According to Crypto News, Jeffrey Huang, a tech entrepreneur, former musician, and a holder of the Bored Ape Yacht Membership NFTs, allegedly embezzled 22,000 Ethereum (ETH) from the treasury administration service firm Formosa Monetary in 2018, in accordance with a current exposé by Twitter sleuth ZachXBT.

The Taiwanese-American businessman, identified as “Machi Huge Brother,” allegedly spent the past 4 years working “on ten failed pump and dump tokens and NFT tasks”. The article additionally sheds light on his historical past within the crypto area, what he did and other people he’s been affiliated with, in addition to proof to show the shady dealings.

22,000 ETH Embezzled and Over Ten Initiatives Failed: The Story of Machi Huge Brother (Jeff Huang)https://t.co/eAzV9vkoRb

— ZachXBT (@zachxbt) June 16, 2022

Huang initially discovered fame as a founding member of the pop/rap band named L.A. Boyz within the 90s. He later went on to discovered the hip hop group “Machi” in 2003, in addition to the document label “MACHI Leisure”.

Though Huang obtained his begin within the music trade, he later transitioned to the tech area when he based 17 Media (M17) in 2015, which grew to become one of the vital well-liked live-streaming apps in Asia, in accordance with the article.

Mithril – Venture #1

Huang entered the crypto market in 2017 with the launch of Mithril (MITH), his first in a protracted listing of failed crypto ventures. Mithril was a decentralized social media web site that rewarded customers with its native MITH token.

The venture raised 60k ETH ($51.6 million) in February 2018, with 30% of the availability offered by way of a non-public sale. These tokens had been locked up or for a while, 70% till the Token Era Occasion (TGE) with the remaining being unlocked over a three month period.

MITH was listed on Bithumb in April 2018 and only a month later, the personal sale tokens had absolutely grown, permitting buyers to take out cash out. These tokens made up 89% of the circulating tokens provided which brought on huge promoting strain.

Formosa – Venture #2

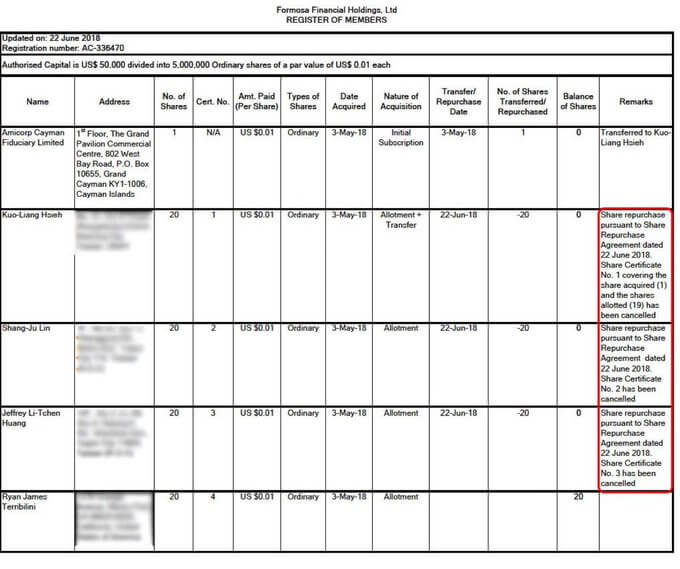

Formosa Monetary (FMF), is a treasury administration platform for blockchain corporations. 22,000 ETH was raised in an angel funding spherical, adopted by a non-public spherical that raised one other 22,000 ETH. Buyers included Binance, Block One, Mithril/Jeffrey Huang, and extra. The promoting level for buyers was a “quick monitor” itemizing on a top-tier centralized trade.

Buying and selling commenced on IDEX in 2018 and the value slumped. Afterward June 22, 2018, two withdrawals of 11,000 ETH had been constructed from the Formosa Monetary treasury pockets (22,000 ETH complete) with co-founder George Hsieh being implicated. Huang and co-founders relinquished roles and George Hsieh transferred 10.5k ETH to Binance, with Huang later making incremental deposits into numerous Binance accounts and wallets. A number of transfers and withdrawals had been made with Jeff being implicated by way of on-chain knowledge.

ZachXBT instructed CryptoSlate that June 22, 2018, was the identical day Huang and Hsieh offered their fairness within the firm.

The article additionally features a SoundCloud audio clip the place Formosa Monetary Co-Founder Ryan Terribilini tells his model of what occurred to the funds on June 22, 2018.

Within the audio, Terribilini is heard saying that “I didn’t take the cash, George and Jeffrey took the cash” on the 0:37 mark. Terribilini grew to become the CEO of Formosa Monetary after the alleged embezzlement came about.

“From the time I grew to become director and CEO of the corporate, there has not been one ETH that has gone lacking, so on the subject of what George and Jeff facilitated on their finish, like I feel actually that’s the place the legal responsibility stands,” Ryan continued on to say.

Terribilini is at the moment working with Algorand (ALGO) and Formosa Monetary appears to be the one MachiBigBrother venture he has been concerned in.

Machi X – Venture #3

Jeff Huang and Leo Cheng began Machi X in October 2018. It’s a social market for mental property rights. Nevertheless, they’d bother getting funding due to Huang’s earlier venture, Mithril, and the Formosa incident. Nearly a yr later, Formosa buyers had been tipped off by way of e-mail concerning the embezzlement of the 22,000 ETH.

Cream Finance – Venture #4

In 2020, Jeff and Leo Cheng based Cream Finance (CREAM), a fork of Compound Finance (COMP). Over $192 million has been stolen from the venture by way of exploits.

Wifey Finance – Venture #5

Wifey Finance is forked from Yearn Finance (YFI) and based by an “nameless” staff. Machi, Leo Cheng, and Wilson Huang are a few of the first members of the venture Discord channel. Transaction data present that cash was despatched to Wilson Huang greater than as soon as by Wifey’s deployer. After 4 days, Wifey Finance was deserted.

Swag Finance – Venture #6

In October 2020, the grownup leisure web site Swag.stay was launched. When Cream Finance quietly listed Swag as collateral, the lack of awareness concerning the itemizing brought on lots of backlash on Crypto Twitter. The token was farmed, dumped, and faraway from Cream all inside a number of weeks.

Mith Money – Venture #7

On December 30, 2020, Mith Money, a fork of the Foundation Money (BAC) protocol (an algorithmic stablecoin) was launched by an “nameless” staff, with Huang as an advisor. Mith Money grew to $1b TVL in only a few days after it was launched, however then it crashed arduous as token holders cashed out their rewards.

Hurricane Money – Venture #8

Hurricane Money was launched as a fork of Twister Money (TORN). The venture had an nameless staff but it surely was believed that Huang and his associates had been behind it. The venture was deserted solely weeks after farming started on the protocol.

Mud Video games – Venture #9

Huang launched Heroes of Evermore, a fork of one other well-liked loot-based sport. The venture had an nameless staff and remodeled 533.92 ETH in revenue. The staff members secretly minted the rarest NFTs.

Squid DAO – Venture #10

Squid DAO was launched by an “nameless” staff as a fork of Olympus DAO (OHM) with Huang being on the primary few holders (by way of his alias MachiBigBrother.eth). Huang had the venture shut down in January this yr.

The article goes on to say that Jeffrey Huang is now concerned in additional tasks together with X Finance, XY Finance, and Ape Finance. The weblog publish identified a typical theme of nameless groups, forked tasks, wallets funded by way of FTX, and quick venture life cycles. ZACHXBT finishes off the article by saying he reached out to Huang who denied the allegations on the publish.

CryptoSlate has additionally reached out to Jeffrey Huang for clarification on the allegations however he didn’t reply on the time of writing.