The beneath is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Core Scientific Sells 7,202 BTC

On July 5, 2022, Core Scientific, the world’s third-largest publicly traded bitcoin miner by market cap ($525.52 million) introduced in its June month-to-month replace the sale of 78.6% of its bitcoin holdings.

“In the course of the month of June, the Firm bought 7,202 bitcoins at a mean worth of roughly $23,000 per bitcoin for whole proceeds of roughly $167 million. As of June 30, 2022, the Firm held 1,959 bitcoins and roughly $132 million in money on its stability sheet.

“Proceeds from bitcoin gross sales in June have been primarily used for funds for ASIC servers, capital investments in extra information middle capability and scheduled reimbursement of debt. The Firm will proceed to promote self-mined bitcoins to pay working bills, fund progress, retire debt and preserve liquidity.”

Final week, in our newest mining concern, we coated a few of the dynamics of the bitcoin mining cycle, and the hash worth bull and bear market.

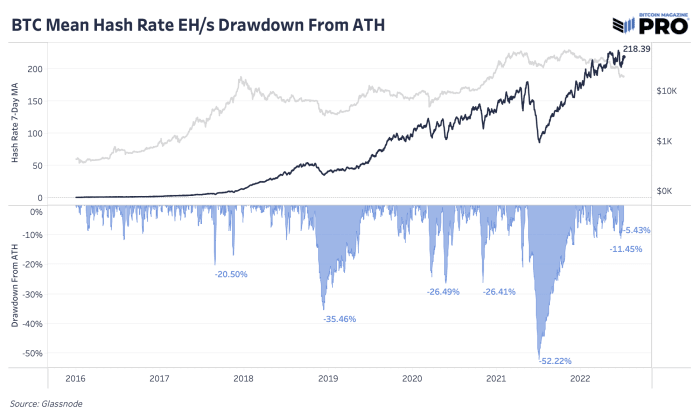

Provided that hash charge is barely 5.43% beneath its all-time excessive studying, some extra strain on mining operations seems to be on the horizon. Earlier bear market miner capitulation intervals noticed hash charge drawdowns of over 25% from earlier highs, with 52.22% after the China miner ban being the most important drawdown within the historical past of bitcoin.

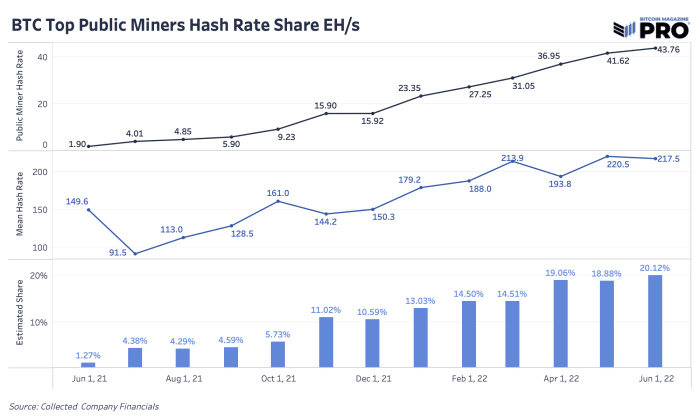

Whereas the relative progress of hash charge has diminished vastly lately, absolutely the progress of the trade has been huge, significantly within the publicly traded sector.

The mining trade’s latest rise and synergy with public markets over the previous two years gave it loads of entry to debt financing that was unavailable in earlier cycles. This allowed for miners to spice up fairness market valuations by borrowing towards their holdings to finance operations and extra capital expenditure.

This dynamic has led miner operations to be underwater on months of bitcoin mining income whereas nonetheless having to finance energy agreements and excellent debt. Whereas it is a broad over-generationalization of the trade, it’s the cause why the fairness of mentioned miners relative to bitcoin have carried out so poorly.

What Sparks A Restoration In Public Miners?

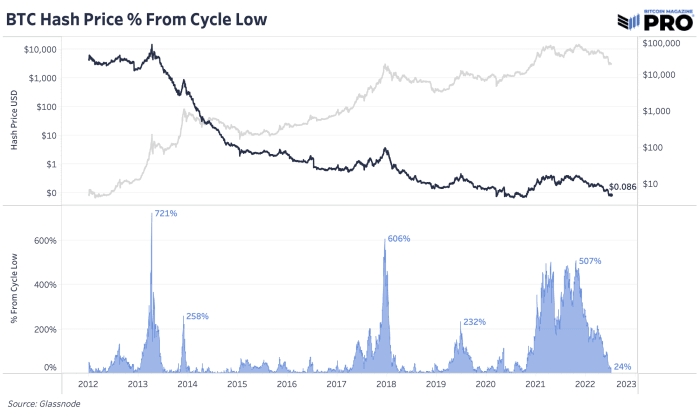

When investing in bitcoin miner corporations or infrastructure, you’re investing for the following hash worth bull market — the “gold rush” section of the bitcoin market cycle. Proven beneath is hash worth (in logarithmic scale) with the underside pane displaying its rise from earlier all-time lows.

As a reminder, hash worth is outlined as each day miner income divided by hash charge.

Given the vicious aggressive nature of mining, and hash charges latest bounce again to 218 EH/s, extra headwinds are on the horizon for the sector — which might place much more strain on the BTC/USD alternate charge, additional reenforcing the squeeze on margins within the mining sector.

In tomorrow’s Bitcoin Journal Professional Problem, we are going to cowl the most recent strikes within the macroeconomic panorama concerning rates of interest, commodities and overseas alternate markets. Subscribe to entry the complete Bitcoin Journal Professional e-newsletter.