The crypto market simply noticed some slight restoration, however the performances are the other way up. Reverse to the way in which sellouts normally play out, the Bitcoin dominance dropped dramatically because the asset is underperforming the Small Cap index.

From final November’s $3 trillion market cap, the crypto market is now all the way down to round $800 billion:

Smaller Altcoins Make A Sturdy Comeback

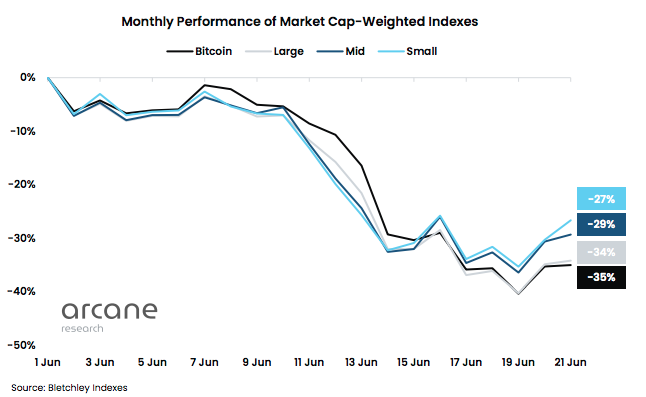

Final week the crypto market noticed its backside, adopted now by some slight restoration. As per Arcane Analysis’s newest weekly report, the smaller altcoins have additionally been seeing pink numbers with the Small Cap index shedding 27%, however it has been the very best performer general.

In distinction, Bitcoin had dropped 35%. Via this small window of aid throughout June, we’ve got seen the blue-chip coin underperform all different indexes.

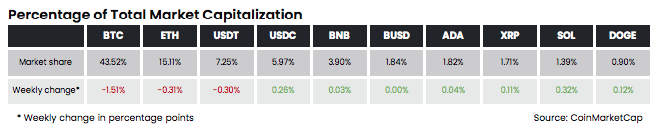

In consequence, BTC’s dominance available in the market fell -1,51% this week to 43,5% whereas Ether fell -0,31. The latter has been declining since Might from 19.5% to fifteen%.

What’s Making This Crypto Winter Colder

The report notes that the first driver of this crypto crash has been the hedge fund Three Arrow Capital (3AC) collapse. Having invested over $200 million in Luna Basis Guard’s token sale, 3AC’s liquidity ended up being worn out and its margin name was the final straw for the already pressured market.

Associated Studying | How Lengthy Will The CryptoWinter Final? Cardano Founder Offers Solutions

As per the Wall Road Journal, the crypto hedge fund employed authorized and monetary advisers to assist work out an answer for its traders and lenders. The agency is on the lookout for a method out, “together with asset gross sales and a rescue by one other agency”. The prognostic isn’t very optimistic in the intervening time, seeing the wave of liquidations and mitigations of losses by crypto exchanges which have adopted the collapse.

“We weren’t the primary to get hit…This has been all a part of the identical contagion that has affected many different corporations,” Kyle Davies, 3AC’s co-founder, mentioned in an interview.

Arcane Analysis defined that “In intervals of insolvency, collectors unwind probably the most liquid property first, which is probably going the basis reason behind BTC and ETH’s relative underperformance within the final week.”

The report provides that “illiquid altcoins are more difficult to promote at measurement, notably throughout pressuring instances, which explains why smaller cash have skilled much less extreme promoting stress within the final week”.

In the meantime, Microstrategy CEO Michael Saylor described the occasions round this winter as a “parade of horribles” through which the results of lack of regulation within the crypto discipline have made it potential for wash buying and selling and cross-collateralized altcoins to overwhelm on Bitcoin.

“What you might have is a $400 billion cloud of opaque, unregistered securities buying and selling with out full and truthful disclosure, and they’re all cross-collateralized with Bitcoin.”

“Most of the people shouldn’t be shopping for unregistered securities from wildcat bankers that will or will not be there subsequent Thursday,” Saylor added, slamming on the latest collapses and suggesting that future actions by regulators might forestall the extent of volatility that BTC is now experiencing.

Associated Studying | Crypto Traders Discover Security In Stablecoins, Bitcoin, Ditch Altcoins En Masse