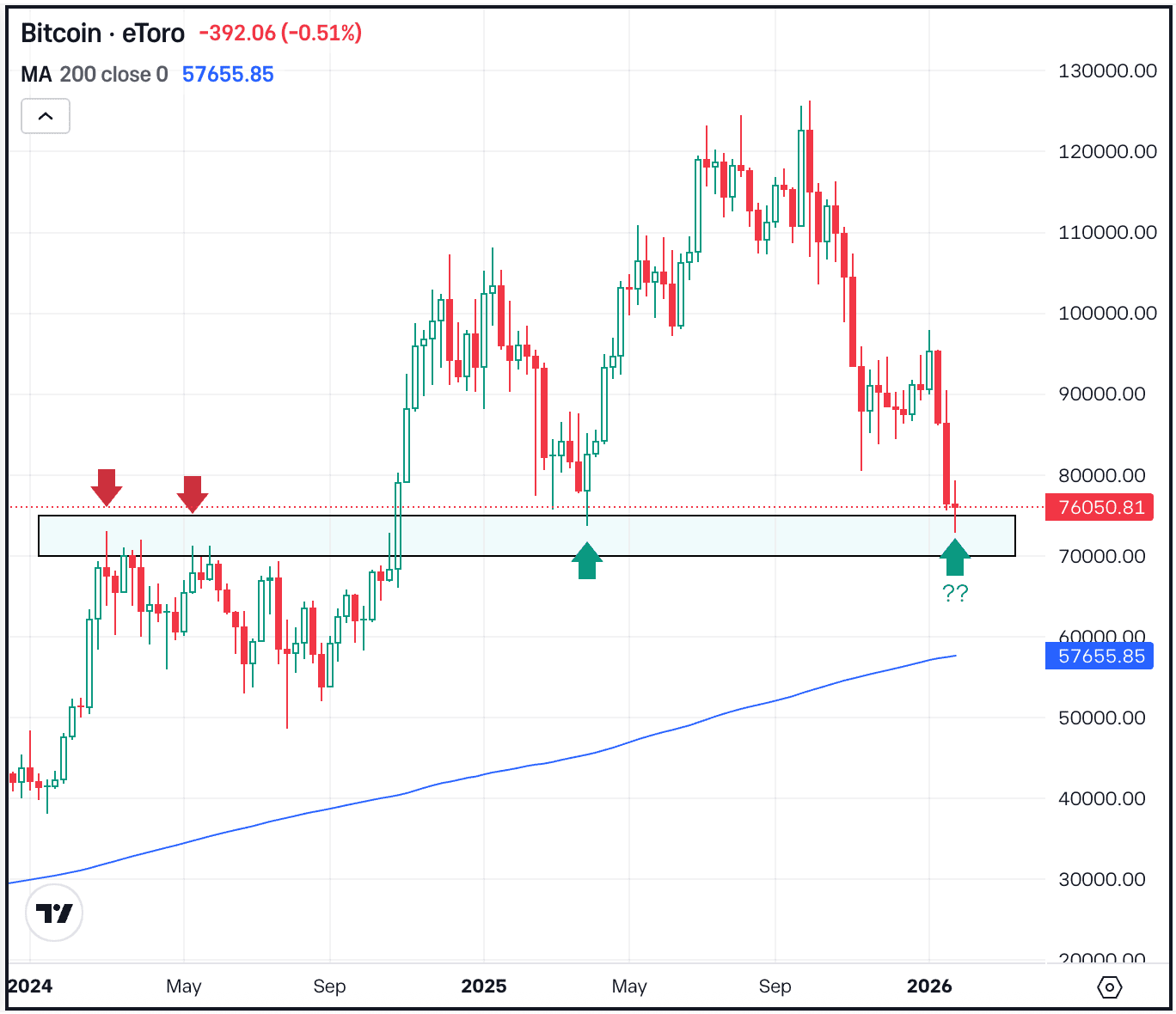

When UST crashed, individuals instantly considered USDT, and its market cap dropped by greater than $10 billion to $72.5 billion over the course of half month.

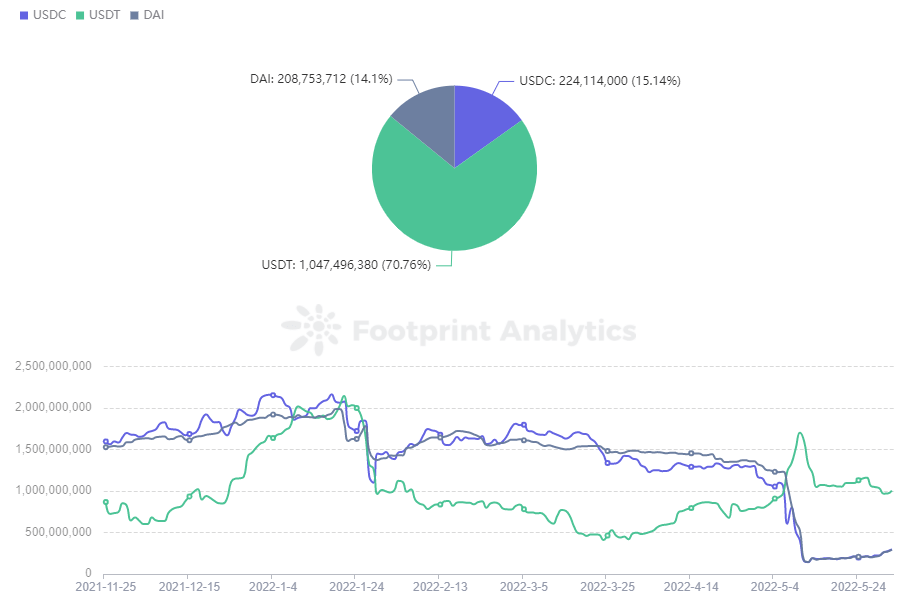

Curve’s 3pool, its largest pool (made up of DAI, USDC, and USDT) displays the market sentiment round these essential stables.

USDT had beforehand remained at 20-30% of the pool. Nevertheless, as Terra Luna collapsed, customers started throwing their USDT into the pool and swapping for USDC and DAI. This frantic sell-off led to USDT peaking at 83%.

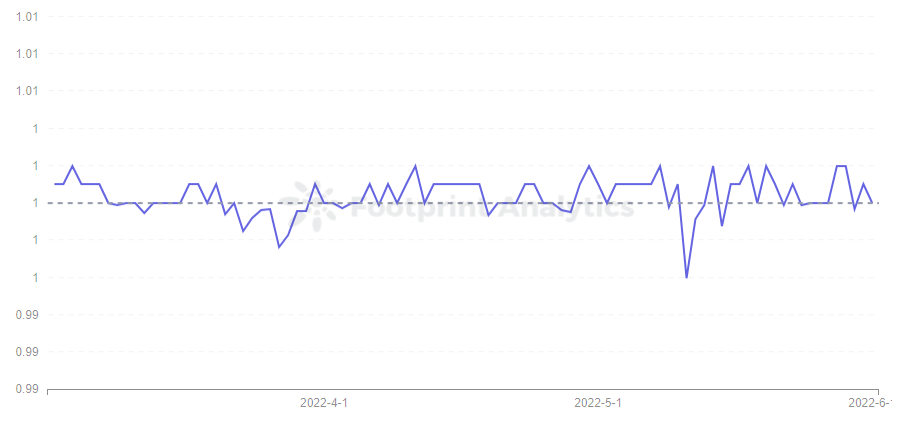

Earlier than the collapse, USDT’s worth tended to hover above $1, however the occasion introduced it to a close to three-month low of $0.996. Paolo Ardoino, Tether’s CTO, introduced on Twitter that they redeemed $7 billion to assist it regain its greenback anchor, and was assured that he might proceed doing so if the market needed.

The transfer has restored some confidence and USDT’s share of the 3pool dropped to 61% on June 5.

USDT’s market cap dropped by $10 billion, however its share of the whole stablecoin market has not declined.

This results in the query of the place UST’s share of the market fled to.

In keeping with Footprint Analytics, USDC has been the largest beneficiary, with its market cap rising from $48.3 billion to $54.1 billion and its market share from 27% to 34%.

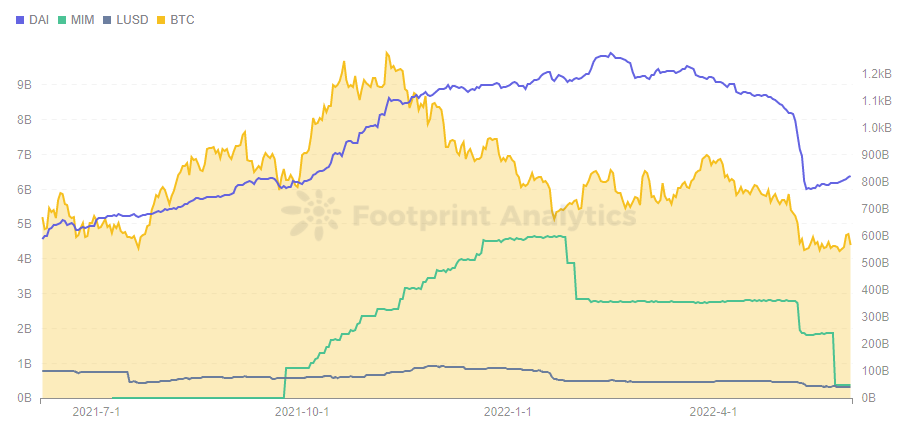

DAI finds its footing whereas Magic Web Cash stumbles

Overcollateralized stablecoins, led by Dai (DAI), Magic Web Cash (MIM), and Liquity (LUSD) are minted by depositing non-stablecoins in extra of the 1:1 ratio into the protocol as collateral.

These overcollateralized cash had been affected by UST’s drop, however not directly. The respective market cap of DAI and MIM dropped by $2 billion, however this downward pattern started on Could 6, earlier than the UST crash.

DAI is generally collateralized by Bitcoin (BTC) and Ethereum (ETH), whereas MIM is collateralized by interest-bearing property like yvDAI. When most cryptocurrency costs fall quickly, the overcollateralized stablecoins they use as collateral additionally decline.

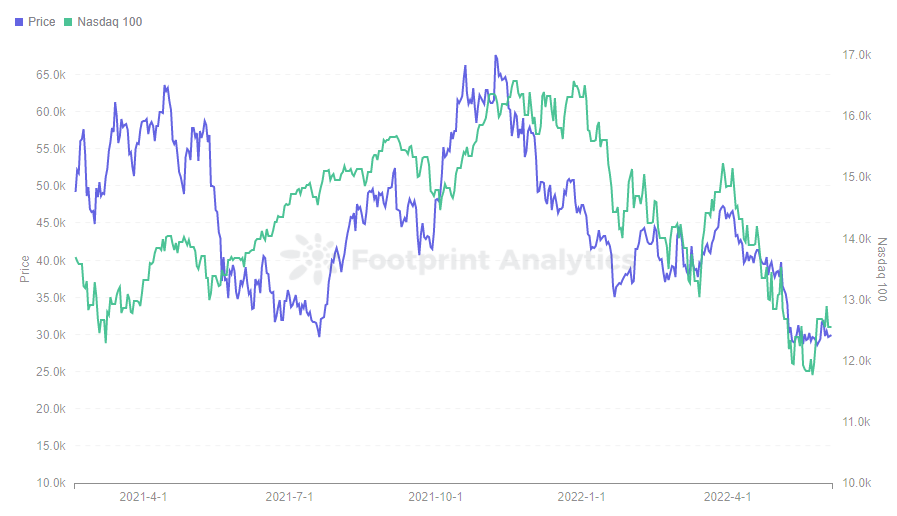

The current drop in BTC, which has been affecting the worth of cryptocurrencies, is once more associated to the US market. The Federal Reserve has taken measures to boost rates of interest as a way to stop inflation, which has induced a drop in US shares as nicely. A transparent downward pattern may also be seen within the Nasdaq 100 Index.

The information at Footprint Analytics exhibits that the worth of BTC was largely uncorrelated with the Nasdaq 100 Index till July 2021, however the correlation between the 2 has grown stronger since then. Whereas customers as soon as entered cryptocurrency partly to hedge their threat, crypto now looks like a extremely leveraged model of the inventory market.

The UST plunge has definitely delivered one other blow to overcollateralized stablecoins, as Terra founder Do Know purchased a considerable amount of BTC as margin for the UST, placing additional downward strain available on the market and inflicting extra individuals to promote BTC in concern. The failure of Do Know’s plan to rescue UST additionally despatched the worth of BTC to a close to 1-year low, additional affecting the liquidation of the overcollateralized stablecoins.

Nevertheless, DAI is minted not solely by means of collateral similar to ETH and BTC, but additionally by means of numerous stablecoin points similar to USDC and USDP. Subsequently, DAI managed to manage the impression inside a restricted vary. In distinction, the state of affairs of MIM isn’t too good, after the market cap dropped by $2 billion in January, it dropped by one other $2 billion in Could.

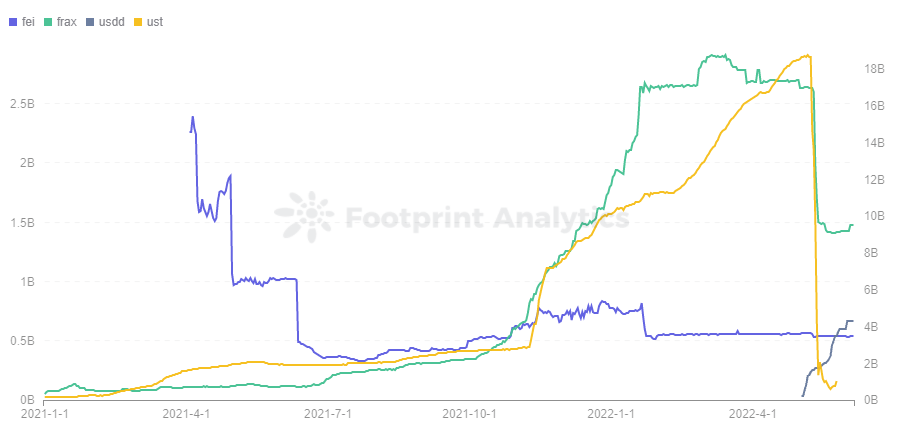

Algorithmic Stablecoin Market

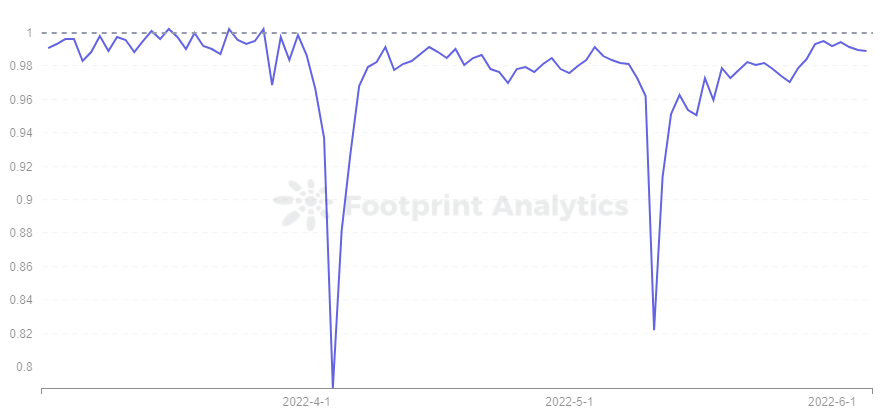

The de-anchoring of UST shattered the newly constructed confidence within the algorithmic stablecoins, and the worth of USDN, which has an analogous mechanism on the Waves chain, additionally de-anchored immediately to $0.8 on Could 11, earlier than steadily pulling again.

Nevertheless, as of June 5, the worth was nonetheless not fully anchored at $0.989. As seen by Footprint Analytics, this isn’t the primary time USDN has been so badly unanchored.

FRAX, which equalled UST in market cap till Could ninth, additionally plummeted by $1 billion. Since FRAX requires each USDC and FXS to be minted, with USDC because the collateral portion and FXS because the algorithmic portion, FTAX is comparatively extra secure than a totally algorithmic stablecoin. Though the worth of FXS additionally fell, FRAX rebounded after its market cap fell to $1.4 billion.

FEI, which permits customers to mint stablecoins with $1 in property, is at present collateralized at 168% and about 70% of the property within the protocol are ETH. FEI’s market cap isn’t giant, at $500 million, and has not been affected a lot.

What’s notable is that whereas most stablecoins have fallen in market cap, USDD, a stablecoin issued by Tron, has surpassed FEI’s market cap by $670 million as of June 5, making Tron the third-largest TVL chain after Ethereum and BSC.

As seen from the success of UST, customers select stablecoins relying on safety and profitability. USDD will be stated to be optimized on UST, however USDD’s issuance, burning and first market actions are managed by TRON DAO Reserve, and abnormal customers can solely commerce USDD on the secondary market. Subsequently, the steadiness of USDD is especially associated to the TRON DAO Reserve and its authorized whitelist, and never a lot to do with the algorithm.

This shifts the customers’ stage of belief from the algorithm to TRON DAO Reserve. USDD additionally has a inflexible rate of interest of 30%, which is extraordinarily engaging to customers.

Abstract

Whereas the marketplace for stablecoins took a giant hit when UST collapsed, there’s additionally a newfound alternative for some protocols like USDC and USDD.

In overcollateralized stablecoins, DAI stays the primary, and the hole with the once-prominent MIM has grown.

Anxieties about USDT proceed, nevertheless it has to date weathered the storm.

Date & Creator: June 16, 2022, [email protected]

Knowledge Supply: Footprint Analytics Stablecoins After the UST Occasion Dashboard

What’s Footprint Analytics?

Footprint Analytics is an all-in-one evaluation platform to visualise blockchain knowledge and uncover insights. It cleans and integrates on-chain knowledge so customers of any expertise stage can shortly begin researching tokens, initiatives and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anybody can construct their very own personalized charts in minutes. Uncover blockchain knowledge and make investments smarter with Footprint.