In keeping with the founders of the index, MVI goals to seize the tendencies in transition of leisure, enterprise, and social actions in the direction of digital economies, on the foundations of blockchain know-how and NFTs. The next dialogue helps you perceive the metaverse index or MVI and its elements with an in depth introduction to fundamentals. On prime of it, you may also be taught in regards to the current tokens on the index and strategies for getting MVI.

Aspiring to Turn into a Licensed Metaverse Skilled? Enroll in Licensed Metaverse Skilled (CMP) Certification Course Now!

What’s Metaverse Index?

The very first thing in any dialogue about MVI or metaverse index would clearly emphasize its definition. MVI is mainly an index product designed for tracing the tendencies pertaining to transition of leisure, enterprise, social actions, and sports activities to digital environments. It was launched in 2021 by Index Coop, a crypto index answer supplier. Index Coop itself is a decentralized, community-driven group accountable for creation and upkeep of different crypto indices reminiscent of Bankless BED Index and DeFi Pulse Index.

The metaverse is a large and open dwell digital universe which might provide many fascinating advantages to customers. Customers can have a way of provenance, shared spatial consciousness, and social presence. On the identical time, the metaverse opens up the doorways to an intensive digital financial system. Additionally it is necessary to notice how digital possession and free markets within the metaverse use blockchain know-how, thereby setting a distinction from social contracts governing web2 options.

MVI, or the Metaverse NFT Index, can assist buyers uncover a chance for investing within the metaverse. How? The index can assist in capitalizing on the selection of metaverse protocols somewhat than investing your property on one platform or token. You may consider MVI as a gateway for rookies into the world of the metaverse. Who developed the index?

Origins of Metaverse Index

One of many vital particulars in a information on investing in metaverse index would concentrate on its origins. The founders of MVI, Verto0912, and DarkForestCapital, launched the index for the primary time with none exterior companions. It was the primary sole venture of Index Coop. Verto0912 and DarkForestCapital have been the early members of Index Coop since its basis in 2020.

Verto helped in resolving the low liquidity points in sure tokens by modifying the calculation of weighting within the preliminary proposal for MVI. Index Coop additionally supported the event of MetaPortal as a substack for establishing MVI as a singular model. The MetaPortal serves as a dependable instrument for the methodologists to develop experience within the metaverse. What kind of tokens can you discover within the MVI index?

Need to be taught blockchain know-how intimately? Enroll Now in Licensed Enterprise Blockchain Skilled (CEBP) Course

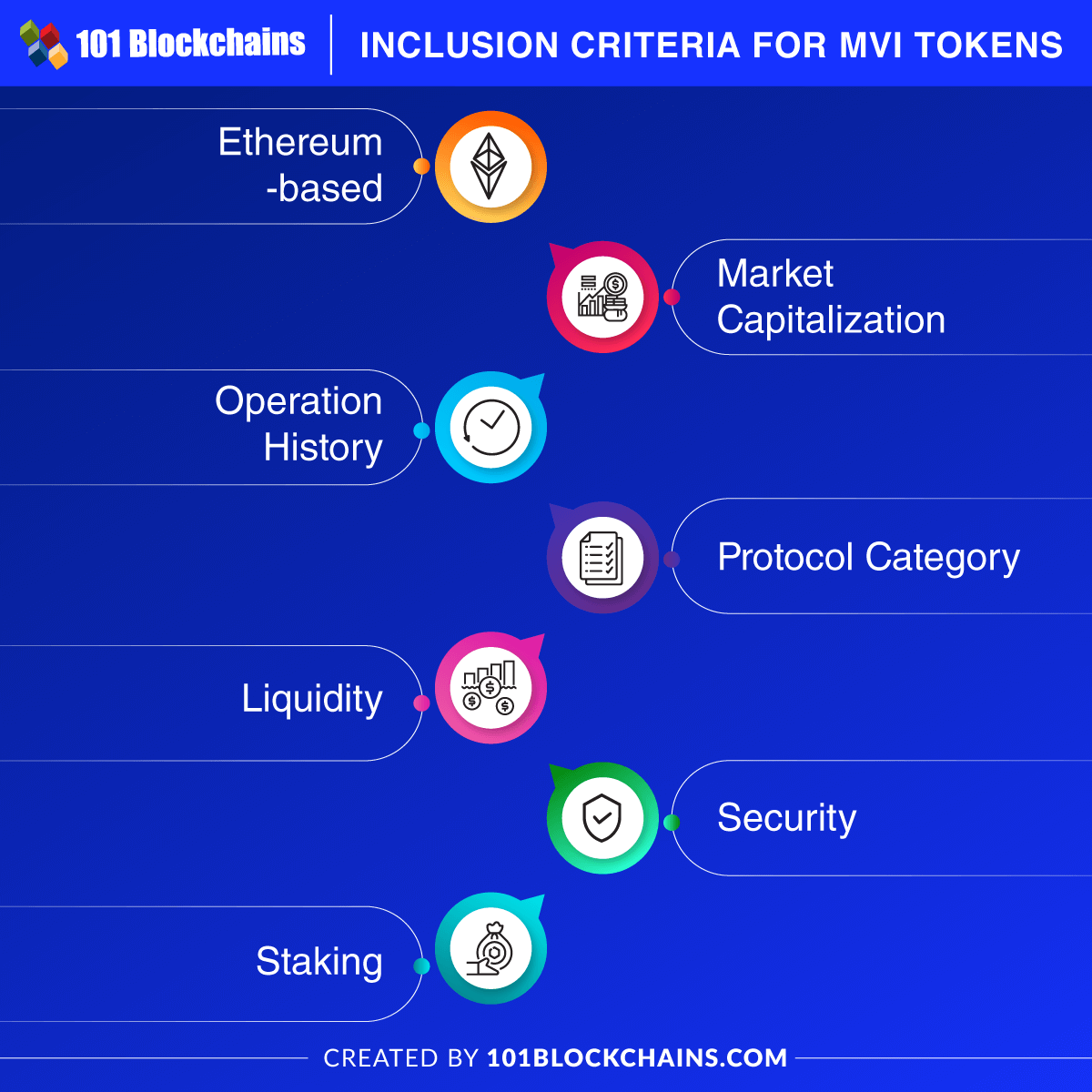

Inclusion Standards for MVI Tokens

The good thing about investing within the desired metaverse protocol by MVI may be fairly interesting. You would possibly search for a Metaverse Index chart to determine the calculations earlier than touchdown up within the metaverse. Nevertheless, it is very important determine the standards for tokens that may be included within the MVI index. If you wish to put money into a particular asset, you could find out about what it has to give you. Listed here are some necessary situations for inclusion within the MVI index.

The primary criterion for together with a token on metaverse index is that the token needs to be accessible on Ethereum blockchain. MVI plans on revising this criterion by introducing a multi-chain Set Protocol infrastructure.

The token will need to have a circulating market capitalization of greater than $50 million.

The protocol eligible for metaverse index or MVI will need to have round 3 months of historical past of operations. As well as, the token of the protocol should showcase a worth and liquidity historical past of a minimal of three months.

As of now, the Metaverse NFT index rightly fulfills the aim of its title by inclusion of NFTs. The protocols included on MVI should adjust to particular token classes reminiscent of NFTs, music, leisure, augmented actuality, and digital actuality. MVI would add extra token classes with the rising maturity of the market.

The tokens eligible for inclusion in MVI should register proof of constant and affordable ranges of DEX liquidity on Ethereum.

A protocol suite for the Metaverse Index chart also needs to go by an unbiased safety audit. On the identical time, a product methodologist will need to have reviewed the outcomes of the safety audit. With out audits, methodologists can use subjective evaluation of the protocol on the grounds of different standards and interactions with group.

The tokens listed on MVI or metaverse index is not going to be staked initially of the index. Quite the opposite, a rise in liquidity can open up the scope for yield era by staking on MVI.

Excited to be taught the essential and superior ideas of ethereum know-how? Enroll Now in The Full Ethereum Know-how Course

How Does Metaverse Index Work?

An important spotlight within the working of MVI is the index weight calculation methodology. As well as, you could additionally be taught in regards to the index upkeep course of as they account for the methodology of the metaverse index. The dialogue on “what’s metaverse index” would stay incomplete with out figuring out how MVI works after deciding on tokens for inclusion.

-

Calculation of Index Weight

The working of MVI entails the rapid step following the identification of eligible tokens. It is very important estimate the appropriate weighting for each token within the index. Methodologists calculate the ultimate weights of the tokens in metaverse index by figuring out the combination worth of DEX liquidity and sq. root of the market capitalization of tokens. The sq. root of market capitalization of the token accounts for round 75% of their last weight. Alternatively, the DEX liquidity accounts for the remaining 25% of the ultimate weight of a token.

The essential index weight calculation methodology emphasizes liquidity, and it ensures that the index doesn’t embody overallocated to property that can’t be rebalanced by DEX. The ample sum of liquidity for tokens related to Metaverse Index or MVI is necessary for stopping vital slippage in month-to-month rebalances. The straightforward system for calculating the burden of every token is as follows,

TW= 75percentxRMCW + 25percentxLW TW represents the whole weight of a token in MVI. RMCW represents the sq. root of market capitalization of the token. LW is the aggregated DEX liquidity of a token.

One other vital side within the understanding of MVI or metaverse index refers back to the index upkeep course of. The methodologists maintain the index upkeep course of to protect the index high quality. The index upkeep course of entails two distinct levels, the dedication section, and the rebalancing section. Within the dedication section, tokens are subjected to a re-evaluation of inclusion standards for including or deleting tokens from the index. The dedication section occurs within the last week of the quarter. The rebalancing section entails modifications within the index composition for updating new weights within the first week of the upcoming quarter.

Get aware of the phrases associated to metaverse with Metaverse flashcards

Which Tokens Are Obtainable on MVI Now?

The plain query for any particular person enthusiastic about investing in metaverse index would emphasize the tokens accessible in MVI now. Right here is an overview of the tokens you’ll find within the index now.

Illuvium

Illuvium has advanced as one of many widespread metaverse gaming platforms primarily based on Ethereum blockchain. The native governance token of the platform is ILV.

Axie Infinity Shards

AXS, the governance token on Axie Infinity, is a number one title within the play-to-earn panorama proper now.

Enjin

ENJ is one other notable entry within the present Metaverse Index chart and serves because the utility token for powering up the NFT financial system of Enjin. The ENJ token can assist in improvement, buying and selling, and monetization of gaming NFTs.

Decentraland

The MANA token of Decentraland can also be one of many notable entries in MVI as Decentraland is a pioneer amongst metaverse platforms.

The Sandbox

The SAND token of Sandbox, a community-driven metaverse platform, can also be a prime participant in MVI index for its function in fuelling a gaming financial system.

Among the different notable tokens accessible on the metaverse index embody the next,

- WAXE (WAX)

- AUDIO (Audius)

- ERN (Ethernity Chain)

- NFTX (NFTX)

- TVK (Terra Virtua)

- RARI (Rarible)

- DG (Decentral Video games)

- WHALE (WHALE)

- REVV (REVV)

- MUSE (NFT20)

Aspiring to Turn into a Licensed NFT Skilled? Enroll in Licensed NFT Skilled (CNFTP) Course Now!

The place Can You Purchase Metaverse Index?

The MVI token enables you to capitalize on the worth of a large base of metaverse protocols with out concentrating the danger on one platform or token. In case you are questioning the place to purchase metaverse index, then you could search for the explanations to take action. Initially, you should purchase MVI if you’re within the metaverse and don’t know the place to begin investing.

You’d discover the benefit of encompassing a number of tendencies on the planet of metaverse with out betting on one particular platform, token, asset, or digital expertise. Curiously, you don’t have to go looking too far for investing in metaverse index, as you’ll find it on Ethereum and Polygon. You need to join your pockets with the required quantity of ETH and swap it for MVI. As well as, decentralized change aggregators are additionally an important reply to buy metaverse index.

Need to be taught Metaverse ideas rapidly? Try Now Metaverse Flashcards and Metaverse FAQs

Backside Line

The general introduction to metaverse index showcases the way it can revolutionize the metaverse expertise for customers. In case you take a more in-depth have a look at the way it works, MVI brings the most effective of all metaverse platforms and tokens into one pool. Any MVI token holder can have the privilege of drawing the most effective of a number of metaverse platforms and tokens in accordance with their necessities.

You don’t need to put all of your cash on a single metaverse token and belief in its long-term potential for development. Quite the opposite, MVI follows an easy strategy to together with the most effective tokens within the index. If you wish to put money into MVI, it’s good to dive deeper into analysis concerning monetary, tax, and authorized implications of the identical. Study extra about MVI and the way it can drive the adoption of a metaverse sooner or later.

Be a part of our annual/month-to-month membership program and get limitless entry to 25+ skilled programs and 55+ on-demand webinars.

*Disclaimer: The article shouldn’t be taken as, and isn’t supposed to offer any funding recommendation. Claims made on this article don’t represent funding recommendation and shouldn’t be taken as such. 101 Blockchains shall not be accountable for any loss sustained by any one that depends on this text. Do your personal analysis!