What Is Bitcoin and How Does it Work?

Bitcoin is an progressive expertise that introduces a brand new financial system, primarily based on a peer-to-peer community of customers’ nodes (computer systems) with no intermediaries like central banks or any sort of monetary establishment.

For the primary time in historical past, anybody can take part in an open community and contribute to empowering it, with no background distinction or permission required by any authority or group.

What Is Bitcoin?

Bitcoin is a fast-growing evolution of cash, an funding, a means out of the present unsound financial system, and a brand new programmable fee technique. Varied ideas and disciplines may very well be approached to completely perceive Bitcoin as a result of it may be of various utility to completely different individuals.

The assorted avenues might be revealed when happening the Bitcoin rabbit gap, and the journey might be fascinating. With this text, you can begin studying about Bitcoin’s function, who creates the cash, and whether it is actual cash, together with extra sensible recommendation about shopping for bitcoin and how one can preserve your cash secure.

Bitcoin is an digital peer-to-peer money system primarily based on a distributed digital ledger known as a blockchain or timechain. The ledger contains transactions authorised by the peer-to-peer community as an alternative of a government. Bitcoin (with an uppercase letter B) refers back to the protocol, software program, and community, whereas bitcoin (with a lowercase b) describes the native financial asset.

Unveiled by a mysterious individual or a gaggle often known as Satoshi Nakamoto, Bitcoin is the primary cryptocurrency ever created and was described intimately within the white paper printed on October 28, 2008. A digital model of money, which in its bodily kind is inherently peer-to-peer, was the toughest factor to construct, and the genius of Satoshi was to mix present expertise and processes to beat the enduring problem of double-spending digital currencies with out counting on a 3rd occasion.

No one is aware of the true identification of Satoshi, who disappeared in 2011, leaving the mission to volunteers to broaden and improve. Due to this fact, it’s honest to say that Bitcoin has no single chief and may survive and thrive with no CEO. Readers who want a comparability can assume extra of an web protocol, comparable to TCP/IP than an organization.

Learn Extra >> Exploring the origin of Bitcoin

Learn Extra >> With Bit gold, Nick Szabo was inches away from inventing Bitcoin

Learn Extra >> Is Bitcoin authorized?

How Does Bitcoin Work?

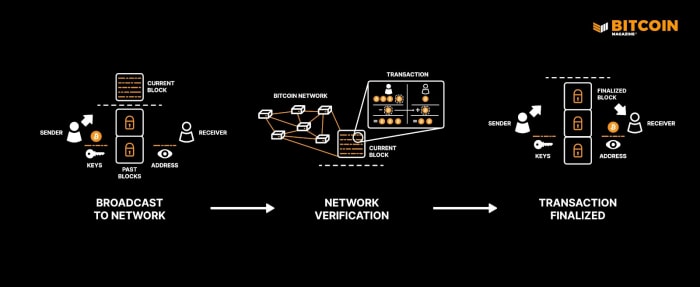

When customers ship or obtain bitcoin, their transaction is distributed to the community of Bitcoin nodes. Every node receives the file and verifies that it’s respectable. As soon as verified, it’s added to the Mempool after which handed onto the opposite nodes within the community. The Mempool shops legitimate, but unconfirmed transactions.

Miners then group these transactions collectively and create a block of transactions, usually deciding on these transactions with the best charges first. Every block is encoded with a block header, transaction counter and transactions, which comprises supporting details about the transactions and the hashes.

Miners then compete with one another to be the primary to append the subsequent block to the blockchain. The miner or mining pool with probably the most computational energy has the perfect likelihood of doing so, nonetheless that isn’t deterministic. Transactions are confirmed and new blocks are added because of a proof-of-work (PoW) consensus algorithm that requires miners to discover a legitimate hash beneath a goal set by the community. The profitable miner is rewarded with new bitcoin as a reward for securing the community; this is named the block reward and it’s how new bitcoin are minted.

Every block is linked to the earlier block thus creating a sequence of blocks that cryptographically establishes a public document of legitimate transactions that may’t be altered (immutable) with out altering its block and those after it..

It’s price noting that the protocol defines the foundations and PoW determines how these guidelines might be adopted and is considered some of the safe options to the Byzantine Generals Downside, a extra educational time period for fixing the double-spending drawback with out counting on any third occasion.

Customers don’t have to understand how Bitcoin works exactly, like they most likely don’t understand how the web works regardless of benefiting from its use. Nevertheless, it’s useful to understand Bitcoin’s fundamentals as it will assist them perceive why Bitcoin issues.

Why Is Bitcoin Revolutionary?

Bitcoin expertise facilitates a trustless financial system the place borderless monetary transactions will be finalized with out intermediaries. Whereas conventional banking and fee programs closely depend on belief, Bitcoin presents a means out of this method with no third occasion to resolve the double-spending drawback and preserve properties like censorship resistance, immutability and decentralization.

Such a framework allowed the creation and implementation of a system successfully disjoined from authorities management, delivering a revolutionary separation of cash and state for the primary time in historical past. Bitcoin breaks all fashions we’re used to, beginning with lowered state energy and management, the precise cause governments and their affiliated mainstream media unfold disinformation and FUD about Bitcoin.

Bitcoin presents actual digital shortage which makes it a store-of-value asset; censorship resistance as an assurance that everybody can use it at any time and in all places, with no discrimination; settlement finality, which nearly immediately ensures that transactions are irreversible.

Bitcoin’s settlement finality continues to be a extensively underrated characteristic, whereas it represents a legitimate different to extra conventional fee strategies like Visa bank cards and SWIFT because the underlying construction of financial institution funds. These extra standard fee programs could take as much as six months to settle, whereas a typical Bitcoin transaction is finalized inside 10 minutes to a few hours.

Bitcoin’s Second Order Results

Bitcoin’s second order results would possibly supply actual innovation and options to a few of the essential points the world is experiencing these days. The swap from an inflationary to a deflationary society that Bitcoin and customarily all expertise encourage, will enhance our buying energy, enhance productiveness and effectivity, and form less expensive programs whereas making a extra equal world.

The vitality sector and local weather change are additionally being addressed by Bitcoin champions. In addition to more and more using renewable vitality, Bitcoin miners are capturing waste vitality — or gasoline flare vitality — in areas just like the Center East the place oil manufacturing is appreciable and gasoline emissions must be contained. Bitcoin is essential to an ample, clear vitality future.

What Is Bitcoin Used For?

Bitcoin’s progressive expertise presents useful utility to each participant, from people to companies. Quick and simple, cell, international funds will be carried out by way of a easy scan-and-pay technique while not having a burdensome verification course of like know-your-customer (KYC) guidelines usually require. A purchaser will show a QR code whereas the receiver solely must scan it for the transaction to be processed and verified.

SHA-256 cryptography ensures safety and management over your cash, guaranteeing that funds can solely be spent by their rightful house owners. The vitality employed by PoW prevents different individuals from attacking Bitcoin by rearranging the blockchain and altering your transactions.

Additionally, Bitcoin permits customers to guard their privateness higher and ship transactions pseudonymously in the event that they make use of the right measures, comparable to altering the bitcoin tackle every time they execute a transaction.

Listed here are a few of Bitcoin’s use instances:

Bitcoin’s volatility usually dissuades institutional and retail traders as a result of they don’t assess its worth in the long run. Certainly, volatility is predicted and because the worth grows and liquidity continues to movement in, bitcoin’s worth will mature and stabilize.

Bitcoin’s volatility has captured the eye of grasping traders who contribute to its speedy worth will increase. They find yourself shopping for out of greed however staying for its promise, which suggests as time goes by, Bitcoin turns into a secure community of fans that received’t simply promote its native asset, thereby bettering its soundness.

Like each asset with worth, bitcoin has grow to be some of the traded holdings in recent times. There are many instruments accessible for anybody who needs to start out buying and selling bitcoin, and lots of merchants have turned it into their main supply of earnings by studying methods to benefit from bitcoin’s volatility. The widespread aim for bitcoin merchants is to not develop their capital in fiat phrases however to extend their bitcoin holdings.

Bitcoin has grown as a hedge in opposition to long-term inflation. Not like conventional currencies that lose buying energy over time, the cryptocurrency has confirmed immune to such market situations because of properties like shortage, growing technological accessibility, and sturdiness.

By eradicating intermediaries and enabling borderless funds by way of the Lightning Community, Bitcoin is rising as a instrument to facilitate remittances. Emblematic is the expansion of Bitcoin remittances in El Salvador, the place the cryptocurrency was adopted as authorized tender in 2021, and remittances account for twenty-four% of El Salvador’s GDP. The nation may symbolize a testing market for worldwide remittances in different international locations.

Decentralized finance (DeFi) is an rising and fast-growing department of finance used to safe mortgages, refinancing, and different companies the place bitcoin can be utilized as a collateral asset to safe funds in several currencies or property. Whereas that is nonetheless a gray space for a lot of who supply conventional monetary companies, bitcoin as collateral is already operative and extensively utilized by cryptocurrency supporters.

Layer 2 (L2) protocols have been created to deal with the scalability problem and supply quicker and cheaper off-chain funds than Bitcoin’s base layer (L1). The most effective two examples which have been developed are the Lighting Community and the Liquid Community, each constructed on prime of Bitcoin and providing the identical strong decentralized safety paradigm.

A monumental breakthrough in vitality manufacturing is going on proper earlier than our eyes. What has usually been seen as an enormous drawback because of extreme mining energy consumption is changing into a bonus for Bitcoin.

The concept is to use extreme renewable sources of vitality manufacturing, monetize the excess provide of the ability output and make the mission cleaner and less expensive. Bitcoin miners are notably fitted for such a scheme since they will transfer and settle the place the ability is, even in distant areas, to fill gaps, thus driving a clear vitality transition.

It’s a win-win scenario for the miners who get loads of low cost vitality and for the vitality suppliers who handle to promote surplus electrical energy that will go wasted in any other case.

Is Bitcoin A Protected Funding?

Professionals

- Bitcoin is taken into account a secure funding primarily as a result of, over time, it has grow to be extremely safe because of its SHA-256 algorithm, which was designed by the U.S. Nationwide Safety Company (NSA). No different cryptocurrency can declare the identical safety; Bitcoin’s blockchain has by no means been hacked, and as time goes by and blocks are added to the chain, it turns into more and more troublesome to assault.

- Bitcoin’s provide and issuance are programmed by protocol and this predictability is a vital characteristic. So so long as provide/demand economics upholds, the properties of shortage ought to prevail.

- Bitcoin can also be distinctive and safe as non-public property as a result of when you personal it and retailer it correctly, it can’t be taken away from you. It doesn’t depend on an area authority or authorized system to guard it; as an alternative, it’s secured by the pure incentives of these collaborating within the community. Bitcoin traders also needs to take into account that their bitcoin is safer of their Bitcoin pockets than their money is in a financial institution the place it’s rehypothecated.

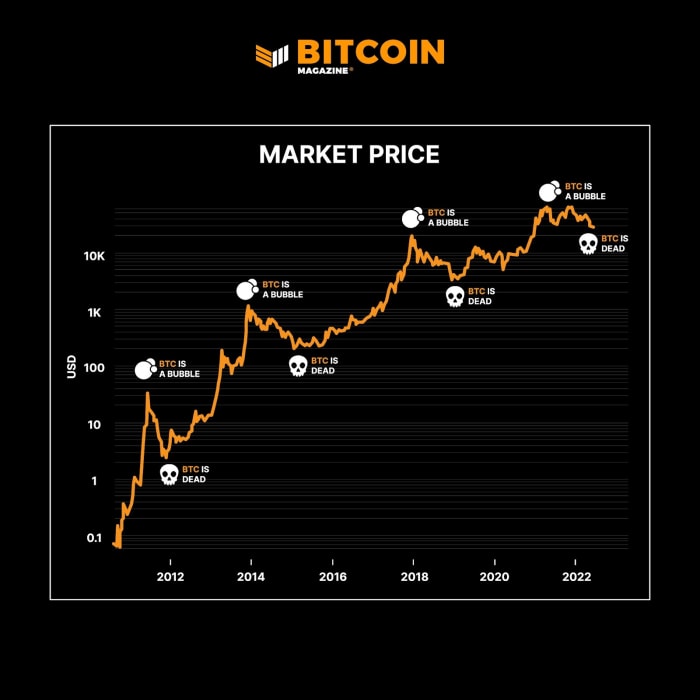

- If we take into account the Lindy impact, in response to which the life expectancy of a expertise is proportional to its present age, then Bitcoin will be anticipated to exist for not less than one other 12 years. Furthermore, regardless of being declared useless lots of of occasions prior to now, Bitcoin seems to be right here to remain, and we are able to count on it to stay for much longer.

- Public personalities, influential traders and entrepreneurs wouldn’t have gone so far as endorsing it if they didn’t consider Bitcoin was right here to remain. Jack Dorsey, Elon Musk and Tesla, Michael Saylor, Ray Dalio, and several other different VIPs have added Bitcoin to their firms’ reserve property, usually changing gold and money reserves, in addition to proudly owning the asset of their private portfolios.

Cons

- Worth volatility is usually seen as a big problem to potential bitcoin traders, however many will argue that’s truly a characteristic, not a bug. To start out with, bitcoin continues to be a comparatively new asset and, as such, is susceptible to substantial worth swings. Worth volatility has lowered over time and this development is predicted to proceed as bitcoin matures. Furthermore, bitcoin’s fluctuations are solely short-term, and the worth tends to go up within the long-term, particularly if we take into account a multi-year chart the place the uptrend turns into obvious.

- Technical limitations are regular for brand new expertise and Bitcoin’s studying curve will be daunting for newcomers. Nevertheless, utilizing wallets, keys, apps, and all equipment turns into simpler with time and because of firms’ contribution to higher usability.

Learn Extra >> Widespread misconceptions about Bitcoin

How Does Bitcoin Make Cash?

Bitcoin’s community fulfills well-designed incentives that guarantee miners are rewarded with bitcoin to maintain it alive.

At first, Bitcoin was mined by common node operators who merely employed their laptop central processing unit (CPU) energy to seek out the subsequent block, in the identical means that Satoshi mined the primary blocks. Node operators have been incentivized to make use of their electrical energy to broaden the community by including new blocks to the longest chain and being rewarded with bitcoin.

This course of is known as proof of labor, and it’s the important consensus algorithm that constitutes the spine of the Bitcoin community and offers it with the best safety.

As new nodes joined the community and began to compete to obtain block rewards, the usual CPU energy was not sufficient. Over ten years, miners needed to swap from graphic processing items (GPUs) to the present application-specific built-in circuits (ASICs) mining gadgets to compete with different miners and discover the subsequent block quicker.

In essence, by way of such an incentivizing system, that is how Bitcoin makes cash. How a lot does it price to supply one bitcoin? A number of components have to be thought-about to evaluate if mining is worthwhile, from the price of electrical energy to the mining problem (an computerized adjustment essential to preserve the block technology time at about 10 minutes) and the block reward.

It’s estimated that with a block reward of 6.25 BTC, problem at 27.5 trillion hashes, $0.15 per kilowatt hour (kWh), and vitality effectivity of 45 joules per terahash, the price to supply 1 BTC is about $35,500.

Learn Extra >> Why Proof of Work is a superior consensus mechanism

Learn Extra >> Making The Resolution To Mine Or Buy Bitcoin

Okay, So Bitcoin Is Comparable To Gold?

Bitcoin has related financial properties to gold and is usually addressed as digital gold. The method for producing gold and bitcoin are related. Gold is mined and extracted from the bottom utilizing energy-intensive equipment, whereas new bitcoin are mined utilizing energy-intensive computer systems. The mining course of they each undergo is what associates them, together with rising marginal prices, a consequence of extra events desirous to mine making mining harder to realize.

Which means that mining is an expense that can not be cast, an idea often known as unforgeable costliness that cryptographer and laptop scientist Nick Szabo explains.

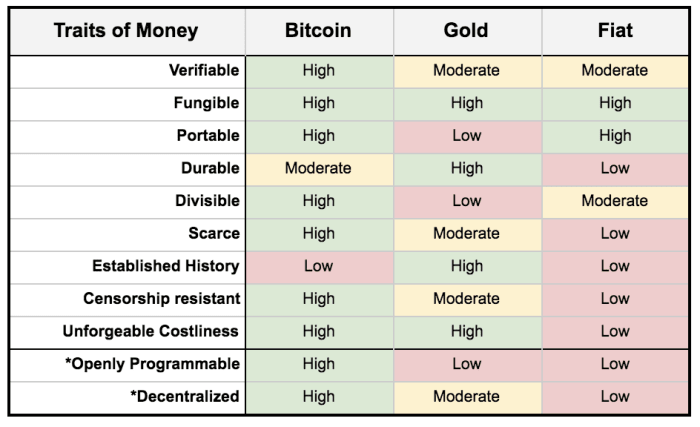

Each bitcoin and gold are scarce, but no one is aware of the general provide of gold, whereas we all know there’ll solely be about 21 million bitcoin in circulation. Bitcoin will be simply verified and audited because of its primarily immutable and programmable protocol, in comparison with bodily property like gold that are a lot tougher to scrutinize. Like gold, Bitcoin is decentralized cash that may be held independently from any intermediate.

Each bitcoin and gold are sometimes called laborious cash, which is one thing everybody wish to retain as a result of it’s strong, dependable and safe. In comparison with gold, bitcoin is already higher laborious cash due to its divisibility and portability properties that permit the cryptocurrency to be extra simply managed and transferred.

Learn Extra >> Bitcoin vs gold

So, Is Bitcoin Cash?

From the usage of commodities like grain to treasured metals like gold and subsequently government-controlled fiat currencies, cash has been perceived as a signifies that facilitates worth exchanges between individuals of an financial system.

Over time the definition of cash has shifted to incorporate a number of predominant properties like fungibility, sturdiness, portability, divisibility, and stability, all relevant to bitcoin, besides stability for now.

If we add shortage and different properties like censorship-resistance, programmability and decentralization, bitcoin is near probably the most excellent sort of cash ever created, as highlighted beneath.

Whereas we’ve been led to consider that solely fiat currencies are cash, this wasn’t the case till 1971, when U.S. President Richard Nixon determined to default on the U.S. greenback convertibility to gold.

These days, our cash is digitally conceived, and what we verify in our checking account, for instance, is a straightforward entry on the financial institution ledger. We don’t even know if any actual cash is definitely held on the opposite aspect of the ledger.

Bitcoin represents the purest type of cash, with out the bodily attribute. Whereas it’s also an entry in a ledger, if we use a non-custodial pockets (not managed by a 3rd occasion however ourselves), we personal entry to it by way of the non-public key, and no one can take that cash away from us. Because of this Bitcoin helps refugees escape wars, and authoritarian governments when the native fiat foreign money is made unavailable by a nation state that may freeze property unchallenged.

Learn Extra>> Understanding Cash Is Key To Understanding Bitcoin

Learn Extra>> What is going on to cash?

Learn Extra>> The financial properties of Bitcoin

Is Bitcoin A Good Funding?

With an asset growing in worth as quick as bitcoin, such a query is unavoidable. Taking a look at bitcoin’s worth growth, it’s clear that there have been a number of excessive bubble phases with subsequent huge worth drops.

Regardless of the large development bitcoin has recorded over time and its worth reaching an all-time excessive (ATH) of almost $68,000 in November 2021, bitcoin’s potential to develop additional may be very robust — sometimes called Quantity Go Up (NGU) expertise, strictly liaised with Bitcoin’s halving occasion that cuts block manufacturing in half, making it extra scarce and, due to this fact, extra helpful every time.

When bitcoin hits a brand new ATH, new potential traders are inclined to consider it’s too late to put money into bitcoin as a result of the worth is already inaccessible. Nevertheless, bitcoin’s worth has all the time proved them mistaken by rising greater each time.

Ought to bitcoin attain $100,000 or $1 million, then individuals received’t thoughts in the event that they purchased bitcoin at $2,000, $20,000 and even $60,000. The necessary level is that you simply purchased bitcoin and took part within the capital acquire. Clearly, ought to that situation occur, the extra bitcoin you will have, the higher.

Monetary establishments and banks alike are more and more providing bitcoin in funding portfolios, suggesting bitcoin just isn’t going wherever and regularly however steadily transferring up in market cap rating in comparison with gold, for instance.

Contemplating that fiat currencies proceed to lose buying energy and bitcoin, in distinction, continues to indicate resilience to market situations growing in worth over time, traders can shortly draw their conclusions.

It’s all the time good observe to know an asset you resolve to put money into, and this text ought to give you the important data to evaluate if bitcoin is price your funding.

It’s A Bit Costly, What about The Cheaper Cash?

A less expensive asset doesn’t correspond to higher worth. It is a idea that many crypto traders have come throughout sadly by dropping their cash in shady initiatives they invested in as a result of they have been low cost.

The rise of cash different to bitcoin (altcoins) has opened the door to extra funding property within the cryptocurrency house. Bitcoin is seen as already too costly to purchase, so new traders are inclined to place their funds in altcoins which, of their opinion, have greater development potential. This technique has repeatedly been confirmed mistaken, and new traders have usually misplaced cash as a result of they invested primarily based on a worth quite than the solidity of a mission.

Watch out to not be fooled by this unit bias, which is the idea that we’re extra enticed to purchase a complete unit of a given foreign money as an alternative of a fractional amount. Many newcomers maintain the irrational view that BTC is simply too costly and therefore look into “cheaper” different cash that they will personal extra items of.

The acute hypothesis that happens in crypto markets has led small traders to purchase the most cost effective of cash as a result of they consider they may go up in worth no matter their actual use case and fundamentals. This leads them to make a lot riskier investments and purchase and HODL altcoins.

Altcoins have shorter life spans than bitcoin and are, due to this fact, much less safe. They’re usually promoted as higher-return investments than bitcoin in fiat phrases however against bitcoin are a disappointment. They’ve not one of the properties that make bitcoin so helpful, ranging from their circulation provide, which is usually troublesome to evaluate and often limitless.

They’re decentralized in title solely (DINO) however are typically managed by an influential chief, a gaggle of builders or enterprise capital companies and supply a sort of governance that makes that decentralization troublesome to verify.

In addition to being a greater asset, bitcoin is very divisible, which suggests a fraction of a bitcoin will be acquired. As little as $100 at the moment buys roughly 100,000 sats (BTC 0.0032), the smallest fraction of a bitcoin. One satoshi is 0.00000001 BTC, and if bitcoin continues to develop, sats would be the new normal technique of trade, and it is smart to start out accumulating them if one can not afford a complete bitcoin.

Can Bitcoin Be Transformed Into Money?

Whereas traders ought to be conscious that turning bitcoin into money could set off a taxable occasion and may very well be a regrettable resolution over time, it’s undoubtedly potential to trade it for money in a number of alternative ways.

- Utilizing cryptocurrency exchanges, that are third-party brokers, is the most well-liked solution to transfer your bitcoin out of a pockets and switch it into money. The operation requires a number of KYC steps to confirm your identification and adjust to cash laundering rules earlier than you possibly can even hyperlink a checking account to switch the related fiat foreign money purchased with the sale of bitcoin.

- Bitcoin Automated Teller Machines (ATMs), additionally known as Bitcoin Teller Machines (BTMs), are one other solution to money out your bitcoin, and there are roughly 38,000 worldwide. It’s as simple as scanning a Bitcoin pockets QR code over the gadget to promote your bitcoin for money; nonetheless, the charges utilizing BTMs are a lot greater than these by way of almost another technique.

- Extra lately, banks have thought-about providing bitcoin. Particularly within the U.S., a number of main monetary establishments are apparently prepared to permit their clients to purchase, maintain or promote bitcoin. The growing curiosity of shoppers round Bitcoin encourages them to observe this path, realizing that in any other case, they’d look elsewhere to put money into bitcoin.

- Among the many fintech companies that banks are rolling out for Bitcoin, there are debit card rewards paid in bitcoin and new forms of financial institution accounts that will pay curiosity within the cryptocurrency.

How A lot Ought to I Make investments?

Taking into consideration that it’s by no means sensible to take a position greater than you possibly can afford to lose, how a lot to put money into bitcoin is completely primarily based on the person’s availability and choice. Even probably the most safe investments bear a sure threat, and bitcoin is not any exception.

Studying about Bitcoin would assist construct belief in it, and beginning with small purchases can supply some familiarity with the asset.

Bitcoin is among the favourite acquisitions of small retail traders who’ve realized to spend much less on futile issues and save such cash to purchase bitcoin as an alternative. Establishing common purchases may help overcome the worry of an excessive amount of volatility and higher address its worth swings. Bear in mind to all the time set cash apart for a wet day.

When Is The Finest Time To Purchase?

Timing the market appropriately is all the time difficult; for that cause, the perfect time to purchase bitcoin is when you will have cash accessible to take a position.

Fundamentals and technical evaluation may help assess if the worth is simply too excessive; as an illustration, when bitcoin reaches an ATH too shortly, it would possible retrace. The other can also be true, so shopping for bitcoin when it dips is all the time a good suggestion if the funding is for a long-term interval, realizing that the asset can go decrease.

The most effective and favourite technique of bitcoiners is to dollar-cost common (DCA), which suggests you allocate inexpensive cash each day, weekly or month-to-month. This manner, worth swings received’t matter, and the distinction can’t even be perceived with small purchases. But, the technique permits you to accumulate an honest quantity of bitcoin over the long run with out feeling a lot of a burden.

Lastly, Maintain Your Cash Protected

All of the information about Bitcoin and eventually shopping for it are helpless in case you don’t safe it. Bear in mind, due to Bitcoin’s decentralized nature, there received’t be a name middle or helpdesk to help when you’ve got issues with its administration.

That mentioned, it’s comparatively simple to soundly retailer your bitcoin in case you observe a number of important steps.

The primary rule is to maintain your bitcoin out of exchanges. These ought to solely be used for money conversions; thus, a non-custodial pockets is advisable as an alternative. With Bitcoin, you’re your personal financial institution and will all the time safe your non-public keys. As a conventional Bitcoin mantra says, “not your keys, not your bitcoin.”

The most effective and most safe wallets are held in chilly storage, which suggests offline. A non-public key ought to by no means, for any cause, be saved in a pc or the cloud. On-line transactions and sizzling storage (all the time on-line) have a a lot greater likelihood of being hacked, and you’ll probably say goodbye to your bitcoin.

Conclusion

Taking full possession and management over our funds by way of Bitcoin requires the willingness and private accountability to study what Bitcoin is, its function and its promise. Sure ideas is likely to be a little bit advanced to understand at first, however with the passing of time it would show to be a worthwhile endeavor. Not solely has Bitcoin the potential to extend an individual’s monetary wellbeing, however also can genuinely reshape the world and make it a greater and fairer place.

You’ll then perceive why it is considered as the subsequent logical step within the evolution of cash, a step that takes — truly re-takes — cash out of the palms of governments. It is for that reason that the media and authorities unfold a lot worry and distrust in Bitcoin, however it’s additionally the rationale why we, as HODLers, consider it brings a lot hope for humanity.

Observe Bitcoin Magazine on Twitter to study extra about Bitcoin and begin incomes some sats by taking the 21 days to study bitcoin course to proceed your studying.