Inflation. Recession. And, one query. Really, two. Have you ever determined already? The place are you going to speculate (save) your cash?

When you have any, to start with. This dilemma doesn’t concern solely your private funds, however the way forward for finance of the entire world. Or, what’s going to be left of it.

In considered one of my earlier tales, Wealthy Dad, Poor Dad, Bitcoin & Canned Tuna, I actually, and one could say naively, anticipated to get the solutions to those pricey questions from the “Daddy of Funding” himself (in case you didn’t know, we have already got the “father of funding,” that’s Benjamin Graham).

It turned out that Robert Kiyosaki’s books and tweets are two completely various things. I skilled the Unusual Case of Dr. Jekyll and Mr. Hyde whereas going by means of his most up-to-date tweets about Bitcoin, gold, silver, weapons (!), bullets (!!), and “cans of tuna fish,” as a result of “you possibly can’t eat gold, silver, or Bitcoin,” are you able to?

God have mercy on us.

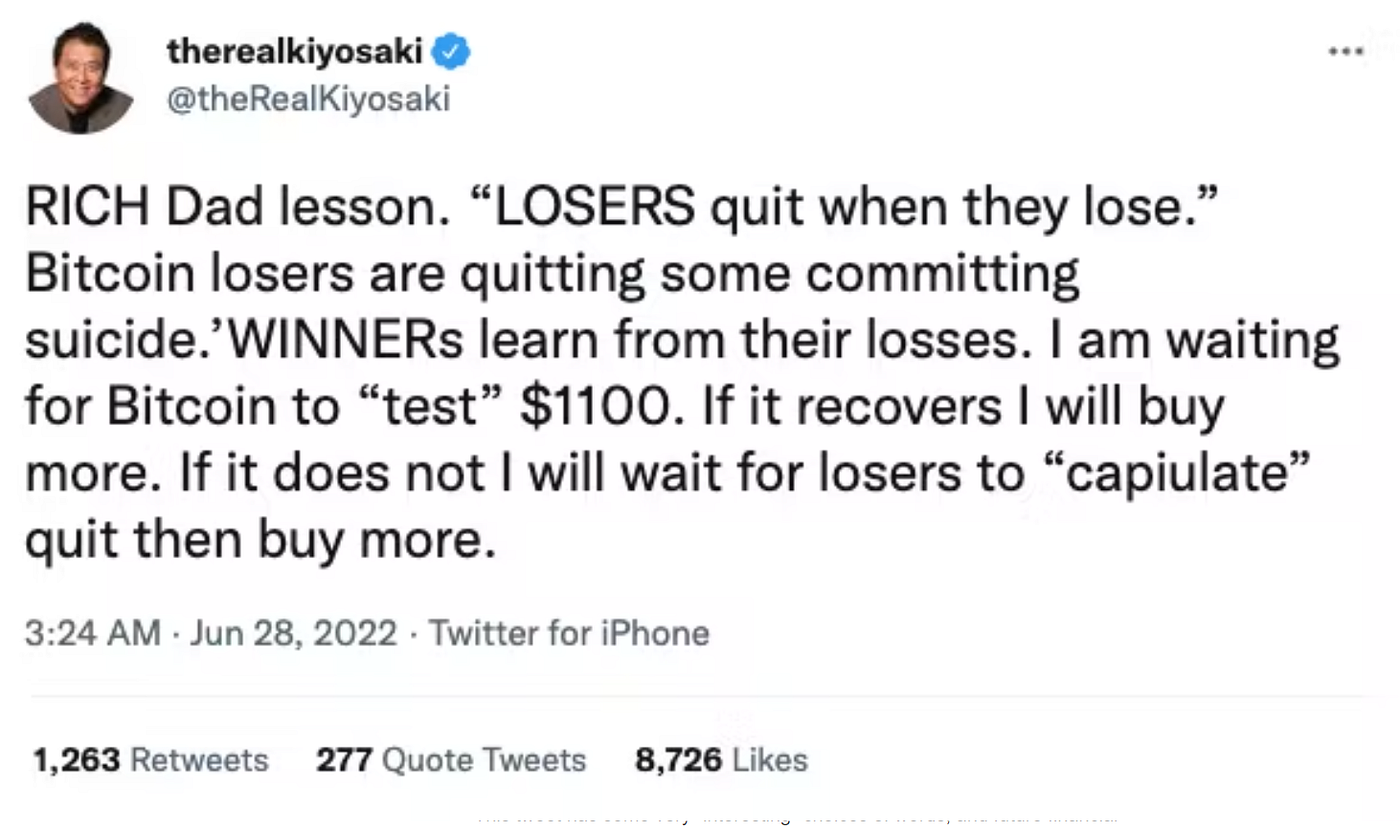

However, Kiyosaki didn’t have mercy when calling the “Bitcoin LOSERS,” in his newest tweet ().

This tweet has some very “fascinating” selections of phrases, and future monetary actions by his writer. I imply his Twitter deal with is difficult sufficient. Is that the “actual” Kiyosaki or another person “impersonating” him on Twitter? The blue verified badge says that this account is genuine. I discovered it to be problematic, as effectively.

I imply, make up your thoughts man:

Ought to I promote? Ought to I purchase?

Ought to I wait? Ought to I have fun or cry?

You need Bitcoin to “take a look at” (chew) the mud at $11K, so you should purchase extra. “If it recovers,” however “if it doesn’t,” he’ll await Bitcoin losers to “capiulate” (capitulate, proper?!). I imply, this tweet is so excessive that I’ve to maneuver on.

Let’s see (learn) what the opposite monetary specialists and analysts need to say (write) about it:

“It’s now clear that bitcoin trades parallel to the chance property, fairly than [as] a secure haven,” Ipek Ozkardeskaya, an analyst with Swissquote, stated in a report earlier this month. “Bitcoin remains to be not the digital gold, it’s extra of a crypto-proxy for Nasdaq, apparently.”

“A crypto-proxy for Nasdaq?!” What does that even alleged to imply? The following analyst is anxious about our future, as all of us are, however he desires us to have a historic perspective. Why? As a result of outdated is gold, I suppose:

“Stagflation dangers are rising, and geopolitical tensions present few indicators of a fast decision,” stated Louise Avenue, senior markets analyst with the World Gold Council, an business analysis agency. “Gold is traditionally one of many strongest performers in a stagflationary setting, by which equities endure, and commodities usually retreat.”

So, the place can we go from right here by means of…

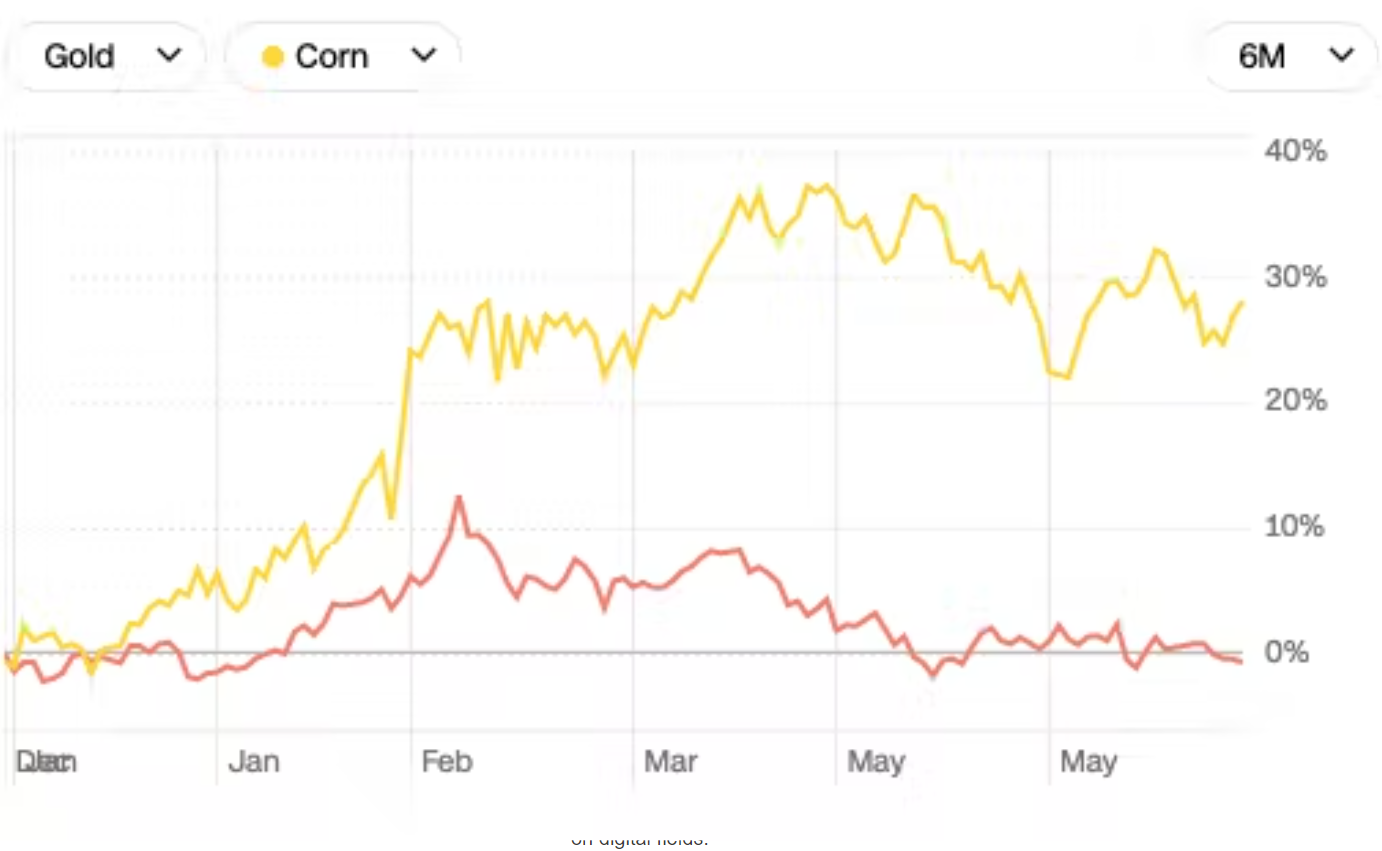

The numbers all the time inform the reality, or so we had been informed. I needed to verify the most recent commodity buying and selling costs at CNN Enterprise. Listed below are some fascinating comparisons. I’m saving the most effective for final: Bitcoin vs. gold. However, proper now, I’m curious to see for myself, which shines longer, gold or silver? I imply, each financially and traditionally.

“Solely” a ten % value distinction, give it or take. I don’t learn about you, however that’s not sufficient to persuade me to affix the “gold staff” of traders. The following comparability, although, leaves no room for doubt that corn is true gold.

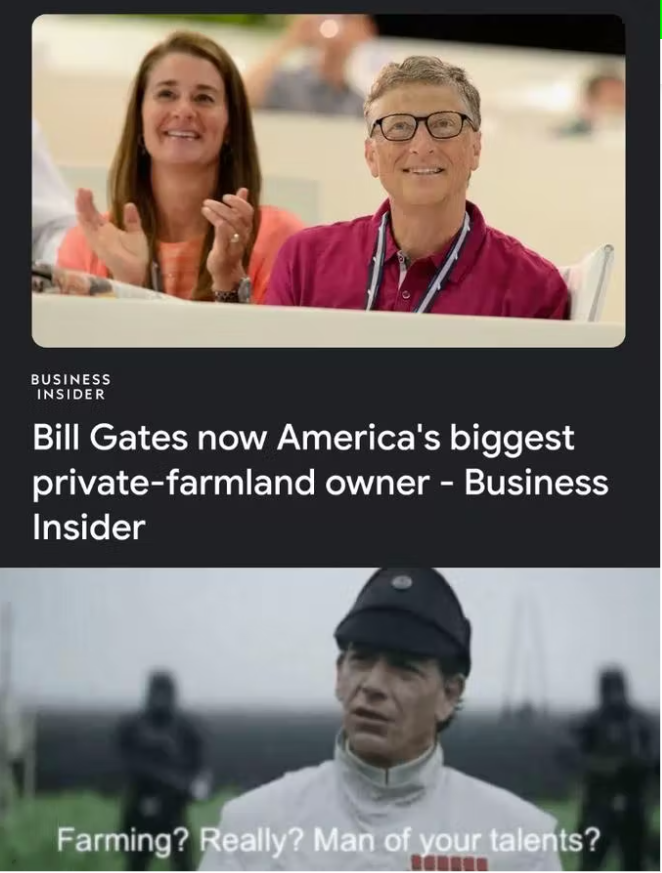

By now, we should always’ve all discovered what blue and yellow signify on the Ukrainian flag. Proper? Blue for the sky, and yellow for the countless wheat fields, but additionally for corn. Do you know that Ukraine is without doubt one of the prime 5 corn producers on this planet? I do know somebody who is aware of that corn doesn’t develop on digital fields.

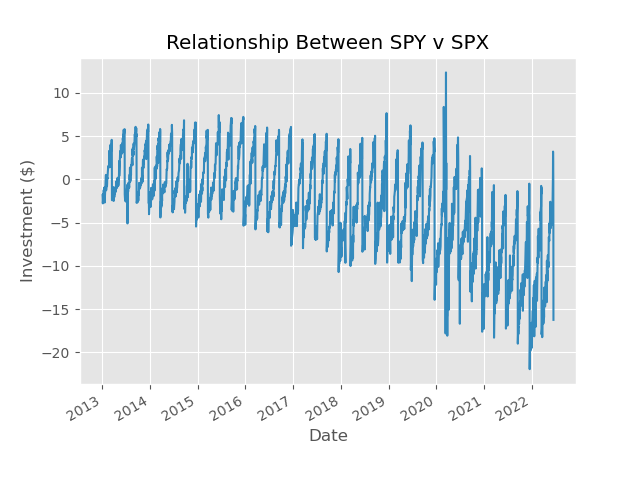

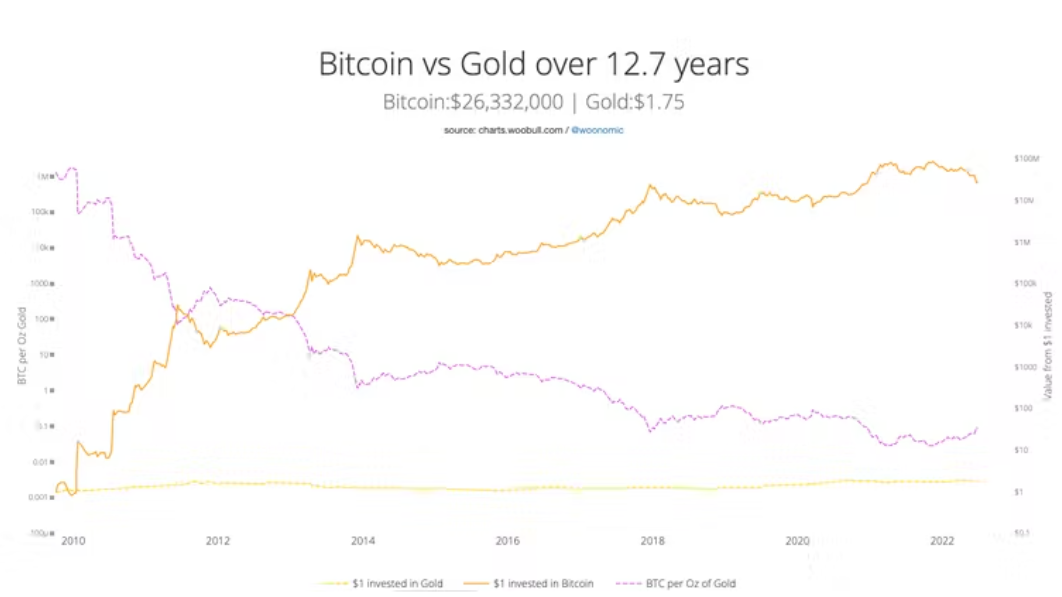

I stumbled upon a busy little crypto bee that has in contrast Bitcoin towards gold because the daybreak of cryptocurrency. Now, I’m going to do your eyes a favor, and shortly clarify that the primary line you see on the backside of this chart represents what would have occurred when you had invested one greenback in gold. The extra interesting one represents the identical funding, however in Bitcoin. The colourful line, which matches down, represents the so-called “the Bitcoin gold ratio,” or what number of ounces of gold you would’ve bought with Bitcoin at a sure time limit. I hope, I bought it proper.

Simply in case, this desk actually is useful. Except you’re superstitious, and consider that the thirteenth Bitcoin birthday isn’t going to be a contented one, in spite of everything. There are a lot of “Again to the Future” followers who wouldn’t thoughts touring again in 2009 and investing in Bitcoin. That’s no shock. What comes as a shock, although, is the “relative volatility” of gold. You’ve been warned, haven’t you? It’s all a matter of non-public perspective.

My story begins with the “Wealthy Dad’s” lesson. Let’s see is there a contented ending for wealthy and poor dads’ children.

“When inflation goes up, we’re going to wipe out 50% of the U.S. inhabitants,” he informed Stansberry Analysis earlier this 12 months. Kiyosaki is admittedly darkish nowadays in no matter he tweets, writes, or says.

“The common American doesn’t have 1,000 bucks,” Kiyosaki says. A current Bankrate survey confirmed that almost all Individuals wouldn’t have sufficient cash put aside to cowl an sudden $1,000 expense. It additionally spells hassle for individuals who wish to take pleasure in their golden years. When the bubbles burst, Kiyosaki says, the inventory market will crash. So these counting on their 401(okay) plans “are toast.”

It’s not simple to focus on making the fitting funding when a “secure (monetary) heaven” is nowhere to be discovered.

We don’t have a retirement, our pensions are bust.

I don’t know whether or not it’s best to make investments your cash in Bitcoin or gold, however I’m completely certain that investing your time in high quality content material is a secure guess as a result of that’s the one inflation-proof factor nowadays.