Thomas Semaan is a finance and economics fanatic. He launched an Arabic talking podcast about Bitcoin, economics and Lebanon. Thomas can be an lively member of the Lebanese and Arab Bitcoin group.

Behind the destroyed, unlit roads and the vacancy of its downtown, Beirut has large skyscrapers that play the position of the headquarters of Lebanon’s native banks. The story of the Lebanese profitable banking popularity dates again to the inception of the Lebanese state in 1943. You’ll be able to pinpoint the success of this sector to many alternative elements, together with however not restricted to the central financial institution’s once-strict financial coverage, the acquisition of big quantities of gold within the twentieth century making Lebanon the third-largest holder of gold per capita on the planet and primary within the center east and north of Africa, or the banking secrecy legislation that imitate the Swiss banking sector which attracted many rich people and companies to leverage it. Additionally, underneath the usually seemingly under-developed elements of the nation, lies an enormous public sector, one which gives the look to be all about productiveness and providers, however is definitely welfarist in essence.

Previous to 2020, two forms of jobs had been thought-about profitable for the common Lebanese citizen: working in banking or working within the authorities. Working in banking meant that you’re basically a part of a too-big-to-fail trade, whereas working within the authorities meant that you simply get to earn an above common wage, greater than common advantages and finish of providers indemnity with barely any effort or expertise and assured by legislation that you’ll by no means be fired out of your place. All this was potential due to a 3rd contributor to the formulation, the financier of the Lebanese banking sector.

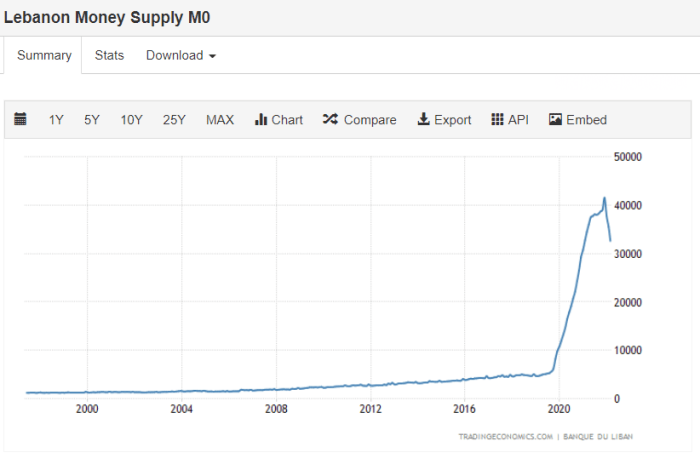

For the explanations talked about above, the Lebanese banking sector was enticing to many buyers and was solely related for a sure time period. One might say from the time of the nation’s civil conflict (lasting from 1975-1990), most of those causes ceased to be related, particularly with the world shifting away from a gold normal and with banking secrecy now not being secret, virtually. By the early 2000s up till the late 2010s, the buyers within the banking sector, often known as depositors, had been lured by excessive rates of interest, solely made potential by banks shopping for even larger interest-bearing authorities bonds. In easy phrases, the formulation went as follows: The federal government offered high-interest bonds to native banks by the central financial institution, the banks had been in a position to afford and compete over who might bait extra buyers by promoting them excessive rate of interest deposits. The depositors had been blissful to participate of this scheme so long as they had been getting paid the hefty quantities on time. Whereas rates of interest world wide had been zero or near zero, the Lebanese depositor was having fun with a whopping 10-15% on their deposits. As you will have guessed already, and much like many shitcoin staking tasks, this technique was certain to break down — and it did. In late 2019, it had been quasi-settled that depositors won’t get their full balances anymore. As a result of the federal government was basically non-productive and incapable of paying again the banks, the banks in flip weren’t in a position to pay again their prospects. With this impending actuality, the central financial institution began printing cash and paying again the depositors accordingly, which triggered the notorious hyperinflation in Lebanon. The Lebanese pound misplaced round 90% of its worth towards the U.S. greenback. In late 2019, $1 equaled 1,500 Lebanese kilos. On the time of writing, $1 equals 35,000 Lebanese kilos.

Lebanon Provide of cash and notes in circulation (M0) went up greater than eight instances in lower than two years. (Supply)

Lebanon is characterised by horrible infrastructure: horrible roads, horrible electrical energy infrastructure, even horrible communication traces and web. All of those sectors are managed by the federal government. On high of that, the Lebanese authorities employs over 300,000 individuals within the public sector. For a rustic that has round three to 4 million adults who’re eligible for work, the federal government is actually using round 10% of the complete workforce of the nation. That is large for any nation, to not point out a rustic that claims to undertake free market and capitalist rules. For a very long time Lebanon was thought-about a Libertarian utopia in comparison with its neighboring area, whereas actually it’s extra like a Libertarian’s nightmare.

Make no mistake, the common Lebanese citizen was not proud of this example in any respect. This financial actuality of the nation may very well be thought-about (relying on the way you see it) because the trigger or the consequence of endless political stress within the nation. For the reason that 2000s up till at the present time, the Lebanese voter all the time strived for political change. Contemplating the character of the nation’s demography, this led to many sectarian and regional conflicts. The final 20 years in Lebanon noticed many protests, political assassinations, shoot outs, conflict with neighboring international locations and emigration. All of it failed for one easy cause: the individuals had been making a political try to vary the federal government, whereas funding it by their native banks on the identical time. Not solely was an enormous chunk of the nation’s capital being funneled into an apparent Ponzi scheme, however this capital was additionally used for probably the most inefficient government-controlled economic system. When the federal government collapsed and was now not in a position to pay again its obligations, it misplaced its main funding supply. Every thing that the federal government used to manage has utterly collapsed with it. For the reason that official power grid in Lebanon has collapsed, people are discovering different sources of power.

Right here’s the catch, the common depositor in Lebanese banks didn’t have the intention to fund the federal government. Nearly everybody knew the federal government was inefficient and there’s a basic tradition of mistrust within the authorities. Nonetheless, depositors had been merely lured right into a excessive rate of interest deal, which appeared to be working for over a decade. Now that this scheme has utterly collapsed, and the necessity for the Lebanese citizen to have an alternate saving mechanism continues to be there, the quick and clear reply for this drawback is and can all the time be bitcoin.

Despite the fact that bitcoin doesn’t care to lure an investor in and make guarantees about future good points, its document speaks for itself. My Bitcoiner buddy who additionally occurred to be Lebanese, Hass McCook, ran the numbers. With a conservative financial coverage of 21 million cash to ever exist, utilizing this expertise as a saving software is in no way a foul thought; it may very well be the one good thought. It’s true that Bitcoin presents peer-to-peer, borderless settlement world wide, which is also thought-about useful for the common Lebanese citizen with a at present disabled banking sector, however it’s the lack of saving drawback that manipulated buyers and led to the collapse of the economic system as a complete.

When cash was deposited within the banking sector, it was getting used to fund the federal government within the background. Comparatively, cash that goes into bitcoin is funding an open-source, truthful, decentralized and trustless community of impartial customers who’re incentivized to be trustworthy — from miners to full nodes to common customers. Above all else, the Lebanese citizen can finally escape being coerced to fund a corrupt authorities and in flip, instantly profit from funding a system that promotes peace and the sovereignty of the person.

This can be a visitor submit by Thomas Semaan. Opinions expressed are solely their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.