Heading into July, the crypto market seems to be commencing a bear run. Save for a number of small-cap cash, asset costs have slid as soon as extra as stress from the standard economic system continues to construct and weigh on them. Nonetheless, the decentralised finance (DeFi) area continues to indicate promise, particularly for traders with the lengthy recreation in thoughts.

On this article, we’ll study the perfect DeFi crypto cash and the components that would trigger them to see worth surges within the close to future.

1. DeFi Coin (DEFC)

The highest coin on our listing of the perfect DeFi crypto cash is DEFC – the native coin for the DeFi Swap buying and selling and alternate ecosystem.

DeFi Swap, launched in 2021, is a decentralised alternate (DEX) that permits seamless coin buying and selling. The DEX permits buying and selling with out a third celebration, providing low charges and virtually on the spot transaction finality. With traders trying to assist the DeFi Swap ecosystem, a lot of them trooped to purchase DeFi Coin – the alternate’s native token.

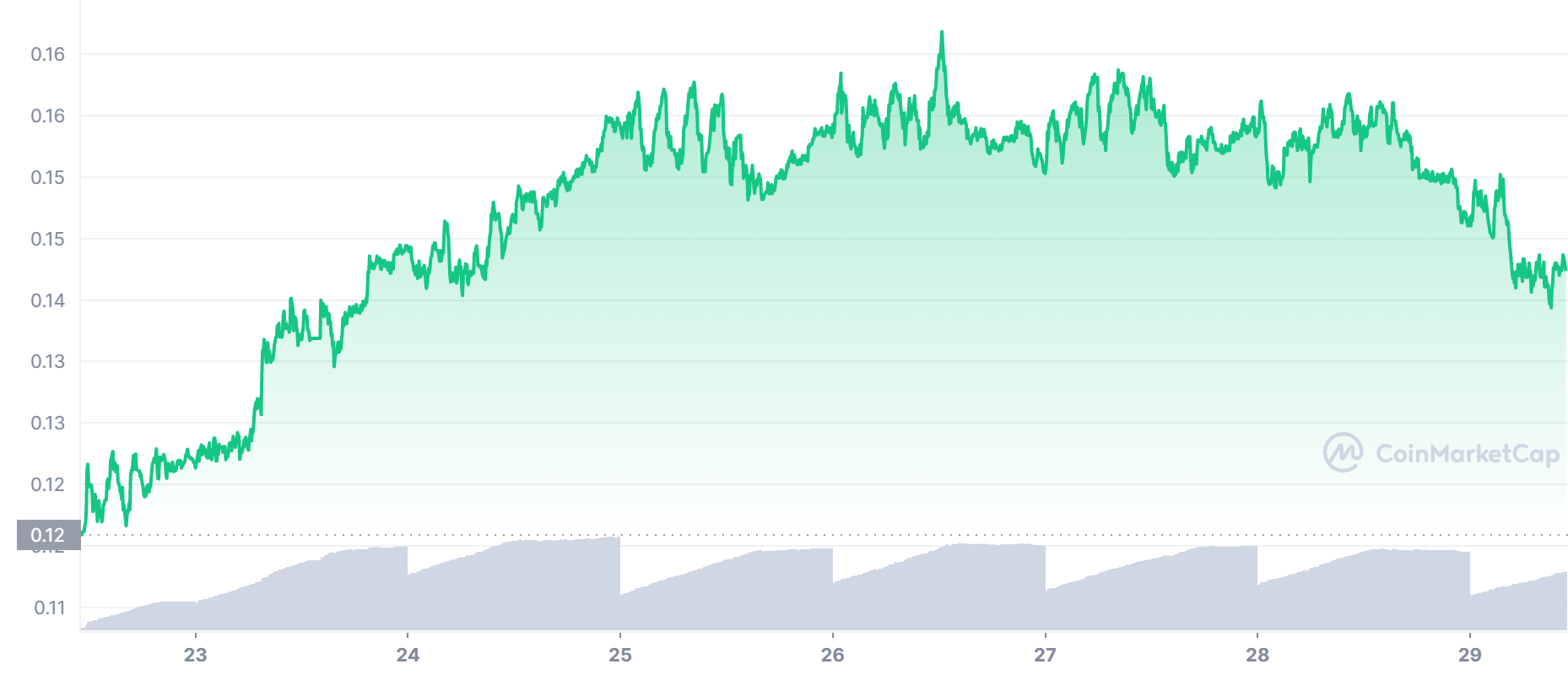

At press time, DEFC trades at $0.14 per token. The crypto asset is driving a formidable 16.6% soar prior to now week.

We chosen DEFC as the general greatest DeFi coin due to the numerous advantages that the digital asset provides. Each time DEFC is offered, DeFi Swap takes a ten% payment. This payment incentivises traders to carry the coin, and we imagine this could push its worth ahead over time and scale back its provide.

DeFi Swap’s builders are additionally trying to listing DEFC on different centralised exchanges. We imagine that this can result in extra development for DEFC because it will get uncovered to a broader investor pool.

2. Uniswap (UNI)

One other spectacular possibility for traders in search of the perfect DeFi crypto cash is UNI. The digital asset operates because the platform token for Uniswap – one of many largest DEXs available in the market proper now.

Like a number of DeFi cash, UNI provides a chance for Uniswap customers to take pleasure in governance and make their opinions recognized. It’s also extremely liquid, so traders can purchase Uniswap and commerce it.

At present, UNI trades at $4.92. The digital asset is up by 3.795 prior to now week, with UNI nonetheless exhibiting sturdy fundamentals to carry its worth acquire.

As a DeFi large, UNI will be sure you see features when the market flips bullish. Additionally, Uniswap continues to develop. After crossing $1 trillion in trades in Might, Uniswap Labs – the alternate’s builders – bought Genie, a non-fungible token (NFT) market and aggregator constructed on Ethereum.

2/ Over the previous three years, The Protocol has

? Onboarded tens of millions of customers to the world of DeFi

? Launched honest and permissionless buying and selling

? Lowered the barrier to liquidity provision pic.twitter.com/mT2ZzjMTav— Uniswap Labs ? (@Uniswap) May 24, 2022

The Genie acquisition indicators a broader push into NFTs by Uniswap, and we anticipate the platform to make a powerful presence within the area quickly.

3. Chainlink (LINK)

Chainlink has seamlessly transcended completely different sub-genres of the crypto area. The decentralised oracle is chargeable for offering off-chain information to blockchain sensible contracts, serving to them to work seamlessly and assist their protocols.

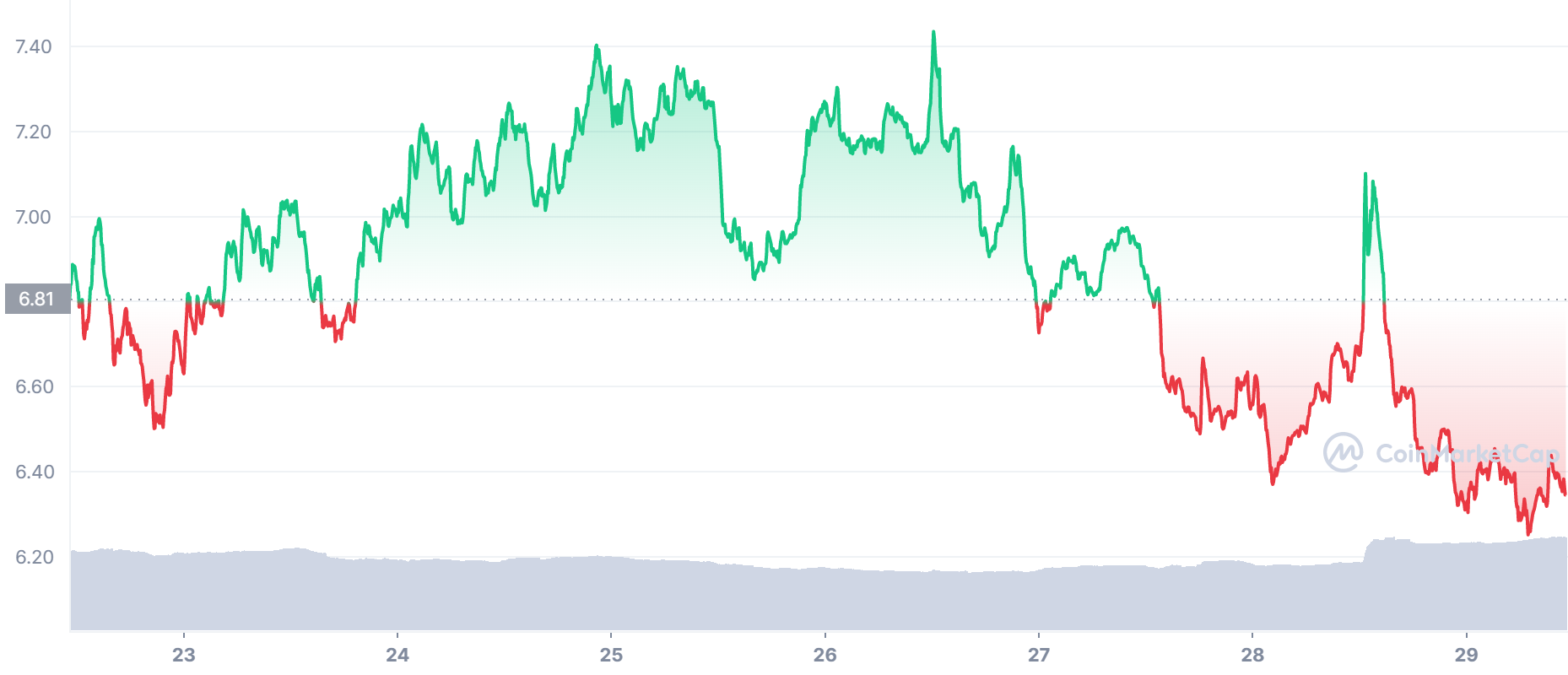

The blockchain oracle has the LINK token, which powers its operation and is used to make information requests. At present, LINK trades at $6.63 – a drop of two.6% prior to now week.

Whereas the market’s forces have weighed on it, there are nonetheless a number of causes to purchase Chainlink. The primary motive is the oracle’s current enlargement to the Polkadot blockchain with a customized parachain referred to as Efinity.

LINK additionally bought an enormous enhance earlier this week when it was listed on the favored retail buying and selling platform Robinhood.

LINK is now on Robinhood @chainlink #CryptoListing https://t.co/0aTjVAOhMy

— Robinhood (@RobinhoodApp) June 28, 2022

The itemizing will grant LINK much more publicity, with a worth acquire anticipated within the quick time period on the very least.

4. THORChain (RUNE)

Subsequent on our listing of the perfect DeFi crypto cash is RUNE. The digital asset is the native token for THORChain – a decentralised liquidity protocol that enables customers to take pleasure in seamless asset buying and selling.

Working with the automated market maker (AMM) mannequin, THORChain provides a easy decentralised alternate platform on the Cosmos software program improvement package. Its protocol permits customers to seamlessly swap cryptocurrencies between blockchains.

RUNE powers your complete community, and it’s used as a pairing token that accompanies each asset in THORChain’s liquidity swimming pools. Thus, RUNE is the second token deposited within the liquidity pool. Traders also can purchase the digital asset to pay for charges and governance.

RUNE at the moment trades at $1.92. The crypto asset is up by 6.07% prior to now week, holding on to its features fairly effectively.

For now, RUNE seems to be benefiting from the launch of THORChain’s mainnet. Previous to this, THORChain had operated on the Ethereum and Binance Chain networks. By launching its personal blockchain, the protocol is trying to change into a standalone service and develop much more.

5. Maker (MKR)

The ultimate coin on our listing of the perfect DeFi crypto cash is MKR – the native token for Maker. The lending protocol has grown to change into the DeFi market’s main service. The platform is operated by MakerDAO – the identical decentralised autonomous group (DAO) that operates the DAI stablecoin.

MKR at the moment trades at $942. The asset is up by 4.08% prior to now week.

Because the main DeFi protocol, traders can purchase Maker and earn features when the market flips bullish. On the similar time, the MakerDAO is at the moment voting on a proposal to speculate 500 million DAI in US treasuries and bonds.

The Maker Governance votes to find out the right way to allocate 500 million DAI between completely different funding methods.

This allocation ballot is a results of the passage of MIP65: Monetalis Clydesdale: Liquid Bond Technique & Execution.

A recap on how it might work.

?

— Maker (@MakerDAO) June 27, 2022

The proposal indicators MakerDAO’s push into the standard economic system – particularly amid the present market circumstances.

Learn Extra:

DeFi Coin – Our Really helpful DeFi Undertaking for 2022

- Listed on Pancakeswap, Bitmart (DEFC/USDT)

- Automated Liquidity Swimming pools for Crypto Swaps

- Launched a Decentralized Change – DeFiSwap.io

- Rewards for Holders, Staking, Yield Farming Pool

- Token Burn

Cryptoassets are a extremely unstable unregulated funding product. No UK or EU investor safety.