That is an opinion editorial by Joakim E-book, a Analysis Fellow on the American Institute for Financial Analysis, contributor and replica editor for Bitcoin Journal and a author on all issues cash and monetary historical past.

When bitcoin tumbles, Bitcoiners get poorer. They don’t have fewer sats of their ({hardware}) wallets however can get radically much less stuff with these sats — therefore “poorer.” Poorer Bitcoiners can do fewer issues on the planet; they’ve much less command over the world’s financial sources. In case you assume Bitcoiners have one thing sensible to contribute to the world, this can be a dangerous factor.

Some issues, like spreading concepts and studying, will be achieved with out funds, however most necessary issues require capital.

When bitcoin tumbles, the press, the skeptics and the haters have a area day (“see, bubble! Corruption! Dangerous rip-off!”).

When bitcoin tumbles, the concept it’s in any form or type an inexpensive asset to carry in opposition to a clownish world appears much less persuasive. For all their flaws, no less than my greenback money, my euros or my bank card — affected by inflation and the occasional censored transaction — don’t explode like this!

It needs to be apparent, then, {that a} falling BTCUSD is dangerous for Bitcoin. Nonetheless, essentially the most vocal Bitcoiners are likely to disagree: falling bitcoin costs purge the weak and over-levered, and it lets the remainder of us stack and study in peace.

Right here is the contrarian case specified by extra element.

Story Time: How Falling Alternate Charges Harm Bitcoiners

Just a few months again, I spent 500,000 sats on an expense for a visit. “What?!” Says the purist. ”You must by no means spend your bitcoin!” Yah-yah, however for those who by no means spend it, its use case by no means grows and, anyway, it made most sense given my monetary scenario on the time (anybody else irresponsibly chubby bitcoin?) Given what got here to cross thereafter, who’ll blame me?

I received a number of nights in a good AirBnB with some mates. I might have gotten about two weeks’ value of groceries or one thing like two years of Nik Bhatia’s glorious subscription, “The Bitcoin Layer.” Once I first wrote this draft, that was all the way down to a few single night time, most likely only one week’s value of groceries, and simply over six quarters of Bhatia’s unencumbered writing. Inflation is likely to be a bitch, however then what will we name a BTCUSD crash?

Now, after one more bitcoin value debacle, these 500,000 sats most likely get me a single hostel mattress or two and would barely have lined what I simply spent so as to add some primary objects to my empty post-travel fridge.

Inflation is horrible and unfair, however it’s gradual, typically predictable and pretty manageable with even the smallest of efforts (typically routinely adjusted by means of indexation in wage contracts or different recurring transactions). Bitcoin is quick, unpredictable and fully unmanageable to the common particular person. That’s what makes it such a poor cash at current. It’s fairly unusable in its foremost duties (carrying financial worth throughout time and house), and that’s earlier than contemplating the altogether synthetic problem of paper, tax and capital positive factors. Maybe that’s a part of the inevitable rising ache. People are ingenious varieties; we adapt and study and make institutional preparations that match our environments. But it surely’s at occasions like these that I’m not so positive. That mountain we’re climbing seems awfully steep.

I by no means thought I might say it, however the bureaucratic monstrosity that’s the euro proved a greater retailer of worth over this identical time interval — the USD much more so, as I pay some portion of my bills in even weaker currencies than the almighty greenback. Between the 2 weeks of pulling some sats-denominated financial savings and spending them, I didn’t lose 25% of what they might get me, however just some minor fluctuation round a fairly regular downward development. My flat’s hire, which is adjusted to official month-to-month inflation metrics, was in June about 3.5% costlier in native forex than in March, about 7% costlier in euros, and about 50% costlier in bitcoin (had I paid it with bitcoin two weeks later, it could have been one other 41% costly nonetheless — hire steadily elevated, greenback recuperated considerably, and bitcoin collapsed even additional). Some retailer of worth, eh?

This isn’t a critique of bitcoin however a type of primary inner housekeeping. Hardcore Bitcoiners and the newly infatuated prefer to say that value is irrelevant, that bitcoin is wonderful at any value, that the revolution is inevitable and gradual no matter what foolish merchants are doing with the foolish BTCUSD tickers. Purchases go a technique, bro.

However you need to get to that future in some way, and having newbies rekt on 50% drawdowns and companies saying “no thanks, give me d-o-l-l-a-r-s!” isn’t precisely serving to.

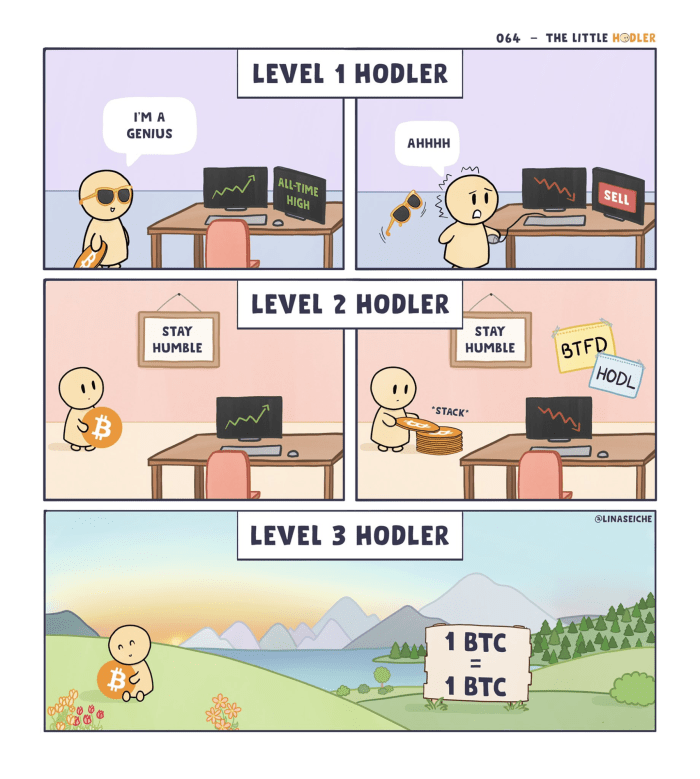

(Cartoon/Lina Seiche)

Like goldbugs have lengthy insisted about an oz. of gold staying the identical, 1 BTC would possibly equal 1 BTC however its financial worth can nonetheless shift. In actuality, costs modify; as financial actors, human beings care about what cash will get you, not what the denomination of that unit is. What, do you assume Venezuelans take into account “1 bolívar equals 1 bolívar” to be a profound assertion?

When every little thing is priced in {dollars}, what “1 BTC” will get you is topic to ever-shifting bitcoin costs, with the nominal “1” in that unit being unimportant. Six months in the past, 1 BTC received you a brand new Tesla Mannequin 3 Efficiency with some further fancy devices. Once I first wrote this primary draft, that very same saving solely received you a brand new Ford EcoSports. Now it will get you a couple-years-old used automobile with 80,000 miles behind it. However 1 BTC still equals 1 BTC, proper?

No. A bitcoin shouldn’t be nonetheless a bitcoin since those that would promote me something of fabric worth index their bitcoin gross sales to the greenback and to not a selected variety of sats. That is likely to be a fault with them that in time should change, however to date appears to be the best way of the non-bitcoinized world. Unit of account is the required trophy for a Bitcoinizing world.

Sats Devaluation

Following the Could blow-up from $45k to $30k, Nico Antuna Cooper wrote what most Bitcoiners chanted in public or in non-public: “Why the bitcoin value doesn’t matter:”

“The distinction between Bitcoin and every little thing else is that the worth of bitcoin doesn’t matter. Over the long run the worth of bitcoin has gone up, sure, however the worth proposition of bitcoin as arduous, non-confiscatable and really decentralized cash is basically what issues.”

Take into consideration that assertion for a minute. Cash’s sole function is to coordinate consumption and manufacturing in the actual world. It’s to maneuver worth from one place to a different, throughout time, and to transact between individuals who subsequently don’t must belief each other. Cash’s value is its buying energy, how a lot actual stuff it will possibly get you. However Cooper, echoing sentiments of most Bitcoiners, claims that the worth of bitcoin doesn’t matter. What you may get for bitcoin and subsequently the way it shops worth throughout time is in some way inessential.

Cooper continues by saying that bitcoin’s worth proposition isn’t as an asset that appreciates, however reasonably as a “arduous, non-confiscatable and really decentralized cash.” True, however irrelevant. Sure, these issues are what Bitcoiners treasure about bitcoin and the way Bitcoin, the financial community, can revolutionize the world. However bitcoin, the asset, can solely do these issues if the community’s whole worth packs some monetary punch. At a sub-$1 trillion market cap — now sub-$400 billion — it doesn’t. With an asset tumbling in real-world market worth, it doesn’t.

Put in another way: the HODL mindset requires you to imagine that -25% weekend drops — or -70% over seven months — in your internet wealth is ok. Dandy advantageous. Time in the market beats timing the market, or another modern Warren Buffet quote.

An asset’s value is a gauge of its success. Nearly trivially so: an asset rises in value when consumers (i.e., those that need it) outnumber or out-money sellers (i.e., those that don’t need it). So within the latest seven-month interval, fewer individuals or cumulatively less-wealthy individuals have wished bitcoin. Inform me once more how that’s good for Bitcoin?

Honey badger ought to care as a result of value is aware of one thing you don’t and since a tumbling bitcoin value is the best vote-of-no-confidence any market economic system might ever ship. Sellers are dominating the market, saying, “We don’t need you.”

It’s as a result of markets know one thing that it’s so hopelessly asinine for “trad-econ” profiles like Nouriel Roubini, Warren Buffet, Paul Krugman or Nassim Taleb to confidently declare that bitcoin is an overvalued bubble at x, y or z value. “Hurray,” cheers the Bitcoin crowd once we’re shitting on the haters.

For the reason that precept works in reverse too, it’s equally asinine to say that bitcoin is undervalued at $29,000 or $45,000 (what about $18,000?), like many distinguished Bitcoiners are keen on doing. However how might or not it’s? Markets know one thing. So that you can say that markets are flawed displays a amount of hubris I don’t even need to ponder. Yeah, actually? Good luck with that.

One other piece in Bitcoin Journal from final month acknowledged confidently that:

“Bitcoin as a financial device permits everyone to have the identical alternative — accumulate and save as a lot cash as doable and protect any quantity of wealth, giant or small, with out the fear of confiscation or inflation, i.e., the best way cash needs to be.”

Within the final seven months or much less, it’s true {that a} holder of bitcoin didn’t lose buying energy to outright confiscation or inflation. However holding bitcoin stripped them of worldly worth as they misplaced buying energy nonetheless. Sellers of products and companies — these issues we want to purchase, at this time and tomorrow and the times and weeks thereafter — charged us many extra sats after the crypto crash than earlier than. After which but some extra once more. How is 1 sat prior nonetheless equal to 1 sat now? Did bitcoin (hyper-)inflate in opposition to the greenback?

The promise is: you’re not going to be debased, that “individuals can plan for that in a way more logical method: they know that they gained’t be debased out of their wealth.” After which they’re anyway.

With a straight face, you may’t say that the issue with the greenback system is that it slowly erodes your buying energy, and on the identical time fortunately embrace a collapse in BTCUSD as a result of it permits you to stack at decrease costs or no matter. That is both disingenuous or schizophrenic. If a depreciating change price between {dollars} and actual items and companies is dangerous for many who maintain and use {dollars}, then a depreciating change price between bitcoin and actual items and companies can also be dangerous for many who maintain bitcoin.

Bitcoin regularly making its uneven method from $60,000 to $20,000 continues to be a non-confiscatable and decentralized factor, but it surely’s not a “arduous” cash — and barely a cash in any respect. Its quantitative shortage — i.e., the variety of sats excellent — remained “arduous” and unaltered (however not unchanged since 34,000 blocks have been processed since then, creating greater than 200,000 new bitcoin). But it surely’s not “arduous” as a result of its worldly shortage was minimize virtually in half, twice in a row. And it’s not that money-like as a result of fewer individuals need it (and with much less urgency) at this time than they did half a 12 months in the past. . What customers of a cash can have interaction with is the costs of products and companies in that cash.

I’ve heard distinguished Bitcoiners say, “Bitcoin is antifragile,” stealing Taleb’s time period and, I presume, content material to rub it in his face. For antifragile issues, any and all volatility is nice, as a result of the factor emerges stronger. That has some ring to it and is at some degree the that means of antifragility. However different issues which can be antifragile, like biospheres or human immune methods or — explicitly citing Taleb — the restaurant enterprise, present us higher limits.

Taleb’s phrase for that’s “absorbing limitations.” The immune system will get stronger when it will get harassed, however at some degree of stress it breaks and the particular person it goals to guard dies. A single restaurant closing is rapidly changed by one other, redistributing the usage of the capital, labor and land that wasn’t valued sufficient by shoppers. However in 2020 to 2022, a political class drunk on fiat cash and preventing invisible COVID-19 enemies made an enormous dent into many cities’ restaurant companies, completely damaging most of it. Not so good.

Bitcoin, the protocol, appears fairly antifragile. Bitcoin, the cash, isn’t.

Bitcoin isn’t cash — but it surely might be (and doubtless needs to be).

With an extended sufficient time horizon, offered that this isn’t the top of our financial experiment, bitcoin’s greenback value can solely go bananas as a result of we’ve got one other system alongside it. The one method in hell it may be “dandy advantageous” after the final six months-plus of chaos is that there’s one other financial system from which we are able to plunge extra of our common earnings to get our fingers on low cost corn. One other financial community that may prop up the amount aspect of your sats stack, choosing up your transaction slack and as an alternative allow you to HODL your cash in relative peace. As a result of man’s gotta eat and we’ve received fiat payments to pay. We are able to dwell in a bitcoin world as a result of we’re sponsored — saved — by the greenback system we hate a lot.

What occurs once we not have that security internet of dollar-denominated incomes, secure(ish) costs and a cash system that also goes bananas over a single weekend? What occurs when bitcoin tries to face by itself two legs?

Feeling conflicted about it, Bitcoiners celebrated the institutional capital when it arrived — the merchants and fast-moving speculative cash after they delivered bitcoin’s newest 10x in 2020 to 2021. However now we’re coming to remorse their presence because the liquidity spigot that propelled these funds is drying up and the fast-moving speculative guys transfer alongside.

Bitcoin’s greenback value issues as a result of no person costs issues in sats. Since retailers modify promoting value to the BTCUSD price, the holder of BTC carries all of the draw back threat, the ache of which we’re now studying to dwell with.

You may ostensibly purchase something for bitcoin, positive, however you’re not likely shopping for it “for bitcoin.” Stuff from retailers left and proper, some on a regular basis issues in El Salvador or choose homes in Dubai and Portugal make the information they usually point out some wonderful adoption of this still-young asset. However you haven’t gotten wherever, actually. Not one of the issues you should purchase for bitcoin have been priced in bitcoin. Which means your BTC didn’t maintain any worth; you took a short-term gamble out of your entry value to your exit value, with a frantic sliver of hope that you simply overtook value appreciation within the Portuguese house you have been eying up or the groceries within the retailer getting nominally pricier.

Had the house vendor or grocery store priced their items in sats, a shift in BTCUSD could be irrelevant, just like the “1BTC = 1BTC” crowd says. However they value their wares in {dollars} and ask you to fork over extra sats when the change price strikes in opposition to you (and fewer sats solely when it strikes in your favor). Which means you’re not holding cash, however a high-risk asset.

Which, in fact, is how monetary markets have priced it.

You Can’t Escape Danger: When Taleb Was Proper

He stated it so stupidly, tucked away in an in any other case laughable article, however he pointed to the risk-carrying drawback of bitcoin adoption. I mentioned it at size in an article final 12 months titled “You Can’t Eat Bitcoin”:

[Taleb] writes that for an individual to buy consumption items with bitcoin, she should have an earnings in bitcoin; however for her to obtain (components of) her wage in bitcoin, the employer should obtain no less than some bitcoin in income; and the vendor of consumption items should get hold of no less than some uncooked supplies in bitcoin. After all, that is terribly flawed; but, he’s additionally profoundly proper – in an virtually trivial method. Until currencies are mounted in opposition to each other or redeemable in the identical outdoors cash, buying and promoting objects in a forex completely different from the one wherein you pay your bills or earn your incomes exposes you to change price threat.”

A lot to the ire of bitcoiners and libertarians alike, Taleb has a degree: once you decide into any financial community, you’re not simply making an remoted transaction between your self and whoever offered you the cash, however a guess on the longer term change price of that cash vis-à-vis different objects.

What we want are excessive costs, rich bitcoiners and a larger tolerance for variation in actual earnings. For Bitcoin to work, really revolutionarily work as its personal impartial factor reasonably than a patchy add-on to a faltering greenback system, individuals should carry the worth threat that’s been artificially purged from the legacy system.

What the goldbug argument above reveals is that you simply can’t escape market threat. For thirty years, inflation-targeting central banks have tried by maintaining the CPI-genie within the 2% bottle — unleashing property booms and busts, monetary mayhem, an economic system of zombie companies and runaway public deficits.

For bitcoin to work as cash, its customers have to embrace the market dangers that in any other case get hidden within the fog.

On a latest “Fed Watch” podcast, Tone Vays says that “Bitcoin was constructed for this, however the value retains taking place.” Let’s rule out the uncomfortable possibility that we have been flawed about this expertise’s potential (if we’re, then something we are saying or hypothesize is moot). Within the case that we’re not flawed, final 12 months’s value run-up was an excessive amount of, too early — however like Vays says, that is senseless in any respect given the hostile macro atmosphere we discovered ourselves in over the last six months or so. Bitcoin was made for this shit.

Maybe, then, the institutional adoption and financialization of bitcoin was a curse, not a blessing? They opened the floodgates from the worst recoils of the fucked-up financial system bitcoin tries to supplant.

Conclusion

I would like Bitcoiners to be wealthy and blissful. Now they’re poor(er) and neurotic. Skittish. Is the dream lifeless? Did I make an enormous monetary mistake?

The dream is for bitcoin to be the world’s cash, its go-to holding for money balances. The most secure and most safe asset.

Getting there requires the BTCUSD value to go up. It both goes up as a result of individuals are embracing the brand new world (adoption) or individuals are embracing the brand new world as a result of the worth goes up (hypothesis). There’s all the time slightly little bit of each they usually most likely feed on one another. But it surely lets us confidently say that we’re going within the flawed course when bitcoin’s change price is falling. As Saifedean Ammous factors out in his interview within the Moon challenge: “It’s solely a gradual enhance in worth over time that can make Bitcoin extra mainstream.”

Possibly some individuals study when bitcoin collapses of their face. Possibly some leverage leaves the overstretched system (presumably solely to return when the prospects look happier, and we repeat the cycle).

But it surely additionally places off extra of these normies that widespread bitcoin adoption requires and fuels the ammunition of its haters.

The world Bitcoiners dream of is an uncensorable community with out discretionary financial coverage. That requires Bitcoin to work for vastly extra individuals, and by itself — not only for the comparatively few or as a tack-on to the greenback, inheriting fiat weaknesses and affected by the anticipated bouts of madness.

At decrease BTCUSD, Bitcoiners are poorer. We want them wealthy.

At quickly collapsing BTCUSD charges, even fewer individuals are inclined to cost their items and companies in sats. We want extra of them to.

Bitcoin’s tumbling greenback value is the market saying “you’re not adequate,” once we want it to say “this revolution will vastly enhance the world.”

To all of the diamond-handed honey badgers on the market: you actually ought to care.

It is a visitor submit by Joakim E-book. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.