The artwork market is booming once more, larger than ever.

That was the message given to the world’s media after final month’s fortnight of marquee auctions at Christie’s, Sotheby’s and Phillips in New York.

A closing tranche of Twentieth- and Twenty first-century works from the “peerless assortment” fashioned by New York divorcees Harry and Linda Macklowe topped up the full to $922m, making this single-owner providing the “most beneficial ever offered at public sale,” in response to Sotheby’s. Phillips’s mixed-owner night sale of recent and modern artwork racked up $225m, a document for the corporate. The earlier week, Christie’s had offered Andy Warhol’s 1964 Shot Sage Blue Marilyn to Larry Gagosian for $195m, the best public sale value ever achieved for a Twentieth-century work.

“The artwork market now not encompasses the market, it simply encompasses auctions. It’s actually the one factor that individuals are speaking about,” says Lisa Schiff, the founding father of the US-based SFA Artwork Advisory, commenting on the sting that livestream expertise and international advertising and marketing have given the worldwide salerooms because the creation of Covid.

Sotheby’s says that its varied livestream gross sales drew 3.6 million views throughout its Might marquee week. However the public sale homes’ capacity to form wider perceptions of the artwork market has led to some hyperbolic messaging.

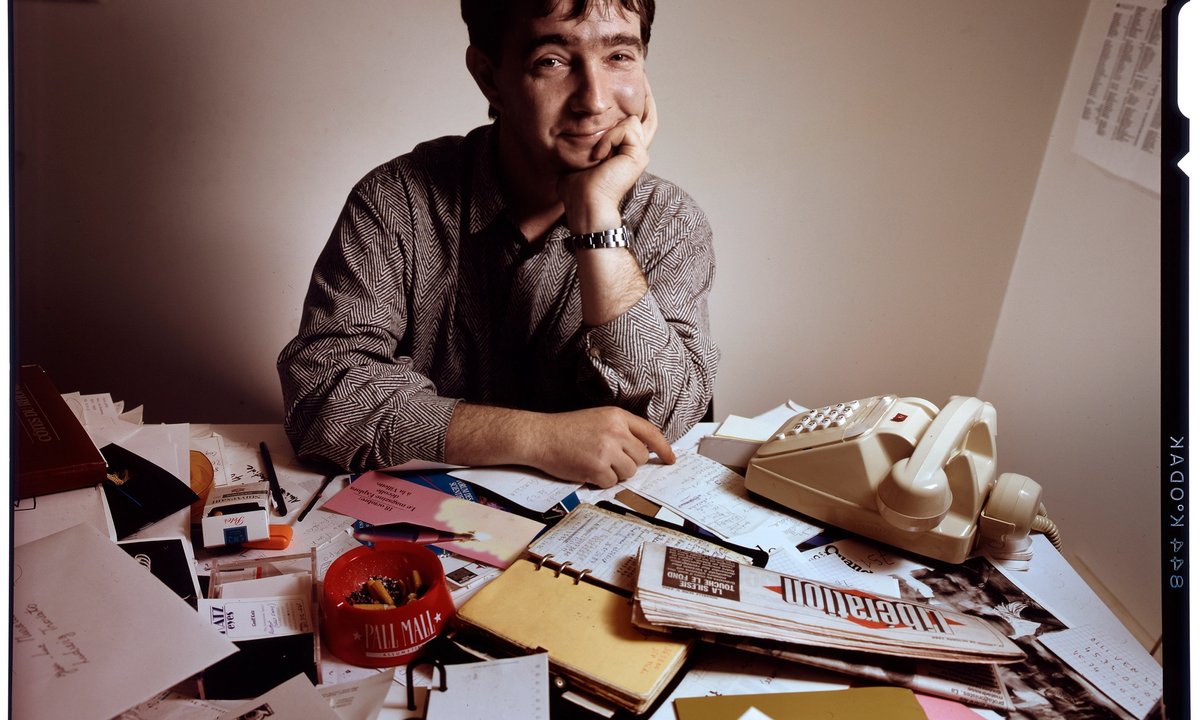

Particular Visitor (2019), by the Los Angeles-based artist Lucy Bull, offered for ten occasions its estimated value, going for $907,200 © Lucy Bull

Based on Sotheby’s information, this newest sequence of New York gross sales on the three predominant homes was the “largest public sale season the market has ever seen”. However numbers crunched by the London-based artwork market analysts Pi-eX disagree. Their independently gathered figures present that Might was the truth is the third highest-grossing sequence of auctions on document: the grand complete of $2.84bn was wanting the $2.93bn achieved in Might 2018 and the $2.89bn taken again in Might 2015.

Warhol’s silkscreened Marilyn, one in all a sequence of 5 such large-scale variations, was described by Alex Rotter, Christie’s chairman of Twentieth- and Twenty first-century artwork as “one of many best work of all time”, standing alongside Botticelli’s Delivery of Venus and da Vinci’s Mona Lisa.

Wow. But when that actually had been the case, why did this ne plus extremely of Pop Artwork promote to Gagosian under its punchy estimate of $200m? Is it {that a} Hollywood famous person who died 60 years in the past is now not the relatable icon she as soon as was? Or did the world’s inhabitants of greater than 2,000 billionaires merely suppose that there are higher methods of spending that form of cash than on artwork?

The truth of bidding

The world is being instructed that the highest finish of the artwork market is booming as soon as once more, however some new realities are lurking beneath the shiny numbers.

To make certain, the mixed $922m achieved by Sotheby’s final month and in November for the 65 works from the Macklowe assortment was an affidavit to the enduring attraction of the divorced couple’s traditional Higher Manhattan style for model artists akin to Warhol, Rothko, Twombly and Richter, exercised over greater than 50 years. Proceeds nicely above the rumoured international assure of $650m appeared to underline the standing of those canonical names as enduring “blue-chip” investments, a minimum of when provided from a long-established named assortment.

However there was noticeably much less demand for big-ticket works by established white male names when provided singly by nameless sellers.

Considered one of Cy Twomby’s massive and hitherto much-prized late Sixties “blackboard” abstracts was assured to make a minimum of $40m in Sotheby’s mixed-owner modern sale. Again in 2015, an analogous Twombly “blackboard” offered at public sale for $70m. This newest instance offered to a single bid from the third-party guarantor for a below-estimate $38m, a value reflecting the reductions that may be loved by public sale backers.

Simply 4 heaps earlier, Francis Bacon’s Research of Purple Pope (1971), which had failed at public sale 5 years earlier than, was additionally assured to promote for $40m. One additional bid knocked out the guarantor, leading to a fee-inclusive value of $46.3m. A single bid that might usually be an increment of, say, $100,000, right here value $8.3m.

“For those who’re a collector, why register to bid with a paddle for those who can assure a piece and get a reduction?” says William O’Reilly, president of the New York department of the advisers and sellers Dickinson.

But when extra rich collectors clever as much as the benefits that guarantors take pleasure in as consumers, this in flip could postpone paddle-registered bidders from paying additional, which in flip may suppress demand for traditional blue-chip works. Saleroom ensures are already troublesome sufficient to know, however the latest ruling by a New York federal court docket that public sale homes now not should declare such preparations has the potential to make this example much more obscure, additional deterring inexperienced consumers.

Based on Forbes, the world inhabitants of billionaires—people who can comfortably spend $200m on an art work—elevated from 1,209 in 2011 to 2,755 in 2021, their mixture wealth ballooning virtually three-fold from $4.5 trillion to $13.1 trillion. Throughout that very same interval, international public sale gross sales of effective and ornamental artwork declined from $32.4bn to $26.3bn, says the info of the annual Artwork Basel and UBS Artwork Market Report.

“The artwork market has been flat for the previous ten to fifteen years,” says Roman Kräussl, a professor of finance on the College of Luxembourg and co-author of the 2016 examine, ‘Does it Pay to Spend money on Artwork? A Choice-Corrected Returns Perspective’.

Purchase now, fear about worth later

“Possibly the ultra-rich realise with all this information round that the returns will not be in two digits,” says Kräussl. “Once I calculate the return on artwork, it’s about 5%, with prices on high.” By comparability, S&P 500 shares have yielded common annual returns of about 14.7% over the previous ten years, in response to Enterprise Insider.

“Individuals who purchase blue-chip artwork like a traditional $25m Richter aren’t shopping for it foremost as an funding, however largely as a hedge in opposition to draw back danger,” Kräussl says.

However what concerning the individuals clamouring to bid six and 7 digits for work by younger, Instagram-favourited “red-chip” artists like Anna Weyant, Flora Yukhnovich and Lucy Bull that just lately offered in galleries for 5 digits? Are they shopping for for funding?

For Kräussl, and for a lot of different market observers, that is merely an indication of a youthful cohort of purchasers with an excessive amount of liquidity (what the remainder of us name “cash”) chasing too few accessible works by too few trendy names. And consumers are wealthy sufficient to not care an excessive amount of about funding.

“You’ve offered a startup for $50m. You’ve obtained white partitions. What do you set there? Not a Richter. That’s old fashioned. However individuals are afraid of shopping for the mistaken artwork,” Kräussl says. “It needs to be politically appropriate. It needs to be gender OK. It needs to be race OK. After which you may say on the dinner desk, ‘I purchased this at Phillips.’ It’s a stamp.”

The document $225m complete achieved in New York by Phillips, which has been specialising in rising artwork for years, in addition to the frenzy of bidding the next evening at Sotheby’s $72.9m The Now sale of 23 works, by “probably the most thrilling artists in the present day”, typified this shift from blue to pink, chip-wise. The $907,200 given for a 2019 summary by Los Angeles-based Lucy Bull, represented by David Kordansky, was one in all 9 new public sale information at Sotheby’s. The Bull art work offered for greater than ten occasions its pre-sale estimate.

“What’s going up? Everybody needs to get in on it. There’s nothing right here that is sensible in a standard value-making situation,” Schiff says. She stays satisfied that although there’s loads of cash to be made by flipping, artwork is an funding that performs higher within the long-term. “You may make cash shopping for and promoting,” she provides. “[But] you can also make a fortune holding.”

The Macklowes actually did, although it took them half a century to get there. Can in the present day’s digitised artwork consumers and sellers wait that lengthy?