Makerdao, the decentralized autonomous group (DAO) that points the stablecoin DAI, authorised a governance vote that gives “collateral integration from a U.S.-based financial institution.” The Makerdao governance vote handed by a majority vote of greater than 87%, and it permits the U.S. monetary establishment Huntingdon Valley Financial institution the means to leverage a stablecoin vault.

Huntingdon Valley Financial institution to Use Makerdao’s Stablecoin Vault System With Off-Chain Loans — RWA-009’s Preliminary Debt Ceiling Is $100 Million

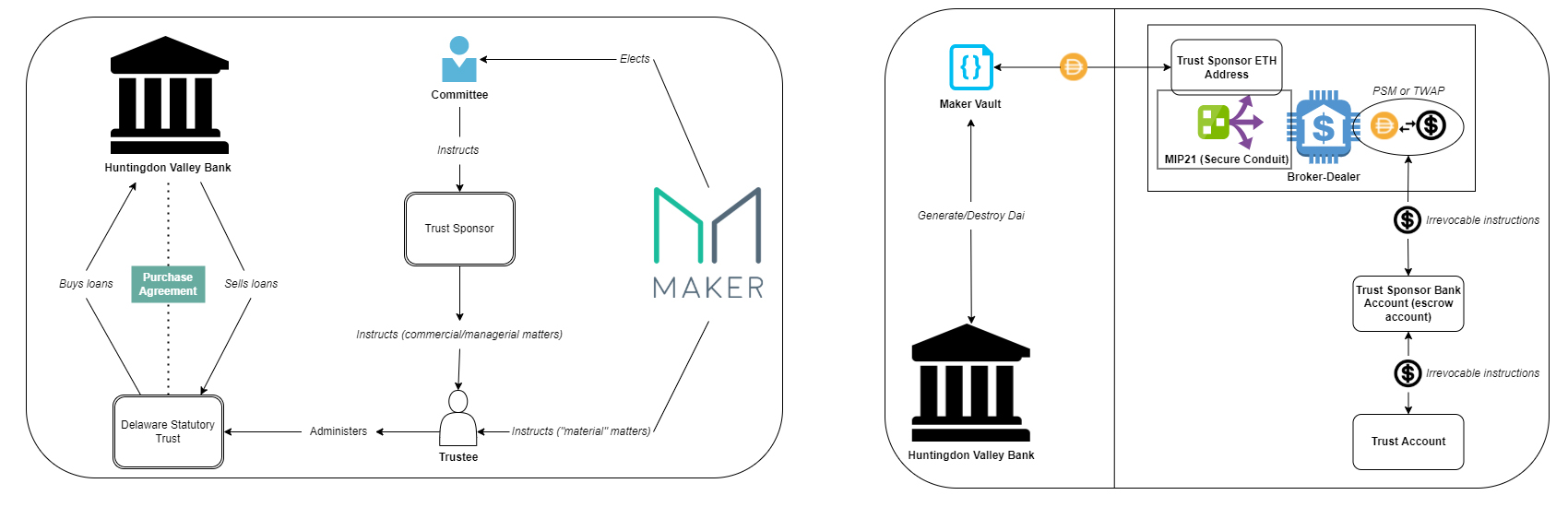

In keeping with a Makerdao governance ballot breakdown, the group has authorised a collateral integration proposal with the Pennsylvania-based monetary establishment Huntingdon Valley Financial institution. Makerdao mentioned the proposal on July 4, 2022, and famous that the RWA-009 idea can be the primary of its form on the earth of decentralized finance (defi). The time period “RWA” used within the Makerdao proposal stands for “real-world belongings.”

“The primary collateral integration from a U.S.-based financial institution within the defi ecosystem is getting nearer,” the undertaking’s official Twitter account explained. “The Maker Governance votes so as to add RWA-009, a 100 million DAI debt ceiling participation facility proposed by the Huntingdon Valley Financial institution, as a brand new collateral sort within the Maker Protocol,” the group added.

In a Twitter thread printed on the finish of March 2022, Makerdao detailed how the scheme would work as it will permit Huntingdon Valley Financial institution (HVB) to borrow DAI through the use of HVB’s participated loans as collateral. “The applying additionally requested an preliminary debt ceiling of $100 million {dollars} of Huntingdon Valley Financial institution Participated Loans diversified throughout all proposed mortgage classes, to be deployed over a interval of 12 to 24 months from inception,” Makerdao mentioned on the time.

Makerdao additionally disclosed that whereas HVB can be the primary to enter the undertaking’s “Grasp Buy Settlement,” the undertaking has the total “intention to include extra banks sooner or later.” The undertaking’s stablecoin DAI is the fourth-largest stablecoin undertaking by way of market valuation with $6.48 billion.

Over the last seven days, Makerdao’s native crypto asset MKR has elevated 2.5% in opposition to the U.S. greenback however year-to-date, MKR is down greater than 65%. On the time of writing, at $921 per unit, the DAO’s native crypto MKR remains to be up 448% greater than the all-time low of $168 per unit recorded on March 16, 2020.

When it comes to defi dominance, Makerdao instructions a contact greater than 10% of all the defi ecosystem’s $75.54 billion in locked worth. Makerdao’s whole worth locked (TVL) right now is $7.56 billion, down 4.38% during the last month.

The not too long ago handed governance proposal with HVB follows Makerdao’s plans to introduce layer two (L2) scaling help from Starknet on the finish of April. Makerdao’s group mentioned that the zero-knowledge (ZK) rollup answer Starknet might make DAI transfers less expensive than onchain charges.

Members of the Makerdao group have been fascinated by leveraging real-world belongings into the undertaking for fairly a while. Hexonaut, a protocol engineer at Makerdao, defined in mid-March 2022, that the DAO wants “to take the subsequent step and start integrating with the actual world at scale.” The settlement with Huntingdon Valley Financial institution makes use of off-chain loans which characterize real-world belongings (RWA) pledged by the Pennsylvania financial institution based mostly in Montgomery County.

What do you consider the Pennsylvania financial institution utilizing Makerdao to entry DAI? Do you envision crypto integrating with extra real-world belongings sooner or later? Tell us your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.