A broadly adopted crypto strategist is unveiling his high altcoin picks amid the crypto pullback, which incorporates Ethereum (ETH) and three of its challengers.

Michaël van de Poppe tells his 611,800 Twitter followers that he’s positioned for enormous rallies in sensible contract platforms Ethereum, Cardano (ADA), Avalanche (AVAX) and Fantom (FTM), in addition to blockchain scaling resolution Polygon (MATIC).

“I’ve purchased roughly 1.1 million FTM tokens round $0.21-$0.22 for round $245,000. Bought some extra longs on ETH, ADA, MATIC, AVAX totalling round $650,000 in longs.

Able to promote for 30-150% income. All are literally already positions and stuffed.”

Van de Poppe says he’ll exit his FTM place if Fantom drops beneath $0.175.

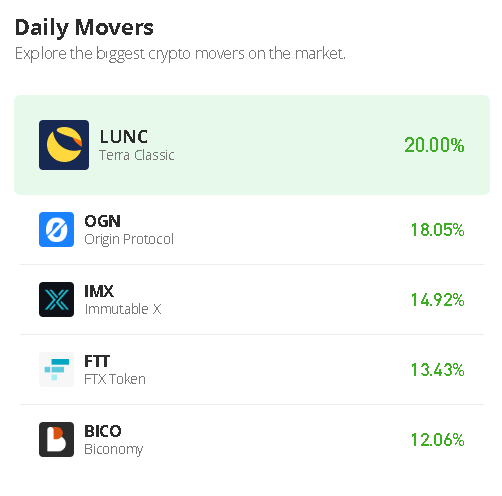

At time of writing, FTM is buying and selling at $0.214, down over 8% within the final 24 hours, however nonetheless over 18% above Van de Poppe’s invalidation level.

The crypto strategist additionally shares a chart of Fetch.ai (FET), a platform that goals to carry collectively applied sciences comparable to machine studying, synthetic intelligence and blockchain, as an instance why he’s bullish on altcoins.

“Posted this one on FET [Fetch.ai] some time in the past, however just about sums up my view on altcoins general.”

Ethereum, Van de Poppe says ETH buying and selling beneath $1,000 is a large alternative for bulls.

“Triple-digit ETH can also be an opportunity of a lifetime.”

At time of writing, ETH is altering palms for $957, down over 10% up to now day.

He additionally says he stays bullish on crypto regardless of one other spherical of pullback during the last 24 hours.

“Weekend strikes are often fakeouts. Nonetheless favouring longs greater than shorts. Prepared for them beneficial properties!”

Verify Value Motion

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses it’s possible you’ll incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in online marketing.

Featured Picture: Shutterstock/studiostoks and Kundra