Knowledge exhibits GPU costs have continued to go down lately as Ethereum mining earnings have been observing a decline.

GPU Costs Plunge As Demand From Ethereum Miners Fades

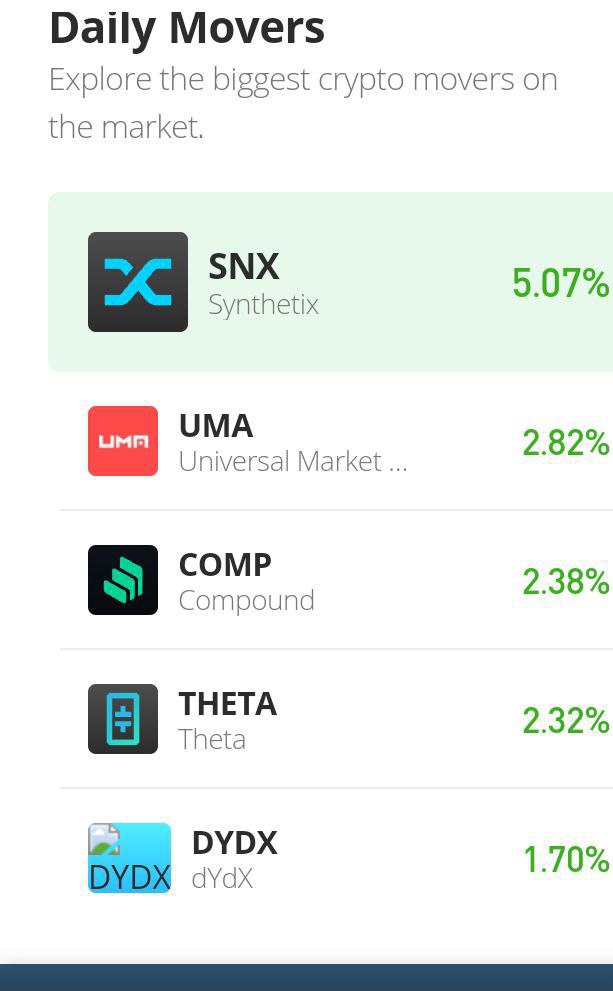

Knowledge from the tech outlet Tom’s {Hardware} suggests graphics playing cards costs continued their drawdown in June as they plummeted one other 14%.

Again in 2020, owing to a bunch of things just like the pandemic and a chip provide scarcity, the brand new era of graphics playing cards launched with fairly low inventory and costs subsequently soared.

Then because the crypto bull run raged on in 2021, Ethereum mining grew to become fairly profitable. Miners added overwhelmingly to an already excessive demand within the GPU house and the proper storm to shake the market was full as each Nvidia and AMD playing cards went on to see double and even triple the costs.

This continued all through 2021 and card availability wasn’t too brilliant in the beginning of this 12 months both. Nevertheless, because the crypto market has noticed a collection of crashes in the previous couple of months and the scarcity has loosened up a bit, the state of affairs has marked a major enchancment.

Associated Studying | Bitcoin Funding Fee Turns Deep Purple, Brief Squeeze Quickly?

Because the January of 2022, GPU costs have declined by a mean worth of 57%. Within the month of June alone they fell by about 14%.

Used and retail worth comparability in opposition to the MSRP for the excessive finish Nvidia GPUs | Supply: Tom's {Hardware}

Costs for used GPUs on web sites like Ebay have noticed a way more severe decline than these on retailers. This might make sense as lately the Ethereum hashrate famous a drop, suggesting that among the miners now not turning a revenue are disconnecting their GPUs and sure dumping them on reselling web sites.

Why Did Ethereum Mining Income Go Down In Current Months?

There are a few fundamental components which have result in ETH mining shedding its excessive earnings from 2021. The primary and the obvious one is the struggling worth of the crypto.

Associated Studying | Bitcoin Mining Facility Shut Down Following Sharp Decline In Miner Profitability

Miners rely on the USD worth of their mining rewards as they often pay their electrical energy payments and different working prices in fiat. This 12 months alone, Ethereum has misplaced 72% in worth, which suggests miners’ revenues would have taken a major hit.

The worth of the crypto has crashed down over the previous couple of months | Supply: ETHUSD on TradingView

The opposite motive can be the ever-rising electrical energy costs world wide. Electrical energy payments normally make up for an enormous a part of the miners’ day-to-day prices, and a rise in energy costs would result in fewer internet earnings for them.

The upcoming transition to the proof-of-stake consensus system would obfuscate miners on the community. Which means that mining has a deadline for Ethereum, prior to which miners have to show an ROI to not lose their cash.

Miners in zones with excessive energy prices could also be left with no alternative aside from to dump their GPUs with a view to reimburse a few of their funding as they could not be capable of make any revenue earlier than PoS arrives.

Featured picture from Kanchanara on Unsplash.com, chart from TradingView.com