Bitcoin miners are promoting their earnings to maintain up with the rising working prices. Because the electrical energy costs proceed to extend and Bitcoin follows its downtrend, miners can’t afford to HODL anymore.

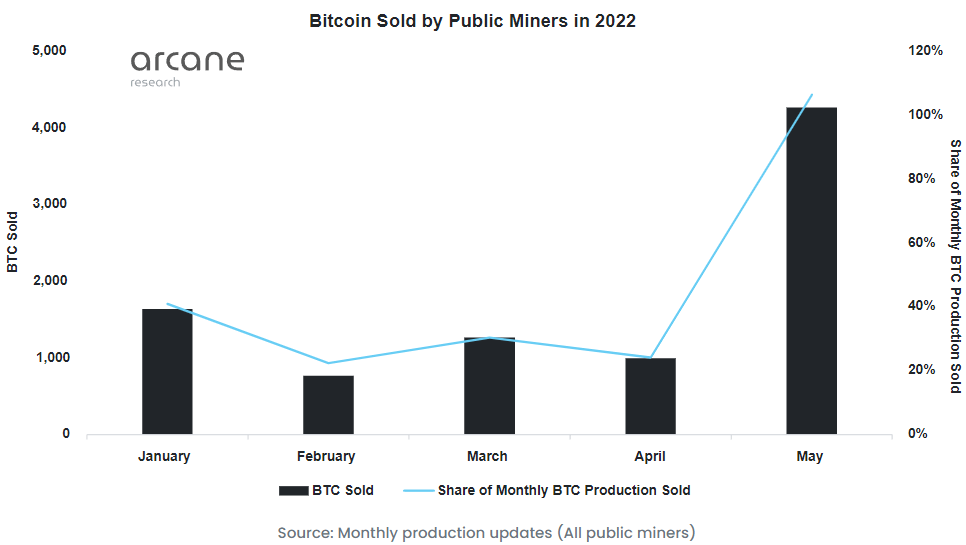

The sell-off development began in early 2022, because the above chart demonstrates. On the time, specialists commented that the miners offered their earnings as a result of they anticipated Bitcoin to proceed falling.

They have been proper. When Bitcoin hit its 18-month-lowest on June 14, mining gear manufactured earlier than 2019 misplaced profitability. On the time of writing, Bitcoin is traded for round $20,170, which is almost the minimal profitability value for a 2021 mannequin Antminer S19j.

Unable to HODL

Arcane Analysis’s information signifies that public Bitcoin miners obtain round 900 Bitcoins each day. They have an inclination to carry as a lot as potential and turn out to be among the largest whales available on the market.

Nevertheless, the rising vitality prices and lowering Bitcoin costs put public miners in a tricky spot.

In line with the numbers, public mining firms offered 30% of their Bitcoin productions throughout the first 4 months of 2022.

Digital asset dealer GlobalBlock analyst Marcus Sotiriou commented on the sell-off development and mentioned that the primary cause for the sale was:

“attributable to profitability lowering with rising electrical energy costs, so they’re compelled to liquidate some if their Bitcoin to cowl working prices.”

One other Glassnode analyst identified that different miners have been sellers as effectively. He mentioned:

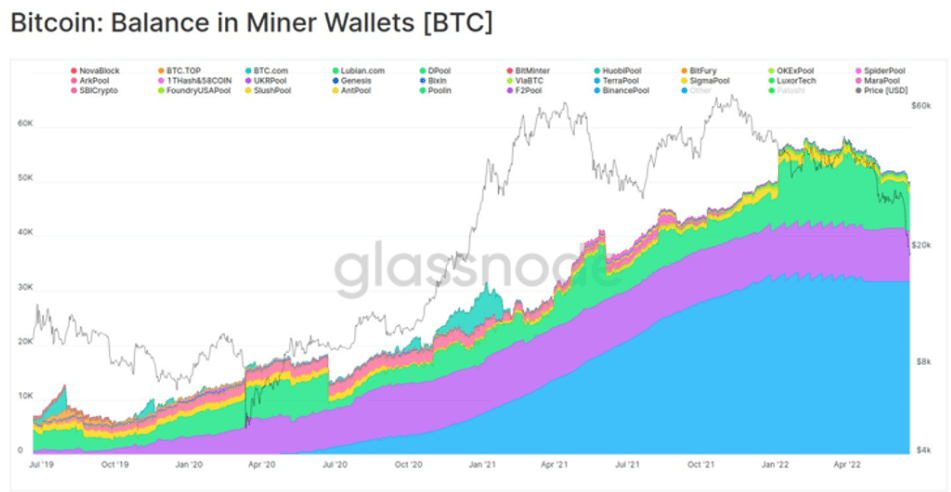

“Miners’ balances have stagnated from the 2019-21 accumulation uptrend and reversed into decline. Miners’ have spent round 9k $BTC from their treasuries final week, down from round 60k $BTC,”

The sell-off was anticipated

Regardless of the gravity of the info stating a sell-off development, specialists notice that that is often how miners behave throughout the bear markets.

Miners are inclined to accumulate in bull markets and promote throughout bear to cowl curiosity funds or pay for greater prices. For instance, within the final bear market in November 2018, miners offered a substantial quantity of their cash whereas Bitcoin was falling.