European establishments have reached an interim consensus on a set of EU laws that can burden crypto firms with the duty to assist forestall cash laundering, amongst different illicit actions probably involving digital belongings. The progress comes because the Union seeks to comprehensively regulate the continent’s cryptocurrency market.

EU Officers and Lawmakers Agree on AML Measures in Crypto Area

Negotiators representing the important thing individuals within the EU’s decision-making course of have reached an settlement on anti-money laundering (AML) guidelines that can require companies within the crypto trade to confirm the identities of their clients and report suspicious transactions. Sooner or later, Europe’s Switch of Funds Regulation (ToFR) may even cowl cryptocurrency transactions.

The laws are but to be finalized and permitted by the related European establishments however the provisional deal indicators an upcoming tightening for the sector. Crypto companies must help monetary authorities in efforts to crack down on soiled cash, the European Parliament and EU Council indicated on Wednesday.

The improved oversight ought to be certain that crypto belongings will be traced identical to conventional cash transfers, Reuters reported, referring to a launched official assertion. Quoted by the information company, Spanish Inexperienced Social gathering lawmaker Ernest Urtasun, who took half within the course of, elaborated:

The brand new guidelines will allow legislation enforcement officers to have the ability to hyperlink sure transfers to felony actions and determine the true individual behind these transactions.

The EU our bodies additional famous that the foundations would additionally cowl ‘unhosted‘ crypto wallets, a time period utilized by European officers to designate wallets held by personal people that aren’t managed by a licensed platform. That can apply to transactions with crypto service suppliers exceeding €1,000 in fiat worth (round $1,040).

The proposals haven’t been met with enthusiasm by the crypto trade. In a letter addressed to the finance ministers of the 27 EU member states, despatched in mid-April, companies working with crypto belongings urged European policymakers to make sure that their laws didn’t transcend the requirements adopted by FATF, the worldwide Monetary Motion Job Power (on Cash Laundering).

On Thursday, the EU additionally seeks settlement on a broad framework designed to control crypto-related actions throughout the Union. Members of the European Parliament and representatives of the EU states must align their positions on the brand new Markets in Crypto Property (MiCA) legislative proposal, which is anticipated enter into drive earlier than the tip of subsequent 12 months. Crypto firms can have 18 months after that to acquire a MiCA license to function within the European Union.

What impact, do you assume, will the upcoming EU laws have on the crypto trade? Share your opinion within the feedback part beneath.

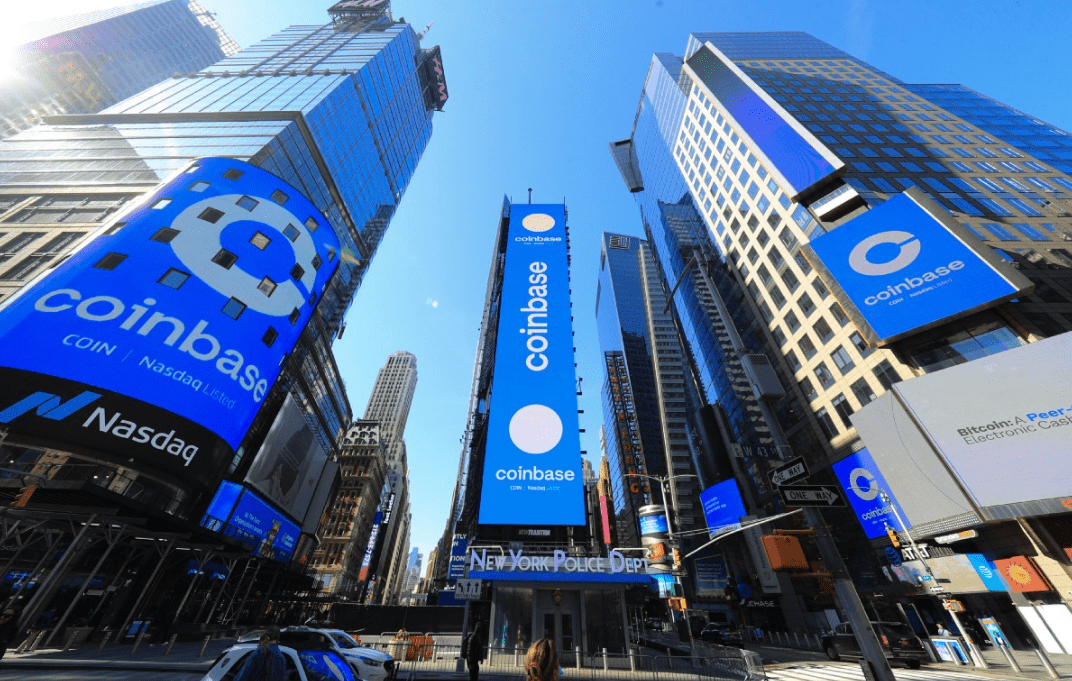

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Alexandros Michailidis

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss precipitated or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.