Over the previous few hours, the worth of bitcoin has deviated from a key stage of assist and fallen beneath $19,000. The transaction historical past reveals that many addresses bought Bitcoin for greater than $20,000. These market gamers would quickly liquidate their holdings to stop additional losses, which might set off a decline towards $16,000

Inflation Warnings Have an effect on Bitcoin Value

Resulting from main inflation worries and fee hikes indicated by central banks, notably the US Federal Reserve, BTC has nearly misplaced half of its worth over the earlier month.

Bitcoin’s market valuation has fallen from $1.27 trillion in November 2021 to underneath $366 billion at current.

Jerome Powell, the chairman of the Federal Reserve, reaffirmed the Fed’s dedication to elevating rates of interest in an effort to cut back inflation. He acknowledged throughout the ECB assembly that the problem of inflation was extra regarding to him than the potential for rising rates of interest to trigger the U.S. economic system to enter a recession.

“Is there a threat we might go too far? Definitely, there’s a threat,” Powell mentioned. “The larger mistake to make – let’s put it that manner – could be to fail to revive worth stability.”

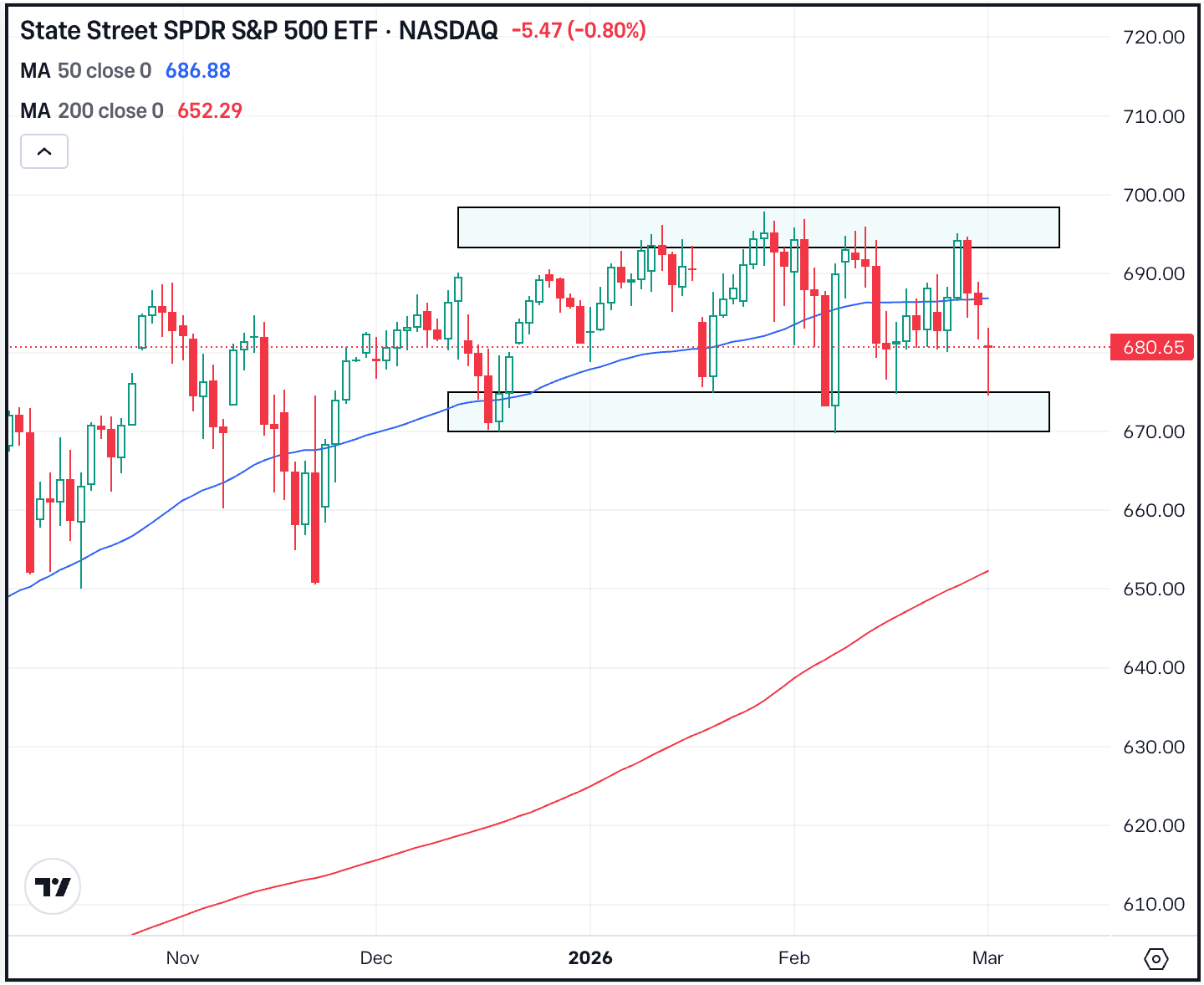

BTC/USD falls beneath $20k. Supply: TradingView

Powell argued that the Fed must shortly increase charges as a result of a gradual hike could give customers the impression that elevated commodity costs wouldn’t go away. He mentioned that fee will increase may be lessened earlier than the subsequent yr.

Associated studying | Doom To Fail: Tether Shorts Pile In As Hedge Funds Search To Revenue From Crypto Winter

Following Powell’s remarks, U.S. fairness market futures declined, with these for the S&P 500 dropping 1.59% and people for the tech-heavy Nasdaq 100 dropping 1.9%. Asian markets have been down, with the Asia Dow index and Japan’s Nikkei 225 each down 1.54%.

Information Suggests Whales Are Ready

On-chain knowledge on CryptoQuant suggests that the majority merchants are awaiting the subsequent important worth decline. The worth anticipation seems to be for a short-term alternative, although.

On-chain knowledge additionally implies that huge whales are ready for an excellent alternative to build up cryptocurrencies, not solely tiny and common merchants. Information reveals that, apparently, whales’ holdings in Bitcoin aren’t now rising.

This demonstrates unequivocally that the whales are awaiting a greater alternative. Whales’ holdings between 100 and 1,000 and between 1,000 and 10,000 Bitcoins at the moment exhibit a flat line.

Associated studying | Bitcoin Slides Beneath $20K – One other Collapse In The Offing?

Featured Picture from Pixabay and Chart from tradingview.com