The Small Steps To Resilience

“Scalability is the important property of cash. It’s the capacity for an excellent to be offered simply available on the market, with out a lot loss in its worth.” —Saifedean Ammous

Scalability By way of Time And How To Deal with Volatility.

Zimbabwe skilled an estimated 79.6 billion % inflation month-over-month, 89.7 sextillion % year-over-year in mid-November 2008. Zimbabwe as soon as once more has the best annual measured inflation fee on the earth. It lacks a forex that’s scalable via time.

Bitcoin’s common unrealized capital good points return is an annual 200%. No particular person who has offered bitcoin after holding it for a interval longer than 5 years has ever misplaced cash. Bitcoin is a deflationary forex, a forex whose buying energy appreciates with time — it’s due to this fact an ideal methodology to retailer one’s wealth.

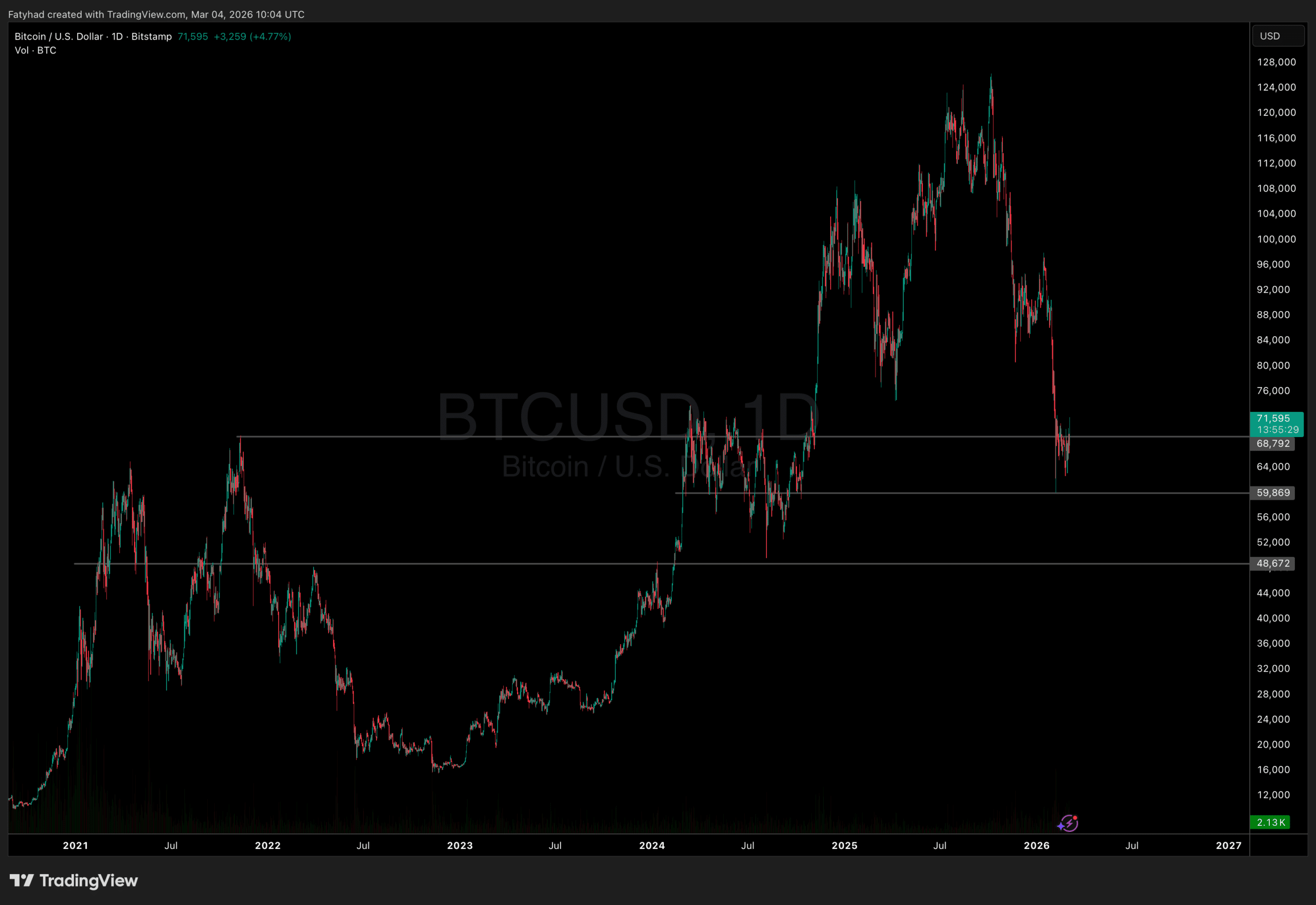

Nevertheless it’s nonetheless topic to volatility. As of immediately we’ve skilled a 70% loss in market worth in comparison with all-time highs. Bitcoin’s costs volatility is all the time a difficulty raised, when requested, “how will Bitcoin turn out to be a medium of alternate?” It’s typically the primary level of rivalry, though many immediately cite that volatility is predicted for any new asset nonetheless inside its “worth discovery” years, and that as adoption will increase the volatility will settle.

Bitcoin is a distributed software program that operates based mostly on peer-to-peer community members who’re all equal. This software program means that you can function a fee community between these friends and that fee community has its personal forex.

It permits money finality; the second at which funds, transferred from one occasion to a different, formally turn out to be the authorized property of the receiving occasion.

Bitcoin gives money finality in 10 minutes, and Bitcoin Layer 2 protocols provide money finality in beneath a second.

Scalability By way of Area And How To Transact On Each Layers Of Bitcoin.

During the last decade Zimbabwe has misplaced greater than 100 relationships in our correspondent banking relationships community, resulting from sanctions. This enormously limits the power to make funds to anyone nation resulting from our native financial institution not having relationships with banks exterior to clear the fee, stopping the power of residents to purchase and promote items throughout borders.

As well as, our authorized tender forex the RTG is a pseudo-currency, which means it isn’t a forex tendered in another nation and it may be solely traded domestically. We lack a monetary system and forex that’s scalable geographically.

Bitcoin gives the switch of worth to anybody on Earth, with out anybody’s permission. The price of doing transactions in an FCA checking account in Zimbabwe on the level of withdrawal has a 2% minimal and will go as excessive as 15% — whereas the price of transacting on Bitcoin (utilizing Layer 2 protocols) is lower than 0.1%, to finish a switch.

Bitcoin has the chance to realize large market share for overseas remittances and native settlements. However solely beneath the situation, I consider, that we mine bitcoin domestically. Miners might promote bitcoin at a 1:1 fee or 2% cost, every time they want fiat forex to pay bills. However the greatest profit miners convey is that people not have to ship fiat forex exterior at 5-15% cost to purchase bitcoin and resell at the next premium.

EcoCash’s new overseas forex pockets, mixed with a Telegram bitcoin bot, might provide an answer to Zimbabweans’ incapability to on-ramp and off-ramp into the Bitcoin community.

The Telegram alternate, which is custodial, permits people to purchase and promote bitcoin to anybody all over the world and obtain funds via the overseas forex pockets and different fiat forex banks.

Zimbabweans can simply purchase bitcoin utilizing Telegram’s community with out having to make use of a bitcoin alternate.

I desire social media platforms, as an alternative of latest Bitcoin purposes, as a result of so many overseas forex transactions are already executed on social media (primarily WhatsApp). WhatsApp has a really sturdy community established domestically, and Telegram is slowly creating one.

Scalability

Sanctions additionally created a 3rd drawback — the storage of foreigners’ forex reserves, which frequently leads to increased inflation. But in addition this introduces the annoying drawback of by no means having small denominations of cash to buy items and companies. We lack a forex that’s scalable, interval.

“ It should be thought of that there’s nothing harder to hold out, nor extra uncertain of success, nor extra harmful to deal with, than to provoke a brand new order of issues.” —Niccolo Machiavelli, 1469-1527

Zimbabwe is in a singular place. Our primitive fiat monetary system is repeatedly and persistently failing, we’re affected by two decade-long sanctions and our authorities deemed bitcoin as an unlawful forex, stopping exchanges from working. Situations like these have destroyed numerous numbers of once-flourishing industries in our nation; industries that merely left and flourished in different areas of the globe, denying us residents the power to create wealth and obtain the next lifestyle.

The Zimbabwe Bitcoin Group on WhatsApp

P2P Zimbabwe Telegram Bitcoin Change Bot

It is a visitor publish by Alexandria. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.