The CEO of Ripple Labs, Brad Garlinghouse, has accused the US Securities and Alternate Fee (SEC) of failing to streamline the crypto regulatory framework within the US, stifling innovation.

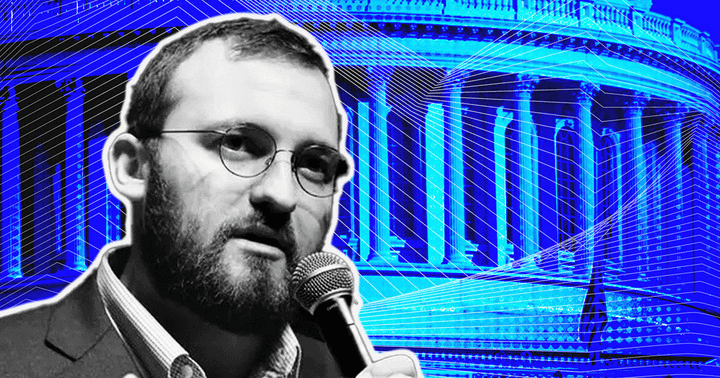

Ripple CEO bashes SEC for stifling crypto innovation

Garlinghouse spoke to the chief editor at Wired on the Collision convention in Toronto, the place he addressed the continued lawsuit between the SEC and Ripple. Ripple was sued by the SEC in December 2020 over an “unregistered, ongoing digital asset securities providing.” In keeping with the SEC, XRP is a safety and never a token.

Garlinghouse referred to inconsistencies with the SEC’s rules within the crypto area. The chief famous that whereas the SEC authorized Coinbase’s public providing early final 12 months, the alternate had listed XRP.

“The SEC now appears to take the place once they sued us that ‘XRP is a safety and all the time has been, however they authorized Coinbase going public though Coinbase will not be a registered broker-dealer. There’s some contradictions right here of the SEC virtually now, inside its group, realizing left hand proper hand,” Garlinghouse mentioned.

Purchase Ripple Now

Your capital is in danger.

The Ripple government additionally mentioned that the SEC was not centered on setting clear guidelines and rules within the sector. As a substitute, the establishment was introducing rules by enforcement, which lacked effectivity. This, in keeping with Garlinghouse, “stifled innovation in america.”

The case between Ripple and SEC

The case between Ripple and the SEC has been happening for 2 years now, and there’s no clear indication of how the lawsuit will finish. Whereas Ripple has recorded some wins, the SEC has put up a robust combat. Nevertheless, the outcomes of this case are anticipated to set priority for crypto rules within the US.

Moreover Garlinghouse, different Ripple executives have additionally commented on the lawsuit. Ripple’s co-founder, Brad Garlinghouse, and the corporate’s CTO, David Schwartz, have leveled complaints towards US regulatory our bodies due to this lawsuit.

In October 2020, Larsen mentioned that Ripple might depart the US market due to the shortage of clear tips. Garlinghouse has additionally criticized the remarks of SEC Chair Gary Gensler about crypto being the “Wild West.” Gensler mentioned that whereas crypto was unstable, all asset lessons additionally had some stage of volatility.

The SEC Chair has beforehand mentioned that almost all cryptocurrencies have been securities. Nevertheless, he has admitted that Bitcoin might be labeled as a commodity that might be regulated by the Commodity Futures Buying and selling Fee (CFTC).

Learn extra:

Fortunate Block – Our Beneficial Crypto of 2022

- New Crypto Video games Platform

- Featured in Forbes, Nasdaq.com, Yahoo Finance

- LBLOCK Token Up 1000%+ From Presale

- Listed on Pancakeswap, LBank

- Free Tickets to Jackpot Prize Attracts for Holders

- Passive Earnings Rewards – Play to Earn Utility

- 10,000 NFTs Minted in 2022 – Now on NFTLaunchpad.com

- $1 Million NFT Jackpot in Could 2022

- Worldwide Decentralized Competitions

Cryptoassets are a extremely unstable unregulated funding product. No UK or EU investor safety.