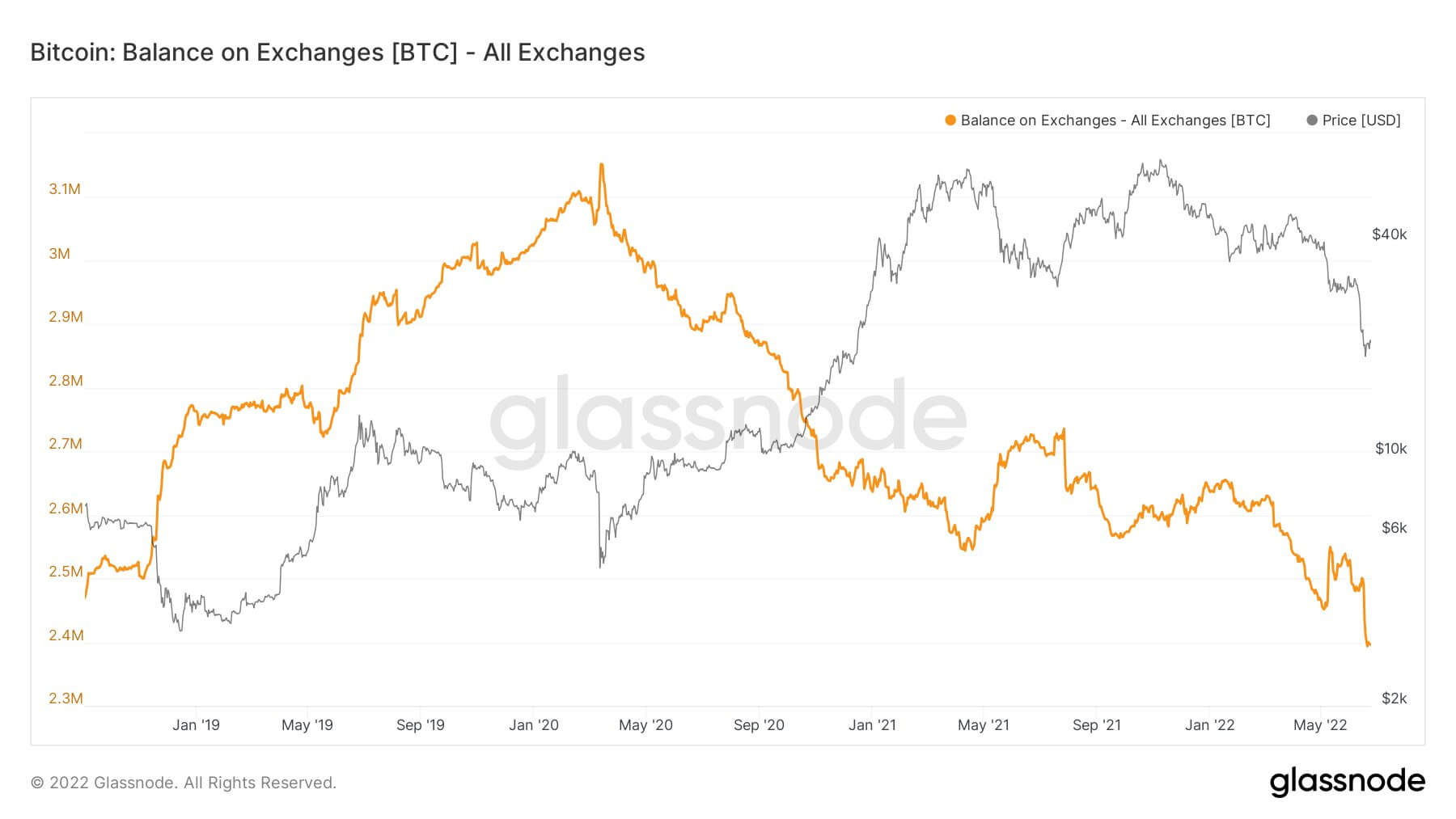

The variety of Bitcoins held on centralized exchanges has dropped to the bottom stage since 2018, based on data from Glassnode. Customers appear to be pulling property following fears of contagion after the current points with Celsius and Babel Finance. The chart beneath confirmed a steep decline in BTC on exchanges on June 13 when Celsius introduced it could droop withdrawals.

Why is Bitcoin leaving exchanges?

The quantity of BTC on exchanges broke 2.4 million BTC in 2018 and has by no means dropped beneath this milestone till this June. It reached a peak in Could 2020 at 3.1 million BTC and has been in a downtrend ever since.

Traditionally, traders have seen cryptocurrency leaving exchanges as a bullish indicator. Because the stability of an asset on exchanges decreases, so does the liquidity and its capability to be traded. Many imagine that when Bitcoin outflows improve, it is because of traders transferring cash into chilly wallets to hodl long-term.

In mild of the considerations round sure exchanges, crypto YouTuber Man from Coinbureau lately affirmed,

“Now could be extra essential than ever to emphasize the significance of *self custody*. Say it with me: Not Your Keys…

You possibly can’t *confirm* the present solvency of all these CeFi lenders. Holding funds with them depends on belief. However, crypto is supposed to be *trustless*. You don’t want assurances, it’s worthwhile to maintain your individual cash.”

The subject was additionally mentioned at size in a current Twitter Space between CryptoSlate, EAM Crypto, and Defi Yield App. The non-custodial nature of centralized exchanges was challenged by Enrique of EAM Crypto, who argued the contagion from the Terra collapse might not be over.

Brad Mills, the host of the MIM Podcast, lately reminded followers of the Mt. Gox catastrophe,

“I discovered “Not Your Keys Not Your Cash” & “Don’t Belief, Confirm” within the MtGox collapse. I’m nonetheless right here.

You’re nonetheless early, this bear market is a reset.”

Buyers in Celsius can nonetheless not entry their funds over two weeks after withdrawals have been paused. Holding Bitcoin in a pockets offers the investor full autonomy over the property, whereas depositing crypto to alternate is just like placing it in a financial institution however with out authorities bailout safety.

With Bitcoin ranges on exchanges beneath 2.4 million BTC and over 30 million crypto traders utilizing Binance alone, the asset shortage is rising. If Bitcoin demand continues to develop whereas alternate balances decline, it might create a sturdy setup for an upward value transfer.