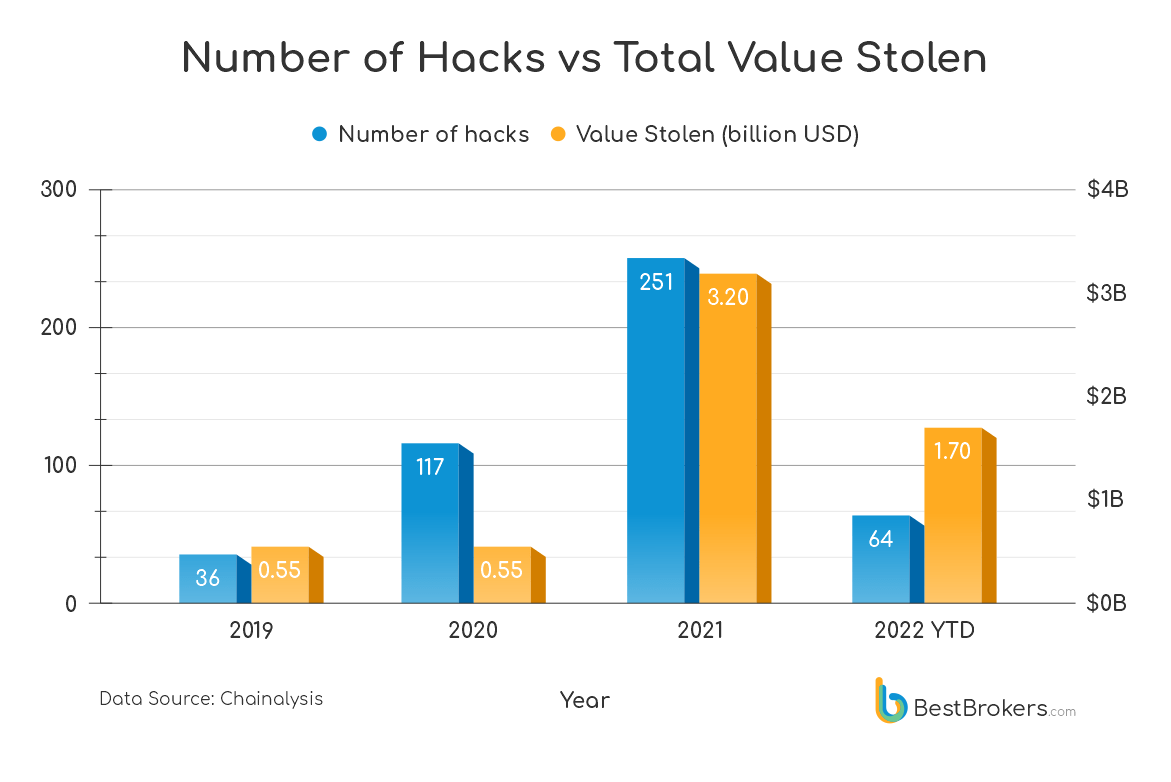

Cryptocurrency hacks have been considerably reducing in numbers because the starting of the yr. In response to the newest analysis from BestBrokers, the trade noticed 64 safety breaches by mid-June — a pointy decline from final yr’s 251 hacks.

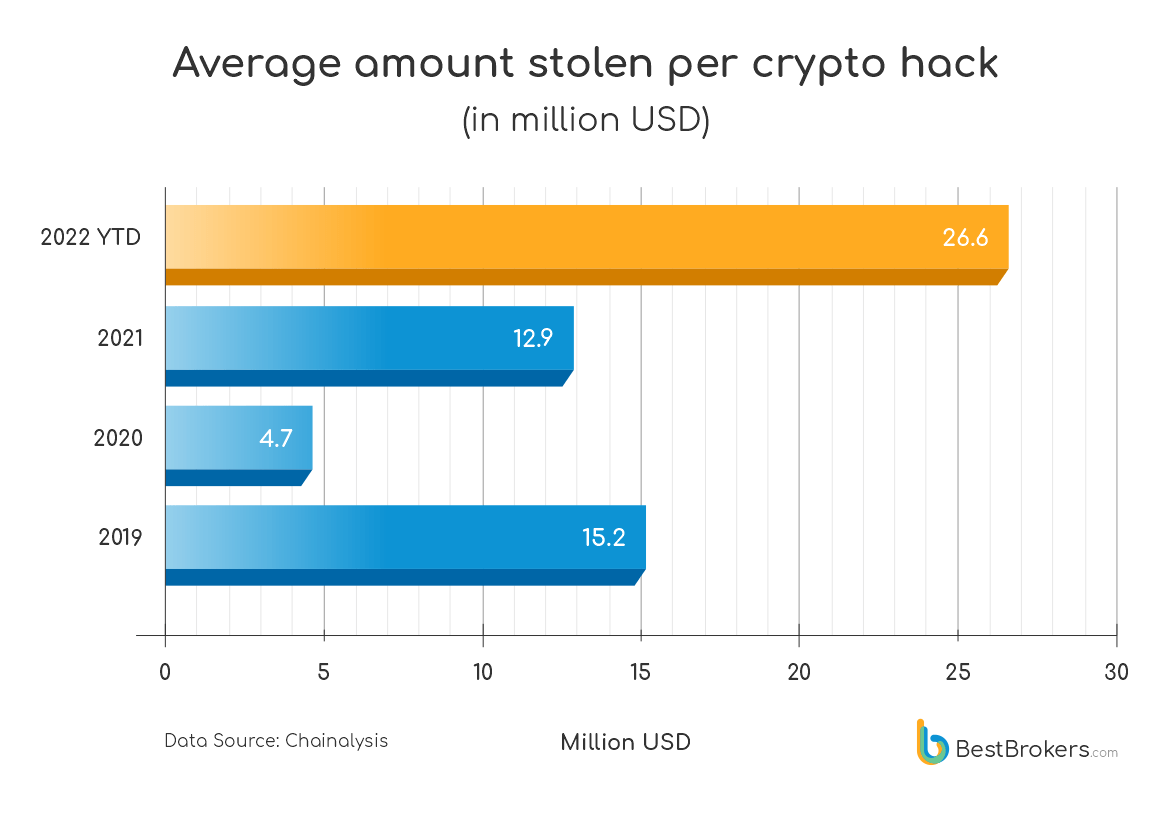

Nevertheless, whereas the variety of profitable hacks has been reducing, the injury they’ve finished to the trade actually hasn’t. Information has proven that the common quantity stolen per crypto hack has elevated by 206% in comparison with the 2021 common.

Hacks appear to be aiming for high quality, not amount

In response to analysis shared with CryptoSlate, 2021 noticed 251 hacks in whole that amounted to round $3.2 billion stolen in crypto. This yr, as of mid-June, the trade noticed round $1.7 billion stolen in simply 65 safety breaches.

“Though the variety of crypto-related hacks is dropping sharply in 2022, this isn’t affecting the whole greenback quantities stolen, regardless of the dropping crypto costs this yr,” the report stated.

The most recent information from Chainalysis confirmed that the common quantity stolen per crypto hack this yr is $26.6 million — a 206% improve in comparison with the 2021 common of $12.9 million. This quantity turns into even greater in comparison with the 2020 common of $4.7 million stolen per hack, representing a 465.9% improve.

Researchers consider that hackers have been aiming for and efficiently hitting bigger targets in 2022. The DeFi market appears to be a favourite goal for hackers, as they’re typically capable of make the most important returns on decentralized protocols.

Round 72% of all crypto stolen in 2021 was attributed to DeFi protocols and providers. This yr, this proportion elevated to a staggering 97%.

Robert Hoffman, a cryptocurrency analyst at BestBrokers, stated that DeFi had turn out to be the principle goal for hackers because of a considerable amount of enterprise capital cash that has been poured into the market. The market’s aggressive nature signifies that protocols that launch first may have the best probability of succeeding.

“The race for constructing the digital monetary system of the fourth industrial revolution is an especially speedy one with many stakeholders competing for the primary spot. Typically when the time to market is just too quick it ends in compromised elements of the product, together with safety,” Hoffman defined.

The technical nature of sensible contracts and the experience required to program them leaves plenty of room for manipulation. Nevertheless, Hoffman believes that after DeFi turns into extra mainstream, most of its safety points can be resolved “as with every new expertise that will get mass adoption.”